Oil price drop of 2.11% and Natural Gas fell by 5.00%

- Oil fell on Monday as weak production data from China and Japan for July weighed on the outlook for demand.

- At the very opening of the trading day, the price of natural gas fell by 5.00% of its value since the market closed on Friday.

- Global oil demand is not falling in a pattern consistent with a recession.

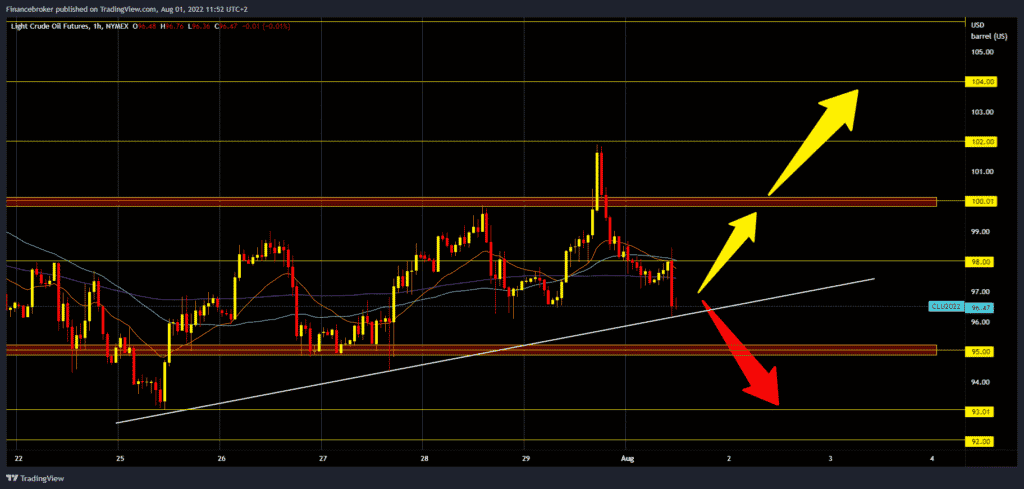

Oil chart analysis

Oil fell on Monday as weak production data from China and Japan for July weighed on the outlook for demand. Investors have been bracing for a meeting of OPEC and other leading producers this semester to adjust supply. The new quarantines led to a brief recovery in production activity in June in China, the world’s largest crude oil importer. The manufacturing purchasing managers’ index fell to 50.4 in July from 51.7 in the previous month, well below analysts’ expectations, data showed in the Asian session.

The Organization of the Petroleum Exporting Countries (OPEC) and allies, including Russia, a group known as OPEC+, will meet on Wednesday to decide on output in September. Two of the eight OPEC+ sources polled by Reuters said a modest increase in output in September would be discussed at the August meeting, while the rest said output was likely to remain unchanged.

The oil price is currently at $96.65, representing a price drop of 2.11% by the start of trading last night. We need further continuation of pullback to the $95.00 support zone for a bearish option. And if we don’t find support there, we could once again go down to last week’s low at the $93.00 level. We need a new positive consolidation from this level for a bullish option. The lower trend line can now provide additional support. Next, we need to get back above $98.00 and hold at that level to try to continue towards the $100.00 resistance zone. If we succeed in that, we could also attack last week’s high at the $101.95 level.

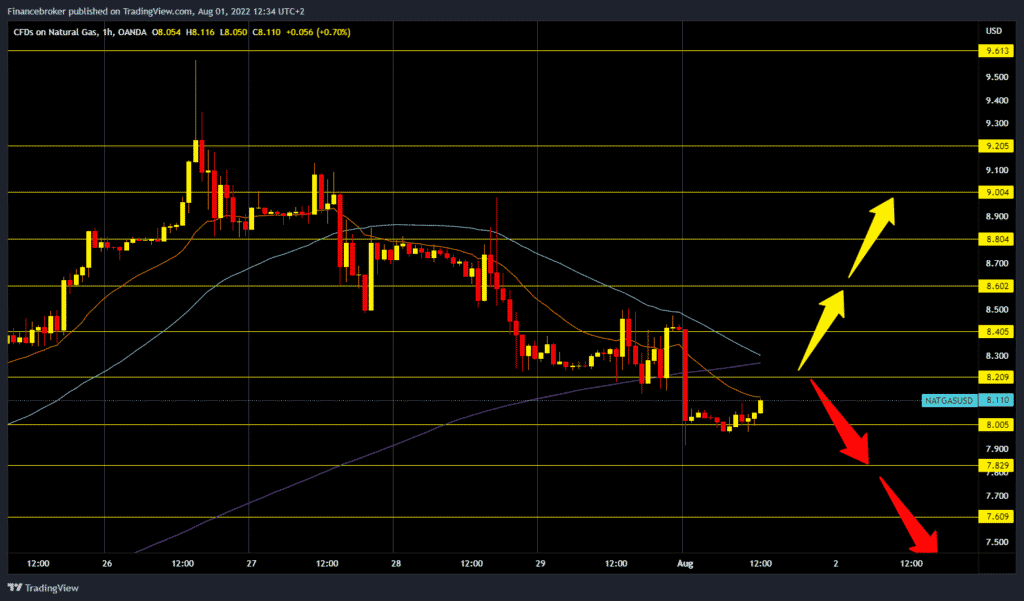

Natural gas chart analysis

At the very opening of the trading day, the price of natural gas fell by 5.00% of its value since the market closed on Friday. From $8.40, the price dropped to $7.90. We now have a slight recovery and hold above the $8.00 level. A recovery to the $8.20 level, a place of support from Friday, could follow. The price of natural gas is in a pullback for the fifth day after reaching $9.57. For a bullish option, we need a return to $8.40 to cancel this morning’s losses. After that, with the support of the moving averages, the price could continue to recover. Potential higher targets are $8.60 and $8.80 levels. For a bearish option, we need a continuation of the negative consolidation and a new price pullback below the $8.00 level. Potential lower targets are $7.80 and $7.60 levels.

Market overview

Global oil demand is not falling in a pattern consistent with a recession, and demand will continue to rise next year from this year despite expected slowdowns in Europe and the United States; Amrita Sen, director of research at Energy Aspects, told Bloomberg. Friday. Energy Aspects’ research director discussed recession fears and the oil market a day after the US Commerce Department’s preliminary estimate showed GDP contracted 0.9% in the second quarter, following a 1.6% drop in Q1. US policymakers insist that the ‘technical’ recession is not a broad-based recession, as many areas of the economy remain strong, particularly the labor market.