OANDA Review 2023 Update – Is it a Good Broker or Not?

| General Information |

|

|---|---|

| Broker Name: | OANDA |

| Broker Type: | Forex Broker |

| Country: | USA |

| Operating since Year: | 1996 |

| Regulation: | ASIC, FCA, 542574 |

| Address: | 135 West 41st Street New York NY 10036 |

| Broker Status: | Regulated |

| Customer Service | |

| Phone: | +1 212 858 7690 |

| Email: | [email protected] |

| Languages: | EN,ES,PT,IT,DE and others |

| Availability: | 24/7 |

| Trading | |

| Trading Platforms: | MT4, Web Trader, Mobile Trader |

| Trading Platform(s) Timezone: | GMT +2 |

| Demo Account: | Yes |

| Mobile Trading: | Yes |

| Web-based Trading: | Yes |

| Bonuses: | N/A |

| Other Trading Instruments: | Currencies, Indices, Commodities, Cryptocurrencies, Bonds |

| Account | |

| Minimum Deposit ($): | N/A |

| Maximum Leverage: (1:?) | 1:50 |

| Spread: | Variable |

| Scalping Allowed: | Yes |

Review Contents:

- Introduction;

- OANDA Regulation and Protection;

- Trading Products;

- OANDA Trading Accounts;

- Trading Platforms;

- Deposits and withdrawals;

- Education;

- OANDA Review Summary

Introduction to OANDA Review

If you’ve been forex trading for some time now and you’ve been through some exciting times, you probably know OANDA.

OANDA is a quite a celebrity for forex traders, having a very long track record as it was founded in 1996, and is a very reputable trading service. It also provides very good trading strategies.

The fees are very appealing, the platforms are excellent, and the forex offerings are super attractive. However, celebrities are not perfect, and neither is OANDA. There are some things it needs to work out, but those things should be forgivable after you read this review. Let’s get it on!

OANDA Regulation and Protection

As with many highly popular brokers, OANDA is regulated. This American forex broker is regulated by top-tier regulatory bodies, including the US Retail Foreign Exchange Dealer and the UK’s Financial Conduct Authority.

These are huge names in the regulation industry. And because OANDA is subject to its regulations, the broker also needs to ensure the protection of its traders.

It’s also registered with:

- US Commodity Futures Trading Commission (CFTC)

- Investment Industry Regulatory Organization of Canada (IIROC)

- Australian Securities and Investment Commission (ASIC)

- Monetary Authority of Singapore

- International Enterprise Singapore.

This list puts OANDA among the most trustworthy brokers out there. There are stellar reviews regarding its reputation and transparency in the market. It received the highest overall customer satisfaction award from Investment Trends magazine.

There are some things that you should remember when trading with OANDA, though. Not all investments are protected. Although OANDA has six legal entities, each of those entities have limited protection coverage for traders.

The good news is that many other instruments and tradings are protected. All you have to do is find out which investments and accounts receive the ideal protections. Overall, this is a flaw that is beyond the regulators’ control, but OANDA will probably fix this eventually.

OANDA Trading Products

OANDA has a wide variety of forex instruments. It’s an ideal broker for forex traders who want

to trade wide range currencies such as EUR USD, USD GBP, CAD JPY, and much more! It’s only necessary to determine your base currency and quote currency as your foreign exchange data and research tools that will assist you along with your brokerage features.

It also offers some other assets like:

- bitcoin;

- bonds;

- metals;

- indices;

- commodities.

As you can see, the trading products are pretty limited. This limitation can put off some traders.

But traders who choose to trade with OANDA and their trading products often turn out satisfied

with the service.

Forex and CFDs Trading

OANDA is primarily a forex and CFDs broker. It offers excellent deals on CFD average spreads on more than 70 forex currency pairs. The majors are all in as well as the minors.

It lets clients trade with the use of leverage and margin.

Traders can control trades that are far larger than what their account can fund. The maximum leverage is 1:50, but you can set this manually when trading. That is a big deal. This feature isn’t available with many other brokers, such as Pepperstone and FXCM.

You can also trade CFDs with many other products like bonds, commodities, and indices. It has a wider variety of CFDs offering than its competitors, even with a limited product portfolio.

Please note, that CFDs are complex instruments and carries high volume of risk, there is always a chance of losing your money. CFD trade also requires high level of knowledge and experience.

