NZD/CHF Forecast for March 17, 2021

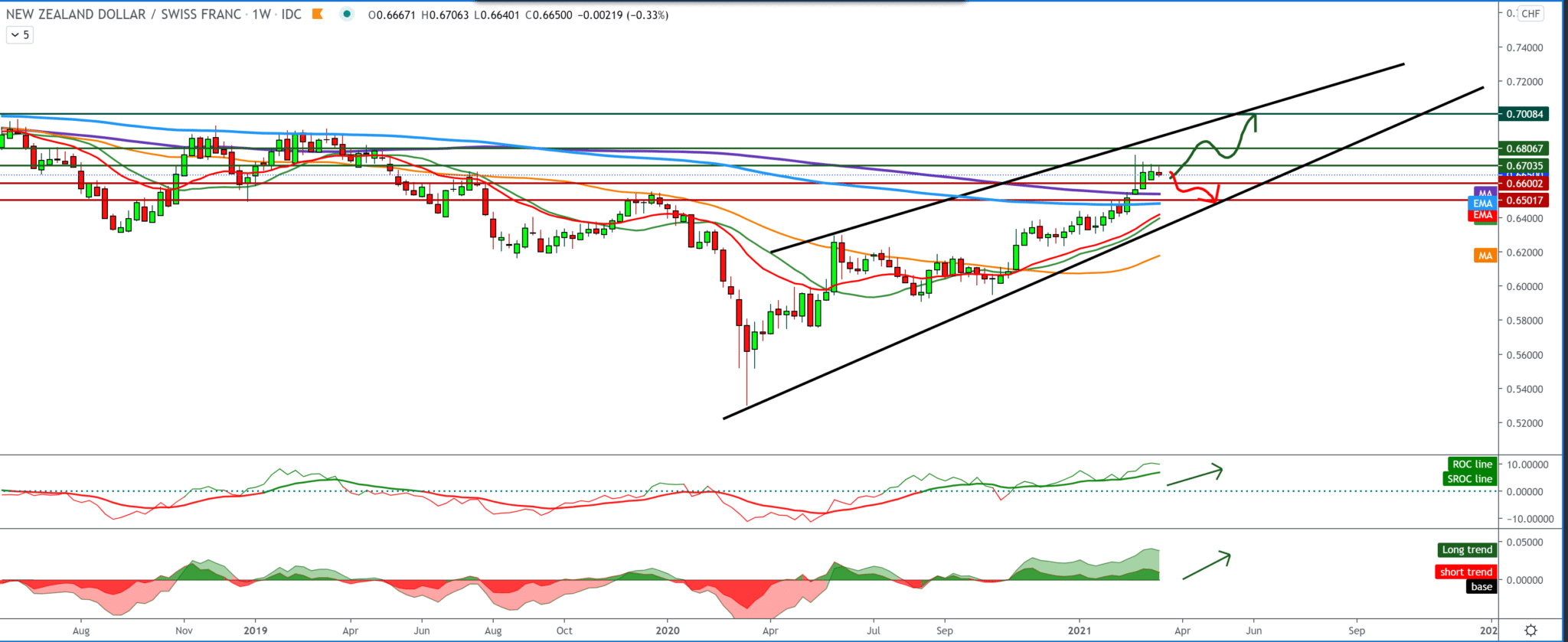

Looking at the chart on the weekly time frame, we see that the NZD/CHF pair after the break above the moving averages of the MA200 and EMA200 has slowed down quite a bit, and on that, we can expect consolidation but above these moving averages. The trend is still bullish, and the global vaccination of the population against Coronavirus will only help the NZD to strengthen against the Japanese yen, so in the coming period, we can expect to see the NZD/CHF pair at 0.70000.

