Market News and Charts for September 21, 2020

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

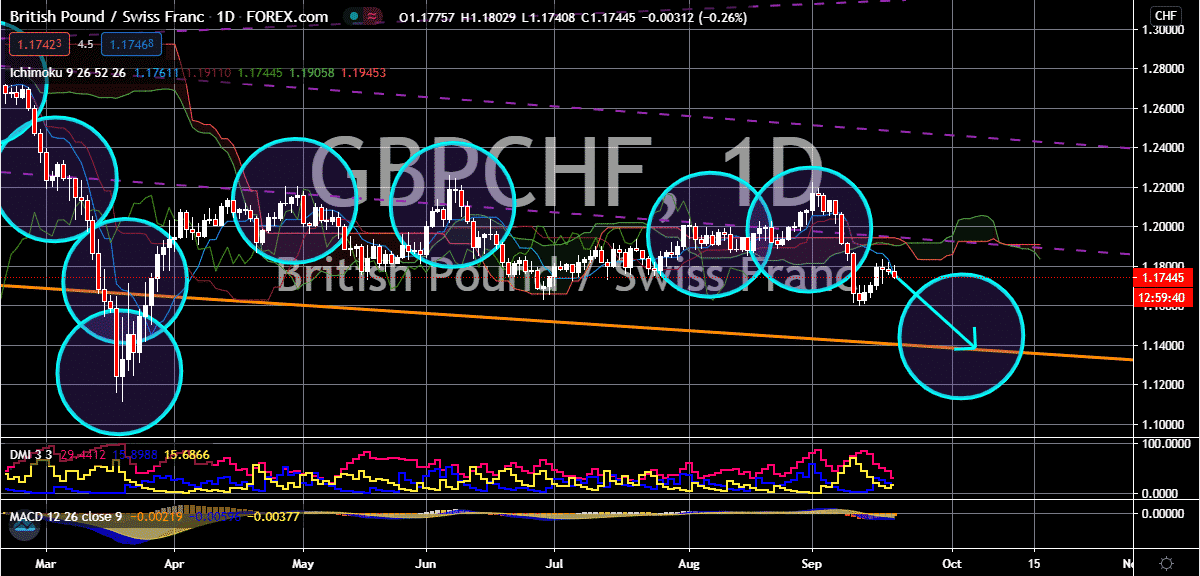

AUD/CHF

The Australian dollar is still projected to perform well against the Swiss franc, pushing the safe-haven currency to the exchange rate’s resistance level in the sessions. However, some experts believe that the Aussie might see a reversal after it reaches that resistance level next month. The Swiss franc is heavily affected by a lot of factors including the increasing number of unemployed citizens in the country. Traders of the Australian dollar are turned off by the economic problems faced by Switzerland hence the Aussie remains stronger. However, unlike with the franc’s matchup against other currencies, it’s widely believed that the Swiss National Bank prefers the antipodean currency to be stronger. Investors are patiently waiting for the meeting of the Swiss National Bank later this week. Of course, their verdict will have a significant impact on the direction of the Australian dollar to Swiss franc exchange rate or its pace in the coming weeks.

