NZD/CAD forecast for January 13

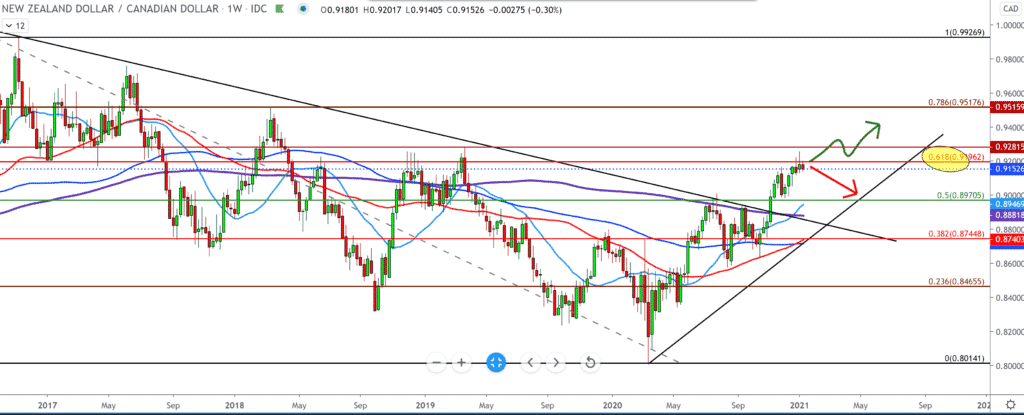

Looking at the chart on the weekly time frame, we see a strong bullish trend over the past year to continue throughout this year. The pair is currently testing a Fibonacci retracement level of 61.8%; we now need to pay attention to whether the pair will make a pullback as at the previous level of 50.0% to 38.2%, here we can expect a pullback to 50.0% to 0.90000. Following the moving averages, it is possible to touch from the chart’s values, and we will see if it will provide support. Since the couple is in a bullish scenario this month, January can only be corrective as it is the beginning of the year.

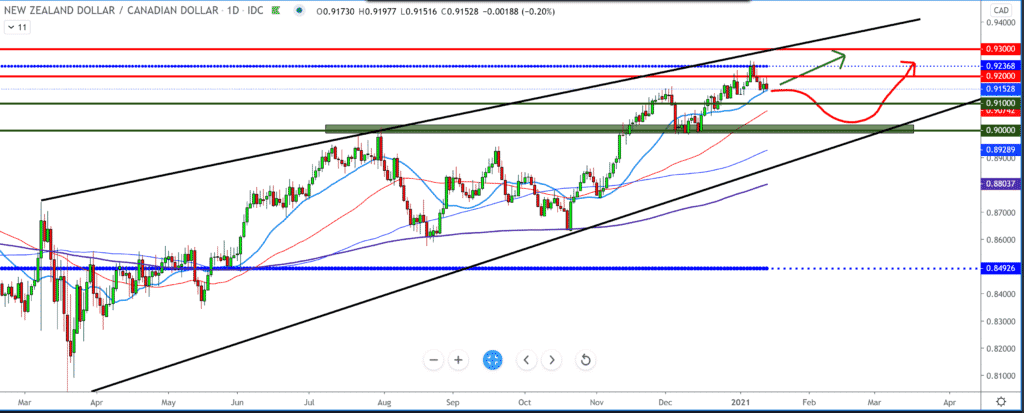

On the daily time frame, the pair is currently testing the moving average of MA20 (light blue line), for a break below the pair we see at 0.91000. Below that, better support is also psychological support at 0.90000. A higher oil price gives strength to the Canadian dollar and finds a vaccine that facilitates business, and thus the oil demand is higher. The bearish scenario on this time frame is likely to be up to 0.90000 as part of the monthly consolidation.

In the four-hour time frame, we see that the pair moves in one ascending channel, and after bouncing off the upper limit of the channel, the pair descends. The parallel channel’s lower limit coincides with the moving average, which may be potential support at 0.91500. The break below the channel line takes us down to 0.90700 previous horizontal support, where we have already seen bounces.

From the news for the New Zealand dollar, we can single out: Commodity prices in New Zealand rose in December due to higher global delivery costs, data from ANZ Bank showed on Wednesday.

The world commodity price index rose 1.8 percent on a monthly basis in December, faster than the 0.9 percent rise recorded in November. Year-on-year, the commodity price index fell 0.4 percent, much slower than the 5.5 percent drop seen the previous month. In local currency, commodity prices were down 0.9 percent from a month after falling 2.3 percent a month ago. Annual prices fell 5.9 percent in December.

-

Support

-

Platform

-

Spread

-

Trading Instrument