Oil and Natural Gas: Inventories fell

- During Asian trading, the price of crude oil confirmed a slight pullback from yesterday.

- The price of natural gas yesterday stopped in its march at $7.00.

- According to the Swedish bank SEB Group’s chief commodities analyst, oil prices are likely to rise above $200 a barrel if the G7 fails to cap the price of Russian crude.

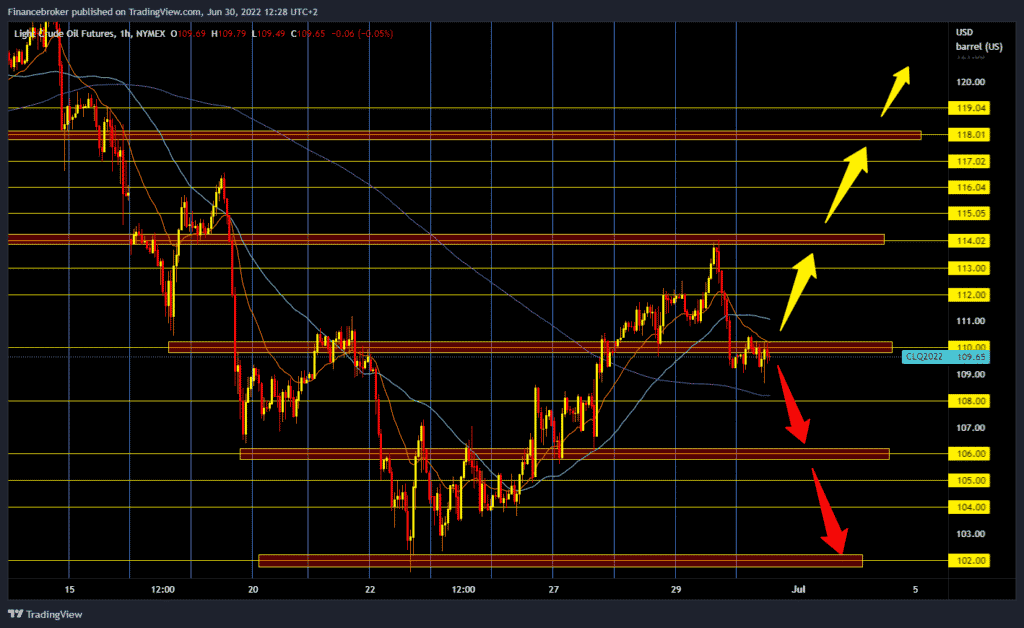

Oil chart analysis

During Asian trading, the price of crude oil confirmed a slight pullback from yesterday. Yesterday, the price of oil rose to the $114.00 level, where it encountered resistance that resulted in a pullback to the $110.00 support zone. An official government report showed yesterday afternoon that US crude oil inventories fell by 2.76 million barrels, but gasoline inventories rose by nearly as much.

The meeting of the OPEC+ initiative is being held today, and expectations are that they will stick to the earlier agreement to add 650,000 barrels in August. Crude oil is trading at $109.60 a barrel, down 0.26% since trading began last night. For a bearish option, we need a continuation of the negative consolidation and a pullback down to the $108.00 level. The first support is waiting for us there; if it does not last, we will probably go down to the $106.00 level. We need a positive consolidation above the $110.00 level for a bullish option. After that, the price of oil could first continue to the $112.00 level. And if the bullish impulse strengthens, we return to the $114.00 resistance zone again.

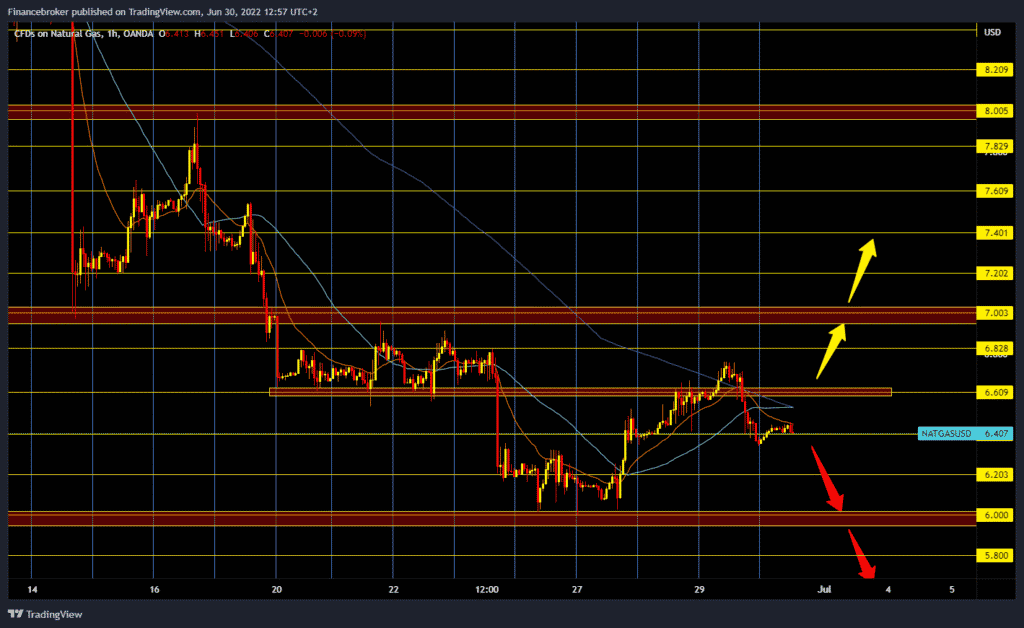

Natural gas chart analysis

The price of natural gas yesterday stopped in its march at $7.00. We stopped at $6.76 and have been in a bearish trend ever since. The gas price this morning finds support at $6.40, and since the beginning of trading last night, the price has been consolidating around that level. For a bullish option, we need a new positive consolidation and a return above the $6.60 level. After that, we could expect the price to continue towards the $7.00 resistance zone. We need a continuation of this negative consolidation and a pullback below the $6.40 level for a bearish option. After that, we can expect a continuation of the bearish trend. Potential lower support targets are $6.20 and $6.00 levels.

Market overview

According to the Swedish bank SEB Group’s chief commodities analyst, oil prices are likely to rise above $200 a barrel if the G7 fails to cap the price of Russian crude. Bjarne Schieldrop, an analyst at SEB, said on Wednesday that the G7 proposal to cap prices is a recipe for disaster given the current stress on the oil market. G7 leaders agreed on Tuesday to study ways to cap the price of Russian oil sold internationally and are seeking support from other countries.

Russian crude oil and condensate production rose 5% in June to an average of 10.7 million barrels per day, Russian daily Kommersant reported on Wednesday, citing sources familiar with the production numbers.

Production levels include condensate, which is not included in Russia’s quota in the OPEC+ deal but is not reported separately from crude oil production by Russian authorities. Russia is believed to be producing around 800,000 bpd – 900,000 bpd of condensate.

In production, all Russian companies managed to stabilize production from the declines in April and May, while Rosneft’s production even jumped by 15%, according to Kommersant sources.