NZD/USD forecast for December 24, 2020

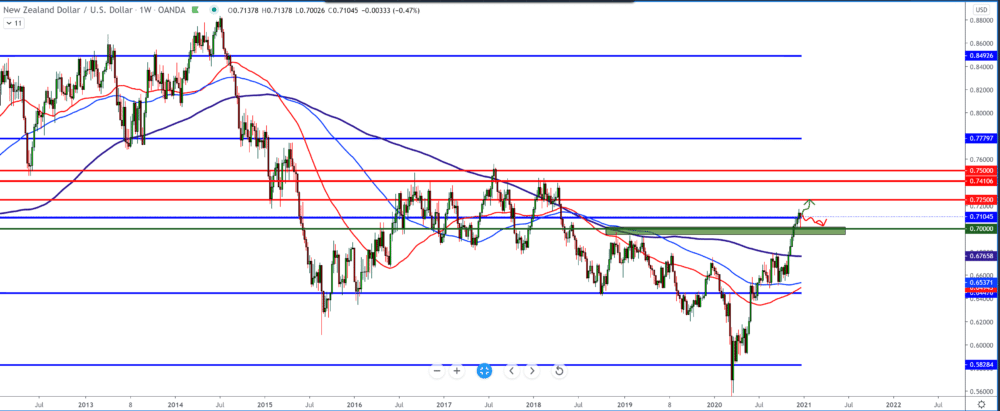

Looking at the chart on the weekly time frame, we see that the NZD/USD pair is stable above 0.70000 for now and records gains against the US dollar. In this time frame, moving averages are of no use because they are far below 0.67000. This week’s candlestick made a pullback to 0.70000 but again pulled up above 0.71000. In the new year, we will likely see the NZD/USD pair above in the zone 0.72500-0.75000.

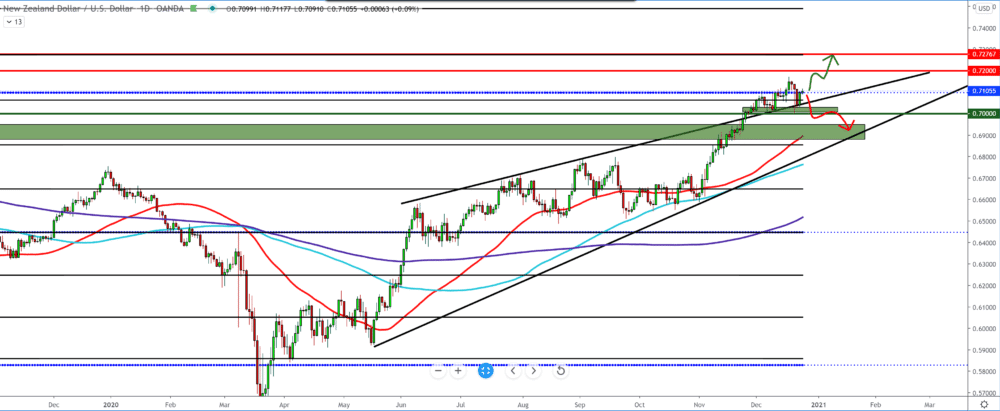

On the daily time frame, we see that the NZD/USD pair has managed to break above the upper trend line and is now consolidating above that line. The bottom side has good support at 0.70000, and the NZD/USD pair has already bounced up several times to 0.71000-0.715000. NZD / USD also has good support for moving averages MA50, MA100, and MA200. For the bearish scenario, we need a break below 0.70000 and a return below the top channel line.

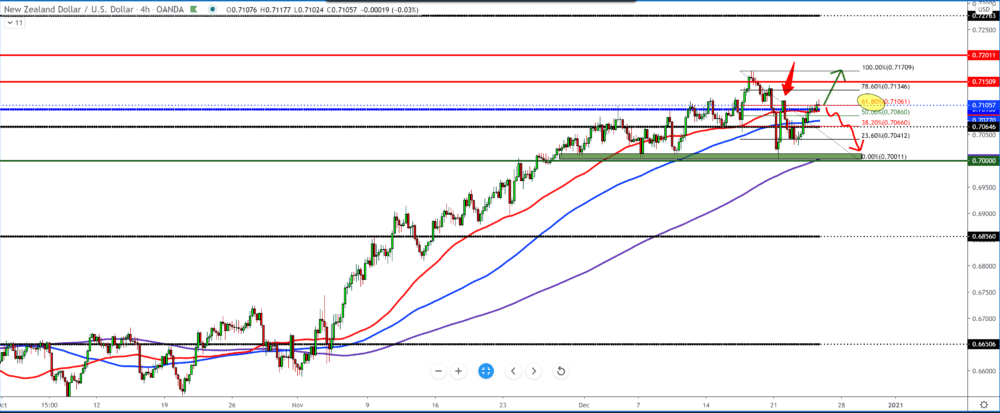

On the four-hour time frame, we see that the NZD is losing power and is now consolidating around the moving averages of the MA50 and MA100, while the MA200 is waiting for it at the bottom. We can set smaller Fibonacci, where we see that the pullback occurred at a level of 61.8%. It is generally a bullish trend in the future, but since it is the end of the year, we will probably not see any major shifts in these last few days.

Markets are shrinking this week during the holiday season. Risk sentiment is being manipulated between positive news about the US phase 4 stimulus and the ongoing rise in global COVID cases.

At least four drug manufacturers expect their COVID-19 vaccines to be effective against a new variant that is spreading rapidly on the coronavirus front.

Currencies like the New Zealand dollar enjoyed risk reduction, making gains relative to major market currencies. Traders remain optimistic at home as well.

Last week, the third quarter’s growth reached above zero (+ 0.4%) year-on-year with a strong 14.0% compared to the same quarter, suggesting a rapid economic recovery and limited impact of new restrictive measures in the third quarter. The market assumes that the New Zealand Reserve Bank will not cut rates in the next year.

-

Support

-

Platform

-

Spread

-

Trading Instrument