Opticapital Review: A Great Trustworthy Brokerage firm

| General Information |

|

|---|---|

| Broker Name: | Opticapital |

| Broker Type: | Forex & CFDs |

| Country: | England |

| Operating since year: | 2022 |

| Regulation: | FCA |

| Address: | 7 Westferry Circus, London E14 4HD, United Kingdom. |

| Broker status: | Active |

| Customer Service | |

| Phone: | +442039961423 |

| Email: | N/A (There is a Contact Form) |

| Languages: | English, French, German. |

| Availability: | 24/5 |

| Trading | |

| The Trading platforms: | MetaTrader |

| Trading platform Time zone: | (GMT+1) |

| Demo account: | No |

| Mobile trading: | Yes |

| Web-based trading: | Yes |

| Bonuses: | Yes |

| Other trading instruments: | Yes |

| Account | |

| Minimum deposit: | $250 |

| Maximal leverage: | 1:500 |

| Spread: | Floating From 0.0 Pips |

| Scalping allowed: | Yes |

First Impressions

Let’s explore why opticapital.com is one of the most reputable brokers online right now in this review.

Opticapital provides traders with a broad selection of trading assets, including CFDs on stocks, indices, commodities, and more. This broker has obtained licenses from prestigious regulatory bodies around the world, including the FCA in the UK, CySEC in Cyprus, and others.

With spreads on major pairs starting at just 0.6 pip, Opticapital is renowned for its extremely low fees. In today’s Opticapital review, we’ll go over every significant point that distinguishes this broker as one of the top businesses in the forex sector. Let’s explore what Opticapital actually has to offer without further ado.

A lot of factors can determine the safety and security of the broker you choose to employ. The regulatory standards that a specific broker adheres to should be one of the key points of emphasis. When researching for this Opticapital review, we found that it was subject to regulation in five separate countries. This is a list of licenses that Opticapital currently holds: Financial Conduct Authority, UK; International Financial Services Commission, Belize; Cyprus Securities and Exchange Commission.

These permits enable Opticapital to provide services to traders across the globe. The CySEC license gives this broker access to the whole European market, while the Belize license enables it to provide services to a lot of international jurisdictions.

Over the past few years, Opticapital has established a number of regulatory requirements to ensure the safety and security of its clients. These rules are intended to guarantee that every client of the broker gets the chance to secure the safety and security of their assets while also taking advantage of top-notch trading services.

Opticapital Review: Policies of the broker

According to our Opticapital review, negative balance protection is one of the rules that Opticapital adheres to; this is crucial for traders who employ leverage. For Forex traders, leverage is highly helpful because it can increase trading earnings.

High leverage can, however, not only increase the potential profits generated through forex trading, but it can also increase the potential losses as well. Negative balance protection is used to make sure traders cannot lose more money than they have in their accounts. As a result, the broker will all automatically close your trades to prevent a negative balance.

In addition to this, Opticapital also maintains separate bank accounts for each of its clients’ funds. This implies that traders will always have access to their money, regardless of what happens. You won’t have to be concerned about the balance you had with the broker evaporating overnight, even if the broker declares bankruptcy. The broker makes sure that their clients’ money is always kept safe by adhering to these regulations.

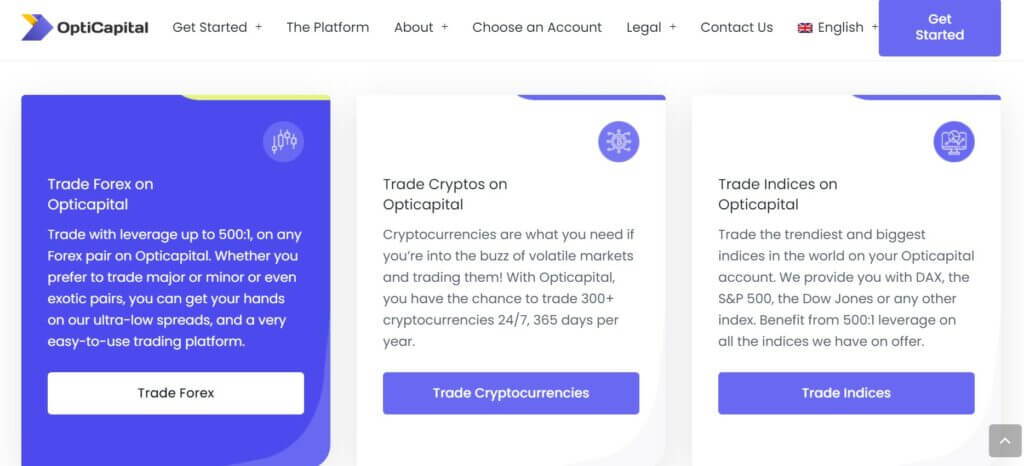

Trading Instruments

We were very pleased to find that Opticapital traders have a selection of more than 120 assets. Even though this may not seem like much, especially when compared to other top brokerages on the market, it should be plenty to allow traders to quickly locate the kinds of trades they may be looking for.

With any account, traders have access to all of these available assets. But bear in mind that only the unique Shares account can be used to trade shares. For CFD shares, additional accounts may also be used to trade them.

All varieties of Forex currency pairs, including major, minor, and exotic currency pairs, are accessible to customers of Opticapital. Almost 55 currency pairings in total are offered for trading on Opticapital. The maximum leverage offered by Opticapital for FX trading is 1:188; however, depending on your region, there may be some limitations on the maximum leverage.

