The red hammer candlestick: How do investors use it?

A red hammer candlestick or inverted hammer is frequently used in technical analysis of financial markets, particularly the stock market. This article overviews the red hammer candlestick pattern usage in trading, its psychology, and its similarities with other indicators. But first, let’s see what hammer candlesticks, generally represent in technical financial market analysis markets.

Understanding hammer candlesticks

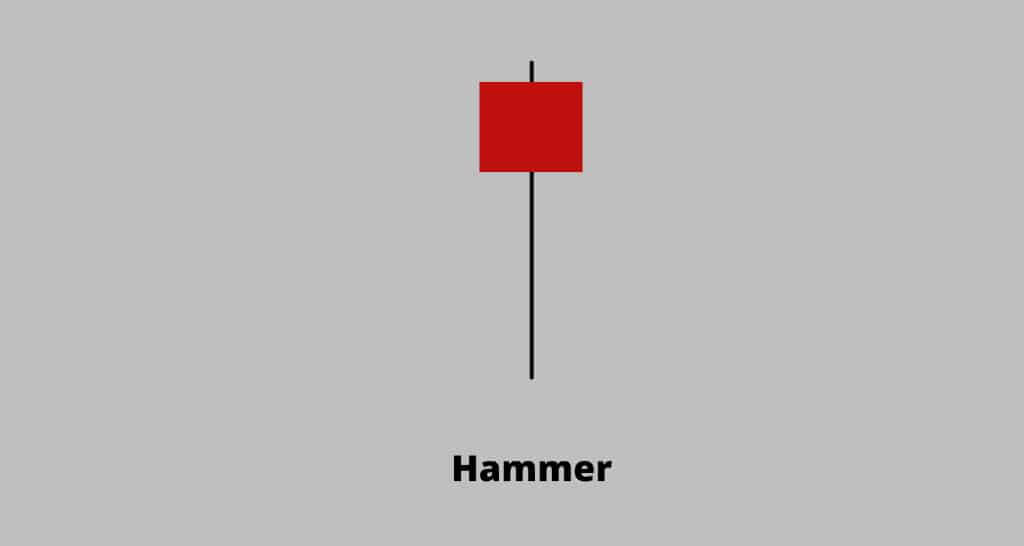

So, what does a red hammer candlestick mean? The hammer is a bullish reversal pattern that comes after a downtrend. It is relevant for all time units.

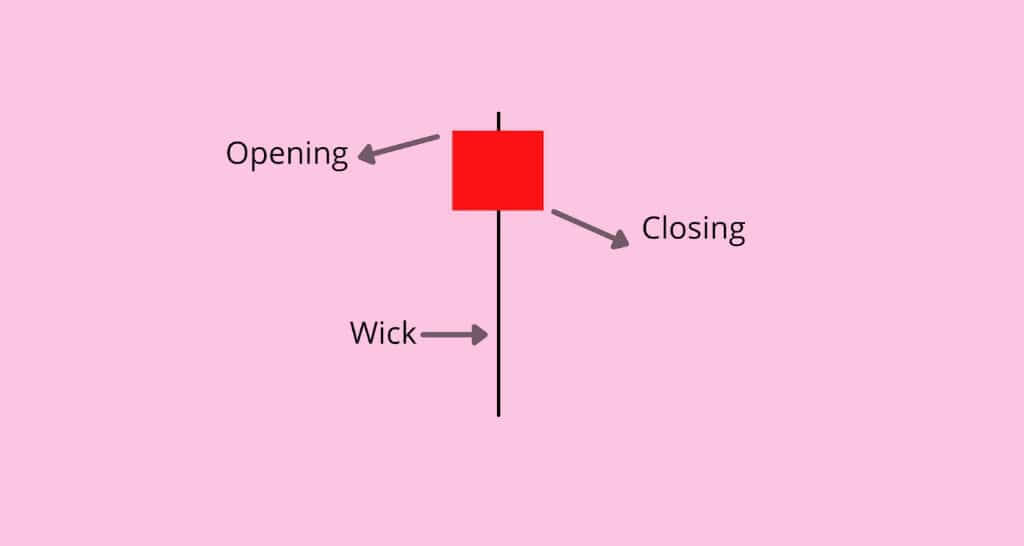

The main elements of a hammer pattern are:

- The hammer should appear following a downtrend.

- The upper shadow should be almost non-existent.

- The body should be small and on the upper part of the candlestick. It can be green or red, but ideally green.

- The lower shadow should be long and ideally be more than 2 times the length of the body.

- The price must make a new low from the previous candlestick.

Red hammer candlestick formation

The inverted hammer represents a bullish reversal pattern that comes after a downtrend.

The low shadow of the inverted hammer should be almost non-existent, ideally zero. The high shadow should be at least twice the length of the body. The body should be small and on the lower part of the candlestick.

The inverted hammer can be green or red, but preferably green. The price must make a new low from the previous candlestick.

The power of this figure depends on the difference between the size of the body and the high shadow.

The hammer is confirmed by the next candle, which must be bullish.

What does a red hammer candlestick mean?

Red hammer or inverted red hammer candlestick points out possible bullish trends in the market. It signals that asset buyers could take control but couldn’t drive up the prices beyond the price opening within the trading time frame.

