PINE token’s ICO sale is live. You don’t want to miss it

Pine is a new two-sided decentralized non-custodial protocol that recently attracted investors’ attention. This platform aims to facilitate asset-backed loan transactions between two parties so that both lenders and borrowers will be satisfied with the deal. According to the team, lenders will be able to set up their own lending pools. They will also have an opportunity to choose NFT collections that they are willing to lend against. Setting your own terms for loan offers is another benefit the platform offers.

Pine will add offers to a one-sided offer book. After that, borrowers can choose the one that suits their needs and borrow cryptos against them. They can use their NFT assets as collateral. This protocol wants to build and facilitate the adoption of new technologies that will eventually bring asset-backed financing on-chain.

The team believes in blockchain technology and thinks that there will come a time when people will make all payments in digital currencies. That’s why it decided to build the Pine Protocol. This smart contract infrastructure will allow customers to conduct asset-back financing more efficiently and transparently on the various blockchains.

Moreover, the company will initially provide technology solutions to cater to the early adopters of digital assets and financial services. However, it aims to extend to a wider set of traditional assets in the future. The Pine team includes professionals with extensive experience in blockchain technology, quantitative trading, digital assets exchange, e-commerce, software development, and traditional banking. The company also has a well-developed and interesting roadmap.

What solutions does Pine Protocol offer?

The platform’s main advantage is that it allows customers to borrow fungible digital tokens from lenders by using NFT tokens as collateral. The team is building a two-sided loan marketplace. It will introduce its decentralized app soon. The platform has a great interface with a modern design, and it’s easy to navigate for users. Lenders and borrowers will be able to interact with the Pine Protocol by using its app.

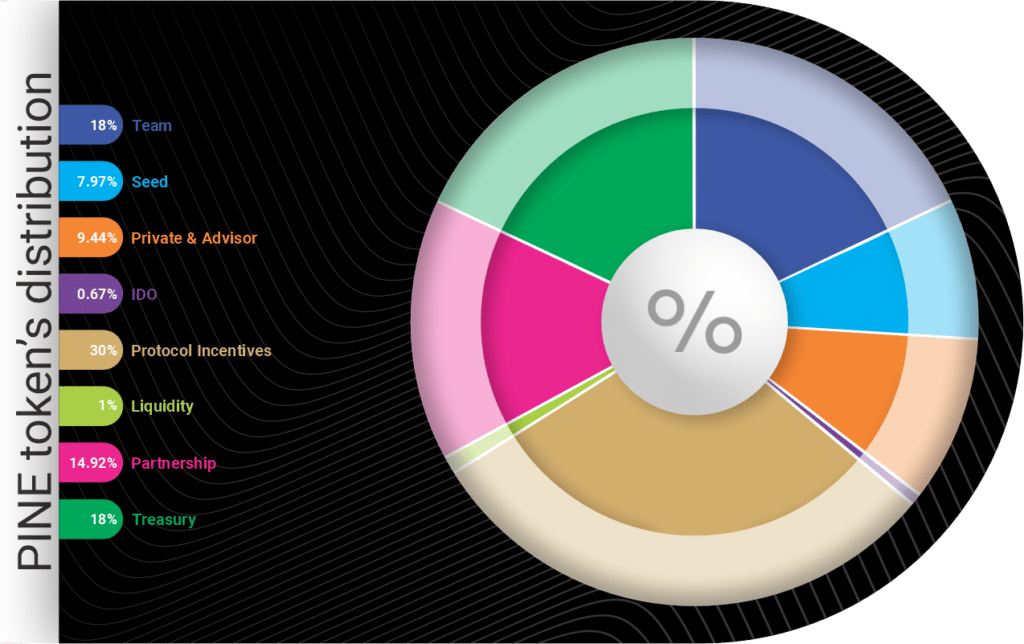

Moreover, the company creates its own native utility token, PINE. The PineDAO issued this coin specifically for the Pine Protocol. The team designed the token’s structure, emission schedule, distribution, and utilities meticulously, ensuring that it would make the protocol scalable and sustainable.

Besides, the company launched the PINE token’s ICO on November 17, 2022. The sale will end on February 8, 2023. This ERC20 token has quite high ratings on various ICO listing platforms. 1 PINE is trading for 0.2 USD at this stage, but its price will likely increase after the initial coin offering ends. The team aims to raise $268,000. The total supply of tokens is 200,000,000, but only some percentage is available now.

Pine stated that the lender would have to lock funds on the platform in order to submit active offers. After the borrower accepts the offer, the funds become unavailable to the lender until the loan term ends. If the lender wants to liquidate funds, they will be obliged to pay a liquidation fee to the Protocol.

On the other hand, borrowers will be obliged to lock the NFT Collateral on the platform until they fully repay the loan and relevant charges. The borrower will permanently lose ownership of their NFT Collateral if they attempt liquidation. However, each loan is an isolated case. Thus, it does not affect the status of any other loan that belongs to the same customer.

What makes the Pine Protocol stand out among other similar platforms?

There are several factors that make this project attractive for investors and customers. Pine is a decentralized and non-custodial protocol. It is also permissionless and enables customers to earn a yield on fungible digital assets. Moreover, its users will be able to acquire NFT assets at a discount. The company even offers a segregated pool structure for better risk management.

Borrowers will find multiple lenders on this platform and will be able to accept the best offer. Healthy competition is also good as it means better terms for customers. Besides, the platform offers a flexible schedule to repay a loan. Borrowers can easily pay it earlier or extend the loan via a rollover.

Pine’s main goal is to serve as a facilitating platform for Asset Back Loan borrowing and lending. As such, the company will enable customers to pledge non-fungible tokens as collateral to meet their liquidity requirements. But at the same time, users will be able to extract extra yield from their idle crypto cash.

What about the platform’s features?

The Pine platform will serve as a marketplace dApp for asset-backed loans. Multiple lenders will list their loan offerings on the platform. Meanwhile, NFT holders will be able to initiate and extend loans with the best terms available on the Defi market. According to the Pine team, this platform operates similarly to exchange, providing an offer book structure. The company will also guarantee the enforceability of the loan terms.

Furthermore, the platform plans to provide a lenders portal. Lenders will be able to manage their loan offers and segregated pools thanks to this feature. They can also use this portal for pool creation, collateral repossession, and overall loan management. The company will add other features in the future, including loan marketplace analytics. The latter will help lenders optimize their yield generation, as well as risk management.

Pine provides different financing options for purchasing non-fungible tokens on open marketplaces. Thus, buyers will be able to bid on or outright buy an NFT with a mortgage. Users can also finance the purchase of an NFT by using their existing portfolio as collateral.

That’s not all, though. Collateral Listing is crucial when it comes to enabling margin trading of NFTs. As a result, the company will allow customers to list their tokens for sale even if they are currently serving as collateral for an outstanding loan. However, in this case, the sales price must be higher than the total outstanding loan amount. After the sale’s conclusion, the platform will automatically use part of the proceeds to repay any existing loan associated with the NFT, and the seller will receive the rest. Overall, this project has a lot to offer.