Market News and Charts for September 29, 2020

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

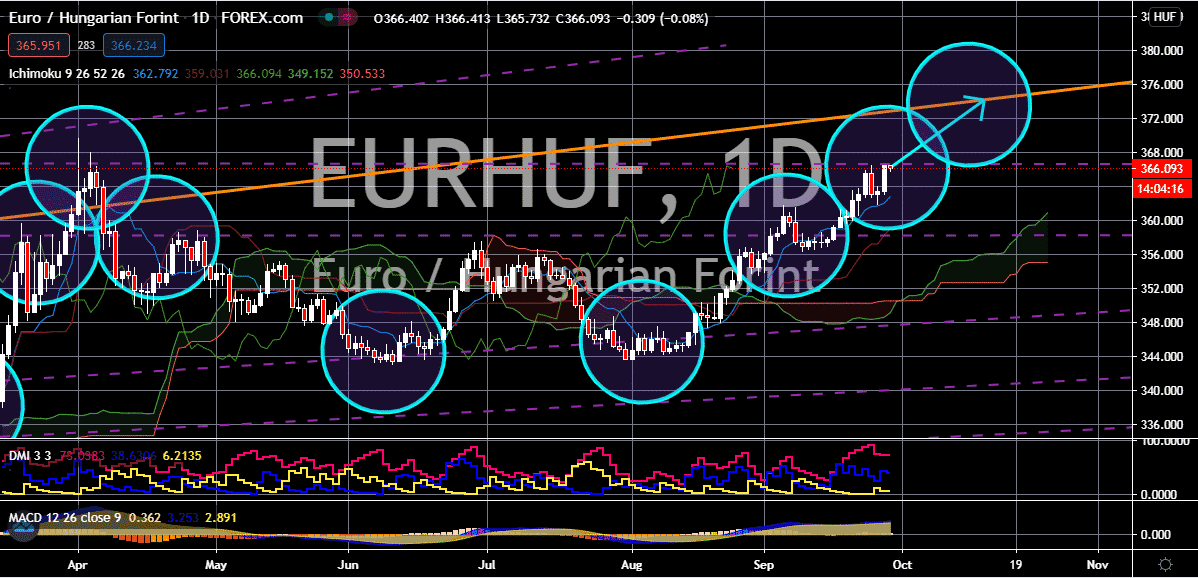

USD/BRL

The Brazilian real doesn’t stand a chance against the US dollar’s new-found strength and the USDBRL trading pair is one a steep climb towards its resistance level. It’s broadly expected that the prices would eventually reach their highest ranges as the Brazilian real gets bombarded by multiple fundamentals, preventing it from defending itself against the power of bullish investors. See, the US dollar remains as the world’s most chosen currency despite the hurdles it has faced this pandemic, this strains the confidence of bearish investors. However, it’s worth noting that the prices also have a potential for a steep plunge once it hits that resistance line as the US dollar as it also faces major turbulences. Meanwhile, the alarming number of daily deaths and cases in Brazil is raising concerns in the market. And to add more negativity for bearish investors, the performance of the emerging markets against major currencies isn’t helping the Brazilian real’s cause.

