Market News and Charts for September 19, 2019

Hey traders! Below are the latest forex chart updates for Thursday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

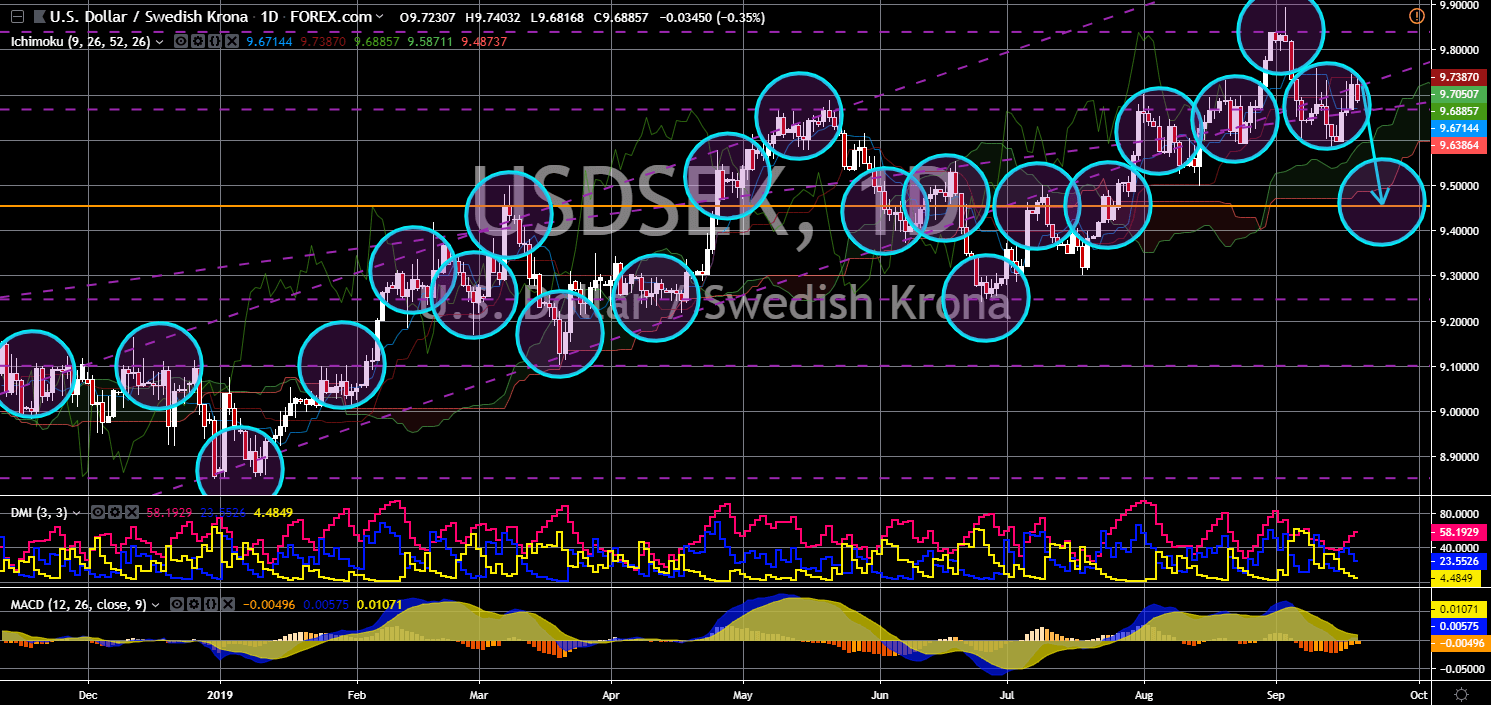

USD/SEK

The pair is expected to move lower in the following days after it failed to sustain its strength and retest its previous high. Sweden’s unemployment rate unexpectedly jumped to a four (4) year high in August, raising questions around the central bank’s plans to hike interest rates and drive the Swedish Korona lower. This report is bad news for Finance Minister Magdalena Andersson, who presented his 2020 budget yesterday, September 18. In addition to this, report shows that Sweden’s Social Democrat-led government is sticking to a surplus budget, making the Swedish Korona weaker. On the other hand, the Federal Reserve cut its benchmark interest rate once again by 25-basis points 2.25% to 2.00%. This was amid the weakening U.S. employment and the escalating trade war between the United States and China. This was the second time that America’s central bank cut rates since the 2008 Global Financial Crisis.

