Market News and Charts for September 16, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

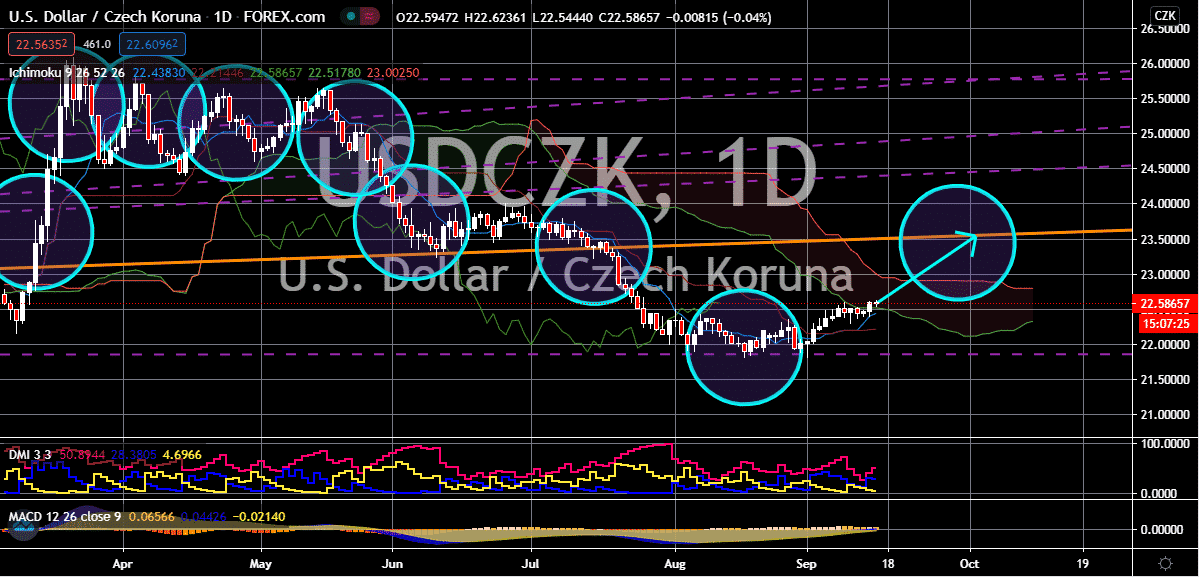

USD/ZAR

As investors wait for the crucial interest rate decision of the South African Reserve Bank, the rand momentarily slows down against the US dollar. However, as the greenback also remains vulnerable, the pair is still projected to go down to its support level by the latter half of the month. Moreover, the monetary policy committee of the SARB has a lot to digest before they come up with a decision on their meeting tomorrow, September 17. It’s widely believed that the SARB will leave its rates unmoved at about 3.50% but some are speculating as to whether they will cut it by at least 25 basis points. Thanks to the virus, the SARB MPC has slashed their rates by about 300 basis points, weakening the rand during the initial days of the pandemic. Fortunately for bearish investors, the broader weakness faced by the US dollar is enough to help them push the exchange rate’s prices to negative territories, allowing the rand to slowly recover against the buck.