Red hammer formation – how to read inverted hammer

Such a Japanese candlestick is formed when, following a downtrend, prices make a new low but then rise to close near the opening level. This shows that a bullish force is emerging. The body should be green because the price has finally closed above the opening level, which bodes well for the next session.

The larger, the lower shadow relative to the size of the body, the smaller the size of the upper shadow (ideally a shaved head, as in the example), and the more significant the hammer will be. Strong volumes could also confirm the figure.

It may be wise to wait for the next candlestick to confirm the hammer before making any purchase decisions. The candlestick should open higher if you plan to buy on the day after the hammer, or should end in the green if you wish to wait until the day after and buy at the opening. Additionally, there was another hammer on D-11 that was not confirmed by the next session.

The invalidation threshold may be placed either below the lowest of the hammer or according to the method of thirds, depending on the participant’s investment horizon.

On the other hand, it’s interesting to combine the observation of reversal patterns with support and resistance level lines. A hammer may thus sometimes form at the level of support. The prices may even, in some cases, go below the support during the session. Still, if the closing occurs above the support, the break will not be validated, and we may be able to observe a reversal on the support like the one occurring in the example, at the 7500 point level.

Hammer vs Red reverse hammer candlestick

These two patterns are identical. Except that the inverted hammer is an inverted hammer figure. Hammers serve as a bullish reversal signal, and an inverted hammer occurs at the end of a market downtrend. It shows the possibility of a bullish trend.

The Difference Between Doji and Hammer Candlestick

Doji differs from the hammer candlestick in many ways. Doji is another candlestick type with a small real body. It shows the market indecision since it has an upper and down shadow. It could point out the reversal depending on the confirmation signal that follows. On the other hand, the hammer occurs after the price decline, indicating an upside reversal followed by a confirmation signal, and only has a long low shadow.

Psychology of the Red hammer candlestick

Hammer patterns, in general, occur in a downtrend of the market when the chart indicates a sequence of lower highs and lows. The hammer formation indicates that more bullish investors take positions in the market while a reversal in the price downward could be imminent.

The long lower shadow signals a possible continuation of the price downward tendency. The higher close, however, shows that sellers were unsuccessful in knocking the price to an intraday low.

The difference between a shooting star and hammer candlestick

A hammer candle shows a possible bullish trend reversal. On the other hand, a shooting star candle points out a bearish trend and occurs after an uptrend representing an upper shadow. Essentially the morning star is the opposite of the hammer candlestick pattern. It rises after the opening price but closes at the same point of the trading period. The shooting star represents the top of a price trend.

The red hammer candlestick explained.

The inverted hammer describes the shape of a single candlestick,, but to use it, you have to go about it like a morning star, an upward reversal pattern made up of three candlesticks.

Therefore, the 2nd candlestick, the actual star, is an inverted hammer. This upward reversal pattern is less powerful than a Morning Star.

The elements that characterize it are:

- The inverted hammer should appear following a downtrend.

- The 1st candlestick must have a red body.

- The 2nd candlestick should form an inverted hammer, preferably drawing a bearish gap and ideally having a green body.

- The 3rd candlestick ideally traces a bullish gap and has a large green body.

Such a structure is formed when, following a downtrend, the day after a day of loss, prices open lower by forming a gap compared to the previous day’s close, go up but end up falling again and close to the opening price. The next day, prices open in a bullish gap and go up to regain a good part of what was lost during the 1st gap. This confirms the pattern, and the major force is now bullish.

Red hammer candlestick vs morning star

It should be noted that the inverted hammer is a less powerful figure than the morning star because during the 2nd Japanese candlestick, the inverted hammer, prices open on the lows, rise and then come down on the lows, which shows that the bulls are not yet strong enough. The hammer’s body should be green because it shows that the bears have been unable to bring down the courses on the lowest, but a red body is not necessarily prohibitive.

The larger the 2nd gap, the more significant the figure. Similarly, the more the Japanese candlestick 3 erases the losses of the candlestick 1 and the 1st gap, the more it will be. Strong volumes on candlestick 3 may also confirm the pattern.

The inverted hammer being a less powerful figure than the morning star, it will be necessary to pay particular attention to the validation of the figure. Still, if it takes place or other bullish technical signals reinforce it, it could give rise to purchases on D+2 (D being the day of the inverted hammer and D+1 that of the green candlestick). The invalidation threshold may be placed either under the lowest formed by the structure or under gap no. 2 if it has occurred and according to the participant’s investment horizon.

On the other hand, it is interesting to combine the observation of reversal patterns with support and resistance lines. An inverted hammer can thus sometimes form at the level of support and even cross it momentarily without invalidating it, as is the case in the example with the 4500 pts, giving rise to a potential reversal upwards.

Trading red hammer candlestick

Red hammer and standard hammer both signal the same price action. Therefore you can use them in exactly the same way using a long-term position to benefit from an uptrend. Or you can close an existing short trading position to prevent loss. Search for the nearby support zone to place a stop loss order and resistance point to find the profit point. Always make sure to confirm the trend using other indicators before you commit to your trading position. You should also check exit points and see if these are aligned with your risk-reward ratio.

Conclusion

The hammer candlestick is a bullish trading pattern that may indicate that an asset has reached its bottom and is positioned for trend reversal. Red hammer candlesticks can be used in different trading strategies like Scalping, Day Trading, or Swing Trading. They are suitable for traders of different levels and can be used with all timeframes. A red hammer signals a potential bullish trend reversal like a green candle hammer.