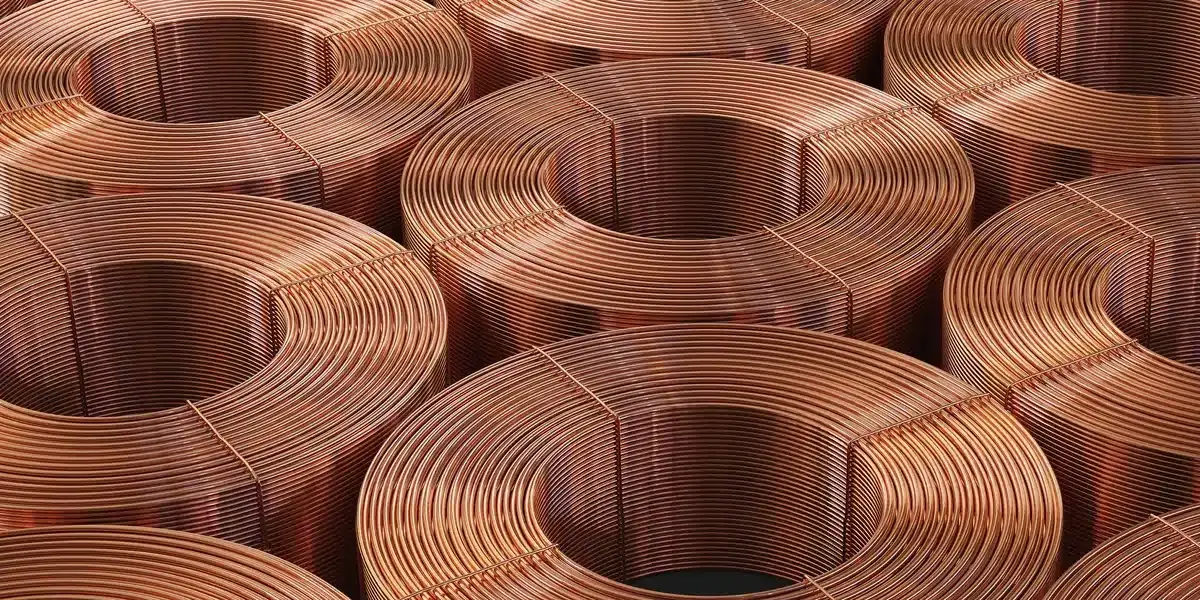

Rising copper price projects a more promising scenario for the industry

On the London Metal Exchange, the price of copper exceeded the US $2.5 a pound. The red metal registered its highest level since March 5. Thus, it is expected that the increase in the product’s value will have a positive impact on the development of medium and large-scale mining. Amid so much negative news due to coronavirus‘s effects on an economic level, such good news gives analysts hope. Copper has experienced a real bullish streak in recent weeks, and it undoubtedly has a positive impact on the economy.

At the beginning of this week, the spot price of the metal rose by 1.27%. It thus reached the US $2.56688 a pound on the London Metal Exchange. Thus, copper has recovered by 22.56% from its annual low of $2.1005 recorded on March 23. Factors such as the signs of China’s economic recovery, the surprising drop in unemployment in the United States, and the increase in liquidity injected by financial entities, motivated the improvement of copper prices.

China is the main factor of the red metal prices’ upward trend

According to the latest report, China maintains two stimulus programs, the “New Urbanization” and the “New Infrastructure,” announced by the Asian giant’s government last week. These programs are the main engine of the recovery. The value of the bonds issued by the Chinese government for infrastructure spending has already exceeded the full-year total of 2019. This is good news for the restart of the world economy and raw material prices.

The low mineral surplus that exists in the market today caused an upward trend in the price of copper. This comes from Chinese demand. On the other hand, the great powers, which are just as large copper consumers as China is, are returning to the normal pace of operation. They are reactivating their production processes, and the price of copper will undoubtedly rise.

There is not enough supply of copper in the market

Analysts think that as soon as China places a purchase order on the market, everyone will start to reactivate because they know they can afford to run out of the mineral’s supply. Copper is soon going to be undersupplied in the market. After the pandemic, the metal assets would not remain for 15 days in the world. Even though copper mining operations remain, many of the copper-producing countries have ceased a large part of their services.

-

Support

-

Platform

-

Spread

-

Trading Instrument