More Chop Before NFPs, Or Not?

Again, today’s report will be way shorter than usual and focus only on select charts to drive position details of all five publications.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

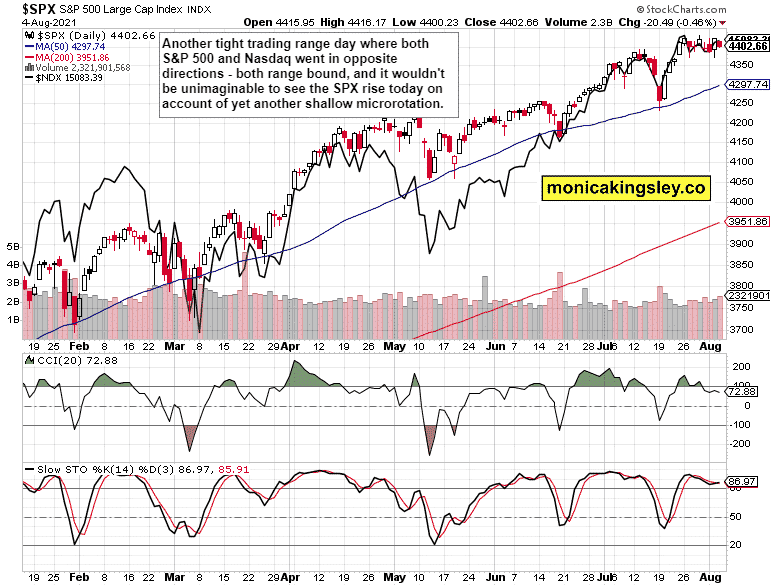

S&P 500 and Nasdaq Outlook

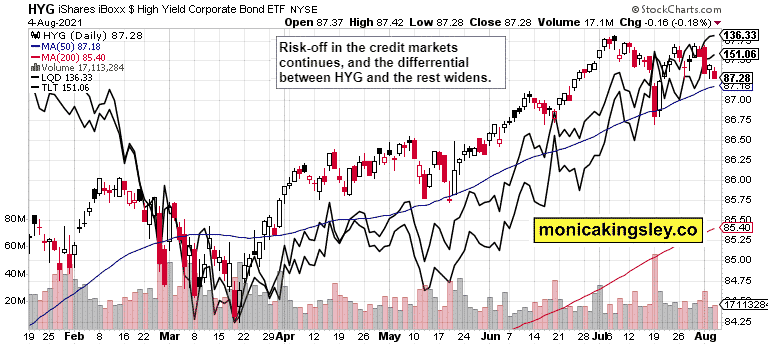

Credit Markets

The plunge in high yield corporate bonds is going a bit too far in my view – and unless the 500-strong index joins, I don‘t see HYG as leading to the downside to usher in a sizable correction. HYG deceleration followed by stabilization and upswing would be the best the stock bulls can hope for.

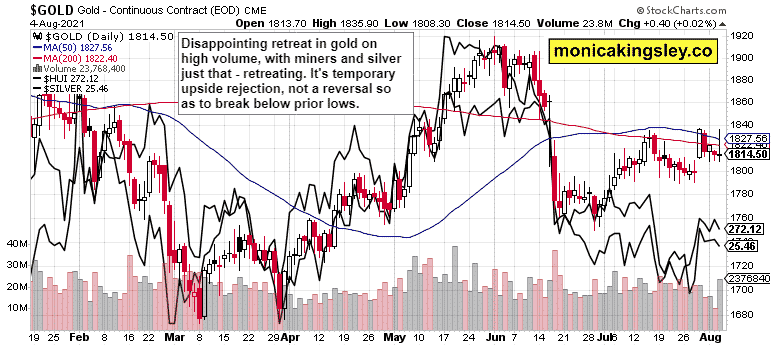

Gold, Silver and Miners

Miners‘ strong showing was relegated to history yesterday, but we haven‘t seen a reversal to the downside – upswing rejection is all that happened. Silver weakness had more to do with yesterday‘s commodity (namely copper and oil) woes than anything else.

Crude Oil

The oil downside wasn‘t over and resulted in fresh oil short profits yesterday, taking my portfolio results to new highs. The rising volume shows that we‘re potentially approaching a reversal, but there isn‘t any proof thereof so far.

Natural Gas

There is a steady uptrend in the other key energy asset, natural gas. The break above the prior sideways to slightly lower flag/triangle approximating structure happened on higher volume and is thus more credible. Good that the fundamentals support the upcoming appreciation higher, too.

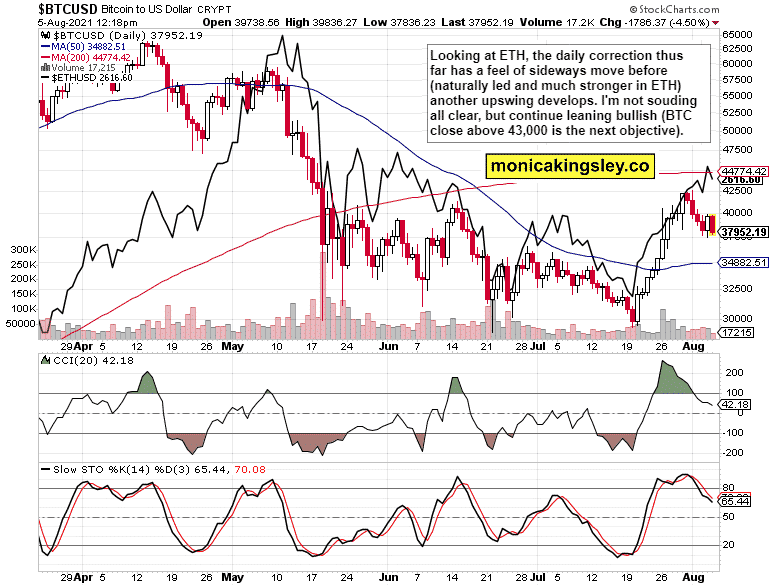

Bitcoin and Ethereum

Yesterday‘s crypto gains haven‘t been entirely defended, but it would be premature to talk about downside reversal. Consolidation playing out with Ethereum‘s continued outperformance of Bitcoin is the kind of surefire conclusion here.

Summary

In place of summary today, please see the above chart descriptions for my opinion.

Thank you for reading today‘s free analysis, which is available in full here at my home site. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www. monicakingsley.co

[email protected]

* * * * *

All essays, research and information, represent analyses and opinions of Monica Kingsley that are based on availability and the latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor.

Please know that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible for any decisions you make. Investing, trading and speculating in financial markets may involve a high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings. She may make additional purchases and/or sales of those securities without notice.

-

Support

-

Platform

-

Spread

-

Trading Instrument