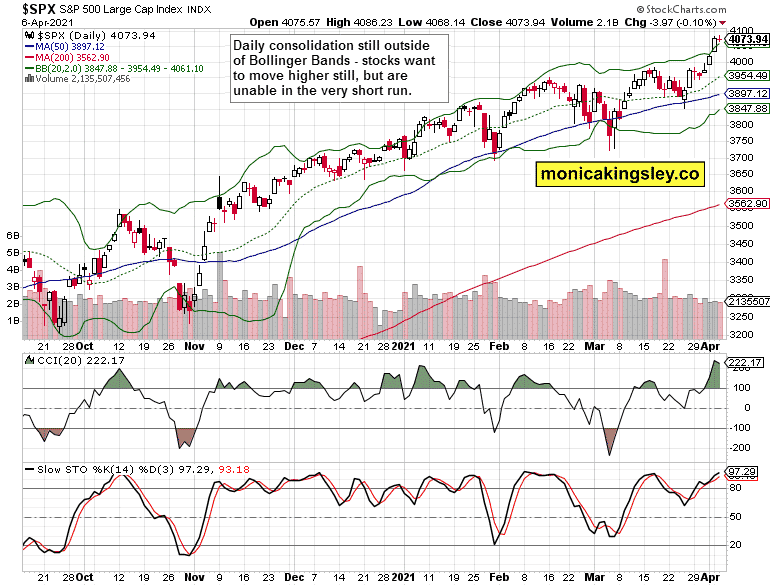

On the Verge of Stocks Pullback

S&P 500 is still consolidating Monday‘s sharp gains, showered with liquidity. Yet it seems that eking out further gains is getting harder as the price action took the index quite far from its key moving averages. If I had to pick one sign of stiffer headwinds ahead, it would be the tech sector‘s reaction to another daily retreat in Treasury yields – the sector didn‘t rally, and neither did the Dow Jones Industrial Average. Value stocks saved the day, and it appears we‘re about to see them start doing better again, relatively speaking.

Yes, the risk-reward ratio for the bulls is at unsavory levels in the short run. What about being short at this moment then? It all depends upon the trading style, risk tolerance, and time horizon. I‘m not looking for stocks making a major top here as the bull run is intact thanks to:

(..) Well, liquidity and bets on the stocks benefiting from the coming infrastructure bill.

Any way you look at it, the market breadth is positive and ready to support the coming upswing continuation. Even though I look for a largely sideways day in stocks on Tuesday given the aptly called fireworks to happen yesterday. Sizable long profits in stock market trades #6 and #7 have been taken off the table – 149 points in my Standard money management, and 145 points in the Advanced money management that comes on top.

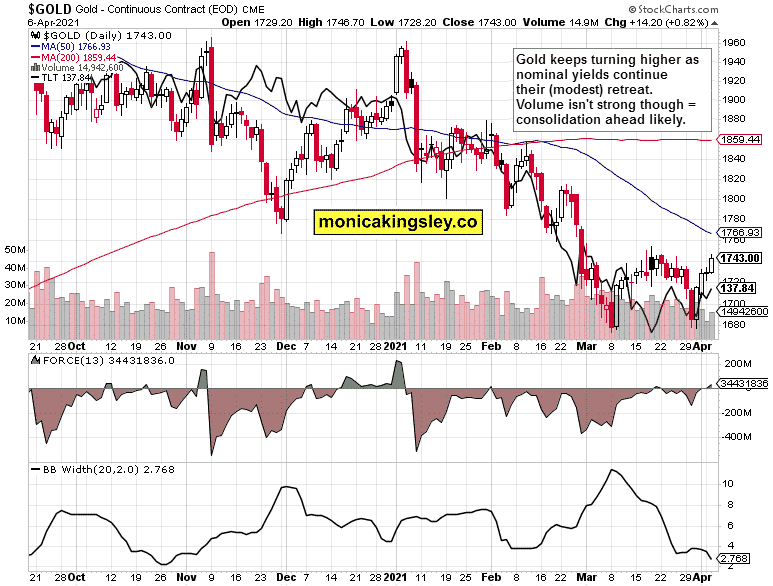

Gold

My prognosis for yesterday‘s session materialized, and we have seen quite a record number (around 95%) of stocks trading above their 200-day moving averages, which is similar to the setup right after the post-dotcom bubble bear market 2002/3 lows, or 1-2 years after the bull market run off the Mar 2009 lows. Hard to say which one is more hated, but I see the run from Mar 2020 generational low as the gold medal winner, especially given the denial accompanying it since.