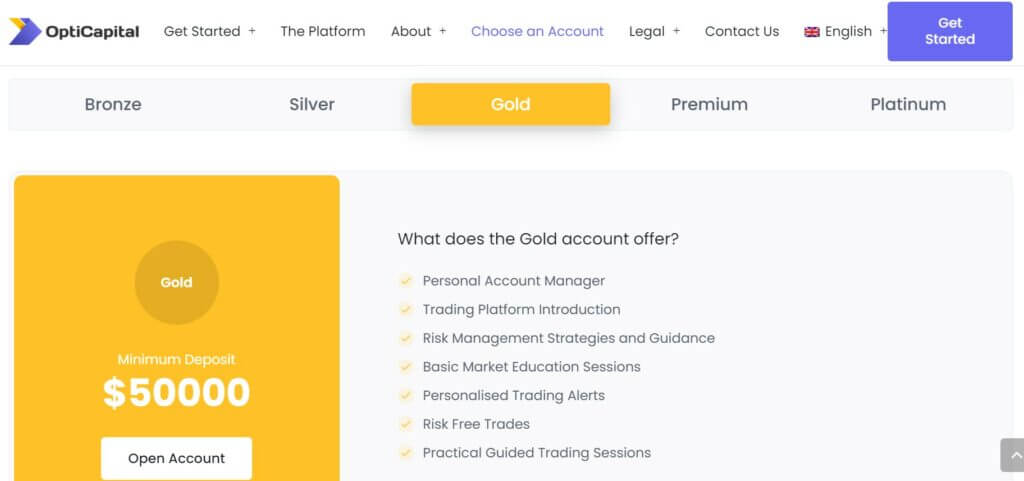

Opticapital Review: Account Types

According to our Opticapital review, the broker has made a significant effort to provide a wide range of account kinds to cater to the needs of various traders. As a result, the broker may provide traders with services that are ideal for their trading requirements. We will go through each of the account kinds that Opticapital offers in more detail below.

A demo account is available to all opticapital.com clients. Both newcomers and seasoned traders alike frequently use this type of account in the forex trading industry.

A demo account is a tool that novice traders can use to educate themselves on the Forex market. A trial account can be helpful for experienced traders to test out different trading approaches and see which ones work best for them.

The broker will provide you with a set amount of virtual money to utilize for trading when you open a demo account. You are free to use this virtual money for as long as you like, and if you run out, you can always get in touch with Opticapital’s customer care and request more.

You can begin trading with real money after you feel confident with the information you have learned through the demo account. For new traders to practice more and get greater experience and market competence, opticapital.com offers a unique account.

Beginners can learn to trade in live market conditions with the help of Opticapital’s Bronze account without having to take on excessive risk. 1,000 units of the asset are included in the contract size for this account. It is fairly little in comparison to the regular lot size because the standard lot equates to 100,000 units of an asset.

For people who have recently concluded their training using the demo account, the bronze and silver accounts can be extremely helpful. While using an opticapital.com demo account is a great way for traders to gain more market knowledge, it is not a good way to learn how to manage your emotions when trading. You will be able to gain greater insight into emotion regulation by gradually moving from playing with play money to real money.

For traders with a variety of interests, Opticapital’s Gold account may be the ideal option. Simply said, this account was designed with a variety of traders in mind. The standard account can be a perfect fit whether you’re trying to figure out how to start trading with a lot of money or you want to find a way to cut your losses.

For traders who want to keep their Forex trading expenses to a minimum, the premium and platinum account types are fantastic choices. For owners of premium and platinum accounts, there are only six base currency possibilities, as opposed to other accounts, which have nine base currency options.

A lot is equal to 1,000 units of the traded asset. Depending on the location and the volume of trading, the leverage is essentially the same. With this account, spreads are really modest, which gives it real uniqueness.

Opticapital Review: Final Verdict

Take advantage of the VIP and VIP+ trading club offered by Opticapital as well as extraordinary advantages like one-on-one coaching from Senior Market Analysts. Opticapital also has managed account options. Members of the club are eligible for special deals and possibilities that have been chosen to provide the best trading opportunities.

After performing some in-depth evaluations of everything Opticapital Station has to offer, we are happy to report that traders from all over the world may easily trust this broker. Every customer using this broker should be able to find something they’re looking for thanks to the finest efforts of Opticapital.

In less than ten years, Opticapital has managed to rank among the top Forex brokers worldwide. Trading possibilities that are safe, secure, and varied are provided by the broker, and they may be tailored to suit the needs of traders with various degrees of experience and market knowledge.

-

Support

-

Platform

-

Spread

-

Trading Instrument

Good trading experience

I am happy to share my trading experience with this broker. I gain good profit from my trades and they are responsible in helping me.

Did you find this review helpful? Yes No

On time withdrawals

A decent trading company to deal with. They attend to all concerns promptly. Also, they process withdrawals on time.

Did you find this review helpful? Yes No

Good broker

There are so many opportunities to make money. Affordable initial deposit with really great returns. Easy to use software, too.

Did you find this review helpful? Yes No

Excellent services

Excellent services. They’ve got low spread, no issue in deposit and withdrawal and they have a cooperative customer service. They provide different types of accounts and has a lot of trading instruments to choose from.

Did you find this review helpful? Yes No