Oil and Natural Gas: Jump on the chart

- During Asian trading session, the price of crude oil stalled at $ 121.00, consolidating earlier gains.

- During the Asian session, the price of natural gas ranged from $ 8.70 to $ 8.80.

- The Biden administration is considering a suggestion to tax oil and gas profits to provide a gas subsidy for U.S.

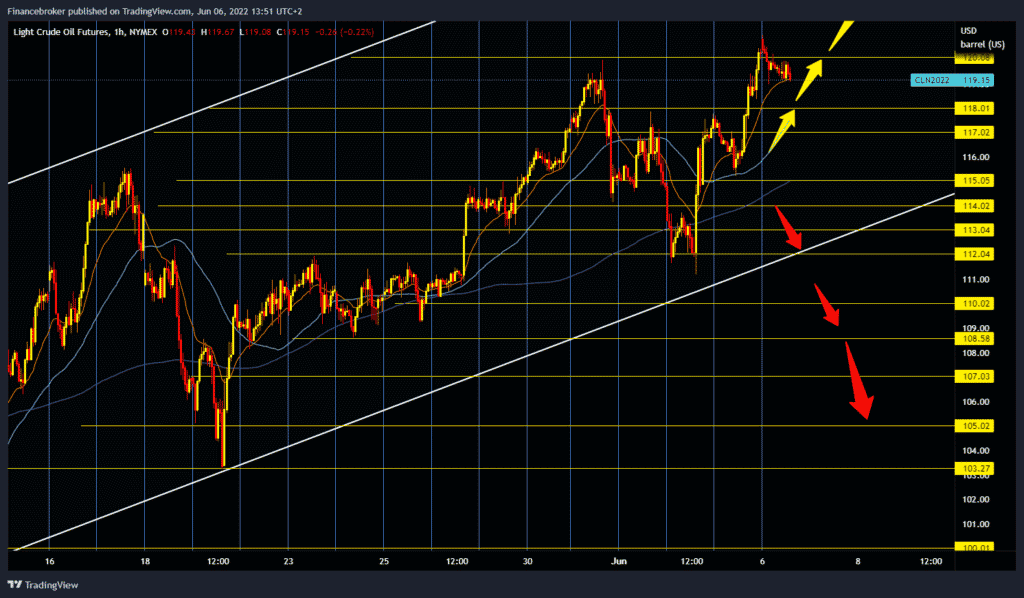

Oil chart analysis

During Asian trading session, the price of crude oil stalled at $ 121.00, consolidating earlier gains. Saudi Arabia raised the prices for the sale of crude oil in July, thus signaling the continuation of the scarce supply even after the producers from OPEC + agreed to accelerate the increase in production in the next two months. It was decided to “return” only 648,000 barrels from July to the market. Last week, EU ambassadors approved a new set of sanctions against Russia, including a ban on importing Russian oil until the end of this year in 90%.

Also, the official government report on the state of crude oil stocks showed on Thursday that crude oil stocks in the United States fell by as much as 5.07 million barrels. Crude oil traded at $ 119.22 a barrel, down 0.28% from closing on Friday. We could now see a further withdrawal of $ 118.00 in support. If prices fail to find support there, the decline would probably continue to $ 115.00, our previous low.

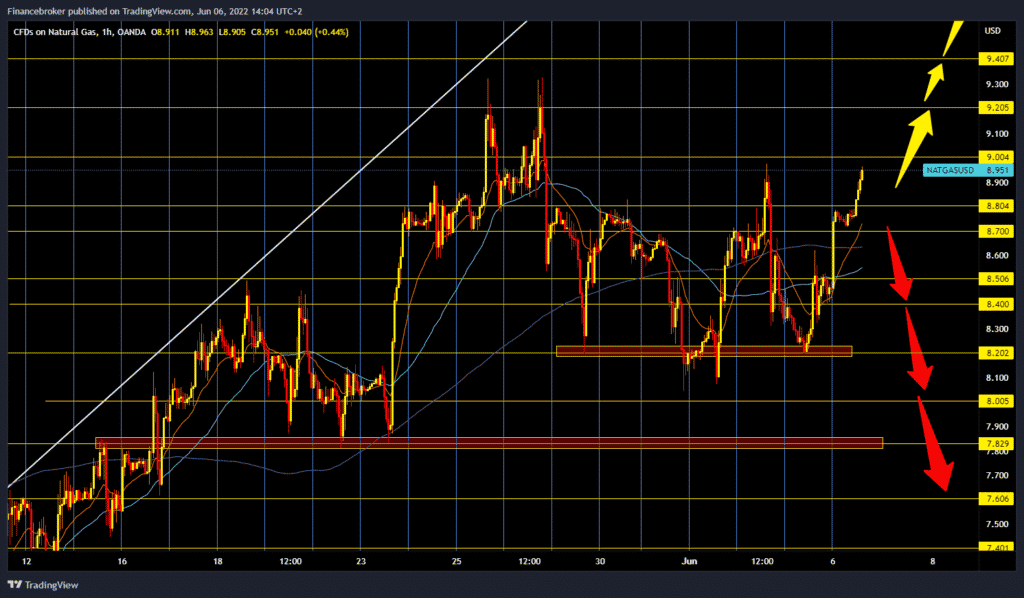

Natural gas chart analysis

During the Asian session, the price of natural gas ranged from $ 8.70 to $ 8.80. At the beginning of the European session, the price started, and we saw a jump on the chart to $ 8.92. It could happen once again that we test the $ 9.00 level before we visit the 9.20-9.35 zone of this year’s maximum. For the bearish option, we need a negative consolidation and a return below $ 8.80. After that, we can expect bearish pressure to increase and the price to start falling again. Potential lower support levels are $ 8.60, $ 8.50, $ 8.40 and $ 8.20 previous Friday’s low.

Market overview

The Biden administration is considering a suggestion to tax oil and gas profits to provide a gas subsidy for U.S. consumers struggling with high energy prices, said deputy director of the National Economic Council Bharat Ramamurti, at a panel sponsored by the Roosevelt Research Center. June 2.

The news followed a similar move by Chancellor Rishi Sunak in the U.K. on May 26 to impose a 25 per cent emergency tax on North Sea energy producers to provide a £ 15 billion ($ 18.9 billion) energy fund subsidy for Britons who pay for rising fuel costs.

The White House considered congressional proposals to increase taxes for energy producers to provide subsidies or tax breaks to households. The proposal would impose a new three-month tax on U.S. oil companies for domestically produced or imported oil.