Oil and Natural Gas: Rose To Highest Level Since April

- The price of oil yesterday failed to break above the $84.00 level.

- The price of natural gas seems to have found its bottom yesterday at the $7.80 level and has since started to recover.

- According to the EIA’s weekly report, U.S. crude oil inventories rose to their highest level since April.

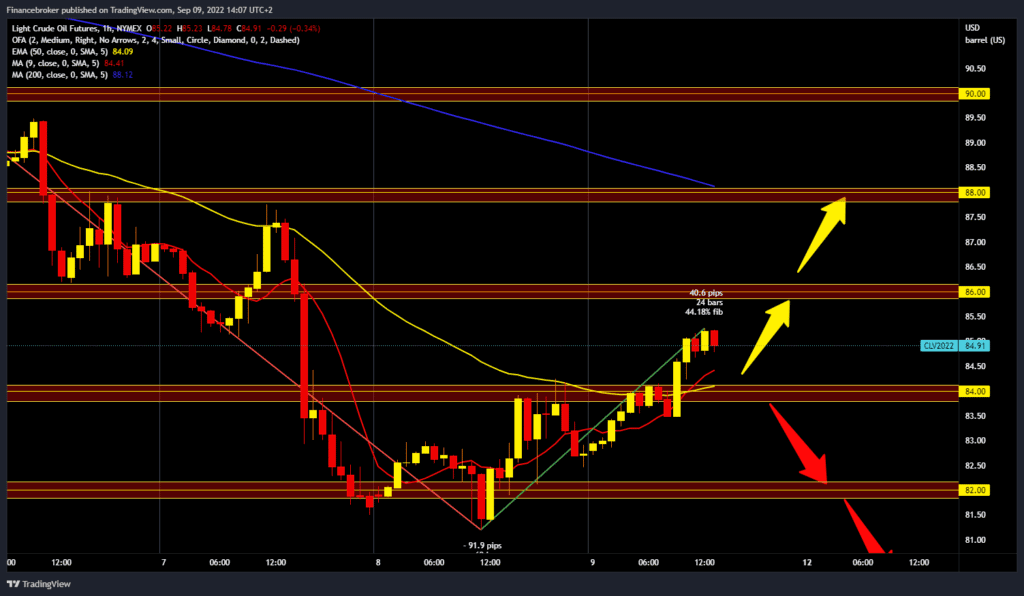

Oil chart analysis

The price of oil yesterday failed to break above the $84.00 level; it did so today. Today, the price is in a bullish trend, and we are now at the $85.10 level. We have received additional support in the MA20 and MA50 moving averages, and by the end of the day, the price could test the $86.00 level. To continue the bullish trend, we need further positive consolidation. Potential higher targets are $87.00 and $88.00 levels. For a bearish option, we need a negative consolidation and pullback to the $84.00 support level. Potential lower targets are $83.00 and $82.00 levels.

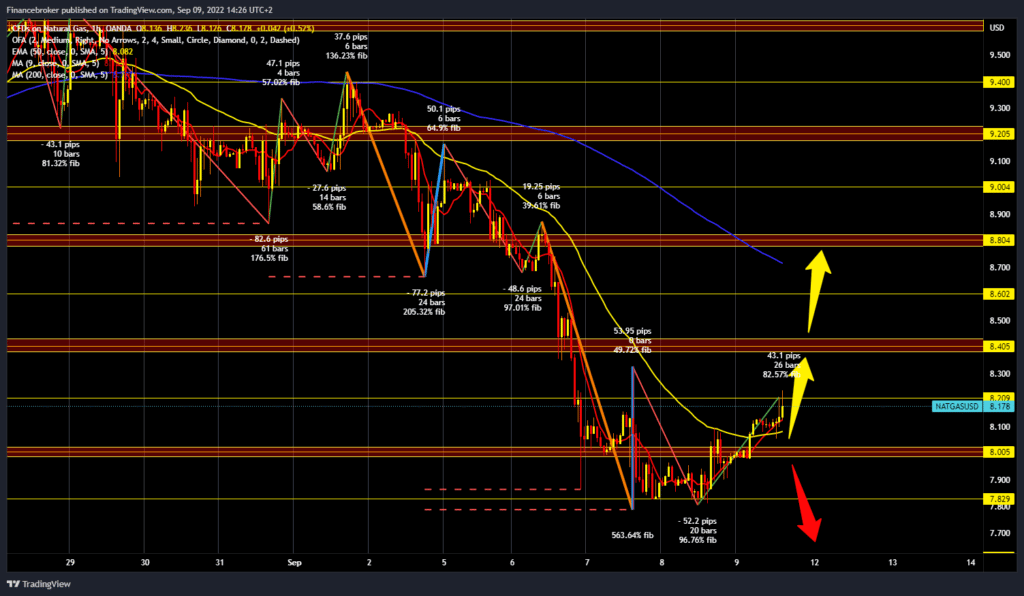

Natural gas chart analysis

The price of natural gas seems to have found its bottom yesterday at the $7.80 level and has since started to recover. During the Asian session, the price finds new support at $8.00 and continues its recovery towards the $8.20 level. MA20 and MA50 have moved to the bullish side and are supporting today’s price rise. The potential next target is at the $8.40 level. If we see a break above, the price could continue first towards $8.60, then up to the $8.80 level. We need a negative consolidation and a return to the $8.00 support level for a bearish option. A marriage below would mean an additional weakening of gas prices. Potential lower targets are $7.80, yesterday’s low, and then the $7.60 level.

Market Overview

According to the EIA’s weekly report, U.S. crude oil inventories rose to their highest level since April. Oil stocks increased last week by 8,844 million barrels. Gasoline inventories rose by 333,000 barrels versus expectations for a 1.667 million barrel decline, while distillate inventories rose by 95,000 barrels, short of an expected 530,000 barrel gain. As aggressive interest rate hikes by central banks and restrictions in China have squeezed demand, we can say that pressure on oil prices remains.