NZD/USD forecast for March 18, 2021

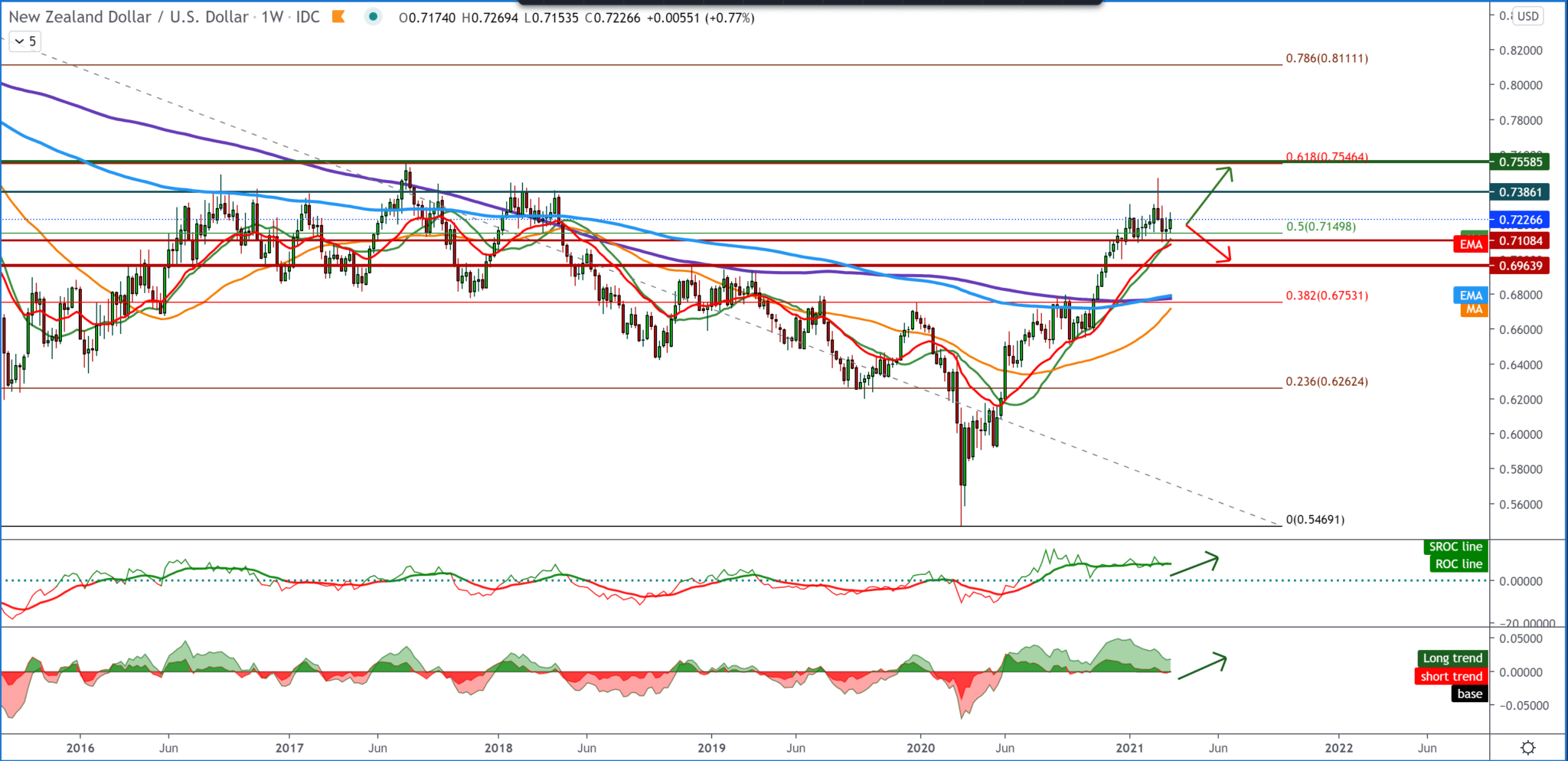

Looking at the chart on the weekly time frame, we see that the NZD/USD pair has dropped to moving averages MA20 and EMA20, and here we can now expect some support. By setting the Fibonacci retracement level, we see that the NZD/USD pair is currently testing 50.0% at 0.71500. If the pair rejects, we look at the bullish trend’s continuation and go towards the 61.8% level at 0.75500. For the negative and bearish scenario, we expect a fall below the Fibonacci level of 50.0% and a fall below the moving averages. Then we look at the moving averages MA200 and EMA200 at 38.2% levels.

