Oil and Natural Gas: Price recovery

- During the Asian trading session, the price of oil consolidated at around 121.00 dollars, and as the EU trading session started, the price started to bullish.

- The price of natural gas today is moving similarly to yesterday, without major oscillations, sideways.

- U.S. shale production is expected to rise by 143,000 barrels in July to 8.91 million barrels.

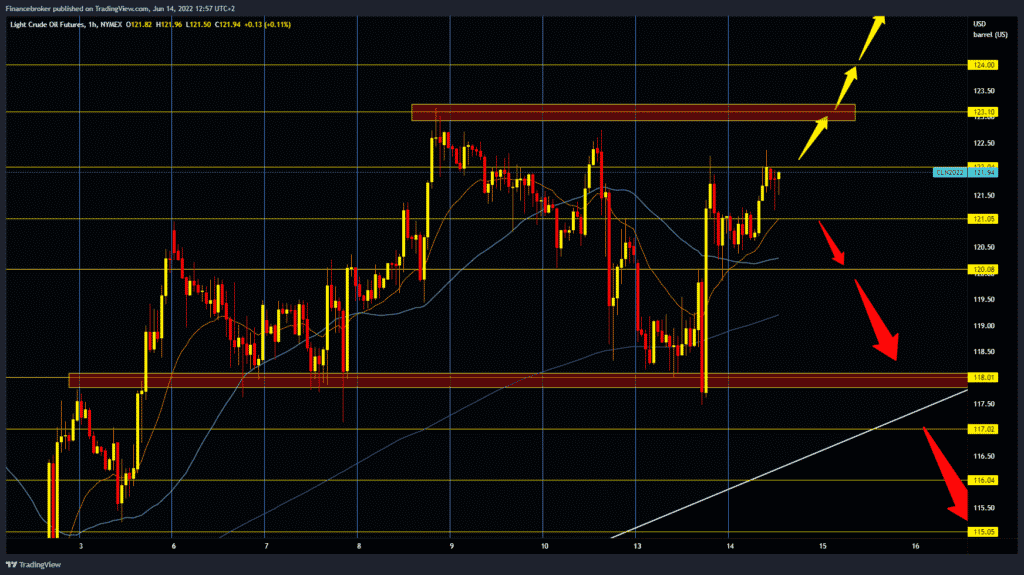

Oil analysis chart

During the Asian trading session, the price of oil consolidated at around 121.00 dollars, and as the EU trading session started, the price started to bullish. Fears of a recession and potential new constraints in China could weaken demand as limited supply remains in the market. Supply shortages have been exacerbated by falling exports from Libya amid a political crisis that has hit manufacturing and ports. Other OPEC + producers are struggling to meet their production quotas, and Russia is facing oil bans over Ukraine’s war. Analysts quoted Libyan oil minister Mohammed Auna as saying the country’s production had fallen to 100,000 barrels a day from 1.2 million barrels a day last year. The market will expect weekly data on U.S.

oil inventories from the U.S. Petroleum Institute on Tuesday and the U.S. Energy Information Administration on Wednesday to get indications of how limited crude oil and fuel inventories are. We need to continue today’s bullish consolidation and break prices above the $ 122.00 resistance for the bullish option. After that, the price could try to attack the $ 123.00 level. A price break above would intensify the bullish trend and further growth towards the $ 125.00 level. We need a negative consolidation and a pullback below the $ 120.00 level for the bearish option. After that, the oil price could retreat to $ 118.00 in the support zone on the lower trend line.

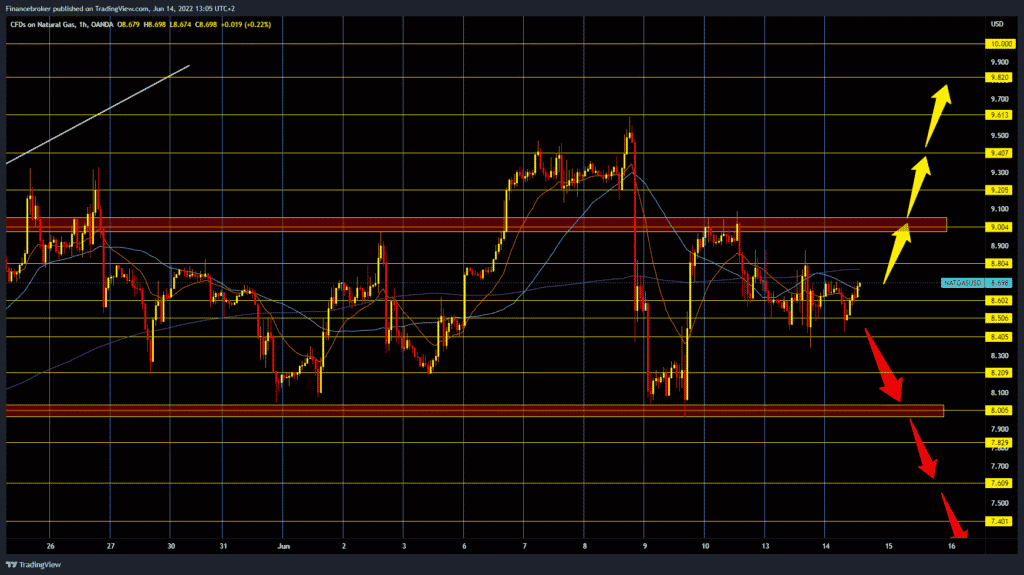

Natural gas chart analysis

The price of natural gas today is moving similarly to yesterday, without major oscillations, sideways. This morning, during the Asian session, the price found support at $ 1.40, then in the EU session, the price recovered to $ 8.70. For a further bullish sequel, we need a positive consolidation and a break above $ 8.80. After that, the price could jeopardize the $ 9.00 level. And if the bullish momentum continues, we could climb to last week’s high of $ 9.60. For the bearish option, we need negative consolidation and a pullback below $ 8.40. After that, the price would be directed towards the $ 8.00 support zone.

Market overview

U.S. shale production

U.S. shale production is expected to rise by 143,000 barrels in July to 8.91 million barrels, according to the latest Drilling Productivity Report released on Monday. Shale producers are under high scrutiny this quarter as gasoline prices rise and inflation reaches a four-decade high. Washington is asking for a large number of production increases because gasoline prices are threatening to reach $ 6 per gallon.