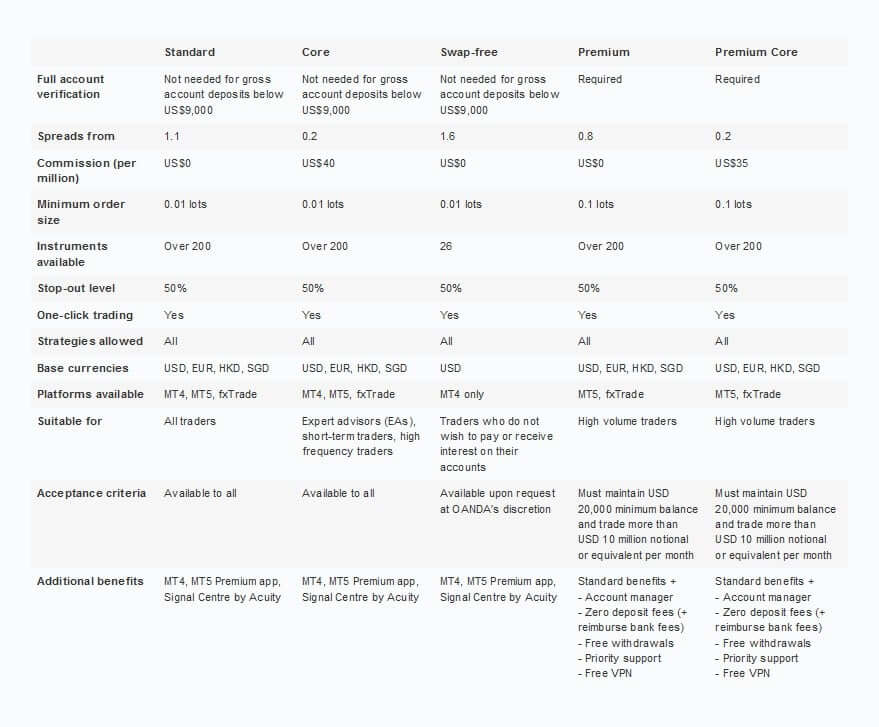

OANDA Trading Accounts

OANDA offers two account types, which are:

- Standard account

- Elite account.

Regarding standard account, there are available:

- 64 FX trading pairs

- OANDA Web platform and mobile and tablet apps, plus TradingView and MT4

- Core pricing + commissions

- Spread-only pricing

- API trading

- 24/5 support

- Variable contract sizes (as low as 1 unit)

- Updates every 20 minutes.

Regarding Elite account, it includes all from above, in addition to:

- Updates every 5 minute

- Monthly TradingView subscription reimbursement

- Unlimited free wire transfers

- Minimum volume trading requirement From 10 Million

- Rebate per million traded From 5 Million.

Account Opening

When opening an account, you do not need to worry about any minimum deposits. At the same time, the process is entirely digital. You can complete it in less than 10 minutes — no sweat.

The catch is that the account approval may take multiple days since you will be asked for some verification documents. You can try your best to respond to these requests promptly so you will not have to wait long.

OANDA Trading Platforms

OANDA offers web and desktop trading platforms, as well as mobile apps. The most important thing is that they offer the MetaTrader4 platform, which is the industry’s standard.

Trade Web

OANDA offers quite a powerful web trading platform, capable of helping the trader spot trading opportunities. It has an excellent trading tech that enables fast execution.

You also get to enjoy superior analytical tools, news aggregators, charts, and more. It also helps the trader with risk management using the stop-loss order feature as well as the tutorials and guides.

Mobile and Tablet Trading

If you are not the type to sit down and you want to trade on the fly, mobile and tablet trading is also available. The custom made trading platform from OANDA is compatible with Android and iOS operating systems, so it’s pretty much accessible on all mobile devices.

The mobile trading platform has a customizable interface to help traders react and trade more efficiently. They can use the charts to suit their trading styles.

At the same time, the platform offers a trading performance tool that shows trading history and professional-grade metrics. There’s also a bunch of market news and data where you can access the economic calendar as well as the earnings calendars.

MetaTrader4 Trading Platform

OANDA also knows that traders will search for something big and familiar. That is why they also offer the MT4 trading platform, the forex market’s standard.

OANDA combines its pricing and execution with the platforms charting and analysis capabilities, paving the way for flawless and smooth trading. That’s something many brokers are striving to achieve.

So if you like using tech to your advantage, you can take advantage of the automated trading capabilities of the MT4. You can build trading algorithms, backtest your strategies, and enhance your existing plan.

MetaTrader5 at OANDA

Understanding the evolving needs of traders, OANDA offers the MT5 trading platform, a step further from the forex market’s conventional MT4.

MT5, with OANDA’s transparent pricing and proficient execution, amalgamates its advanced charting and analysis competencies, thereby delivering an impeccable and streamlined trading experience that brokers universally aspire to provide.