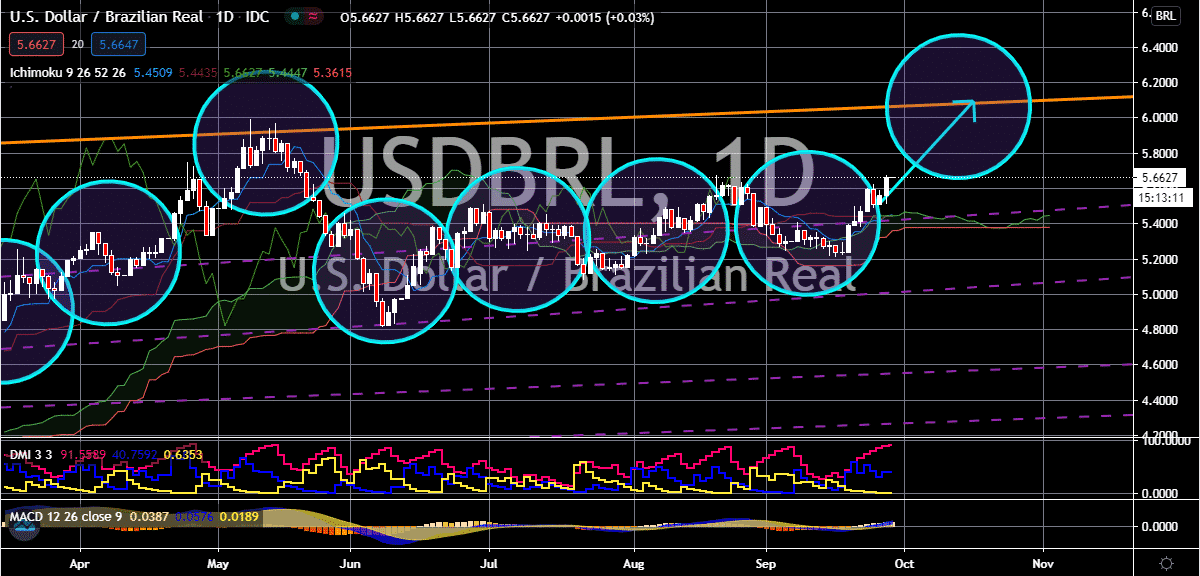

USD/RON

The Romanian leu manages to gain against the US dollar yesterday and today, but it is widely expected that the buck will still have the upper hand in the coming days. The US dollar to Romanian leu exchange rate should head to its resistance level in the first half of October as bullish investors look to redeem their losses from the initial days of the pandemic. Right now, Romania is closely focusing on how it will respond to the impact of the coronavirus pandemic on its economy. Just recently, it was reported that the European Commission approved the reallocation of about 550 million euros in the bloc’s cohesion policy to the funding of the country’s pandemic response budget. The financial aid will be granted to more than 120,000 enterprises and businesses in the country, helping them cope with the crippling impact of the pandemic. This, however, has not helped the cause of the Romanian leu, allowing the buck to seize the opportunity to gain.

