Oil and Natural Gas: Unexpectedly increased?

- During the Asian trading session, the price of crude oil consolidates earlier gains and continues to look above $ 120.00.

- The price has been stable for the last 48 hours and ranges from $ 9.20 to $ 9.40.

- The U.S. Petroleum Institute (API) reported an increase in the crude oil of 1.845 million barrels this week, while analysts predicted a withdrawal of 1.8 million barrels

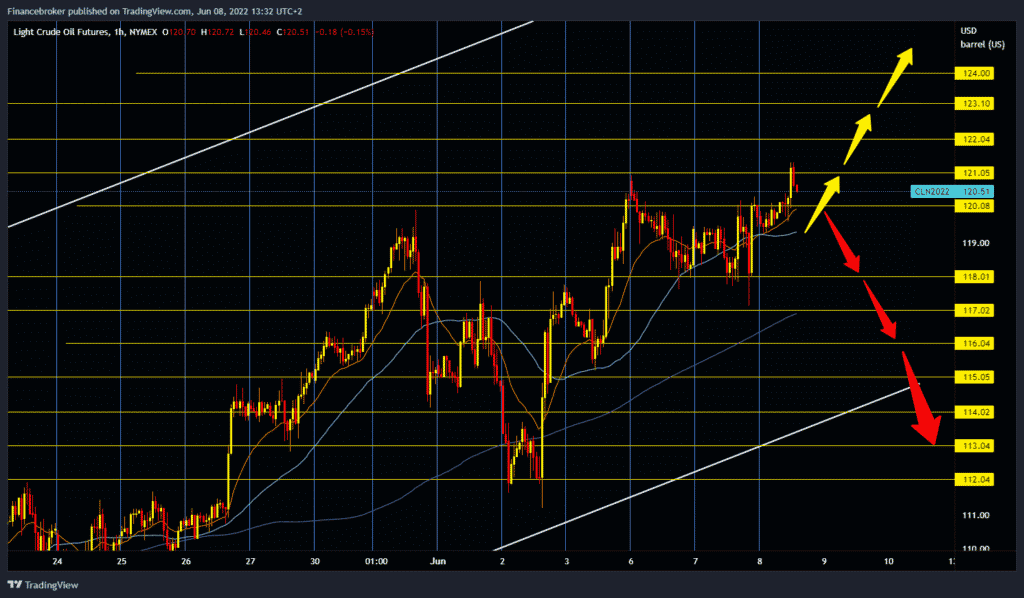

Oil chart analysis

During the Asian trading session, the price of crude oil consolidates earlier gains and continues to look above $ 120.00. The American Petroleum Institute announced last night that the stocks of crude oil in the USA unexpectedly increased by 1.8 million barrels. Stocks of petroleum products are at a very low level in the United States, and shortages are not ruled out. Crude oil is trading at $ 120.60 a barrel, an increase of 1.00% since the start of trading last night. At 16:30, an official government report on the state of crude oil and oil products in the United States will be published. Today’s high was at $ 121.35, after which we see the current pullback to $ 120.50. At the $ 120.00 price, we have support in the MA20 moving average, and a break below would intensify bearish pressures, and Oil prices could visit the previous support zone at $ 118.00. We need a break above the $ 121.00 price for the bullish option. The oil price could advance towards the $ 122.00 level with continued bullish consolidation.

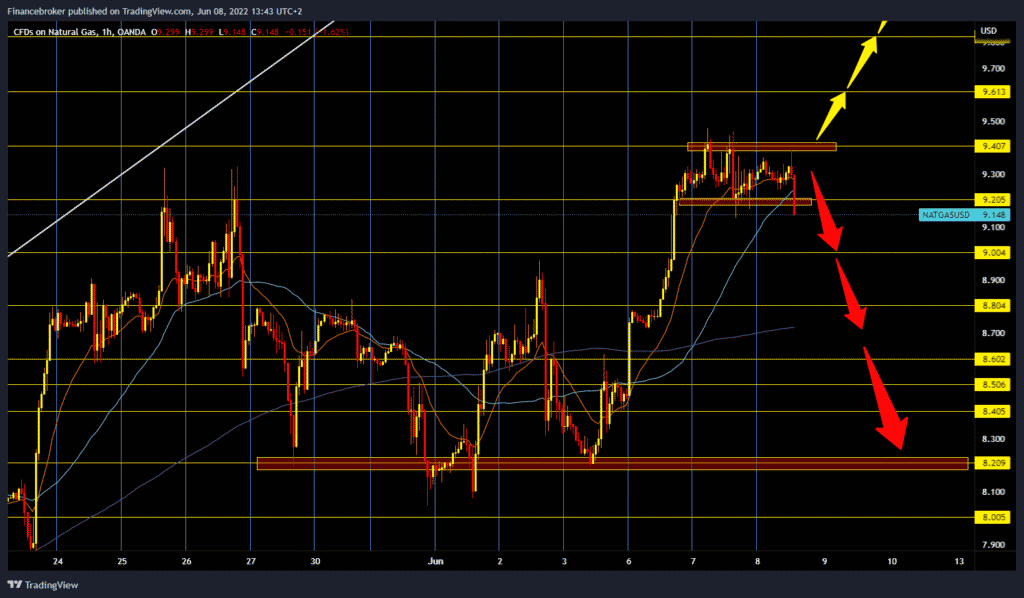

Natural gas chart analysis

The price has been stable for the last 48 hours and ranges from $ 9.20 to $ 9.40. We need a break above $ 9.40 and consolidation above that level for the bullish option. After that, a continuation of the bullish trend could happen. Potential higher targets are $ 9.50, $ 9.60 and $ 9.80. For the opposite bearish option, we need a break below $ 9.20. MA20 and MA50 then moving to the bearish side, may increase the negative price pressure. Potential lower support targets are $ 9.00, $ 8.80, and $ 8.60.

Market overview

API report

The U.S. Petroleum Institute (API) reported an increase in the crude oil of 1.845 million barrels this week, while analysts predicted a withdrawal of 1.8 million barrels. The withdrawal came even when the Ministry of Energy released 7.3 million barrels from strategic oil reserves in the week ending June 3. According to API data, U.S. crude oil inventories have fallen by about 74 million barrels since early 2021 and about 17 million barrels since early 2020.

Oil prices rose on Tuesday, with major banks raising their oil price forecasts for the rest of the year. WTI was up 1.33% on Monday to $ 120.10 a barrel the day, more than nearly $ 5.50 a barrel from the previous week. Brent crude rose 1.34% that day to $ 121.10 – and nearly $ 6 a barrel from the previous week. U.S. crude oil production stagnated at 11.9 million barrels a day for the third week in a row.