If you prefer leveraging technology in your trading operations, the MT5’s superior automated trading features can be beneficial. This platform empowers you to construct complex trading algorithms, backtest your tactics robustly, and refine your existing strategy, thereby providing a significant edge in today’s dynamic forex market.

Technical analysis package

What’s more, OANDA has its own technical analysis package and proprietary MT4 plugin. The plugin enables the trader to execute trades directly from the platform’s interface. You also gain access to intraday market scanning as well as automated chart alerts for specified patterns.

There are a lot of features that the MT4 provides that helps traders. Still, traders can opt for the desktop and web platforms or the mobile platforms that OANDA offers for their unique offerings. Also, MT4 is available on mobile.

So as you can learn from this OANDA review the broker pays sufficient attention to mobile trading. No surprise OANDA has also developed Currency Converter App available for most of the android devices.

Deposits and Withdrawals

This part can be most vital for some traders, that is why we dedicated entire section in OANDA Review to deposit and withdrawals options. OANDA also has a deposit and withdrawal policy for the traders.

Summing it up, you do not have to pay any deposit fee, and you can do it using a debit card. Meanwhile, withdrawals are free in most cases. But bank transfers are pretty expensive. Withdrawing from your account more than once a month also involves some fees.

Deposit options vary according to locations. They can be bank transfers, credit cards, debit cards,and PayPal.

Moreover, withdrawals can be done via:

- bank transfers;

- credit cards;

- debit cards;

- electronic wallets.

OANDA does not charge any withdrawal fees for the first transfer each month. But subsequent

withdrawals cost at least $15.

Paypal is free for transactions made using the euro, dollar, and

British pound. Meanwhile, bank transfers can cost at least $20.

OANDA Education

Education is also among OANDA’s priorities. It offers a ton of webinars that cater to both beginners and experts. The videos they provide are well-produced. The webinars cover all the important topics for traders, from forex basics to placing orders.

This broker also offers demo accounts for traders who want to try their strategies first on a practice account. Here, you trade with virtual money while dealing with real-time market conditions. You can practice until you feel confident enough to make the jump from practice to live trading.

The only downside to these educational and learning features is that they appear to be a bit scattered. It is not a huge flaw, but it can use some improvement.

The Market Pulse feature, meanwhile, serves as the source of the most current information about the developments in the market.

OANDA Review Summary – Is it Good?

OANDA is one of those brokers that has all essential bases covered: regulation, accounts, platforms, and education. This feature places it among top picks for a trader to choose from.

Trading with OANDA is undoubtedly a good one.

Of course, no broker is ever perfect. OANDA can work out its fee structure since some fees are pretty high relative to other brokers.

At the same time, there are issues with protection when it comes to its registrations. Nonetheless, these are pretty common. And the best brokers deal with this.

Conclusion

Overall, OANDA ranks among the brokers that shouldn’t be ignored. Trying out their services will prove to be an enjoyable experience.

Considering transparency, the company always publishes a trailing average of its average spread around nearly all timeframes. It is a part of its push for greater transparency alongside pricing.

Nevertheless, it is difficult to make a more precise comparison. It is because it never publishes a

number that is reflecting the average spread over a fixed period.

As already said from third-party developers within OANDA’s are available additional platforms.

It includes the Seer Trading Platform. The platform supports the development of the trading

system, including forward-testing and back-testing automated trading systems.

Moreover, OANDA is supporting trading connectivity to multiple platforms such as MotiveWave,

NinjaTrader, and MultiCharts.

Also, OANDA has content dedicated news site called MarketPulse. The site analyzes and

researches firms’ power and content.

Customer Support

If you need any professional customer support in the financial market with your standard account (or any other) you can also visit the Oanda’s contact page to see all the relevant numbers and emails as an existing customer or the potential one!

Is it Good?

As the summary of OANDA review we have to answer one core question: is it good broker or not? The final answer is below.

All in all, the edge of OANDA is its strong track of regulatory record. It has licenses in the

strictest centers of major finance, with robust research of the market.

Cons are including pricing

that trails discount leaders and a small list of tradable products.

OANDA is a suitable platform for sophisticated traders who prefer to connect via API alongside.

And, also for the casual investors who use automated trading systems on MT4. Thus, if you want to trade and have gains, this platform is an extremely good and rational choice.

For additional information and educational material regarding this brooker, you can visit the official oanda.com review page!

-

Support

-

Platform

-

Spread

-

Trading Instrument

Bad forex broker

This is a bad forex broker making so many delaying tactics for withdrawals. Signals aren’t that good and believe me, it is almost impossible to withdraw.

Did you find this review helpful? Yes No

Poor signals

Poor trading signals. Have just wasted my money and time on this.

Did you find this review helpful? Yes No