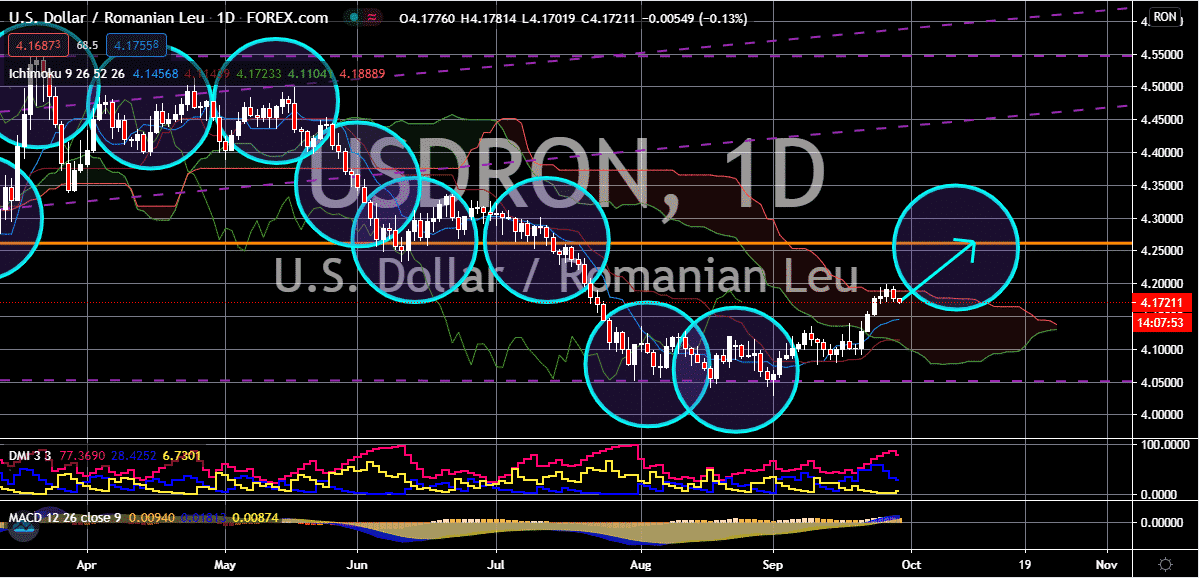

EUR/NOK

The recent dilemma in the commodity market has allowed the Norwegian krone to force the pair’s prices to go down in yesterday’s trading sessions. However, it’s forecasted that the prices would still turn out bullish, steadily rallying to its resistance level. As of today, the EURNOK is steady as investors weigh on the outlook of the commodity market. See, yesterday, the crude market saw bullish winds thanks to the optimism sparked by the latest talks about a massive stimulus program. Looking at it, the main problem faced by the Norwegian krone is the risk aversion in the global market, which is driving investors towards safe-haven currencies and major currencies like the single currency. On the other hand, the euro is poised to rise in the coming weeks as the fundamental difference in the approach of the European Central Bank and the US Federal Reserve starts to kick in and make an impact on their respective economies.

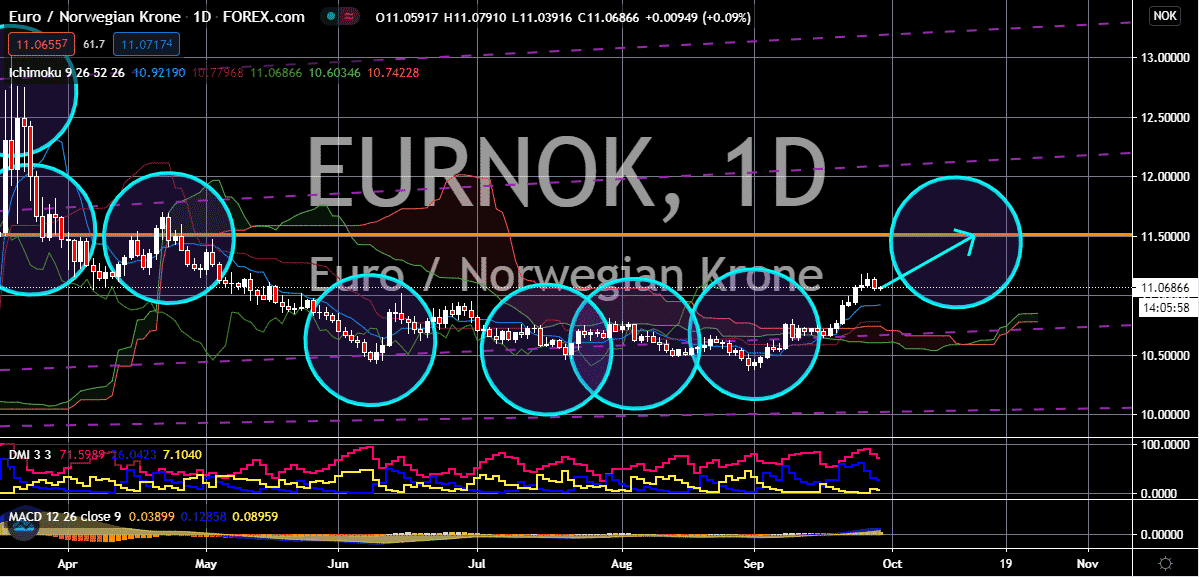

EUR/HUF

Despite the unexpected rate hike of the Hungarian National Bank, the forint remains significantly vulnerable against the bloc’s single currency. The euro to Hungarian forint exchange rate is on track to gradually head up towards its resistance line the coming sessions once it manages to break through the current resistance line it’s facing. So, just recently, Hungary’s central bank raised its interest rates on its one-week deposit facility by 15 basis points to 0.75% but kept its main interest rates unchanged. The decision to raise its rates momentarily powered the forint but the euro is now looking stronger. Meanwhile, an expert on the foreign exchange market projected that the euro will appreciate in the coming weeks as the impact of the moves of the European Central Bank and the US Federal Reserve takes effect. But it’s worth noting that the trading pair has a huge potential for a reversal as the ECB faces some problems regarding its governing council members.