Market News and Charts for September 24, 2020

Hey traders! Below are the latest forex chart updates for Thursday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

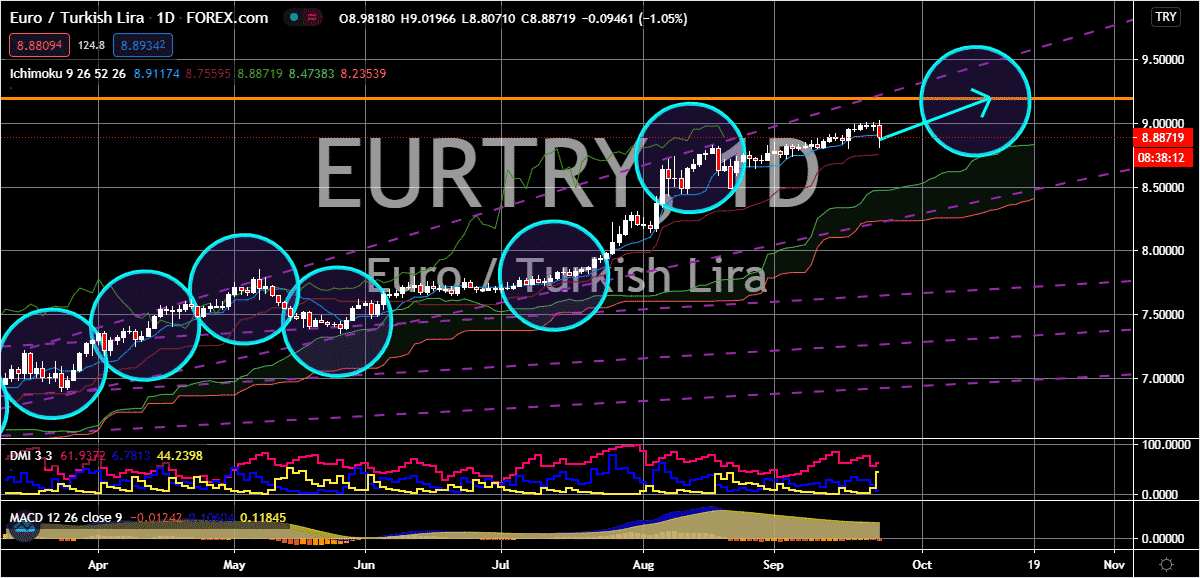

GBP/AUD

The British pound to Australian dollar exchange rate continues to edge higher despite the problems faced by the United Kingdom’s economy and Brexit woes. The prices of the trading pair are expected to remain bullish, continuing its uphill route and eventually reaching its resistance level. See, the Australian dollar is weighed down by the recent decision of the Reserve Bank of New Zealand to hold on to its official interest rates this September. Aside from that, the recent statement of the Reserve Bank of Australia’s deputy governor Guy Debelle also made a significant impact on the Aussie’s strength. The developments with his speech earlier this week surprised the foreign exchange market, weakening the antipodean currency significantly against the British pound sterling. According to Debelle, a lower exchange rate could be beneficial for the Australian economy, zapping the strength of the currency and the confidence of investors.