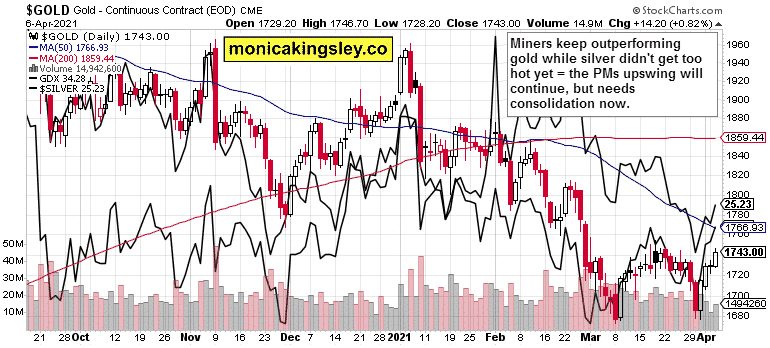

Gold made a run above $1,740 in line with retreating yields and copper not giving up much gained ground, but the immediate run‘s continuation to the key $1,760s or even better above $1,775 looks set to have to wait for a few sessions. I don‘t expect today‘s FOMC minutes release to change that. While the metals are likely to take their time, the healthy miners‘ outperformance supports its continuation once the soft patch we appear entering is over.

The Thursday called dollar downswing is playing out, putting a floor below the commodities, which are undergoing a much needed correction from their late Feb top. It‘s not over yet, and the shy AUD/USD upswing is but one clue. Given the oil price meandering around $60 (by the way, not even the unlikely decline to $52 would break black gold‘s bull run), the USD/CAD performance as of late is disappointing, as the greenback got mostly stronger since mid-Mar. More patience in the commodities arena appears probable as we‘re waiting for both Treasury yields and inflation expectations to start rising again.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 Outlook

The SPX headwinds are readily apparent, and a brief pullback would be healthy. Don‘t look though for too much downside.

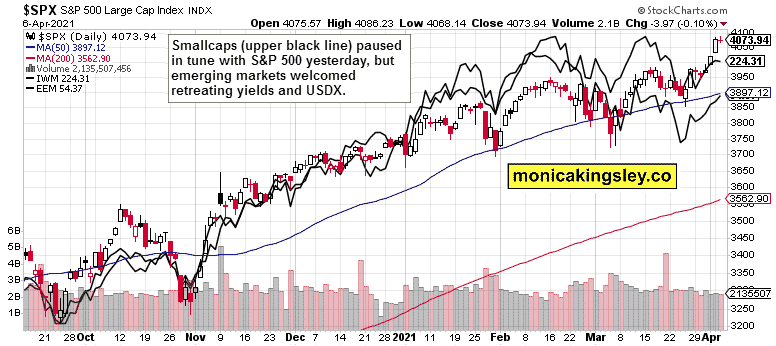

Russell 2000 and Emerging Markets

Smallcaps are still underperforming for now. But emerging markets scored gains thanks to improving yield differentials and another down day in the world reserve currency.