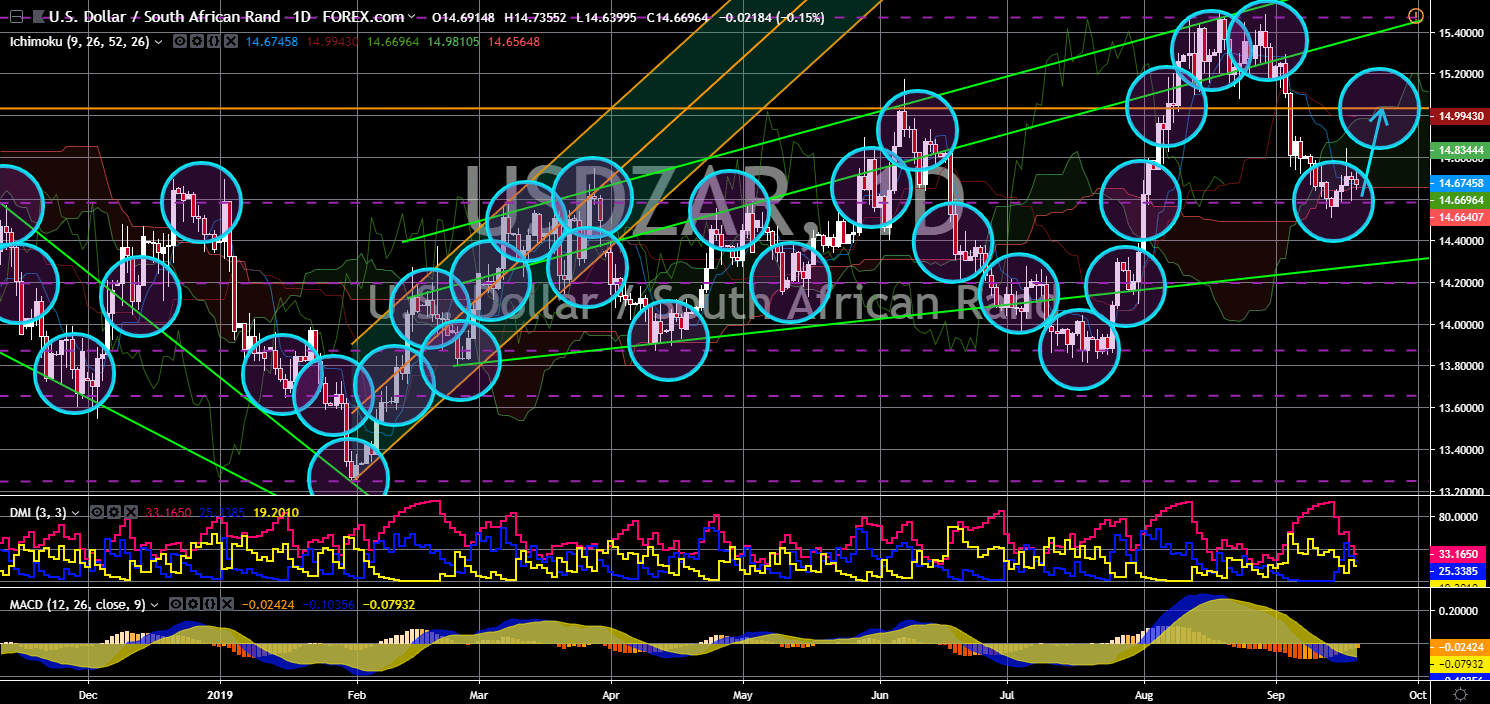

USD/ZAR

The pair found a strong support from a major support line, which will send the pair higher towards a key resistance line. South Africa avoided a recession after it grew 3.1% in the second quarter after sinking 3.2% in the first quarter. In line with this, South African cabinet holds a special meeting today, September 19, to discuss a draft plan formulated by the National Treasury to revive the economy. However, South Africa’s economy is expected to continue to weaken amid the global economic slowdown and the escalating trade war between the United States and China. The country is caught up between the two (2) largest economies as it tries to transition from a U.S. economic ally to China’s economic ally. The country takes billions of loans from China in Yuan denomination, while exhausting its U.S. Dollar reserves for international transactions, which is sending South African Rand lower.

