The RBI to Boost Rates In August

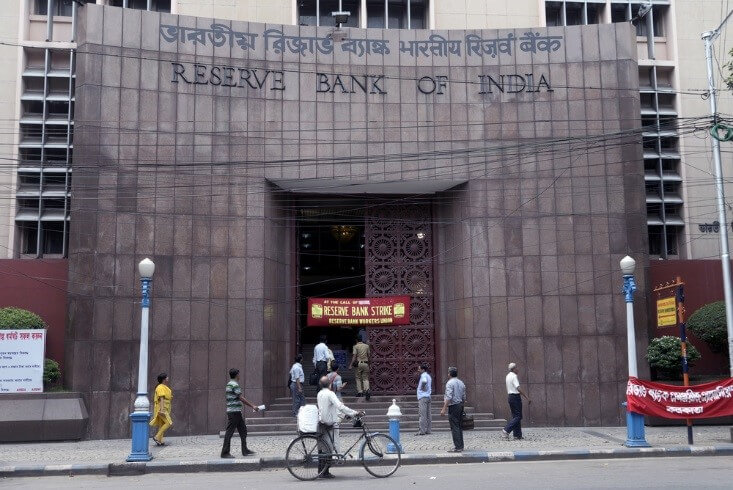

According to economists surveyed, the Reserve Bank of India would increase its benchmark interest rate on Friday. Still, given the lack of specific direction from the central bank, there is no agreement so far.

The RBI only started hiking rates in May. It should have upcoming front-load rises to keep up with its international rivals since inflation is running at a near-decade high. 26 out of 63 analysts, or more than 40%, predicted that the RBI would raise the repo rate by 50 basis points to 5.40 percent. Twenty of the 63 respondents, or more than 25%, expected a drop in the rise by 35 bp. Out of 63 respondents, 14 (22%) said 25 bps, while the remaining three (3%) said 40 bps.

The RBI should offer some clarification. However, given the current level of uncertainty, it would be best not to make any predictions at all, according to Societe Generale’s (OTC: SCGLY) India economist Kunal Kundu, who forecasts a 50 bp increase.

RBI Effort’s to Combat Inflation

Deutsche Bank (ETR: DBKGn) chief economist Kaushik Das expressed the bank’s optimism that the RBI will accept the benefits of front-loading rate increases. We believe it is a dangerous approach at this point to be an outlier in delivering less than 50 basis rate rises. Still, the RBI may always slow the pace of rate hikes from September forward if inflation and GDP momentum weakens.

With end-2023 projections ranging between 4.75 percent and 6.75 percent, the picture for the following year was even less certain. Heavy capital outflows from India, where the RBI has lagged in the global tightening cycle, have contributed to the rupee’s decline to historic lows of about 80 rupees to the dollar. The RBI has limited choices to protect the rupee without depleting its foreign exchange reserves because it is anticipated that the dollar would remain strong in the short to medium term.

According to Sanjay Mathur, head economist for Southeast Asia and India at ANZ, front-loaded rate rises by the RBI will complement its FX intervention towards regulating the rupee’s exchange rate.