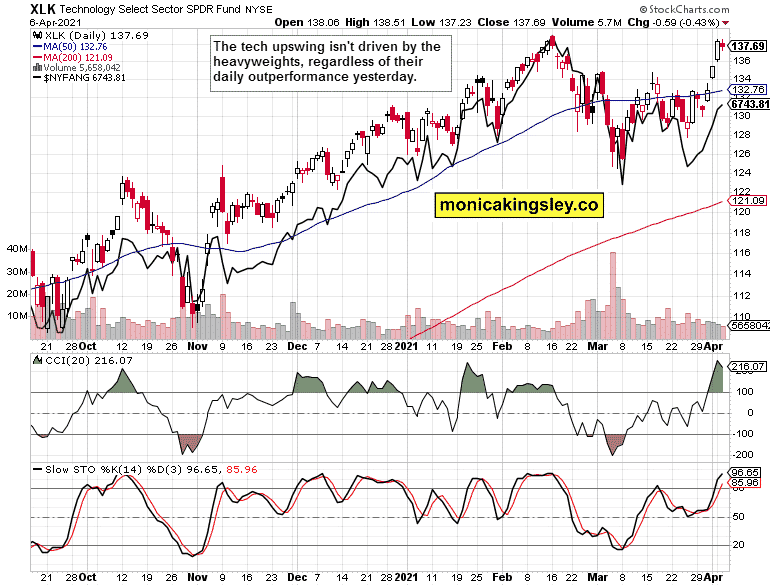

Focus on Technology

Tech (XLK ETF) was the key retreating sector yesterday – little wonder the mid-Feb resistance it‘s approaching. The big names ($NYFANG, black line) are lagging behind still, showing that the sector got a little ahead of itself on a short-term basis.

Gold and Silver

Gold‘s Force index finally crossed into positive territory. But the yellow metal isn‘t taking yet advantage of retreating yields in a visually outstanding way. Quite some resistance in the $1,740s needs to be cleared first. Which would likely take a while, but the rally‘s internals is still on the bulls‘ side.

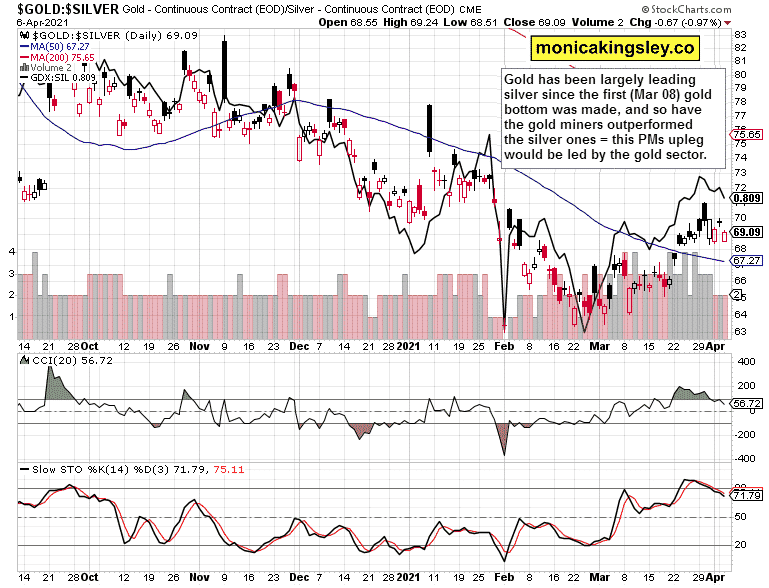

Gold miners keep strongly outperforming the yellow metal. The seniors (GDX ETF) are doing particularly great – better than gold juniors or silver miners. Seeing signs of the silver sector getting too ahead, wouldn‘t likely be bullish at all unless sustained – at the current stage, I can‘t underline these words enough in the ongoing physical silver squeeze.

Gold to Silver Ratios

Since the gold bottom was hit in early Mar (that‘s still the leading hypothesis), the precious metals‘ leadership has moved to the yellow metal. It‘s visible in both the gold to silver ratio and gold miners to silver miners one. The time for the white metal to (out)shine would come, but clearly isn‘t and won‘t be here any day now.

Summary

S&P 500 is likely to keep consolidating gained ground, and (shallow) bear raids wouldn‘t be unexpected here – in spite of solid corporate credit markets performance. Yet, it‘s the extraordinary nature of VIX trading and put/call ratio moves, that point to the bull market run as intact and merely in need of a breather.

Precious metals are likely to run into short-term headwinds before clearing out the next major set of resistances above $1,760s. The upswing though remains healthy and progressing, and will be led by the gold sector.

Thank you for having read today‘s free analysis, which is available in full at my personal site. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

[email protected]

* * * * *

All essays, research, and information represent analyses and opinions of Monica Kingsley that are based on availability and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes. It should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks, and options are financial instruments not suitable for every investor.

Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading, and speculating in financial markets may involve a high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings. She may make additional purchases and/or sales of those securities without notice.

-

Support

-

Platform

-

Spread

-

Trading Instrument