Market News and Charts for September 23, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

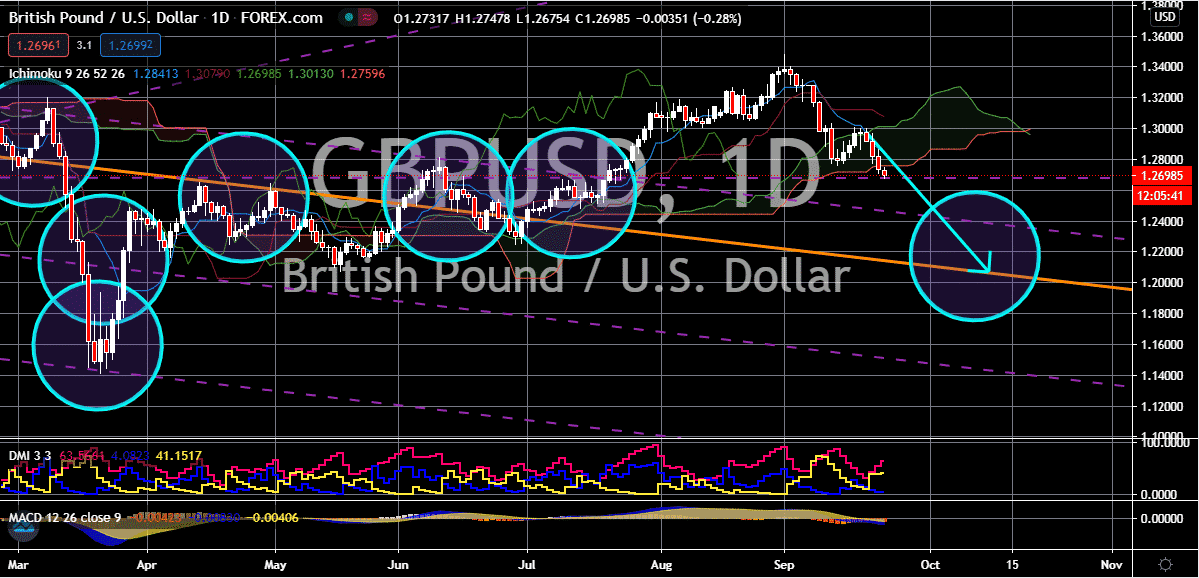

GBP/USD

Again, the British pound gets hammered by concerns surrounding the Brexit deal and the rising number of coronavirus cases isn’t helping its cause too. The British pound to US dollar exchange rate is expected to plummet towards its support level as Germany warns the Britain. Just recently, it was reported that the German Minister of State for Europe, Michael Roth, said that Britain’s plan to override the prospects of snatching a deal with the European Union by December might jeopardize the chances of snatching a trade deal with between the two sides. This news comes after British Prime Minister Boris Johnson was reportedly pushing ahead with the legislation that would bypass the two sides’ withdrawal agreement. Meanwhile, the trade tensions between the United States and China is helping bearish investors drag the exchange rate’s prices lower in the sessions, but also poses as a major threat to its long-term run in the foreign exchange market.

