Oil and Natural Gas: Potential Downsides

- This morning, the oil price retested the $76.00-$76.50 support zone.

- During the Asian trading session, the price of natural gas tried to climb above the $6.80 level, but without success.

- The increase in interest rates by the Federal Reserve has fueled expectations of a recession and the associated negative implications for oil prices.

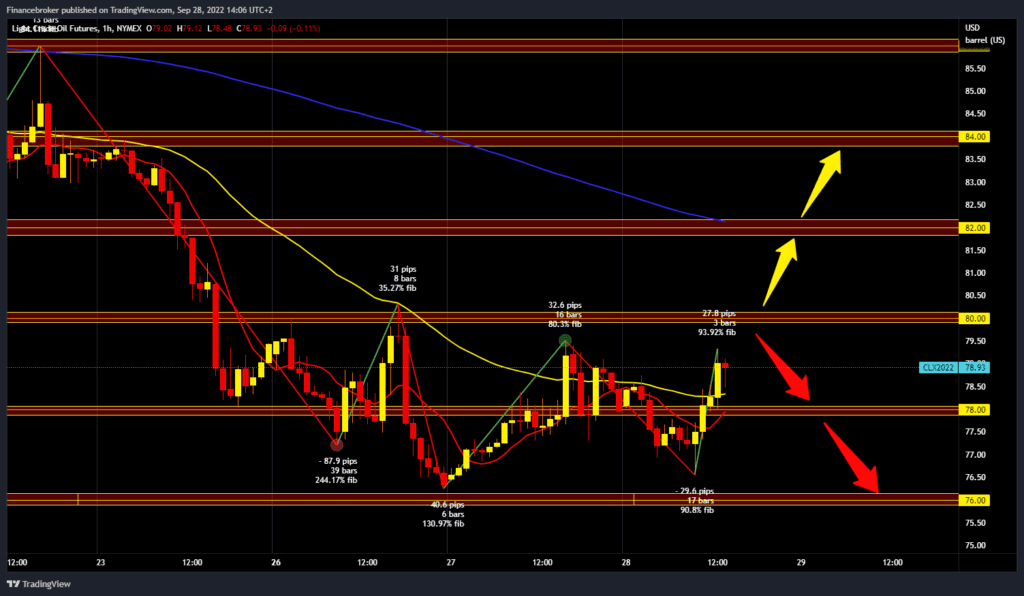

Oil chart analysis

This morning, the oil price retested the $76.00-$76.50 support zone. After that, we see a bullish impulse, and the price went up to the $79.50 level without testing the $80.00 level. For a bullish option, we need a move above $80.00, then a positive consolidation with a new bullish impulse. Potential higher targets are $81.00 and $82.00 levels. We need further negative consolidation and a drop in oil price below the $78.00 level for the bearish option. After that, we return again to look for support at the $76.00 level. Potential lower targets are $75.00 and $74.00 levels.

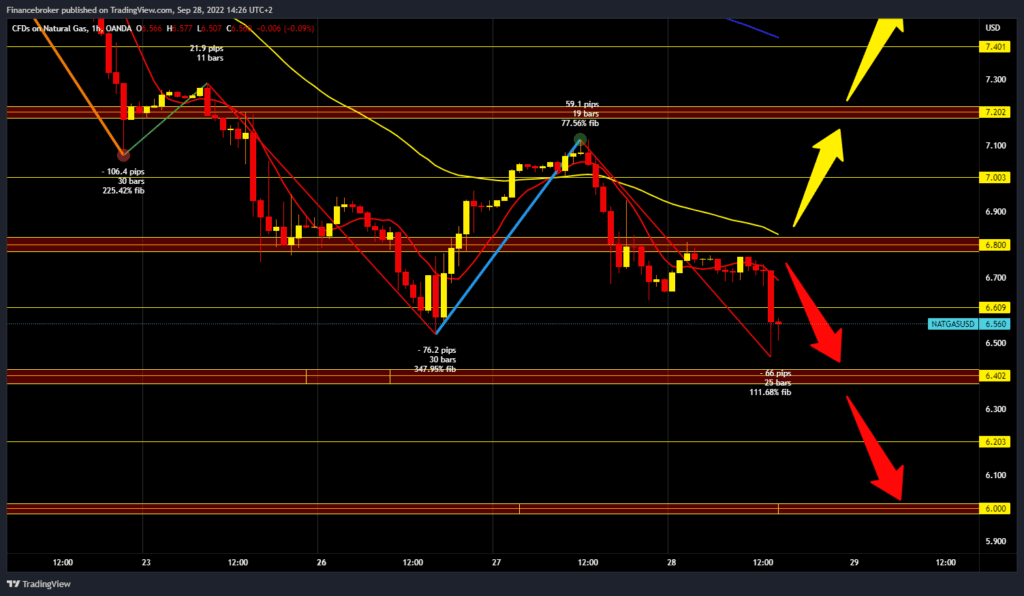

Natural gas chart analysis

During the Asian trading session, the price of natural gas tried to climb above the $6.80 level, but without success. The opposite happened; the price fell to the $6.45 level. This created a new lower low. In the future, we could expect a further pullback in gas prices. For something like that, we need a continuation of the negative consolidation up to $6.40, the next support level. If we see a break below, potential lower targets are $6.20 and $6.00. For a bullish option, we need a new positive consolidation and a move above the $6.80 resistance level. If we could do that, we would get additional support in the MA50 moving average. Potential higher targets are $7.00 and $7.20 levels.

Market Overview

The increase in interest rates by the Federal Reserve has fueled expectations of a recession and the associated negative implications for oil prices. Economists expect the Fed to raise interest rates more now than previously thought. A recession is a terrible scenario for oil prices. Just the talk of a recession is enough to affect the price of oil negatively.