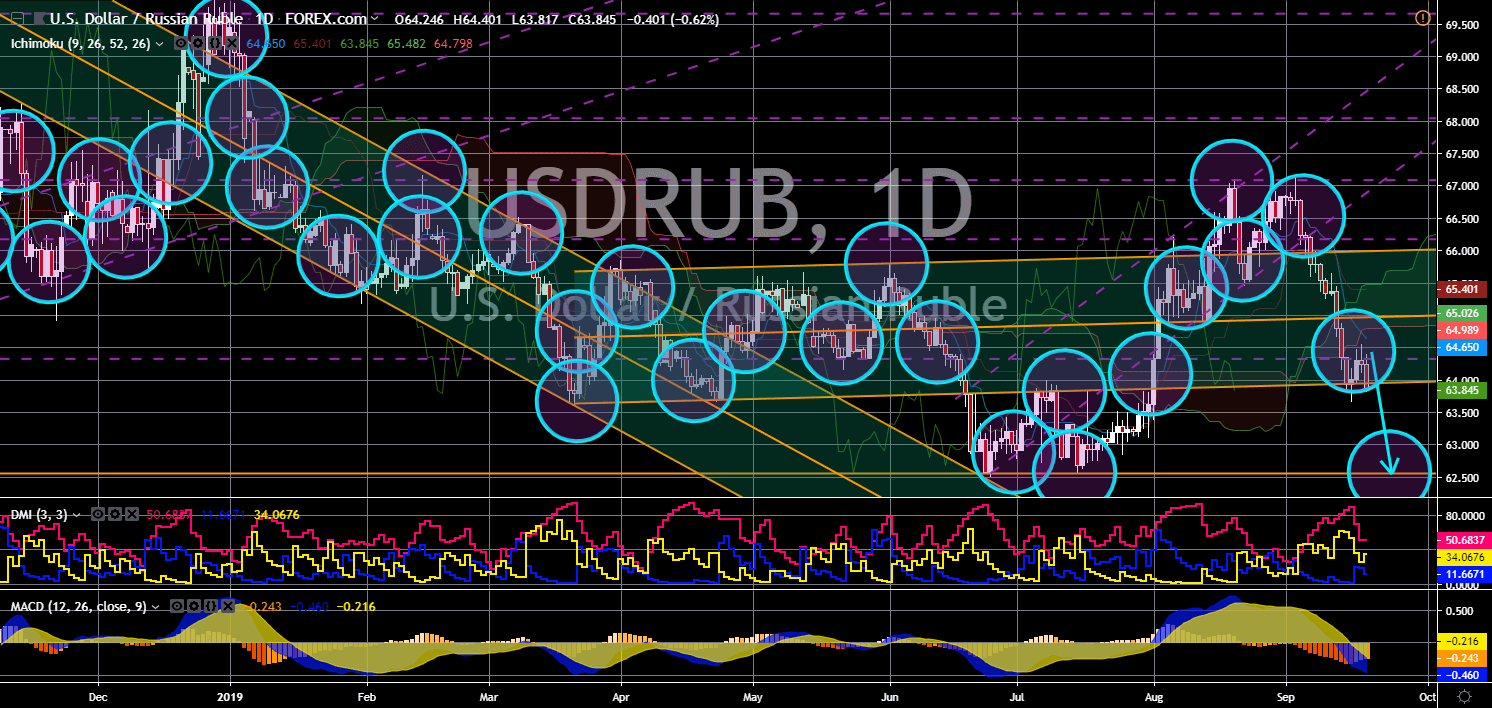

USD/RUB

The pair is expected to break down from a major support line, which will send the pair lower toward its previous low. The Federal Reserve’s second interest rate cut in more than 11 years suggests a looming recession in America. Added to the pressure for the U.S. Dollar was Russia and China’s ditching of U.S. Dollar with their international transactions. Reports also shows that Russia and China have been increasing their gold reserves, which could further weigh on greenback. Not only in economic, but the U.S. vs Russia and China tension is turning to a more political one. America and Russia withdraw from the 1987 nuclear pact treaty, the INF (Intermediate-range Nuclear Forces), which pave way for a new generation of nuclear weapons. The U.S. also takes action against Russian expansion in Belarus by restoring ambassadors between the countries.

