Oil and Natural gas Rise and fall

- During the Asian session, the price of crude oil rose with the help of increased demand for fuel in the United States, reduced supply and a slightly weaker US dollar.

- During the Asian session, the oil price was around 8.10 dollars, and as the European session began, the price started to fall.

- German Minister of Economy Robert Habeck said today that Germany is ready to continue with the Russian oil embargo even without Hungary.

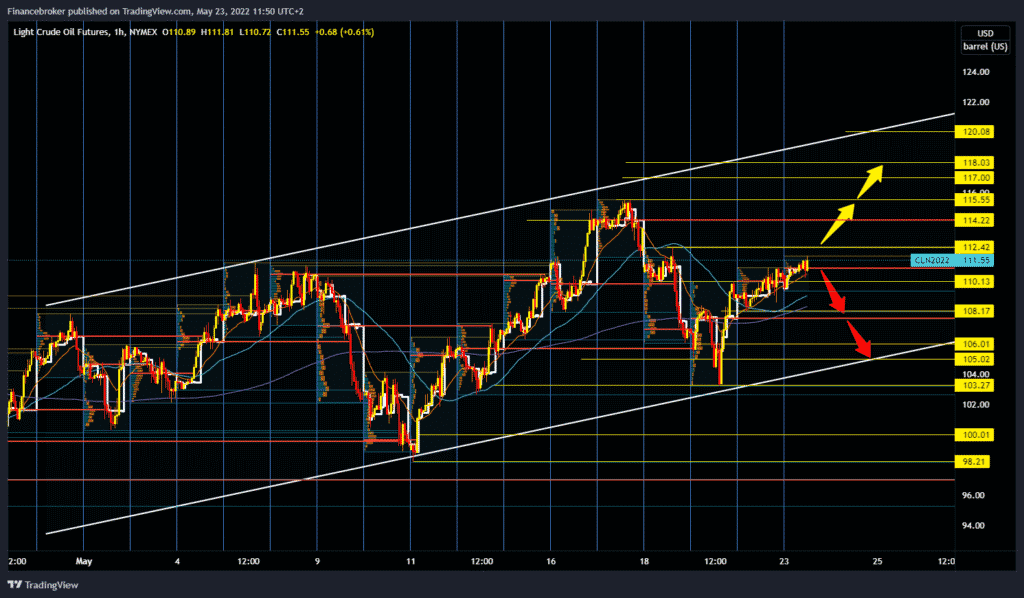

Oil chart analysis

During the Asian session, the price of crude oil rose with the help of increased demand for fuel in the United States, reduced supply, and a slightly weaker US dollar. Shanghai is preparing to reopen after a two-month lockdown that has raised concerns about a slowdown in global economic growth. The US strategic reserves have been at their lowest level since 1987. Crude oil is trading at $ 111.30 a barrel, up 0.88% from trading last night.

The price of oil continues to move within the growing channel. On May 11, we had a higher low formation at $ 98.20. After that, oil started its new bullish impulse. On May 17, the price climbed and stopped at 115.55 dollars, then started another pullback. On May 19, the price formed a new higher low and started a new bullish momentum. Last Friday, the oil price found support at the $ 110 level and continued on the bullish side. We could expect the next maximum in the 118-120 dollars zone. We need negative consolidation and pullback prices below the $ 110.00 level for the bearish option. After that, the price could go down to the lower support line in the zone around $ 105.00-106.00. Possible middle support is in the zone around $ 108.00-108.30.

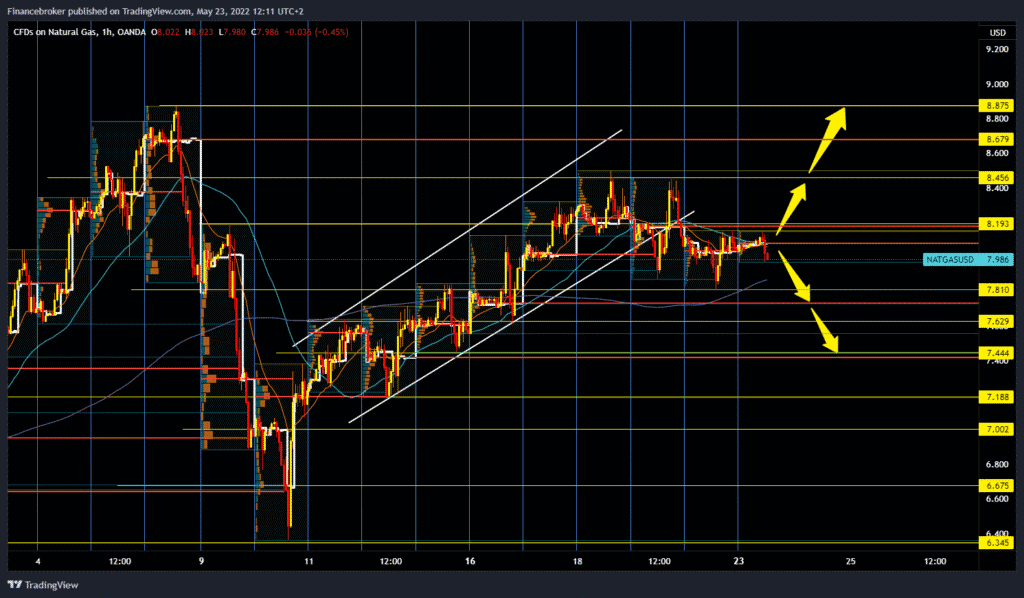

Natural gas chart analysis

During the Asian session, the oil price was around 8.10 dollars, and as the European session began, the price started to fall. We now have a break below the $ 8.00 level, and bearish pressure slowly increases. We are looking for potential support at $ 7.81, the previous low from Friday. If we see a break below this level, then we could say that this week we expect a bearish trend for the price of natural gas. Our potential following support levels are $ 7.63, $ 7.44 and a $ 7.18 ten-day minimum. The May low is the $ 6.34 level. We need a return above the $ 8.20 level for the bullish option. After that, the price could try to threaten the previous high of $ 8.45. If it succeeds, our next target is May high at $ 8.87.

Market overview

German Minister of Economy Robert Habeck said today that Germany is ready to continue with the Russian oil embargo even without Hungary. Habeck said he was disappointed that it took so long to agree on a proposal to impose an oil embargo on Russia.

The comments came after Reuters reported on Sunday, citing its sources: “Germany and Italy have told companies they can open accounts in rubles to continue buying Russian gas without violating sanctions against Moscow after talks with the European Union.