Market News and Charts for September 7, 2020

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

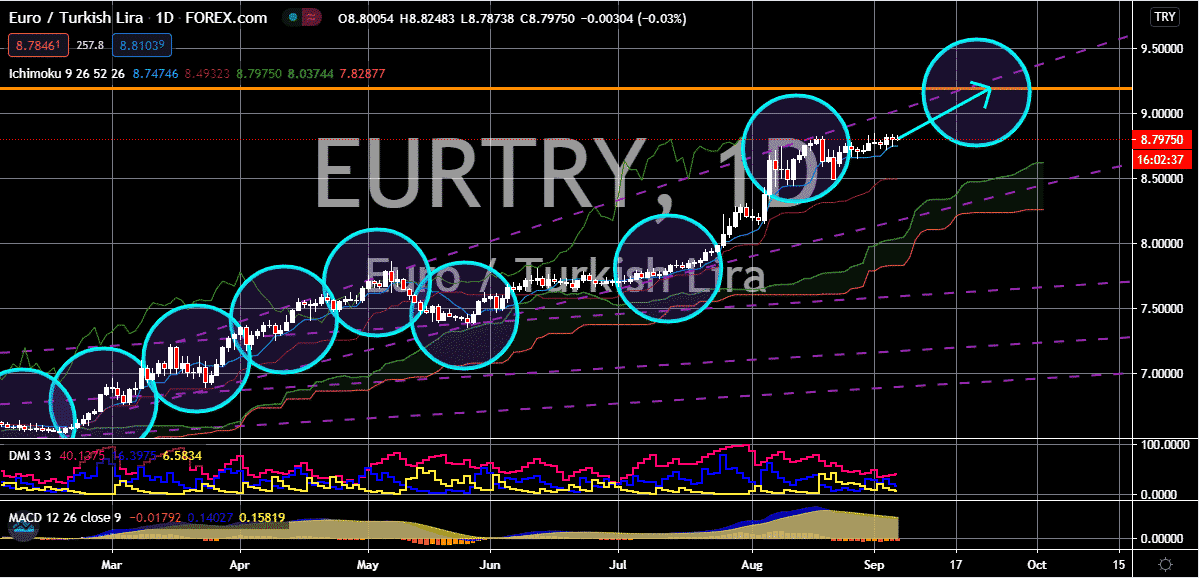

NZD/JPY

The New Zealand dollar faces some turbulences ahead and the exchange rate is projected to turn bearish in the coming days. The pair’s prices are on track to gradually go down towards their levels as more experts argue about the prospect of negative interest rates from the Reserve Bank of New Zealand. Just recently, it was reported that an expert said that there is still more room to accommodate more debt in the New Zealand economy. Thanks to the pandemic, it’s seen that the total debt in the country continues to climb as government borrowing continues to increase. As for the safe-haven currency, most experts believe that the Japanese yen will surge in the coming weeks as the country prepares itself for the next prime minister after Shinzo Abe’s surprise resignation following health concerns. The next leader could call a snap general election shortly after taking office next week according to the senior member of Japan’s current governing party.