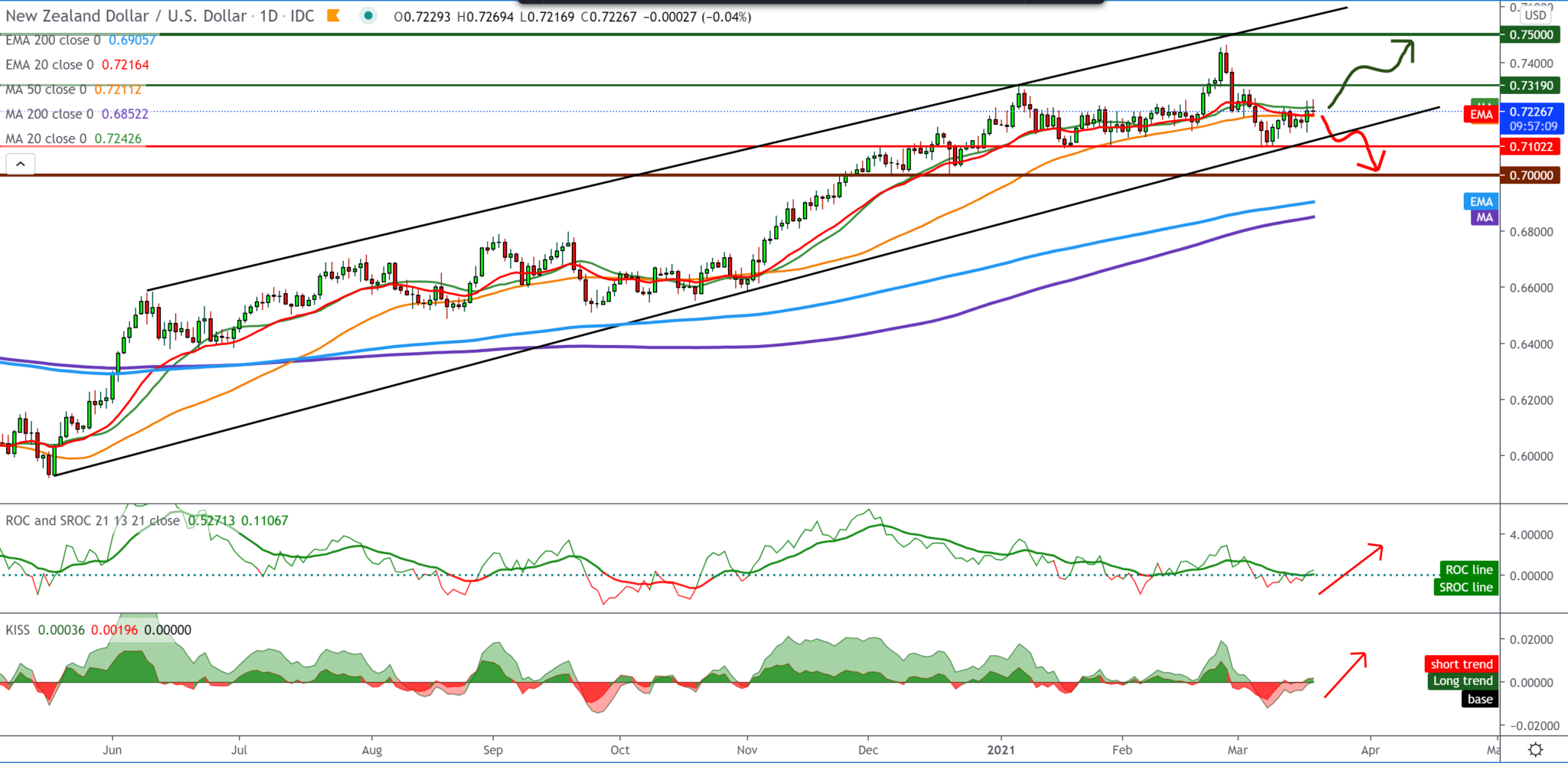

On the daily time frame, we see that the NZD/USD pair is still moving in the ascending channel, and the NZD/USD pair is now also testing moving averages MA20, EMA20, and MA50. To continue the bullish trend, we need to break again, again above the moving averages with the lower trend line’s support. The break below this line opens the bearish trend, and then we see how the pair will behave in the encounter with the MA200 and EMA200.