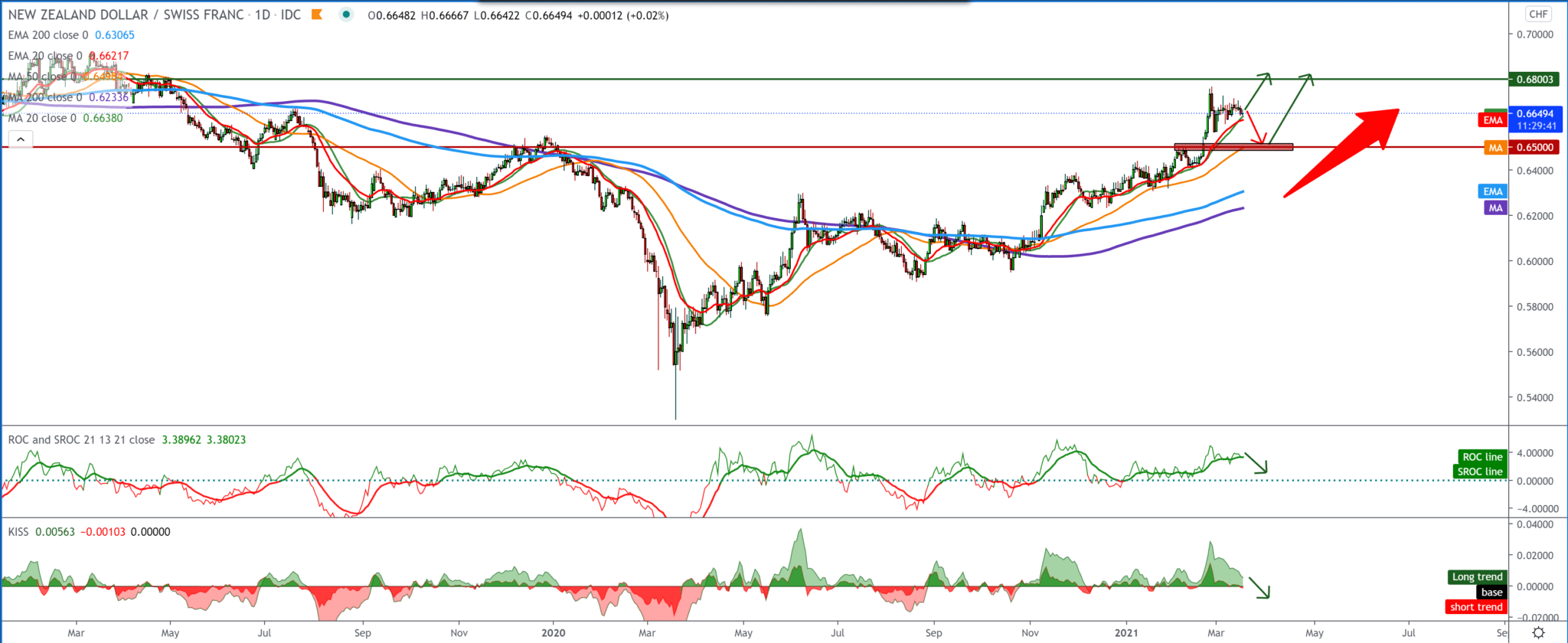

On the daily time frame, we see that the NZD/CHF pair is losing power below 0.67000 and is currently testing moving averages MA20 and EMA20. So far, these two moving averages have been good support for this bullish trend. Break below, our descent to 0.65000, where we encounter a moving average of MA50. And if we see the sequel above, we will see the pair again at 0.68000, the previous level from April 2019.