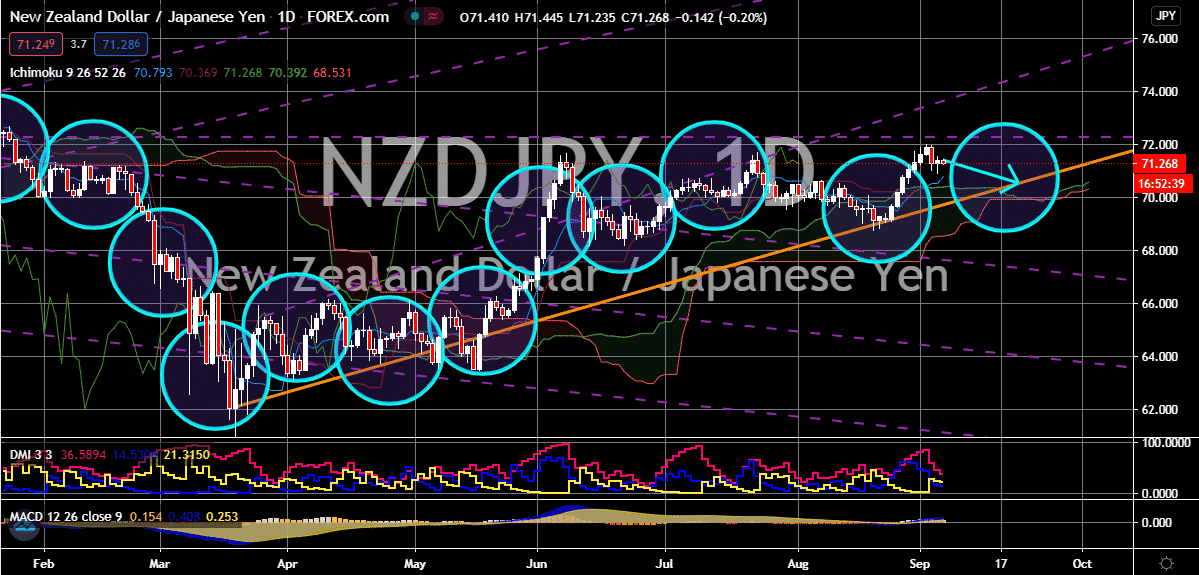

USD/SGD

The weak economic projections for the Singaporean economy are very detrimental to the country’s beloved currency. Prices of the US dollar to Singaporean dollar exchange rate are bound to go up to their support level thanks to the recent reports about Singapore’s economy which cast a massive cloud of gloom in the country. Most experts say that Singapore’s economy is expected to shrink drastically in the third quarter of the year thanks to the coronavirus pandemic. The economic contraction in Singapore is said to be the country’s worst quarterly contraction in history according to the Singapore Department of Statistics. Meanwhile, the US dollar might finally see positive waters in the coming weeks as the US economy records better signs amidst the chaos faced by the country. The upbeat US jobs report last week was the main factor why the dollar gained as it eased the hopes of new stimulus measures from the government.