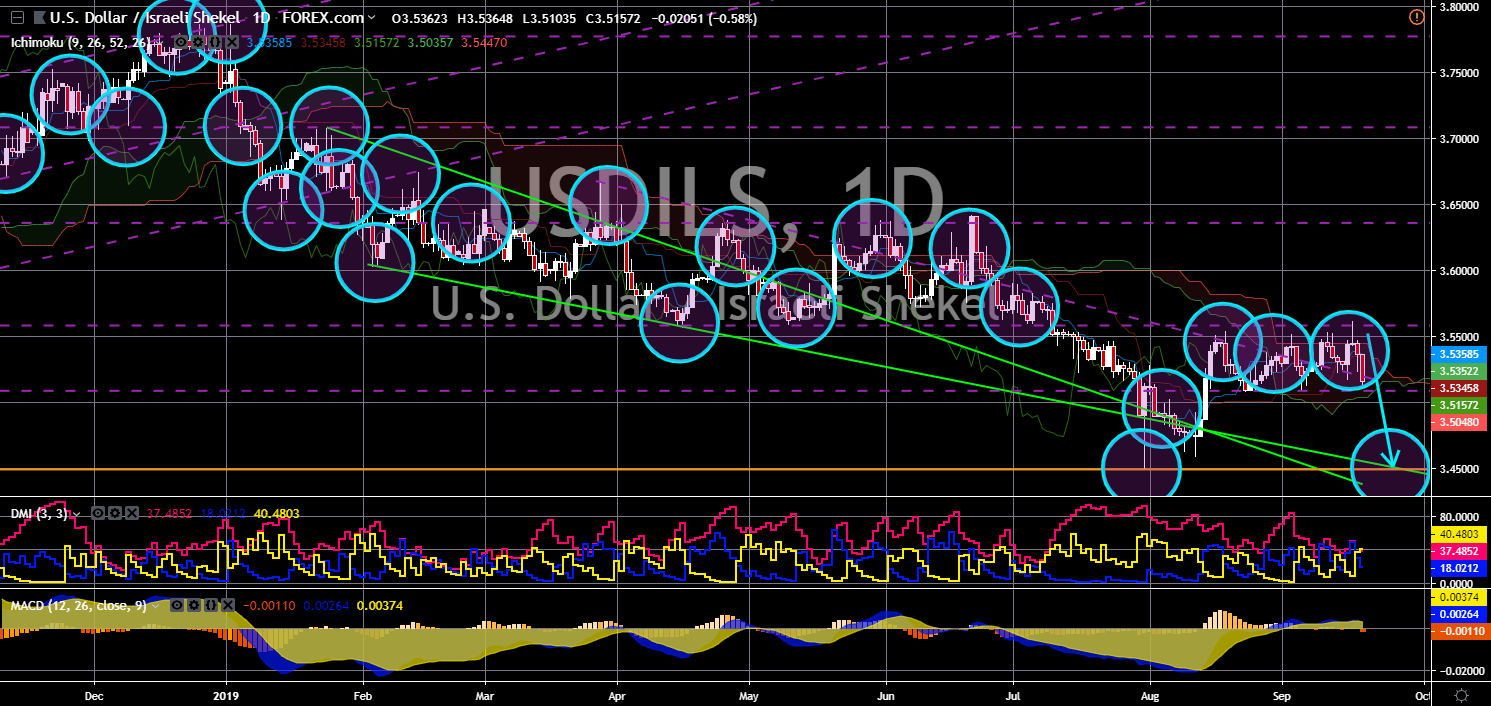

USD/ILS

The pair is seen to breakdown from a sideways channel toward its previous low after it failed to breakout from a major resistance line. Saudi Arabia shows evidence that Iran was behind the bombing of its oil facilities, which limits the country’s production by 50%. The United States is now planning to sell its F-22 Raptors and B-52 Bombers to Israel to contain Iran’s actions. The tension escalated after the U.S. withdraw from the Iran Nuclear Deal, with recent tensions showing Iran blocking the Strait of Hormuz. The strait is where 1/3 of oil supply is passing. The seizure of oil tankers in the strait affects U.S. oil supply. America is the largest consumer of oil and is vital for their economy. However, the U.S. might have a problem in Israel as election shows that incumbent Prime Minister Benjamin Netanyahu fails to impress its citizens of a unity government. PM Netanyahu losing the election means U.S. possibly losing Israel.