Oil and Natural Gas: July maximum

- During the Asian trading session, the price of crude oil consolidated after yesterday’s decline.

- Yesterday, the price of natural gas formed its July maximum at $6.85.

- Despite the ongoing market selloff, Goldman Sachs continues to maintain a bullish view on oil prices.

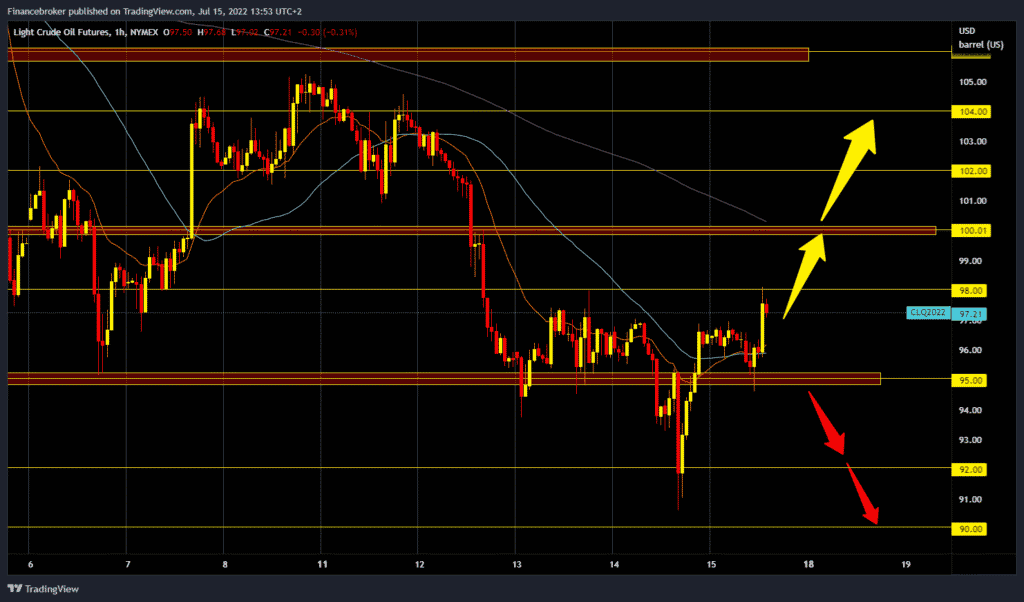

Oil chart analysis

During the Asian trading session, the price of crude oil consolidated after yesterday’s decline. The American president is in the Middle East, where he will meet with Arab leaders tomorrow. Crude oil is trading at $97.50 a barrel, up 1.70% since the start of trading last night. Today’s high was $98.00; we need a break above to form a new higher high. After that, the price of oil could rise again to $100.00. Additional pressure and resistance at that level is the MA200 moving average. We need a new negative consolidation and a pullback to the $95.00 level for a bearish option. A fall below this support could threaten the previous low again. Potential lower targets are $94.00, $92.00 and $90.00 levels.

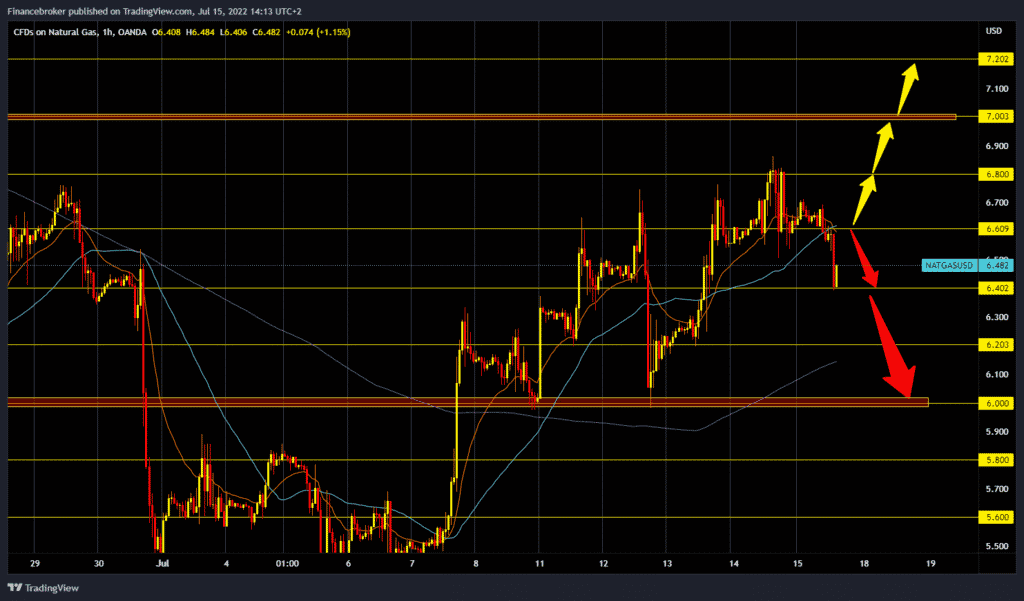

Natural gas chart analysis

Yesterday, the price of natural gas formed its July maximum at $6.85. We did not manage to hold on to that position for a long time, and a pullback followed. During the Asian trading session, the price consolidated at around $6.60. During the European session, the price broke through the $6.60 support zone and dropped to the $6.40 lower support zone. MA20 and MA50 crossed and formed a bearish pattern. We need a break below the current support to continue the bearish option. Potential lower targets are $6.20 and $6.00 levels. For a bullish option, we need a new positive consolidation and a return to the $6.60 level. If we manage to hold above, we could test the previous high at the $6.80 level. Potential higher targets are $7.00 and $7.20 levels.

Market overview

Despite the ongoing market selloff, Goldman Sachs continues to maintain a bullish view on oil prices. In the note, he reiterated his position that the price skew is directly up from here on the bullish side.

Goldman Sachs strategists tested their bullish view and found that despite growing concerns about oil fundamentals, due to both higher supply and weaker demand, Brent will remain above its current market value in the second half of 2022 and 2023.

With inventories low and a potential increase in Saudi Arabia/UAE production in the region of 500,000 bpd further draining “record low spare capacity,” the risks are therefore firmly on the upside.