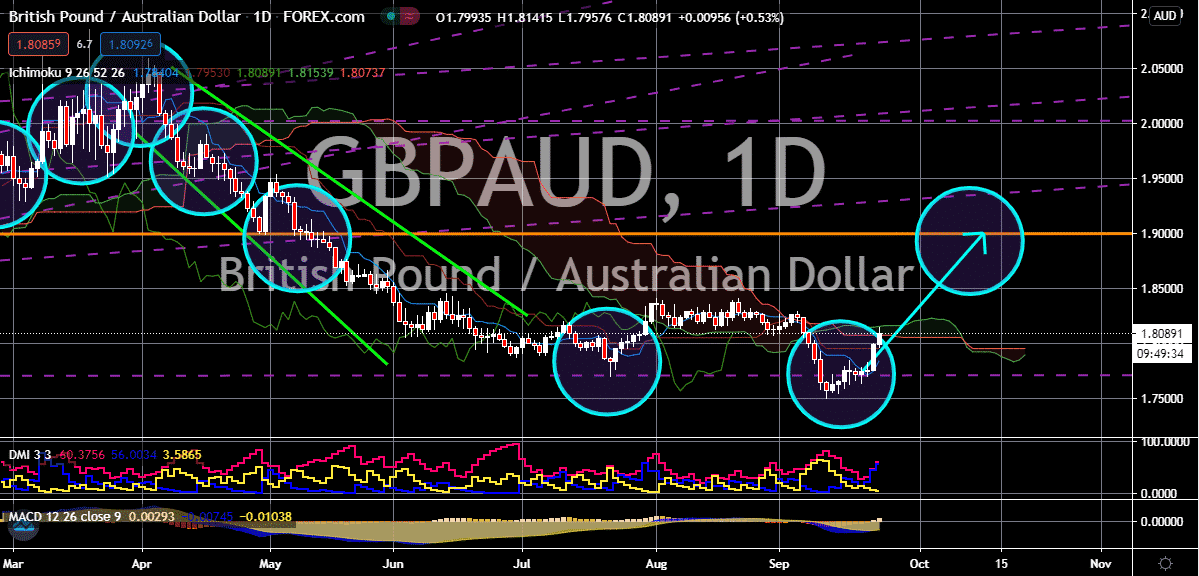

GBP/CAD

The British pound powers through against the Canadian dollar despite the steady stance of the loonie in the currency market. It is believed that the trading pair’s prices would eventually climb back up towards its resistance level in early October thanks to the new-found strength of the Canadian dollar. See, the Canadian dollar may be performing well against the US dollar, but against other currencies in the market, it has had some troubles. The main factor that affects the loonie’s direction is the uncertainties met by the stock market. However, there is an upside potential in the equity market that could slow down the pace of the GBPCAD’s upward direction. On the other hand, the British pound is also affected by the recent developments regarding Brexit. It was just found that the economic costs of a no-deal Brexit would be three times as bad as the pandemic, putting more pressure on the lawmakers to snatch a deal with the European Union.

