Oil and Natural Gas: Bearish pressure is noticeable

- The oil price continued its recovery after falling to $104.66 on Friday.

- During the Asian trading session, the price of natural gas hovered around support at the $5.60 level.

- The production pact made by OPEC+ in April 2020 is set to end a month earlier than originally planned, in August 2022.

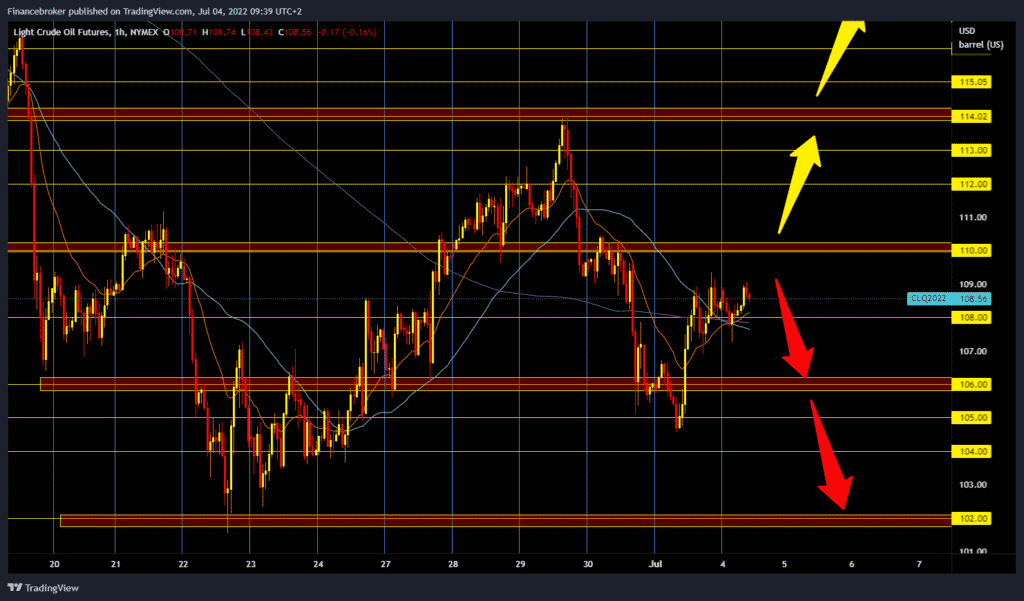

Oil chart analysis

The oil price continued its recovery after falling to $104.66 on Friday. Today’s high is at $109.00, and we are encountering resistance there for now. We have support in the zone at around $108.00, along with the moving averages. If we hold above, we could go up and test the $110.00 level. A break above the price would open up space for us towards $114.00 instead of last week’s high. We need a negative consolidation and a pullback below the $108.00 level for a bearish option. Potential lower targets are $107.00 and $106.00 levels. And maybe we will threaten the $105.00 support zone.

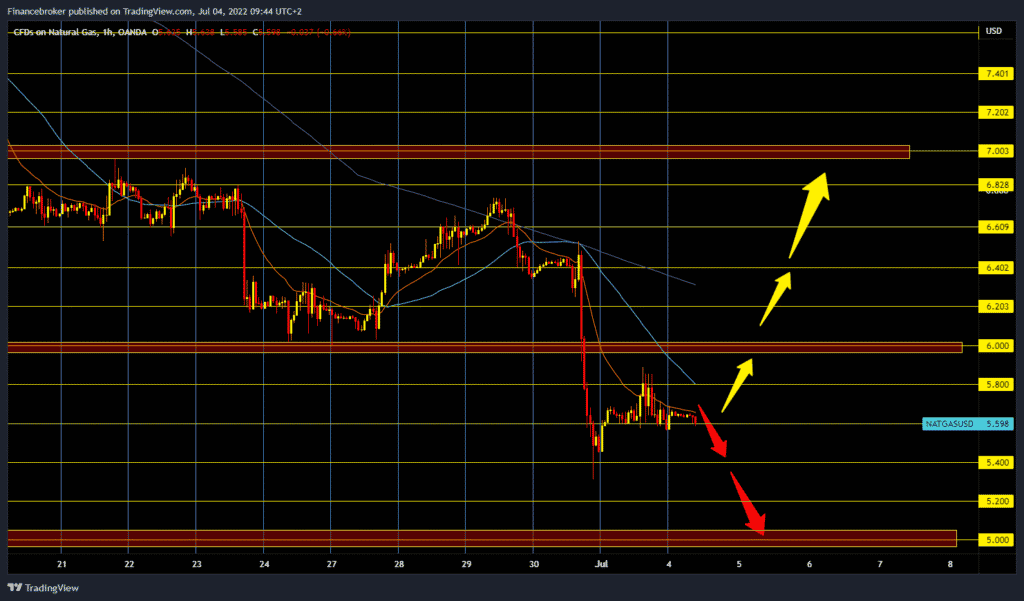

Natural gas chart analysis

During the Asian trading session, the price of natural gas hovered around support at the $5.60 level. Bearish pressure is noticeable on the chart, and it is not excluded that we will see the gas price at the $5.00 level. Before that, we need a continuation of negative consolidation and a break below last week’s support at the $5.40 level. After that, the $5.20 and $5.00 levels are our potential targets. For a bullish option, we need a new positive consolidation and a return to the zone around the $6.00 level. A break above would take the bearish burden off the gas price, at least for a short time. Our potential higher targets are $6.20 and $6.40 levels.

Market overview

The production pact made by OPEC+ in April 2020 is set to end a month earlier than originally planned, in August 2022. Oil Production Group. Russia invaded Ukraine in February, and the price of oil soared above $100 per barrel. The war premium and sanctions and embargoes on Russian oil in the West keep prices so high that inflation in advanced economies, including the United States, has risen to its highest level in four decades.

The new dilemma for OPEC+ is whether to give in to mounting pressure and increase supply, thereby sacrificing what little precious spare capacity the world has. The group could stick to its guns, keep that spare capacity intact and let a slowdown or recession solve the demand-side problem of rising oil prices.

Saudi Arabia has little oil. The Kingdom’s production target for August will be near 11 million barrels per day. Record Saudi production was in April 2020 at 11.550 million barrels per day, according to secondary OPEC sources. But that was a one-off when Saudi Arabia and Russia entered a brief war for market share in March and April 2020 before agreeing on record cuts amid global COVID-related quarantines and falling spending.