Moovy ICO (MOIL) is the new hot token. What about CED?

Today we will be looking at two of the newest ICOs from Moovy and Cedro Finance, let’s find out what they offer in depth!

Moovy is a new gaming project that boasts an experienced team and a well-developed roadmap. Its platform will enable players to drive real-world cars and get rewards in the process. Moreover, users will have a chance to socialize with people who share their interests and make lasting friendships. The company uses the most advanced technologies. It utilizes blockchain, GameFi, and DeFi to offer the best gaming experience to its customers.

In addition, Moovy developed a drive2earn infrastructure that enables players to actually own their cars. Users will have a chance to earn $MGAS tokens by winning races. Afterward, they can exchange their tokens or other game items for fiat currencies.

Initially, the team wanted to create a Move-and-Earn application, as this trend became especially popular in 2022. It planned to create a game that revolved around ordinary cars and their mechanics, including repairing and tuning them. But the team members soon discovered that they wanted to create something even more exciting. That’s how they ended up developing the Drivers Metaverse. The latter unites various mechanics interacting with each other. The company made sure that it would work seamlessly.

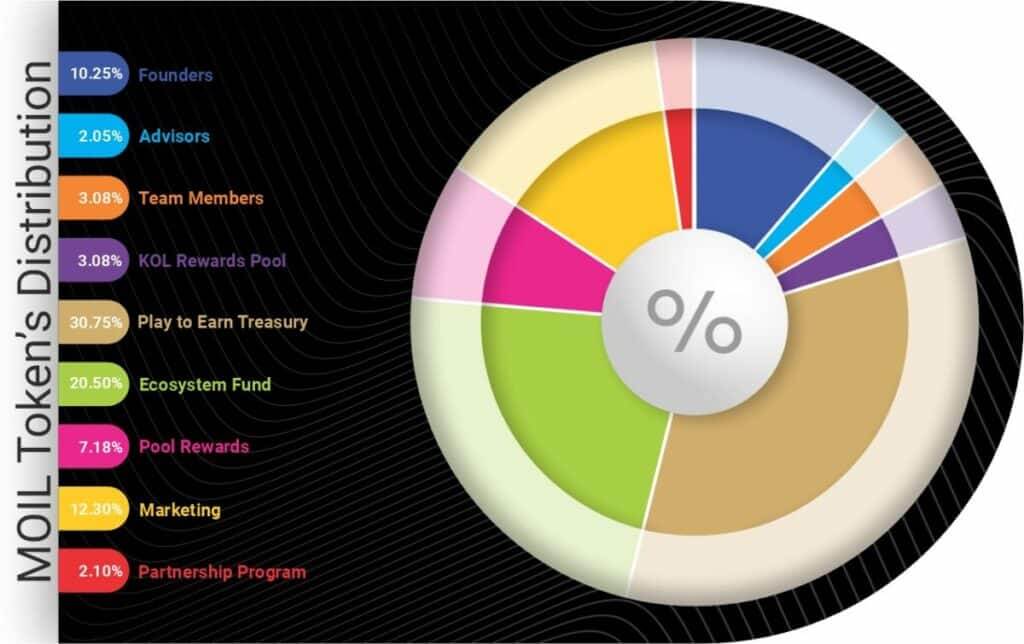

Moreover, Moovy introduced its native utility token – MOIL. The Moovy ICO team plans to launch its public sale on February 20, 2023. The sale will end on March 5, 2023, though. According to the company, the price of 1 MOIL token will be $0.19 during the initial coin offering. The platform will accept ETH, BTC, BNB, USDT, and BUSD in exchange for its native tokens.

What is Cedro Finance ICO (CED)?

Cedro Finance is another promising project that has attracted investors’ attention. This cross-chain decentralized liquidity protocol will enable people to lend and borrow various listed assets. By depositing their assets, lenders will contribute to the platform’s liquidity. On the other hand, borrowers will be able to borrow the liquidity.

The team created the platform’s native token, CED, which is currently trending. While Cedro Finance hasn’t announced the ICO’s starting date yet, it will likely occur soon. The total supply of these ERC20 tokens is 500,000,000, but the team will offer only some percentage for purchase.

Cedro Finance has many advantages that set this platform apart from other similar ones. For instance, it provides higher capital efficiency by connecting fragmented liquidity across chains. Thanks to such an approach, both lenders and borrowers will get better rates on their assets.

Furthermore, users can get access to multiple chains simultaneously and find more financial opportunities. The team guarantees that its users will get the best possible experience. Typically, customers need to use multiple third-party services to open different positions across chains. But this platform simplifies that process and makes it much more convenient. Besides, Cedro Finance is secure and easily scalable.

The team has designed its protocol architecture from an innovative viewpoint. It incorporated smart contracts into the platform. As a result, customers have to interact with these contracts on the asset’s chain if they are repaying or depositing tokens. The company also noted that if the user is withdrawing, borrowing, or liquidating, they can do that on the platform without switching networks.

What other features does Cedro Finance offer?

The company pointed out that many users treat multichain assets as different assets. Consequently, liquidity fragmentation often remains on an asset level.

Take USDC, for example. It is live on multiple chains, such as Ethereum, Polygon, Solana, etc. But customers treat them as different assets. On the other hand, Cedro Finance aims to virtually merge these assets’ liquidity across various chains. Thanks to such an approach, users won’t need to bother investigating their multichain asset’s original chain. The team calls its innovative features – CULT.

Furthermore, Cedro Finance wants to connect the multiple chains’ liquidity flow, as well as merge their liquidity. That introduces infinite possibilities. The team also considers that users might be wary due to multiple scams on the defi market. Hence, it takes the security problem very seriously. The company has developed a decentralized protocol to avoid such concerns.

It sends all the funds to its smart contracts. While these contracts are accessible to anyone, only the key owners will be able to withdraw funds. Thus, this system is absolutely secure and transparent. The company periodically tests the system to provide that security works.