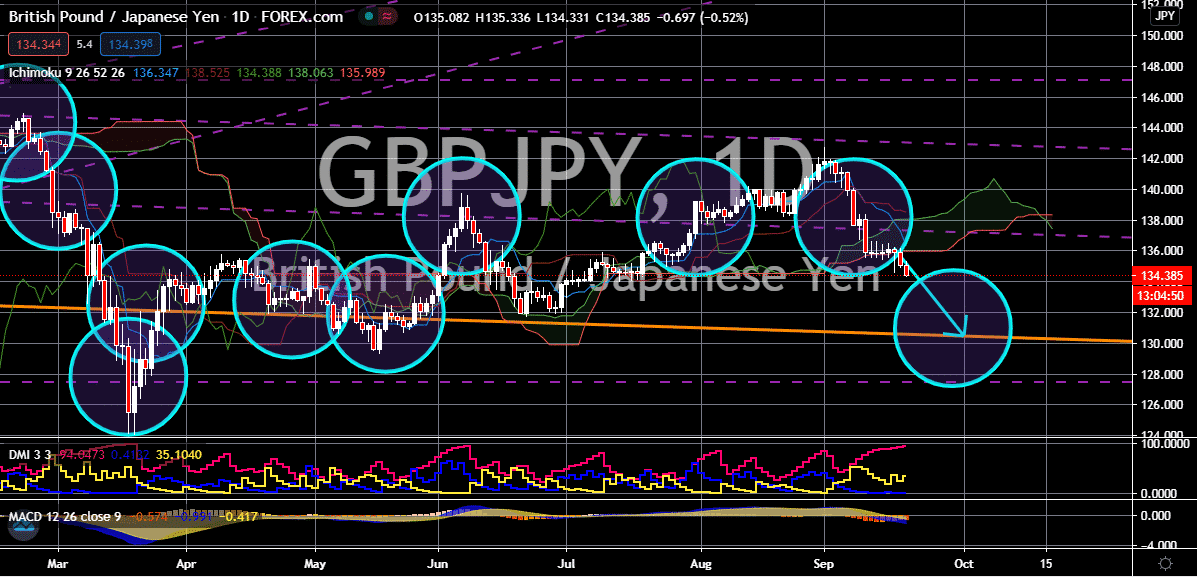

GBP/JPY

Brexit concerns remain as the main fundamental that drives the British pound in the trade sessions, and thanks to the worsening tension between the two parties, the hopes of clinching a deal are slowly fading. Meanwhile, the geopolitical tensions between the United States and China are helping the Japanese yen thrive against the British pound, forcing it on its back foot this Monday. The two economic powerhouses are stubborn with their stances regarding their rivalry over the South China sea and according to some experts, countries in the region are affected, mainly the Philippines. However, it could be argued that the safe-haven appeal of the Japanese yen could still be the main attraction for bearish investors. But again, it’s still arguable considering the sudden shift in leadership and the economic woes faced by Japan. Moreover, Theresa May commented that the Brexit bill risks the United Kingdom’s reputation, adding that it is reckless.

