Oil and Natural Gas: The Price of Oil Fell to the $83.10

- During the Asian session, the price of oil fell to the $83.10 level.

- The price of natural gas formed a new multi-month minimum at the $5.15 level.

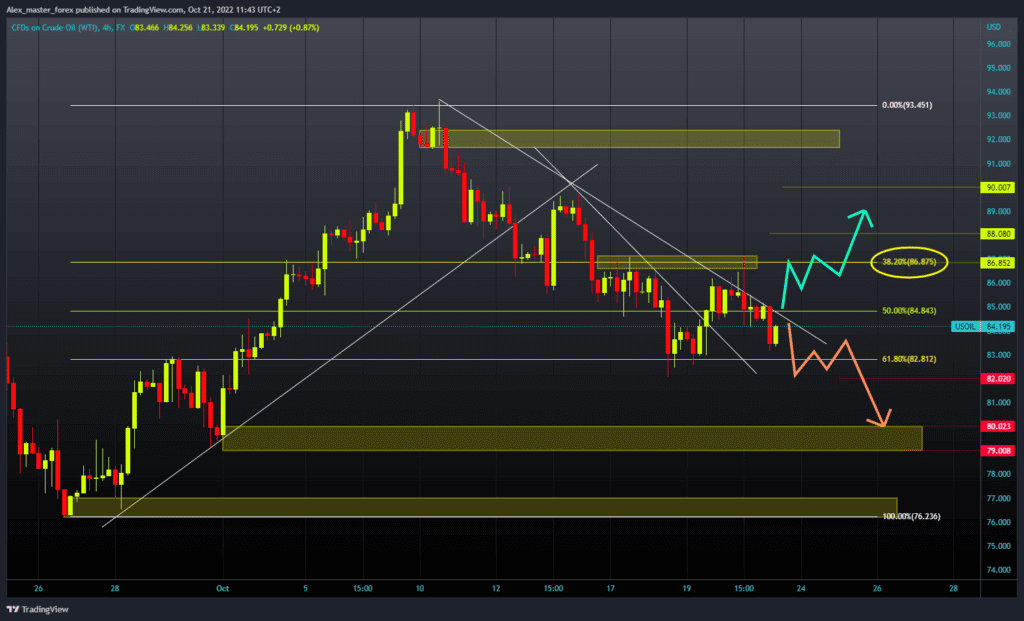

Oil chart analysis

During the Asian session, the price of oil fell to the $83.10 level. For now, we have found support at that point, and we see a price recovery to the $84.00 level. The price is now trying to climb up to the $85.00 level and form a new higher low from which it could start a new bullish impulse.

We have the next important resistance zone in the range of $86.50-87.00. A break above the price would be of great interest to us and further the bullish trend. Potential higher targets are the $88.00 and $90.00 levels. We need a continuation of the negative consolidation and a new pullback below the $83.00 level for a bearish option.

After that, we look at the $82.00 level as the next potential support. A break in oil prices below would only intensify the bearish pressure. Potential lower targets are the $80.00 and $79.00 levels.

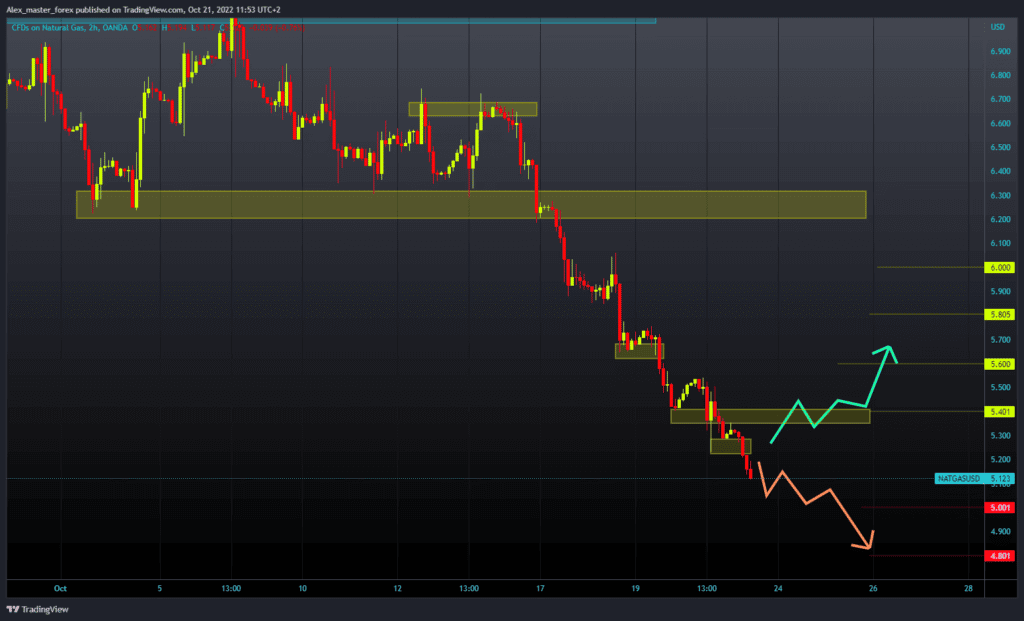

Natural gas chart analysis

The price of natural gas formed a new multi-month minimum at the $5.15 level. The gas price has been in a strong bearish trend since October 6. We are now looking at $5.00 as the next target and potential support.

We cannot rule out that we will see a continuation of the further decline in gas prices. Potential lower targets are the $4.90 and $4.80 levels. For a bullish option, we need a new positive consolidation and a return above the $5.40 level.

There we could form a new higher low and, with a bullish impulse, start a potential recovery of gas prices. Potential higher targets are the $5.60 and $5.80 levels.

Market overview

European Union leaders have again failed to agree on capping gas prices. The idea of a price cap on gas imports was put forward earlier this year and supported by 15 EU members. The concerns of those opposed to the bill center on the possibility that the price cap will lead to more spending, which is the last thing the EU wants right now.