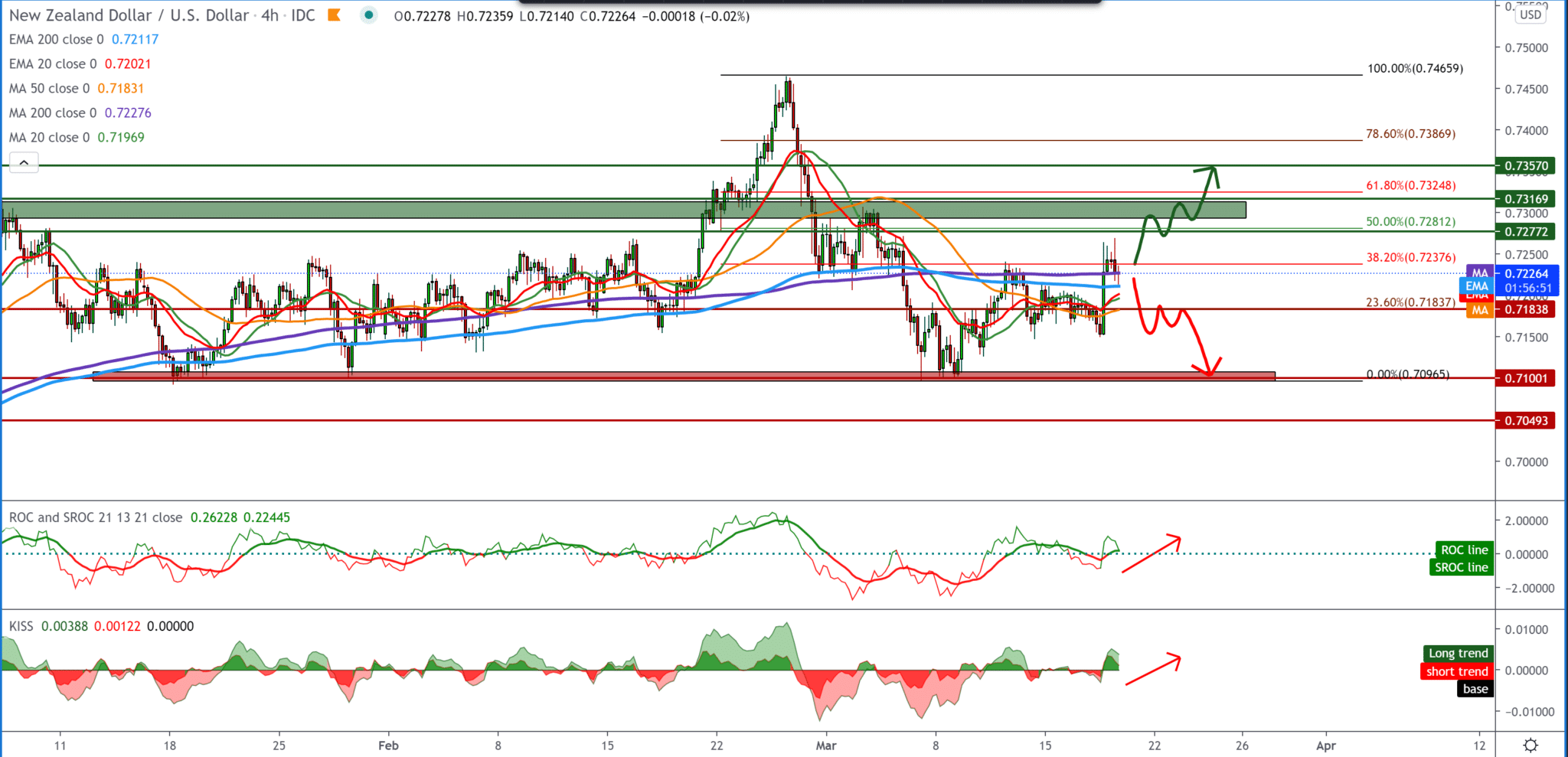

On the four-hour time frame, we see the NZD/USD pair testing moving averages of the MA200 and EMA200, but with the support of the MA20, EMA20 and MA50. By setting the Fibonacci retracement level, the NZD/USD pair is currently testing a 38.2% level. Based on that, we can expect the bullish trend to continue, and our target is the zone between 50.0-61.8% Fibonacci levels.

From the news for the NZD/USD currency pair, we can single out the following: New Zealand’s gross domestic product in the fourth quarter of 2020 decreased by 1.0 percent in the quarter, New Zealand statistics announced on Thursday. That missed forecasts for a 0.1 percent increase after a revised 13.9 percent decline in the previous three months (originally 14.0 percent). “The decline in activity in the December quarter follows the record growth in the quarter of September 2020,” said Paul Pascoe, senior manager of national accounts. “The September quarter reflected a return after a fall in the June quarter, due to the national COVID-19 blockade when many businesses were closed for weeks.”

Updated projections show Federal Reserve members expecting stronger economic growth and higher inflation this year. However, the central bank still expects that it will keep interest rates close to zero until 2023.

Updated forecasts were released on Wednesday, along with the announcement of the Fed’s universally expected decision to keep the target range of federal fund rates at zero to 0.25 percent. The central bank also reiterated plans to continue buying bonds at a rate of at least $ 120 billion a month until “significant further progress” is made toward its policy goals.

-

Support

-

Platform

-

Spread

-

Trading Instrument