After merging, only Ethereum Proof of Stake will be supported by OpenSea

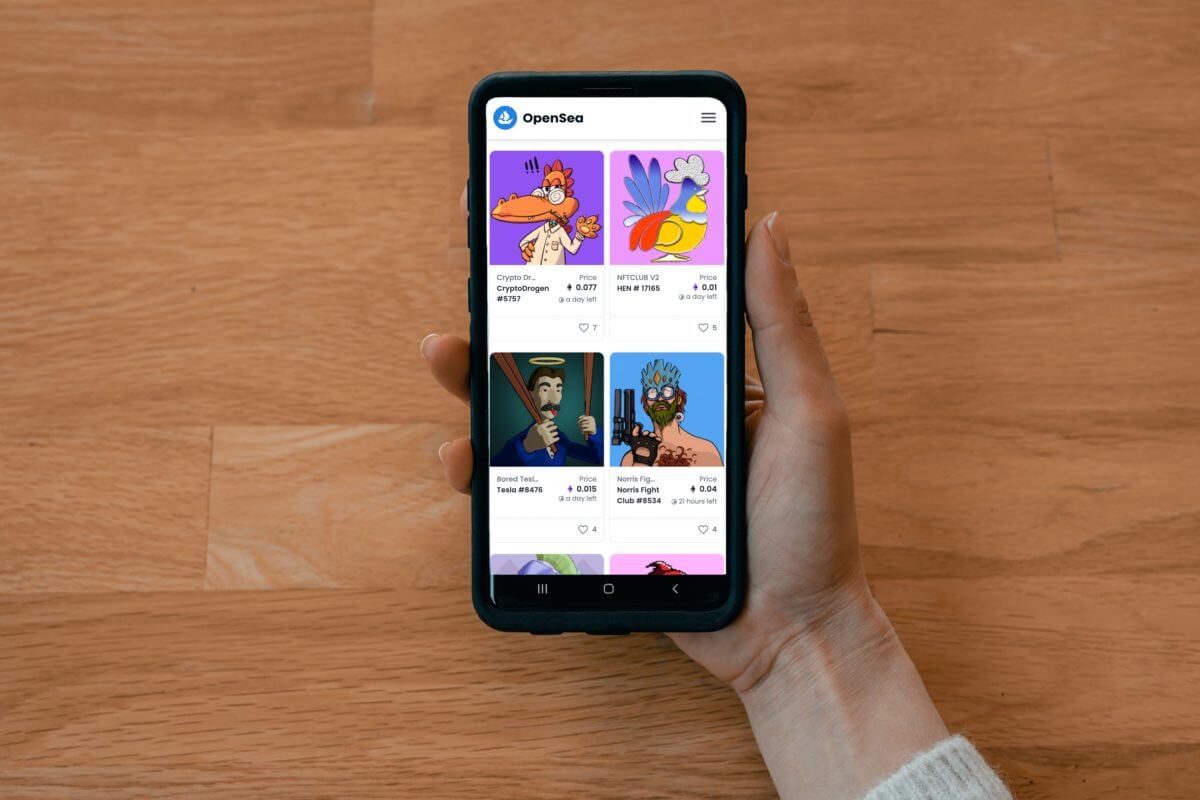

According to its website, OpenSea is the first and biggest online market for non-fungible tokens and crypto collectibles (NFTs). Users can browse their many categories to find exclusive digital goods that are for sale and purchase, sell, or discover them. Anyone can develop an NFT and sell it on OpenSea as well as other networks and marketplaces, but OpenSea has served as the industry standard for all significant NFT initiatives that have gained widespread acceptance and entered the public sphere.

Once the Merge occurs, OpenSea has declared that it would only support Ethereum’s proof-of-stake chain. It also disclosed that Polygon is now supported by the Seaport protocol. Once the Merge has occurred, NFT marketplace OpenSea has said that it would only offer the proof-of-stake version of Ethereum. On September 1, the business tweeted that it was “dedicated to exclusively supporting NFTs on the improved Ethereum PoS chain.” In order to ensure a smooth transition to Proof-of-Stake, it has also been getting ready for it.

Along with a sharp reduction in active users and traders, OpenSea’s trading volume has also drastically decreased. Transaction volume has decreased, which could mean that individuals are no longer interested in or value blockchain-based collectibles. It was one of the most active areas of the cryptocurrency and blockchain industries in 2021, and the high gas costs on Ethereum were frequently linked to the volume of transactions occurring on OpenSea. The enthusiasm and fear of missing out appear to have turned negative along with the value of cryptocurrencies now that the bull market of 2021 is conclusively finished. On OpenSea, the volume has drastically decreased over the past four months by 99%.

Is the NFT Bubble About to Burst on OpenSea?

To put it into context, on May 1st, $2.7 billion in NFT transactions were transacted on OpenSea. On August 28, it was only able to process NFTs valued $9.34 million. On August 28th, there were 24,020 active users on the site, which is almost a third fewer than there were on May’s record-breaking day. Losing 99% of your customers would mean the death of your business in any other industry, but in the crypto world, these norms frequently do not hold true.

Similar to the dot.com and housing bubbles, many had predicted that the NFT bubble would burst. The sharp drops in volume on NFT exchanges have occurred at the same time as the collapse of cryptocurrency values. Since individuals were buying and selling NFTs in cryptocurrency, namely Ether. Prices fell during the past year without much of a problem. The true value is in the NFTs’ floor price. Even though Ether has dropped around 59% from its peak to around $1,590. If you own a rare NFT with a rising floor value. You are still gaining ETH even as the price of ETH is decreasing.

Why does this matter for NFTs? Well, the floor prices have started to decline as well, and very drastically at that. The floor price of some of the most well-known NFT collections has dramatically dropped, with Bored Ape Yacht Club dropping by nearly 53% to 72.4 Ether (about $110,000) from 153.7 Ether. CryptoPunks, another well-liked NFT collection, is down 19% from its peak in July.