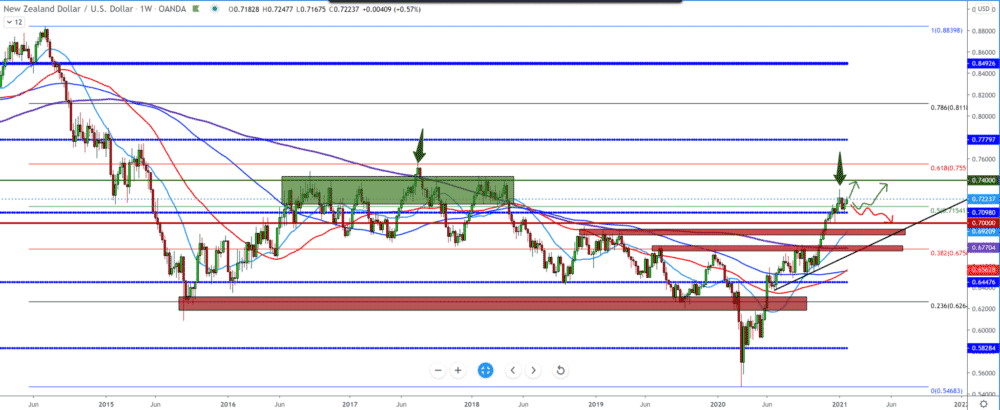

NZD/USD forecast for January 27, 2021

Looking at the graphon on the weekly time frame, we can see that the NZD/USD pair is now starting to make a consolidation above 0.71500; technically speaking, the graph makes a FLAG pattern on this time frame. We need another confirmation break above the previous high at 0.73100. By setting the Fibonacci retracement level, we see that the pair is now testing 50.0% level.

At the previous level of 38.2%, we see how the NZD/USD pair made a break breaking through the zone at 0.67500. In the last week of December, the NZD made a retest to the 0.70000 psychological level, climbing to higher levels. The NZD/USD pair finds the next support at 0.71000 and, as we said, consolidates slightly above the Fibonacci level of 50.0%, accumulating funds to continue towards the 0.7400 previous high from April 2018.

On the daily time frame, we see a growing trend from March 2020 at the bottom. We have a trend line to support the bullish trend. Moving averages can be helpful here, and we see that the moving average MA20 and MA50 are good support following the movement of steam on the chart. We have a break above the top’s trend line, and we see how the couple made a retest on that line several times and bounced up again. It can now be our first support if there is a possible reversal of the trend.

Check-out FinanceBrokerage’s Comprehensive Review on Libertex

On the four-hour time frame, we see that the NZD/USD pair finds support in the zone around 0.71500 and that now with the previous low to 0.71000, it is making a trend line as support for the NZD/USD pair towards higher levels. To continue above, we need to first break above 0.72500, and there would be a possibility for the pair to reach the previous high at 0.73150. Moving averages give the first support at 0.72000, while the next support is at 0.71700. For the bearish scenario, we need a drop below 0.71000, where the pair would then probably consolidate around 0.70000 with a tendency to turn to the bearish side.

-

Support

-

Platform

-

Spread

-

Trading Instrument