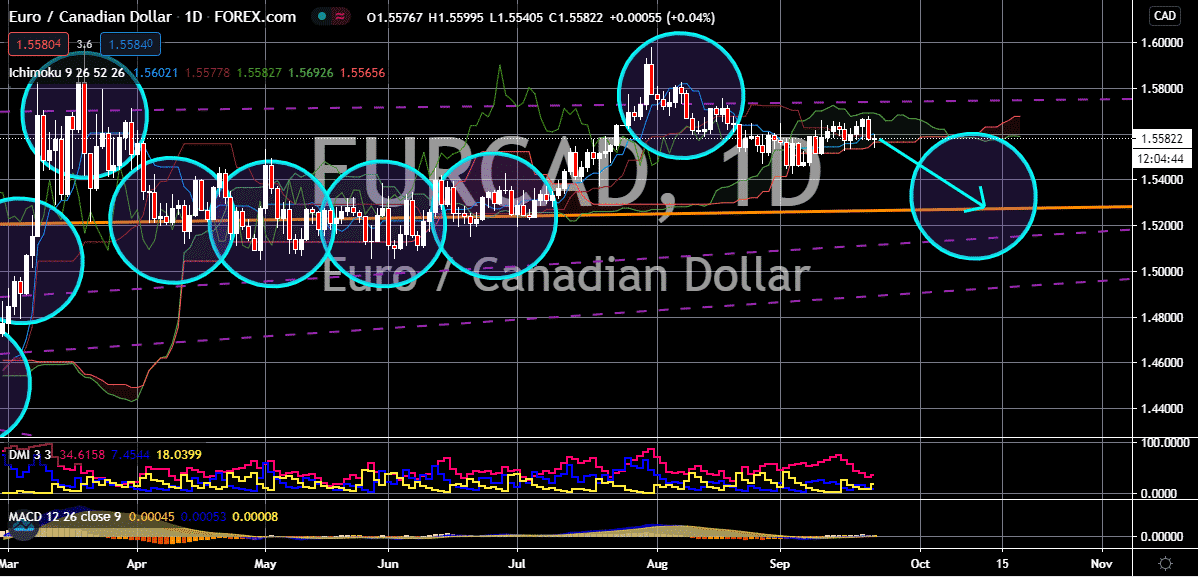

EUR/CAD

The Canadian dollar is looking to force the euro to it its lowest levels in months as it gathers strength from the US dollar and the commodity market. The euro to Canadian dollar exchange rate is on track to go down to its support level in early October as investors maneuver through the single currency’s weakness. The faltering recovery of the eurozone’s economic activity is weakening the euro and the recent outcome of the European Central Bank’s meeting did very little to support the euro. The angst of the coronavirus has boosted the dollar, fortifying its neighbor, the Canadian dollar in the foreign exchange market. The morale in the eurozone has been deteriorating in recent weeks thanks to the threat of another bigger wave of infections. Germany, the bloc’s most powerful economy has also been feeling the pressure brought by the pandemic, raising concerns about the single currency’s prospects and the economies’ outlook.