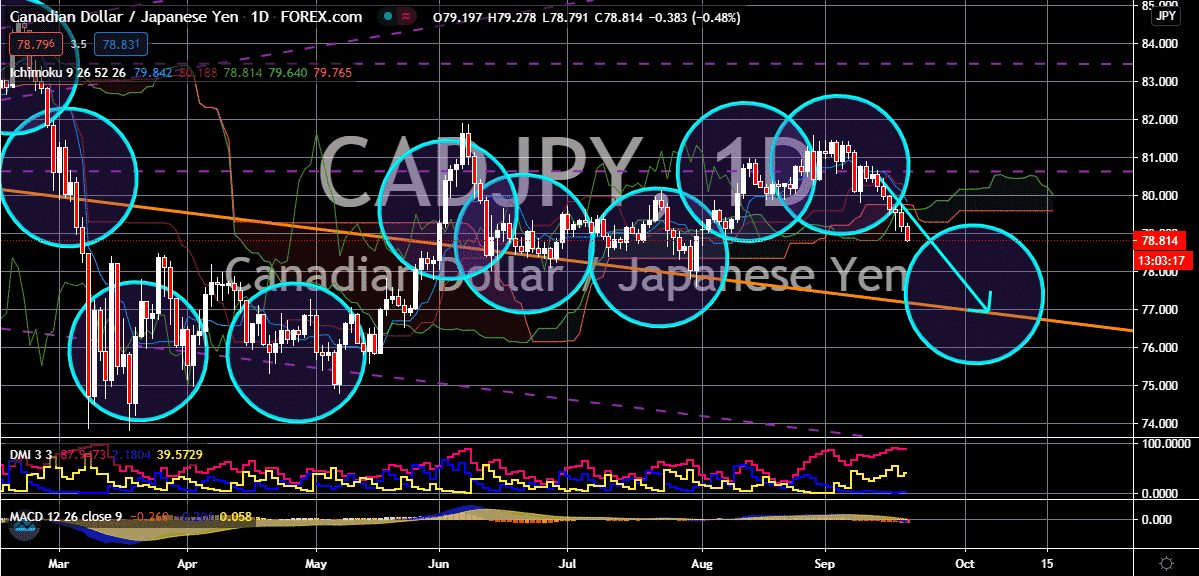

CAD/JPY

The Canadian dollar continues to crumble against the Japanese yen thanks to the problems it has encountered in the West. The Canadian dollar to Japanese yen exchange rate is projected to climb down to its support level by the first few days of October. The struggle faced by the US equity market is felt by the Canadian dollar, and the uncertainties faced by the commodity market isn’t helping its cause. Looking at it, energy stocks have been dragged down by the woes faced by the sector, which gives a double blow to the Canadian dollar. Also, it’s worth noting the US dollar has had a rough time in the sessions, dragging its neighbor, the Canadian dollar, along with it. The negativity comes as the markets brace themselves for the expected economic implications of the once again rising number of coronavirus cases all around the globe. The uncertainty has strengthened safe-haven assets like the Japanese yen in today’s trading sessions.

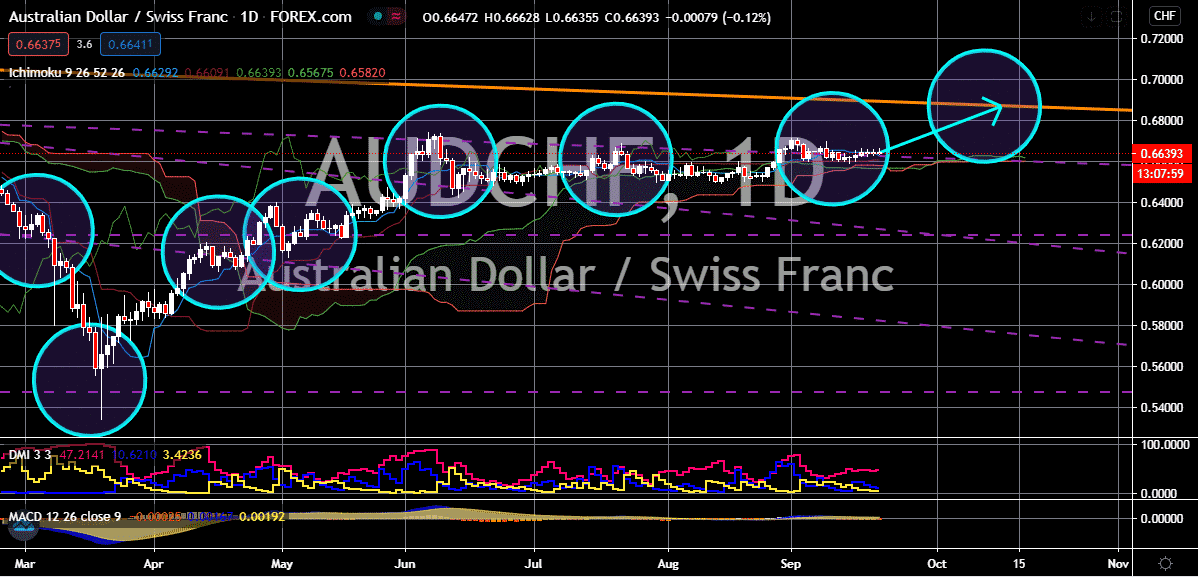

GBP/CHF

Brexit concerns drill through the British pound this Monday, weakening it against the Swiss franc. Experts now believe that the trading pair’s prices would soon fall to its support levels, hitting ranges last seen in March 2020. Aside from Brexit concerns, investors are also widely worried about the chances of new and tighter coronavirus restrictions that could further hammer the United Kingdom’s economy. The set of hurdles faced by the sterling makes it an ideal situation for bearish to finally take advantage and grab the opportunity to drag the pair to its support level. On the other hand, the Swiss franc is empowered by the unending concerns seen by the global market; from the trade war between the United States and China to the Brexit deal dilemma faced by the European Union and the United Kingdom, to other big events happening. Investors are holding tight for further guidance from the Swiss National Bank’s upcoming meeting soon.