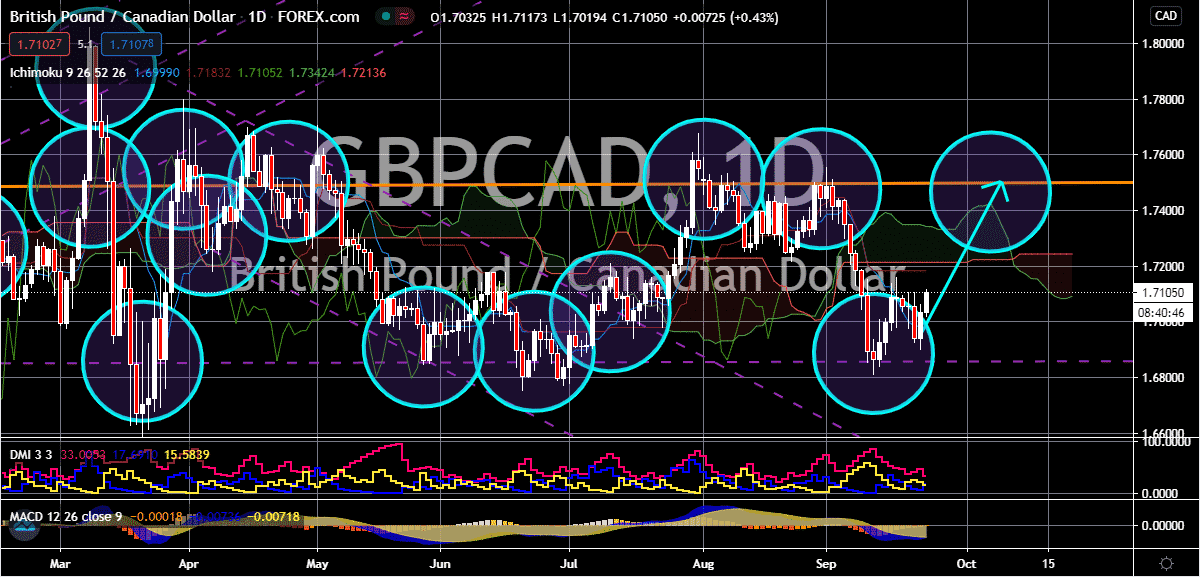

EUR/DKK

The euro steadily gains against the Danish krone and is looking to finally break the bearish momentum of the pair. Bulls are hoping to buoy the exchange rate’s prices to its resistance level in the first half of October. Moreover, it was just recently reported that banks in the eurozone have borrowed exactly 174.5 billion euros from the European Central Bank. With the hopes that banks in the region would continue to finance companies amidst the drastic recession, the ECB has reduced its rate on the TLTRO to as low as negative 1% and extended the duration of that program from two years to three years. This should come as good news for bullish investors as it could help fuel the bloc’s economic recovery. On the other hand, the Danish krone is weighed on by the recent alarming statement of the Danish central bank. Reports say that the Danish central bank reiterated that the economy is not back to its pre-coronavirus level and is facing a moderate recession.

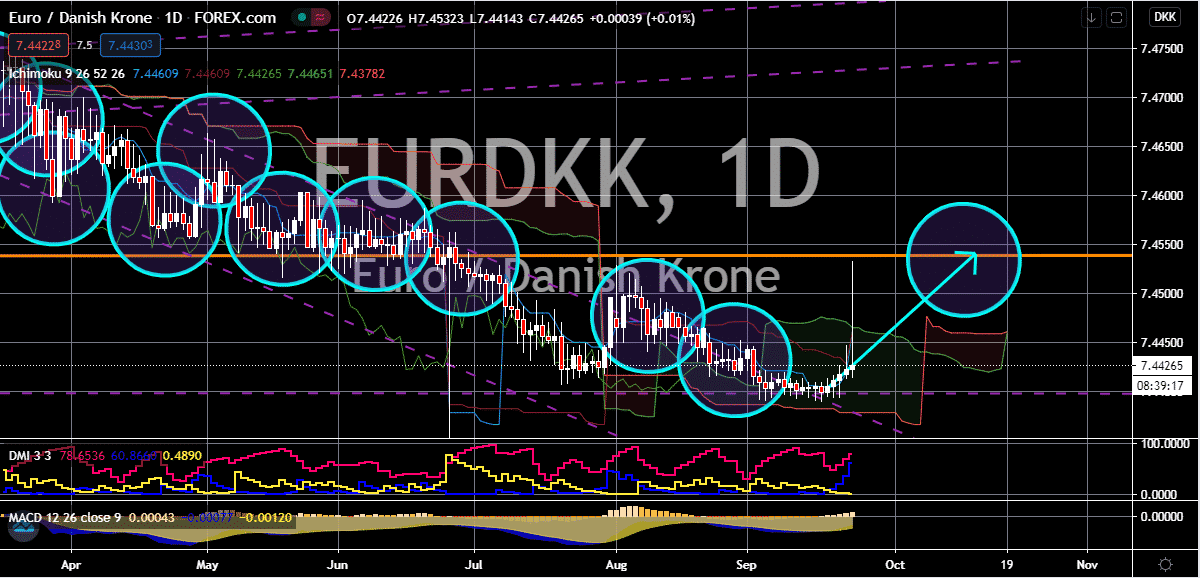

EUR/TRY

As of today, the Turkish lira is seen rallying against the euro as bearish investors seek the redeem their losses from the previous months. However, it’s quite evident that bears do not have sufficient strength to pull prices lower, suggesting that the euro could most likely remain dominant in the coming days. The euro to Turkish lira exchange rate’s prices are projected gradually and steadily climb up to its resistance level in October, hitting its record highs thanks to the pandemic. The near-term strength of the Turkish lira can be traced to the surprise decision of the Turkish central bank to raise its interest rates amidst the pandemic. But most experts are concerned by this decision as it could take a toll on the country’s economic recovery. The lira surged earlier today as the Turkish central bank raises its benchmark interest rate to about 10.25%, catching the market off guard as most analysts initially believed that the bank would leave its rates unmoved.