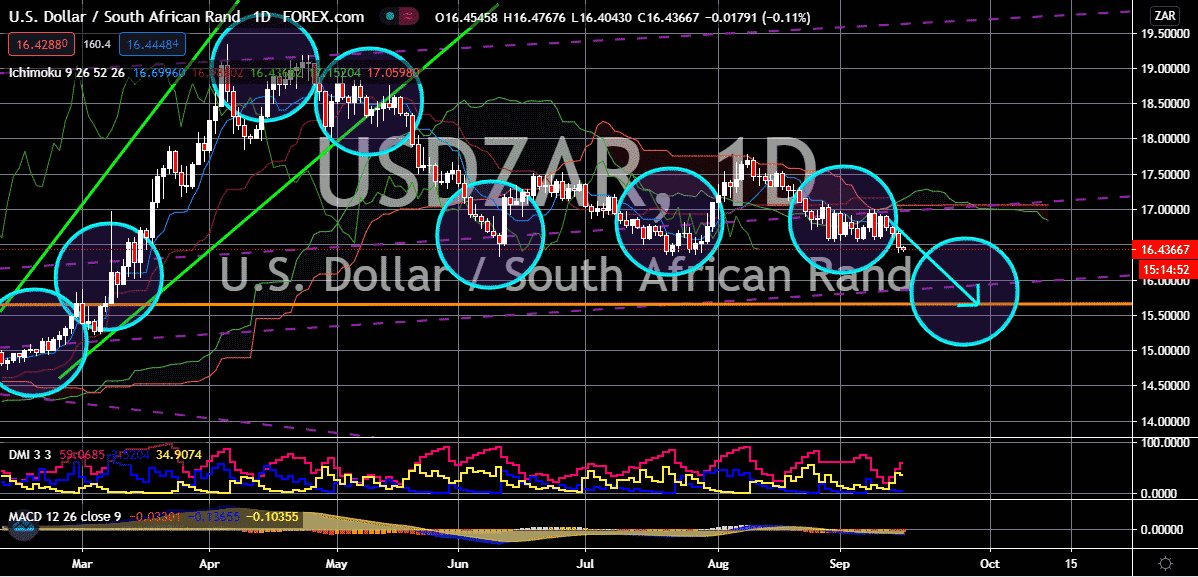

USD/RUB

The concerns in the commodity market and the political problems faced by Moscow are slowing down the Russian ruble, allowing the also weak US dollar to steadily advance against in the trading sessions. In fact, the trading pair is on track to reach its resistance level by the latter part of the month. Moreover, crude prices are seen climbing up right now as a hurricane continues to lash out in the Gulf of Mexico. However, the main worry for the oil market is the expectations that the Organization of the Petroleum Exporting Countries will cut back on its estimates for global crude oil demand. If the demand will be adjusted lower, oil prices could fall down in the trading sessions, pulling the Russian ruble along with it. Meanwhile, the US dollar is also seen slowing down thanks to the jitters felt by investors as they wait for the outcome of the US Federal Reserve’s last official meeting before the highly anticipated US Presidential Elections next month.

