Oil and Natural Gas: Price Recovered Partially

- During the Asian trading session, the price of crude oil recovered partially after forming a new lower low at $94.00 this morning.

- The price of natural gas yesterday formed the July maximum at the $6.75 level but soon followed a sharp drop to the $6.00 level.

- API Reports a significant inventory build.

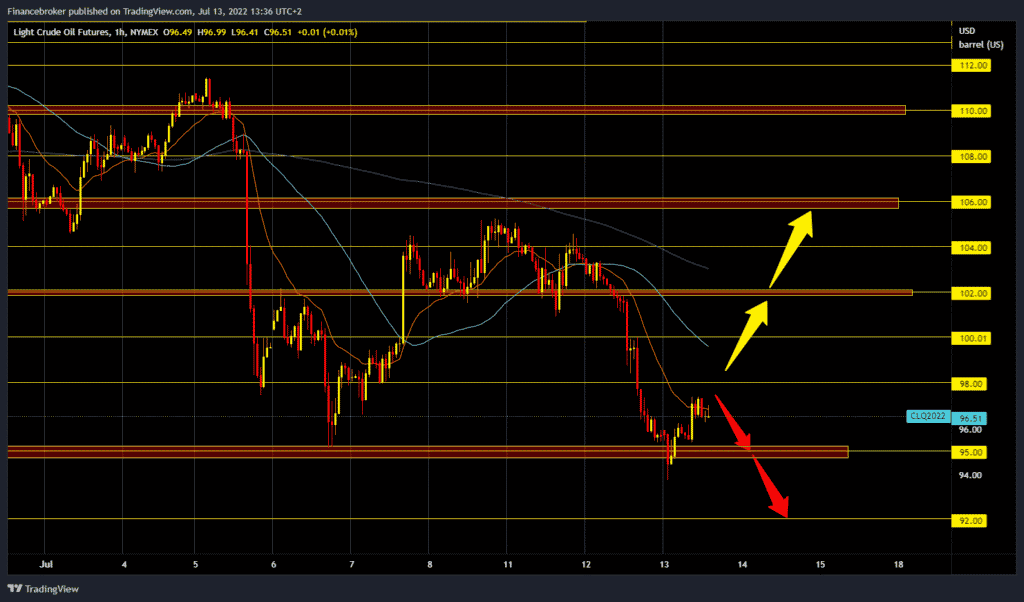

Oil chart analysis

During the Asian trading session, the price of crude oil recovered partially after forming a new lower low at $94.00 this morning. The number of Chinese cities adopting new measures to prevent the spread of the COVID-19 pandemic is increasing. From business shutdowns to partial shutdowns to contain new infections as a highly contagious omicron subvariant emerges in the country. The American president is traveling to the Middle East today, where he will have meetings with Arab leaders, so there were also calculations that he could achieve slightly higher production.

Last night, the American Petroleum Institute announced that crude oil stocks in the US increased by 4.78 million barrels, but gasoline stocks increased. Also, the strong strengthening of the US dollar makes the real oil price more difficult and expensive for all those for whom the dollar is not the national currency. Crude oil is trading at $96.85 per barrel, up 1.00% since the start of trading last night. At 4:30 p.m., an official government report on the state of crude oil and petroleum products stocks in the US will be published.

To continue the bullish option, it is now necessary for the price to rise above the $98.00 level and gain support from the first MA20 moving average. After that, it would have a chance to continue towards the $100.00 level where the MA50 moving average awaits us. The next higher target is $102.00, $104.00, and $106.00. We need to go back to the 95.00 support zone for a bearish option. A price break below could take us down to the next support at the $92.00 level.

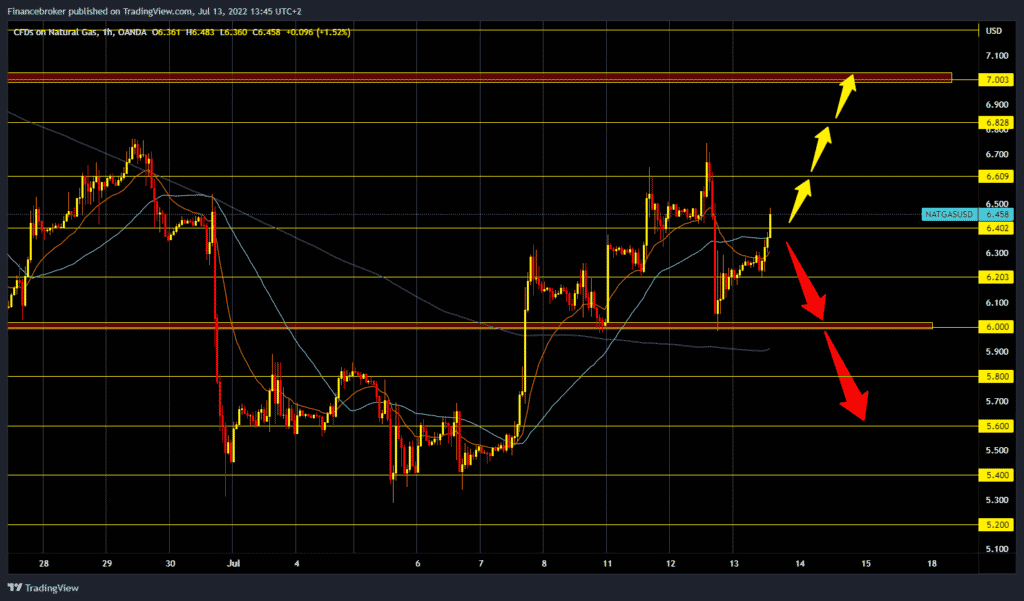

Natural gas chart analysis

The price of natural gas yesterday formed the July maximum at the $6.75 level but soon followed a sharp drop to the $6.00 level. Since then, the price has started to recover and is now at $6.45, which represents a 3.53% increase in the price of natural gas since the beginning of last night’s trading day. If this bullish impulse is maintained, the gas price could retest yesterday’s maximum. Potential bullish targets are $6.60, $6.80 and 7.004 levels. We need a negative consolidation and a return to the $6.20 support zone for a bearish option. A break below this zone would take us to the larger support zone at $6.00. If we fail to hold here, we continue lower towards the $5.80 and $5.60 levels.

Market overview

API Reports a significant inventory build

The American Petroleum Institute (API) reported a significant increase for crude this week of 4.762 million barrels; expectations were a drawdown of 1.933 million barrels. The upgrade comes as the Energy Department released 6.9 million barrels from the strategic oil reserve in the week ending July 8 to 485.1 million barrels. WTI continued to fall on Wednesday on fears of a recession and fears of a drop in Chinese demand due to the presence of a new variant of Covid.