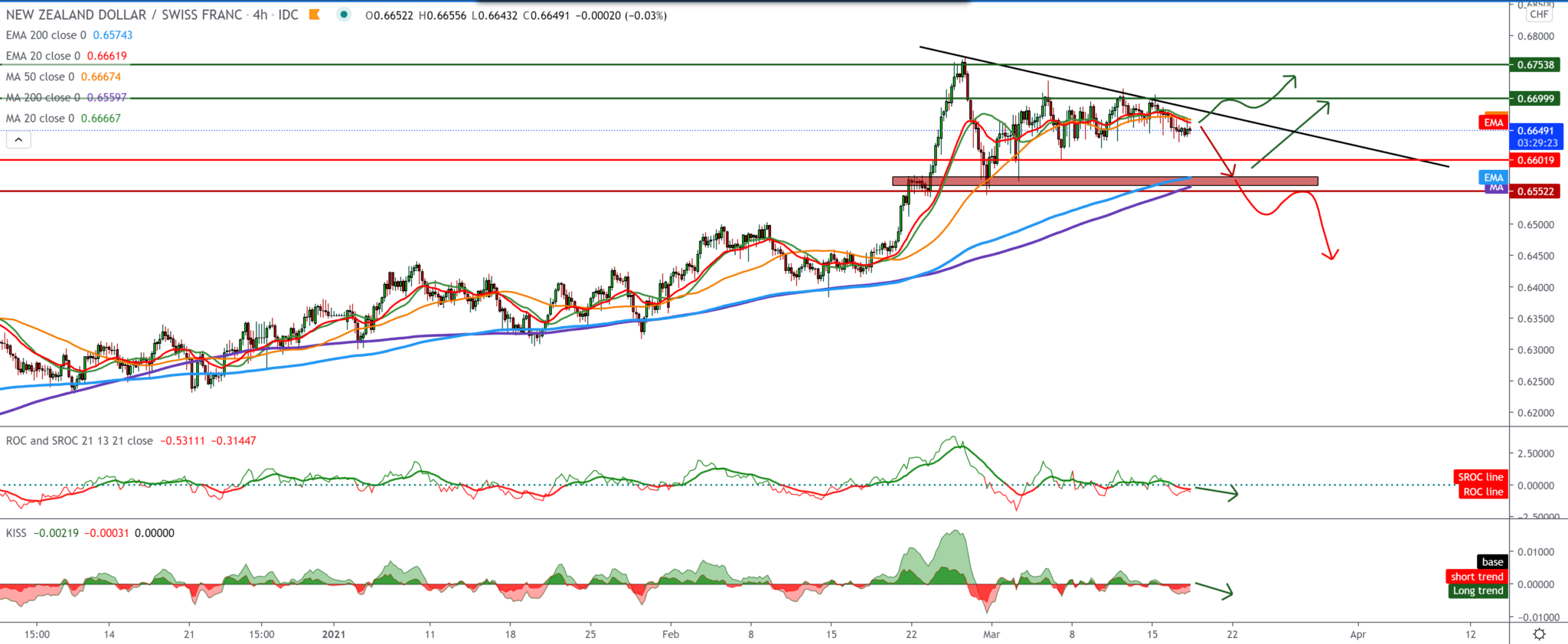

In the four-hour time frame, we see how the NZD/CHF pair slows down and falls below the moving averages MA20, EMA20, and MA50 and directs it towards 0.66000, and then to the pre-rejection zone at 0.65000 where the moving averages MA200 and EMA200 await us. We need a break again above the moving averages and the upper smaller trend line of resistance for the bullish scenario.

From the news for the NZD/CHF currency pair, we can single out the following: New Zealand had a seasonally adjusted current account deficit of 2.695 billion New Zealand dollars in the fourth quarter of 2020, New Zealand statistics announced on Wednesday.

That beat forecasts for a deficit of 2.88 billion New Zealand dollars due to a deficit of 3.521 billion New Zealand dollars in the previous three months.

The net position of international responsibility in New Zealand was 177.1 billion New Zealand dollars, compared to 177.2 billion New Zealand dollars in K3. For the Swiss franc from the news, we only have a TRade balance report tomorrow, as well as any statement about vaccines, the number of newly infected with Coronavirus, and the global mood that can affect CHF.

-

Support

-

Platform

-

Spread

-

Trading Instrument