Oil and Natural Gas: The Pressure Continues

- Today’s oil price is putting pressure on the $85.00 level throughout the Asian trading session.

- The natural gas price continues declining after failing to climb to the $7.00 level on Friday.

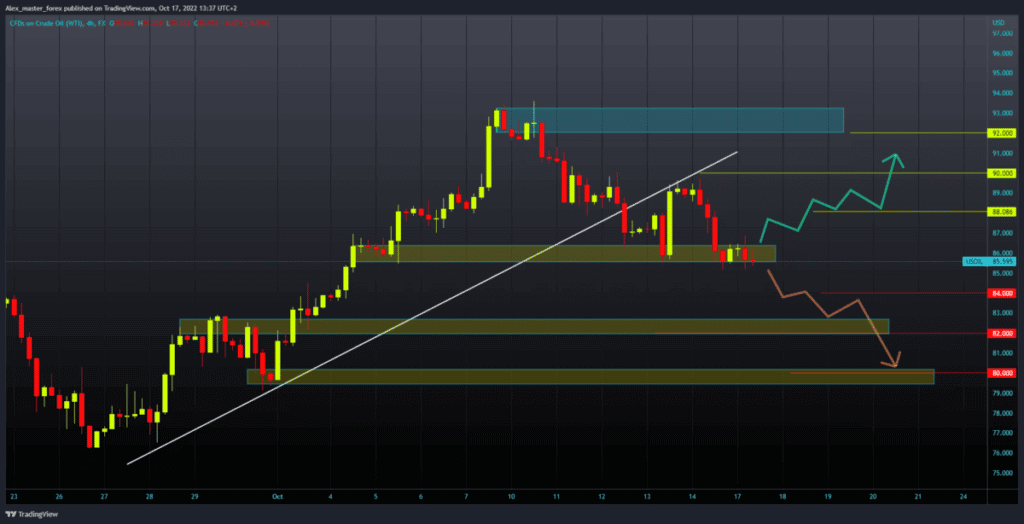

Oil chart analysis

Today’s oil price is putting pressure on the $85.00 level throughout the Asian trading session. The pressure continues in the EU trading session, and now we expect a break below and a potential continuation of the bearish trend. For something like that, we need a negative consolidation and a drop to the $84.00 level first. If the negative pressure on the price of oil continues, it could continue to decline. Potential lower targets are $82.00 and $80.00 support levels. For a bullish option, we need a positive consolidation and price return to the $87.00 level. Then we need to try to stay there. After that, oil prices could continue recovering with a new bullish impulse. Potential higher targets are the $88.00 and $90.00 levels.

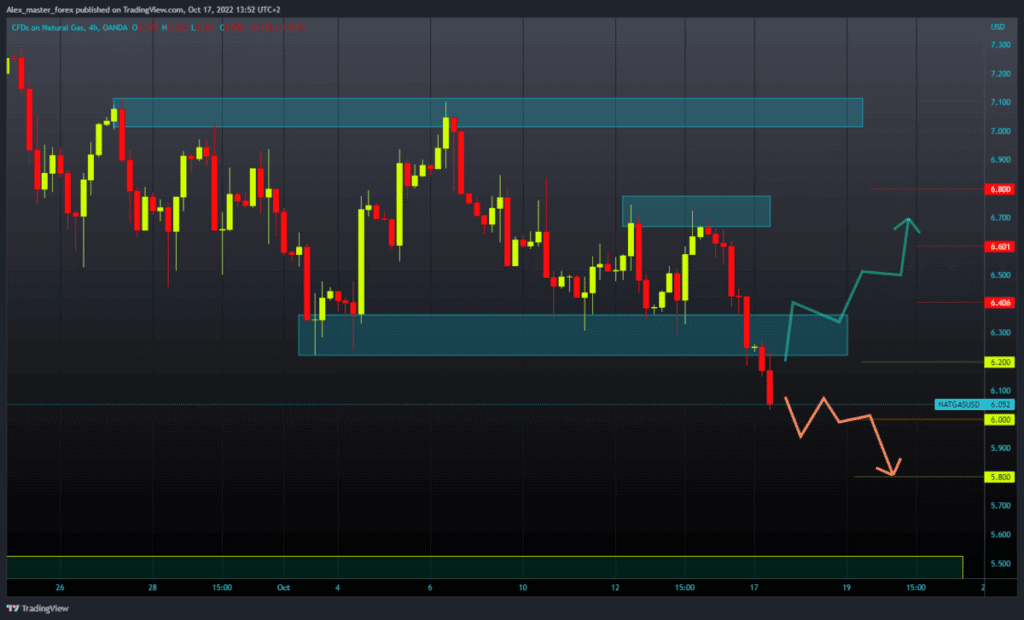

Natural gas chart analysis

The natural gas price continues declining after failing to climb to the $7.00 level on Friday. The price stopped at $6.80 and thus formed a new lower high, which is a sign of the continuation of the bearish trend. During the Asian session, the price was $6.20, and in the EU session, it fell to the $6.00 level. We need a continuation of negative consolidation and a further decline below the $6.00 support level for a bearish option. A potential lower target is the $5.80 level. For a bullish option, we need a new positive consolidation and a return of the maximum price to the $6.40 level. Then we need to form a new higher low and, with that bullish impulse, continue to recover the price. Potential higher targets are $6.60 and $6.80, the previous high.