Oil and Natural Gas: Struggling to Climb Higher Level

- The oil price recovered from Friday’s drop to the $91.00 level.

- At the beginning of the trading day, the gas price jumped to the $9.60 level.

- Expectations are that OPEC will cut production if necessary to maintain prices

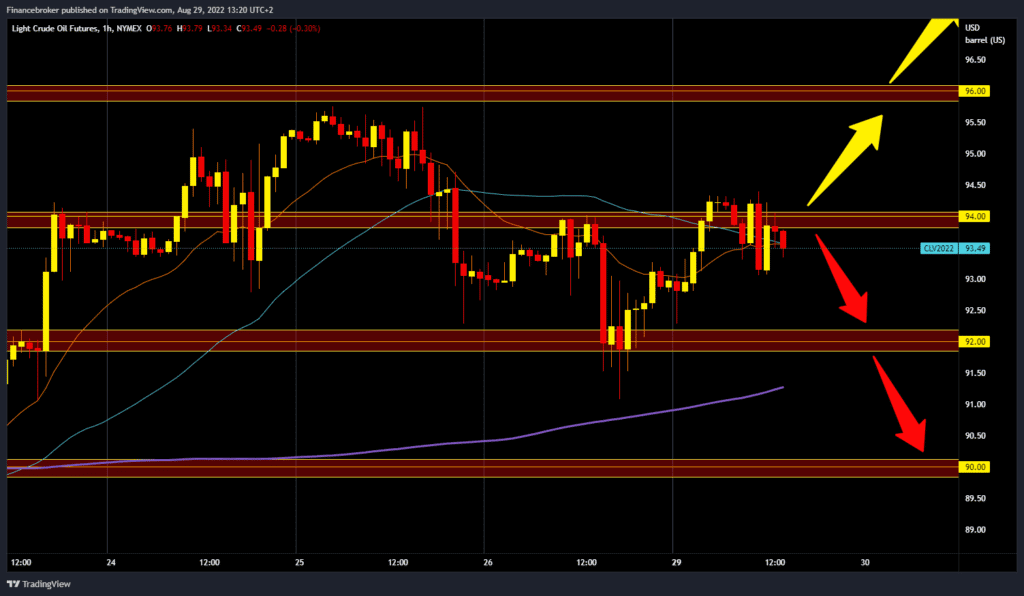

Oil chart analysis

The oil price recovered from Friday’s drop to the $91.00 level. We started the day at $93.00, and soon the price was already at the $94.00 level. For now, we have a barrier at that level, and we had another pullback to the $93.00 level. The price is currently struggling to climb and maintain above the $94.00 level. And if we don’t see a break, we could see a pullback down to the $92.00 support level. Additional support just below that level is in the MA200 moving average. Potential lower targets are $91.00 and $90.00 levels. We need to hold above today’s resistance zone for a bullish option. After that, we need a continuation of positive consolidation. Potential higher targets are $95.00 and $96.0 levels.

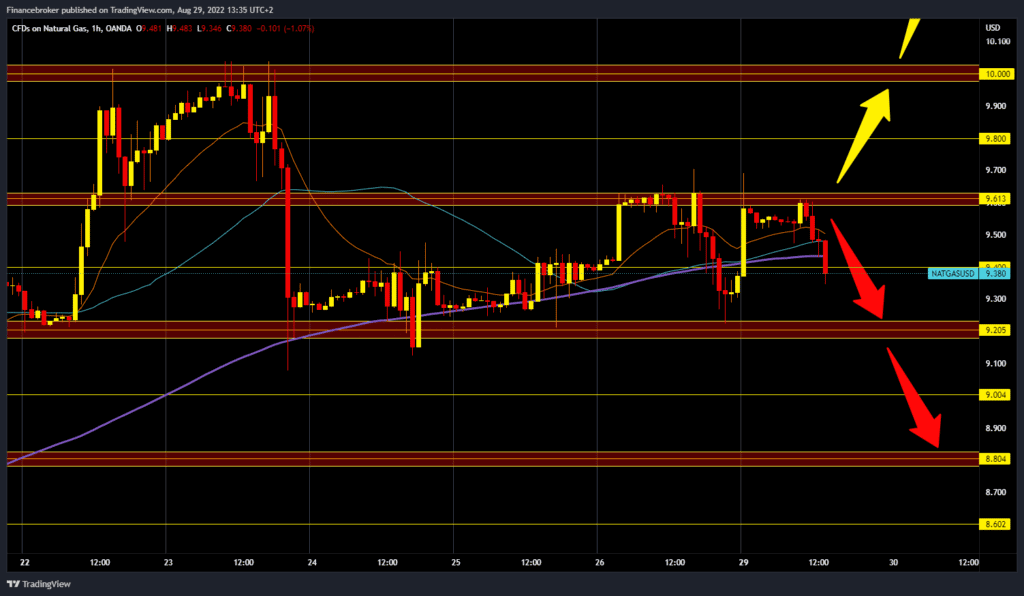

Natural gas chart analysis

At the beginning of the trading day, the gas price jumped to the $9.60 level, then it made a bearish consolidation, and we saw the price drop to the $9.40 level. The gas price could revisit the $9.20 level, and if it does not find that support, it would continue to fall to the $9.00 level. We need to climb and hold above the $9.60 level for a bullish option. Then we need a continuation of positive consolidation. Potential higher targets are $9.80 and $10.00 levels. We need a negative consolidation and a drop to the $9.20 support level for a bearish option. A price break below would increase bearish pressure, which would lead to a continuation of the price decline. Potential lower targets are $9.00 and $8.80 levels.

Market Overview

Expectations are that OPEC will cut production if necessary to maintain prices. The conflict in Libya and rising demand from a surge in natural gas prices in Europe helped offset the poor growth outlook in the United States. The dollar rallied after sharp comments from the Federal Reserve chairman on Friday that the United States was facing a long period of sluggish growth due to further rate hikes. Oil prices have been supported by hints from Saudi Arabia and other members of the Organization of the Petroleum Exporting Countries and allies that they may cut production to balance the market.