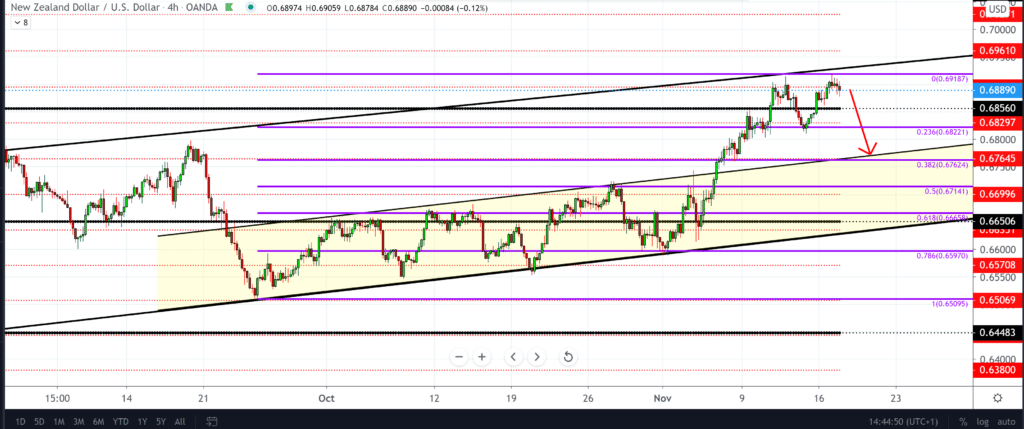

NZD/USD forecast for November 17, 2020

this morning the NZD/USD pair managed to make it to the previous peak of March 2019, after which we see that it encounters resistance in the area and is slowly transitioning to a bearish scenario.

We can now expect a slight pullback to better support at 0.68500. Macroeconomic data released from China and a risky market environment helped the NZD outperform its rivals earlier in the week.

Renewed optimism against the coronavirus vaccine after Moderna announced that its candidate is 94.5% effective launched a set of risks yesterday, and global stock indices recorded strong gains. The growing number of coronavirus cases in Europe suggests that there could be additional locking measures before the vaccine becomes widely available and that the risks are still behind us as the number of new infections globally has exceeded 55 million.

With over 150,000 new infections daily, America is at the top of the list. Coronavirus headlines (number of cases, vaccine prospects, lock concerns) will continue to shape risk-taking and demand for NZD. Electoral uncertainty and a lack of incentives in the United States could affect this week’s overall appetite, as can China’s economic data this week.

The good news about the Chinese economy can help the New Zealand dollar. Recent moves by the Reserve Bank of Australia (RBA) and the Reserve Bank of New Zealand (RBNZ) have been necessary steps to strengthen their economies. They are probably in the best position to take advantage of the expected growth if coronavirus vaccines prove effective.

RBNZ kept interest rates at 0.25% and introduced a new monetary policy tool to encourage more loans by reducing lending costs to banks, in line with market expectations. With these moves, the central bank may have indicated that it should not reduce interest rates to negative ones in March 2021, which many traders determined.

-

Support

-

Platform

-

Spread

-

Trading Instrument