Oil and Natural Gas: Jump and Recovery

- The oil price fell again this morning to the $82.00 support level.

- The price of natural gas is in the range of $7.60 – $8.00 for the third day in a row.

- The Fed raised interest rates for the third time by 75 basis points to curb inflation and make it clear that borrowing costs will continue to rise this year.

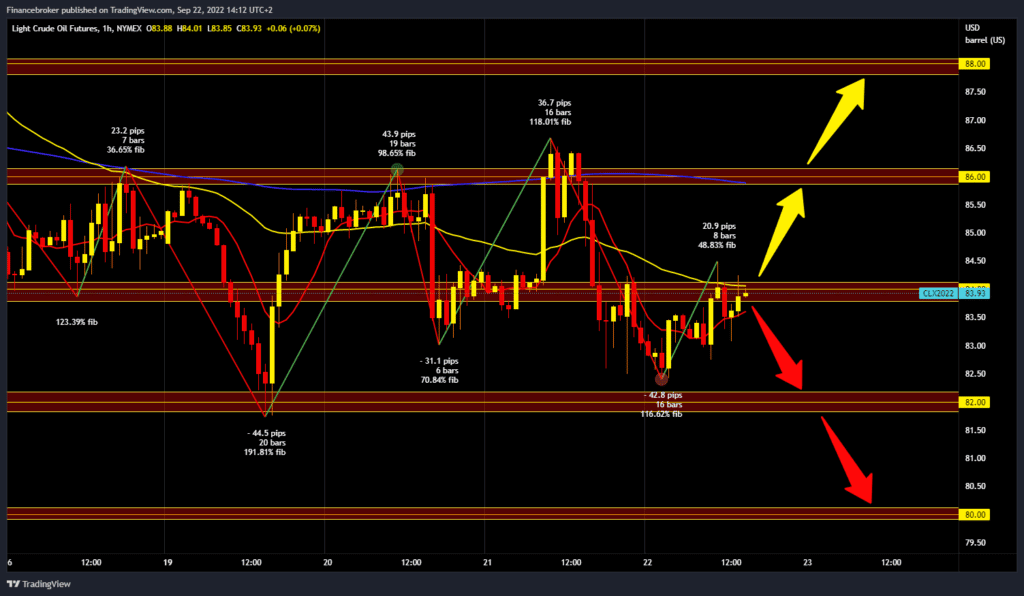

Oil chart analysis

The oil price fell again this morning to the $82.00 support level. After which we see a price recovery and a test of the $84.00 resistance level. A break above and continued recovery to yesterday’s high at $86.00 could occur. We first need a positive consolidation above the $84.00 level for a bullish option. Then we need to hold above and with a new bullish impulse to continue the recovery. Potential higher targets are $86.00 and $88.00 levels. We need a negative consolidation and a pullback towards this morning’s support zone at the $82.00 level for a bearish option. If we were to stay down, there could be an increase in price pressure, and we could see a break below. Potential lower targets are $81.00 and $80.00 levels.

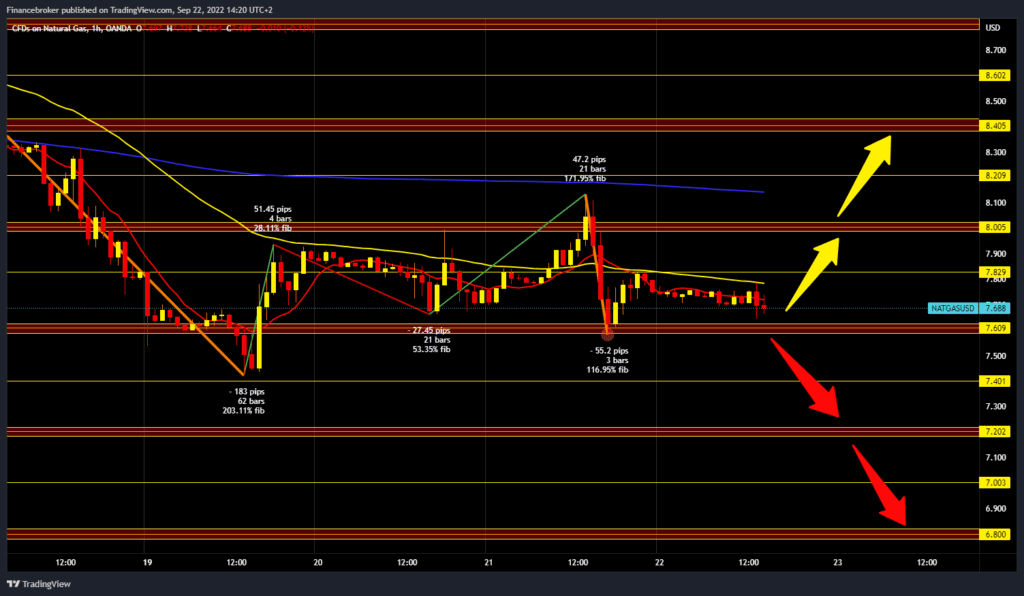

Natural gas chart analysis

The price of natural gas is in the range of $7.60 – $8.00 for the third day in a row. Yesterday we had a jump to $8.10, but the price quickly returned to the channel. Today we are moving in a narrow range of $7.60-$7.80, exerting more pressure on the lower support level. For a bearish option, we need a break price below. After that, we look for the first support at the $7.40 support level. Potential lower targets are $7.20 and $7.00 levels. We need a positive consolidation to the $8.00 resistance level for a bullish option. Then we need to break the price above this resistance and stay above it in order to continue the recovery of the gas price with a new bullish impulse. Potential higher targets are $8.20 and $8.40 levels.

Market Overview

The Fed raised interest rates for the third time by 75 basis points to curb inflation and make it clear that borrowing costs will continue to rise this year. Russian President Vladimir Putin on Wednesday called for 300,000 reservists to fight in Ukraine and backed a plan to annex parts of the country. U.S. crude oil inventories rose by 1.1 million barrels in the week to Sept. 16 to 430.8 million barrels, missing analysts’ expectations for a rise of 2.2 million barrels. A rising dollar is also holding back rising oil prices. On Wednesday, the dollar index hit a 20-year high against a basket of currencies.