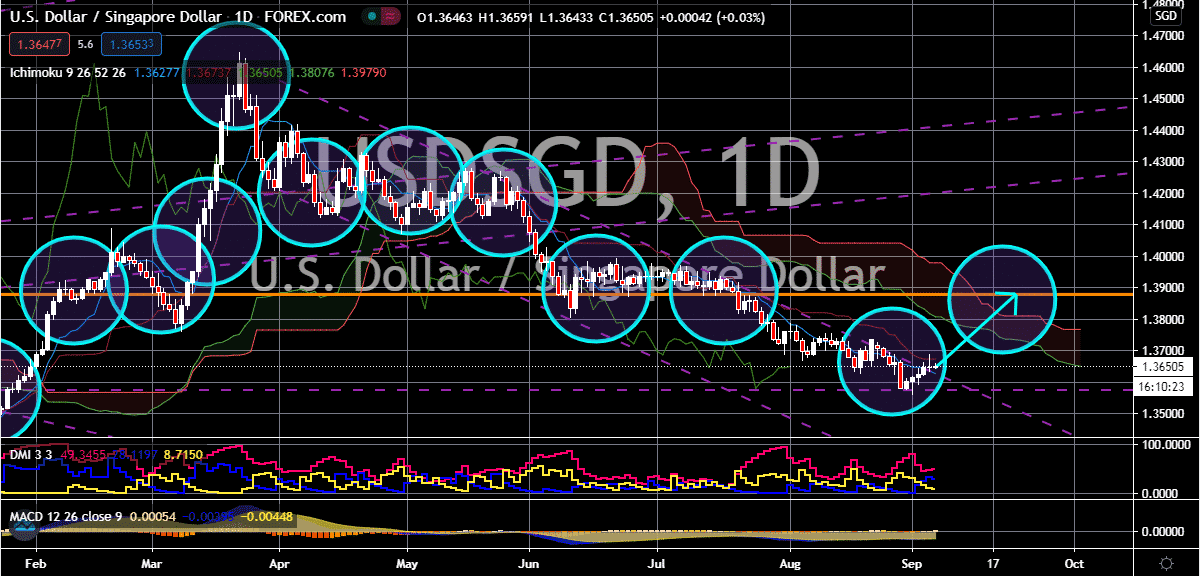

EUR/DKK

Despite concerns for the Danish economy, the krone remains stronger against the bloc’s single currency. The trading pair’s prices are projected to climb down towards their support level in the coming sessions due to the broader weakness of the euro. last week, Denmark proposed a massive boosting package for the next year, including a massive “war chest” that’s worth a whopping 1.5 billion US dollars. According to reports, the fiscal boost aims to help the coronavirus-struck economy and successfully secure the country’s future access to the vaccine. Among other countries in the region, Denmark was one of the first to shut down its economy and unleash some stimulus packages to ease the impact of the pandemic. Meanwhile, investors are also eagerly waiting for the meeting of the European Central Bank this Thursday. However, no big policy changes are expected from the central bank, just statements from its head, Christine Lagarde.

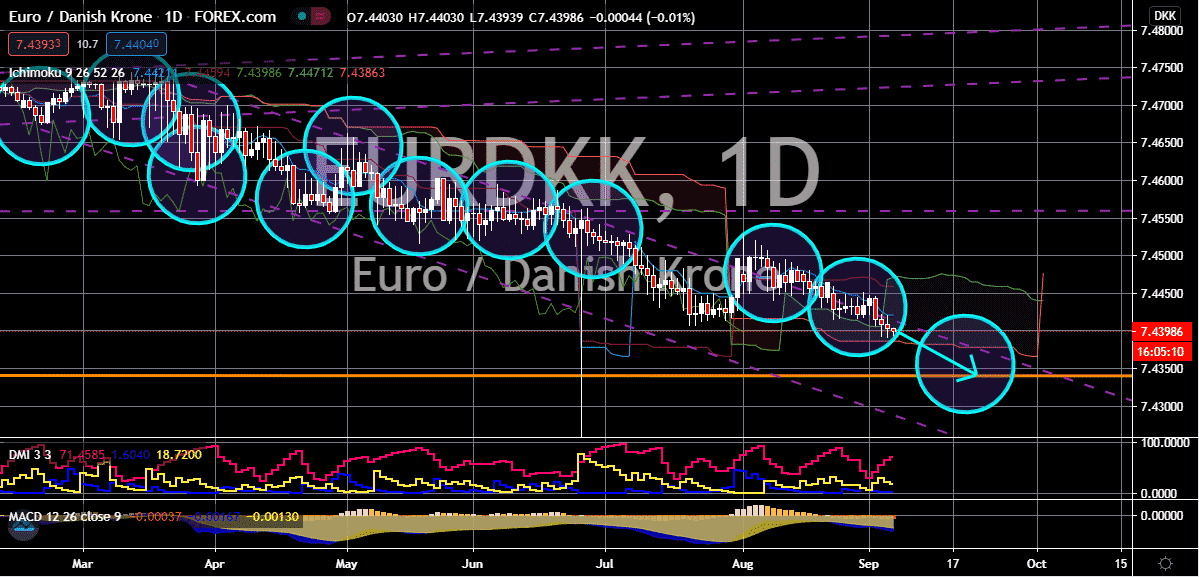

EUR/TRY

The Turkish lira is currently trading at record lows against the euro. The exchange rate has been extremely bullish since the pandemic began and unfortunately for bearish investors, the uphill trend isn’t expected to die down anytime soon. The stubbornly high inflation rate in the country and the concerns for emerging market currencies sealed the deal for the Turkish lira, causing it to buckle against the euro. Since the beginning of the year, the lira has lost 20% of its value despite the interventions of the central bank, dubbing it as one of the worst-performing currencies. The global pandemic has forced businesses and the lives of people in Turkey into very rough times and its impact on the currency has been dire. Meanwhile, one of the most awaited market events this week is the meeting of the European Central Bank. But sadly, for bears, there are no major monetary policy changes are expected, thus no drastic changes in the strength of the euro.