Market News and Charts for October 24, 2018

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

EUR/USD

The restructuring of the world dominance as Trump puts the United States on isolation, pulling the country out of pacts and agreements opens doors for the European Union to take the role as a global leader committed to multilateralism. Germany and France were also able to make Italy sit on the negotiating table showing commitment from the union of an undivided Europe. The only uncertainty for the Union now is the Brexit. Expect swings from the pair until next months’ meeting of European leaders including the UK.

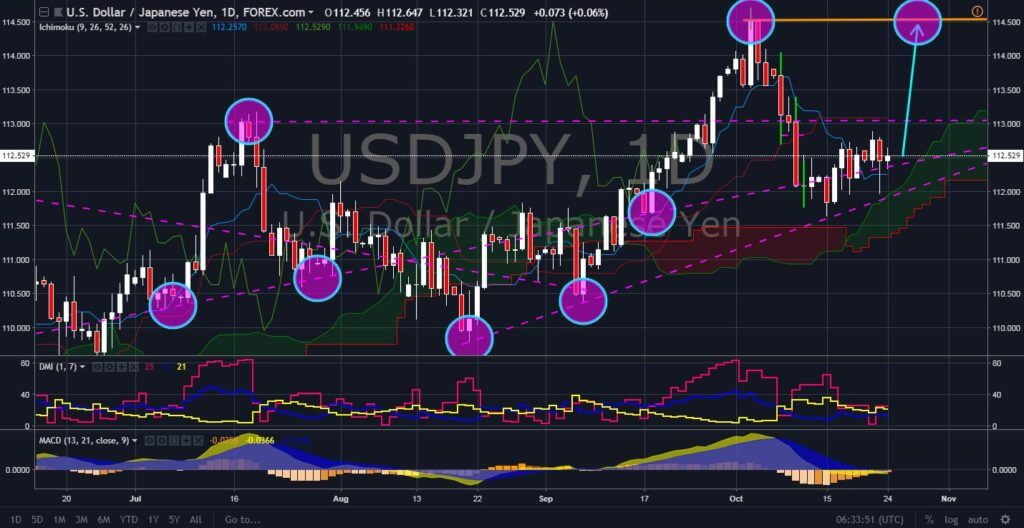

USD/JPY

As a threat from increasing China’s dominance and influence, the United States under the Trump Administration waged war to stop its power. The problem was it was not only China who is affected. The United States is the leading country and every attempt to hurt the country next to it will affect everyone else, including the third in line for the biggest economy, Japan. The country was put under the pressure to make negotiation with Trump to minimize the effect of the trade war.

USD/CAD

The BoC (Bank of Canada) was planning to raise its interest rates to 1.75% as developed countries are ending their Quantitative Easing, or printing of money and buying bonds to stimulate the economy. Most of the Quantitative Easing happened during the 2008 Financial Crisis and Governments introduce Quantitative Easing to revive its economy and now as the outlook of the global growth was seen positive, the countries are tightening their interest rates. This strengthens the Canadian Dollar against the US Dollar in the short term.

AUD/USD

The Australian Dollar continues to fall as Australia was exposed to China’s economy, which was its biggest trading partner. Until now, there was still no talks between the United States and China, which can further threaten retaliation and hurt the emerging countries. Expect for the price to further go down as it was likely that the Federal Reserve will continue the interest rate hike by December.