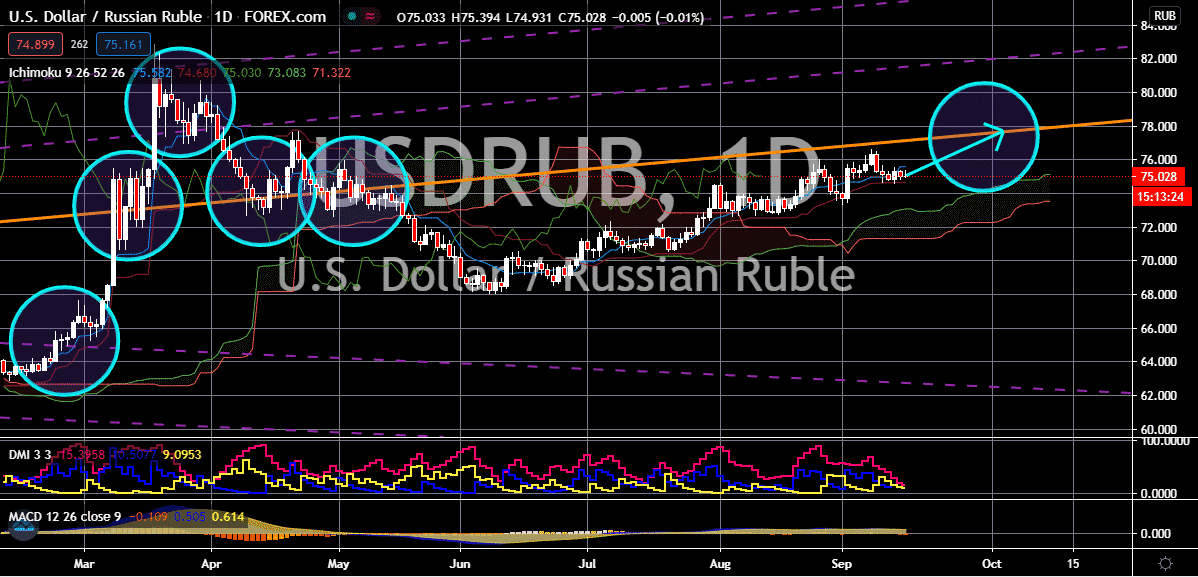

USD/CHF

The US dollar to Swiss franc exchange rate is projected to face serious volatility in the coming weeks and experts believe that the tides will eventually turn even more bearish. Both of the safe-haven currencies will be heavily affected by the outcome of the US presidential elections, the Brexit, and the progress made with the development of coronavirus vaccines. The risk sentiment in the global market will, of course, determine the phase of the exchange rate’s decline. According to a report, the United States is considering putting Switzerland in its watchlist of considered “currency manipulators”, which raised speculations whether the Swiss National Bank will continue to try and weaken the country’s currency. Also, the negative rates in the nation aren’t enough to help the cause of bearish investors. Aside from that, despite the significant recovery of the US stock market, the risk sentiment in the market still drives the franc higher than the buck.

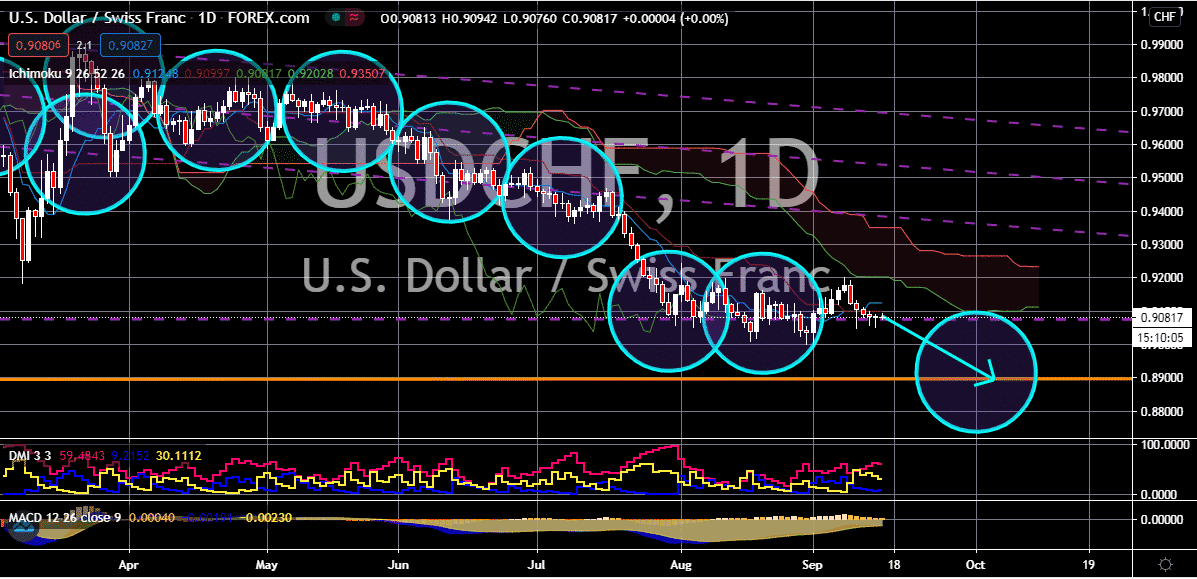

USD/CZK

The Czech koruna is on its back foot against the US dollar. Bullish investors of the trading pair are aiming to push prices higher towards their resistance level as they take advantage of the news from the Czech National Bank. Bears failed to capitalize on the news about the recent statement of the Czech Republic’s central bank. See, earlier this year, the Czech National Bank said that it does not see any reasons to ease or more its monetary policy despite the increasing number of new coronavirus cases in the country. Looking at it, the Czech Republic is one of the countries in the region that saw the greatest number of cases in recent weeks, behind France and Spain. The spike in cases forced the authorities to tighten the restrictions in the country. Meanwhile, officials from the US Federal Reserve, who have just announced a more relaxed inflation strategy, are expected to provide further details about their plans this Wednesday’s meeting.