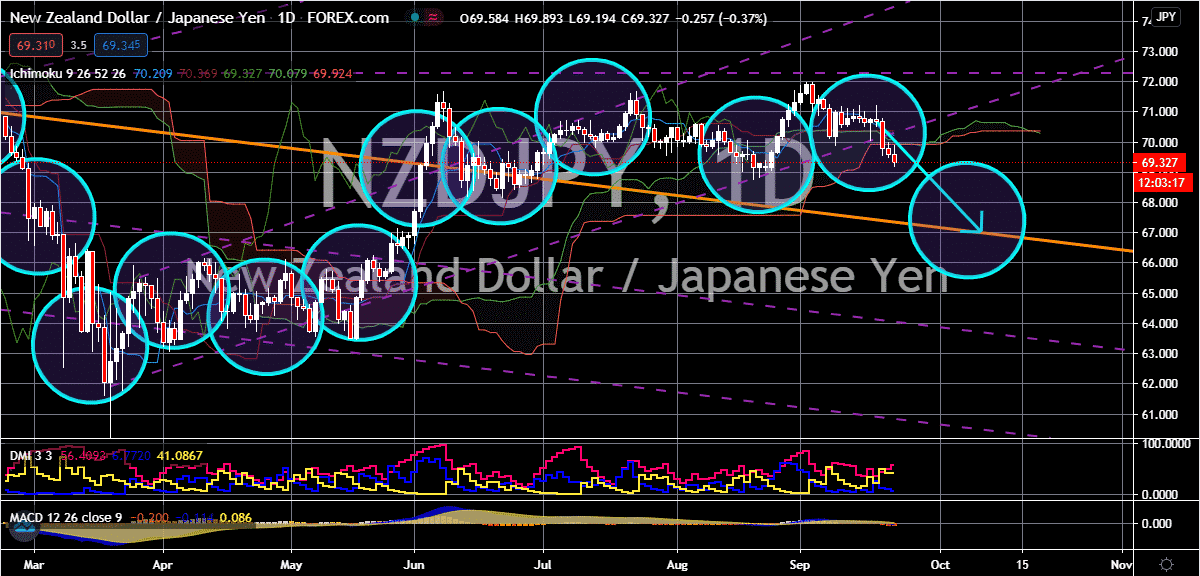

NZD/JPY

The New Zealand dollar buckles under the pressure of the Sino-America trade war and the recent news about the Reserve Bank of New Zealand. The trading pair’s prices are bound to crash to its support levels as the Japanese yen takes advantage of the antipodean currency’s new weaknesses. Earlier today, it was reported that the RBNZ stuck around with its script and has official decided to keep its interest rates unmoved this September. The only comment that stood out to most experts is the reiteration that the bank aims to have funding for lending for local or domestic banks in place by the end of the year 2020. The country is facing one of its worst economic contractions in decades and the decision to hold back has weakened the New Zealand dollar. On the other hand, according to most experts, the Japanese yen has a huge potential to hold its strong rally against most major currencies despite the change in leadership and economic problems faced by Japan.

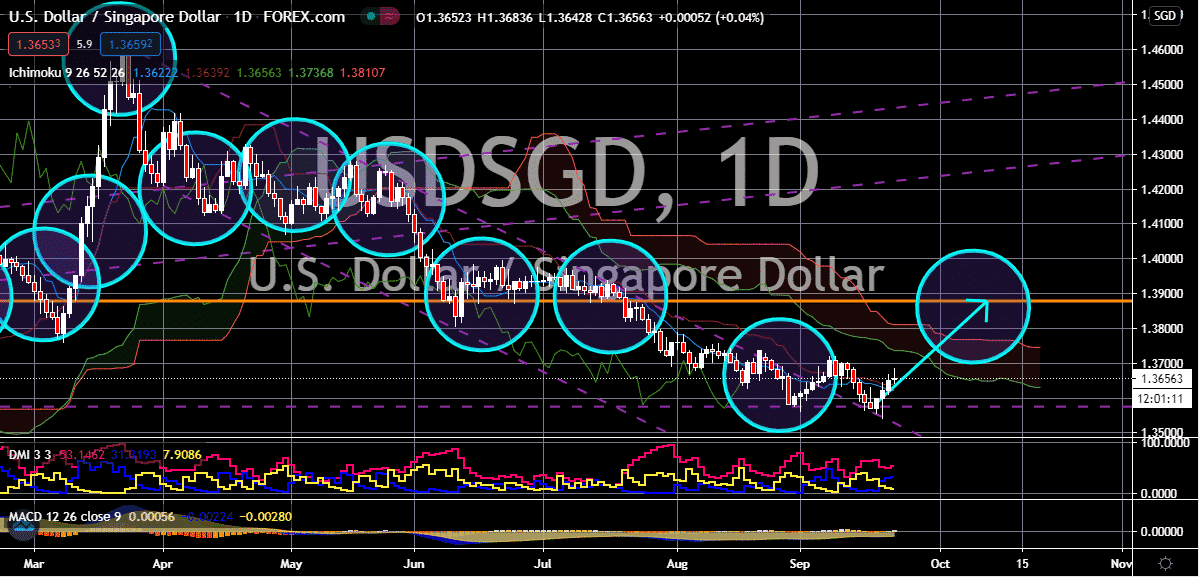

USD/SGD

The broader strength displayed by the US dollar in the foreign exchange market has fueled it against the Singaporean dollar, helping it to redeem itself in the trading sessions. Bullish investors are taking things rather slowly as they don’t seem to be rushing to force the pair’s prices drastically higher. Instead, bulls are taking a steady route, working to bring prices higher towards their resistance level by the middle half of October. The latest reports regarding the United States economy has fueled the US dollar, boosting the battered confidence of bullish investors. And as for the Singaporean dollar, the struggles faced by the Asian stock market has said to have an impact on the direction of the currency, weakening it against the safe-haven asset. This scenario, however, is quite the opposite for the US dollar as its strength is concerning the country’s equity markets. The rising number of cases also prompts investors to flee to security assets like the greenback.