Market News and Charts for September 06, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

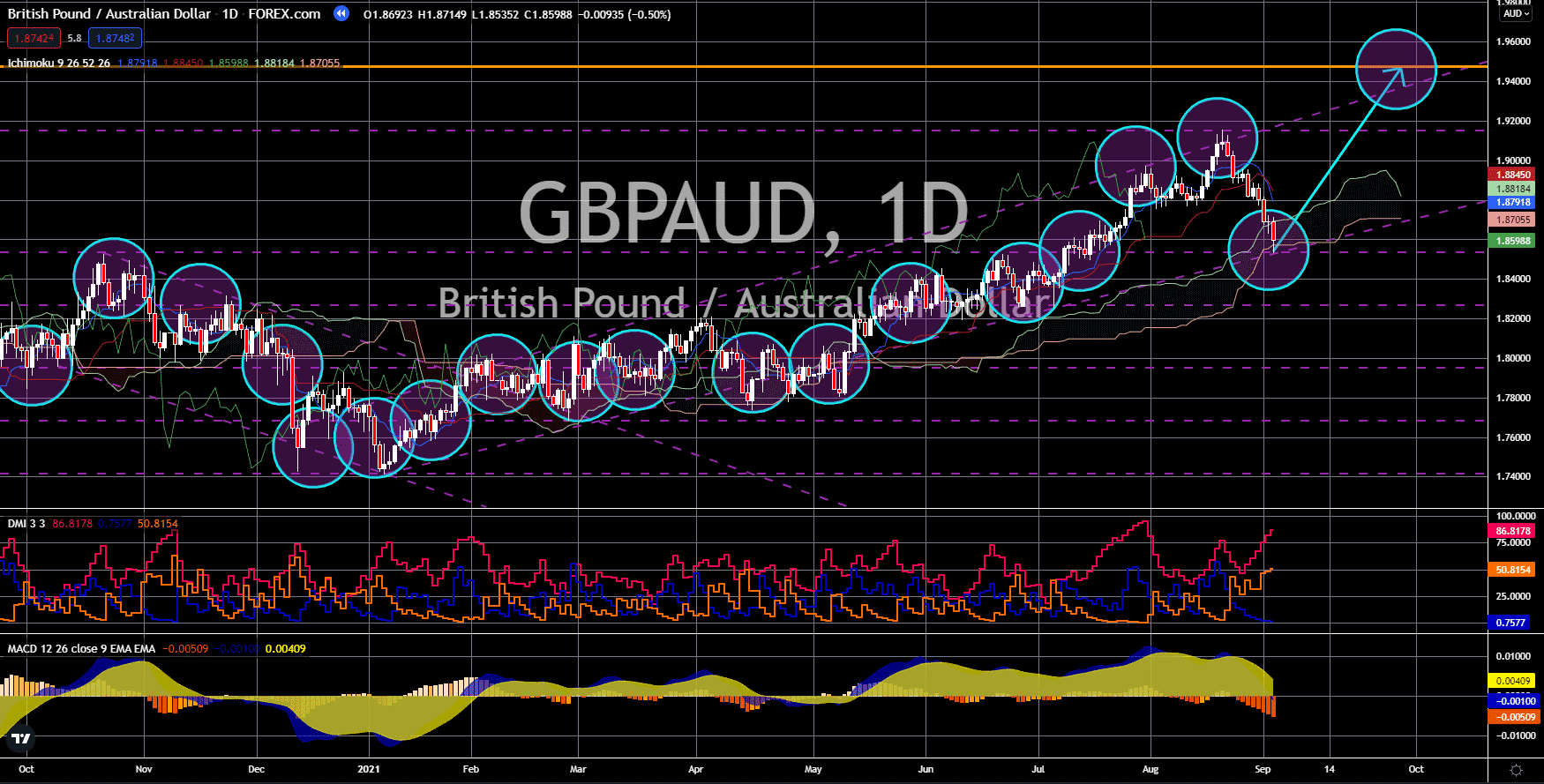

USD/SGD

The pair will continue to move lower in the week, with a target price of 1.31500. The United States released a mixed report last week. The initial jobless claims fell to a pandemic low of 340,000, while the Non-Farm Payrolls added only 235,000. The consensus estimate for the monthly NFP is 750,000, and the July report is at 1.05 million. In addition, the unemployment rate was down to 5.3% in August. The Purchasing Managers Index (PMI) reports are also lower than their previous 59.9 points and 59.9 points, respectively. The Services and Composite PMIs came at 55.1 points and 55.4 points. Also, last week were the trade reports. Imports fell, recording 282.90 billion in the month. On the other hand, exports advanced to 212.80 billion. The increase in exports sent the trade deficit lower to 70.10 billion. Analysts are now looking forward to the developments in the US vaccination. The rising coronavirus cases in America threaten to put the recovery on hold.

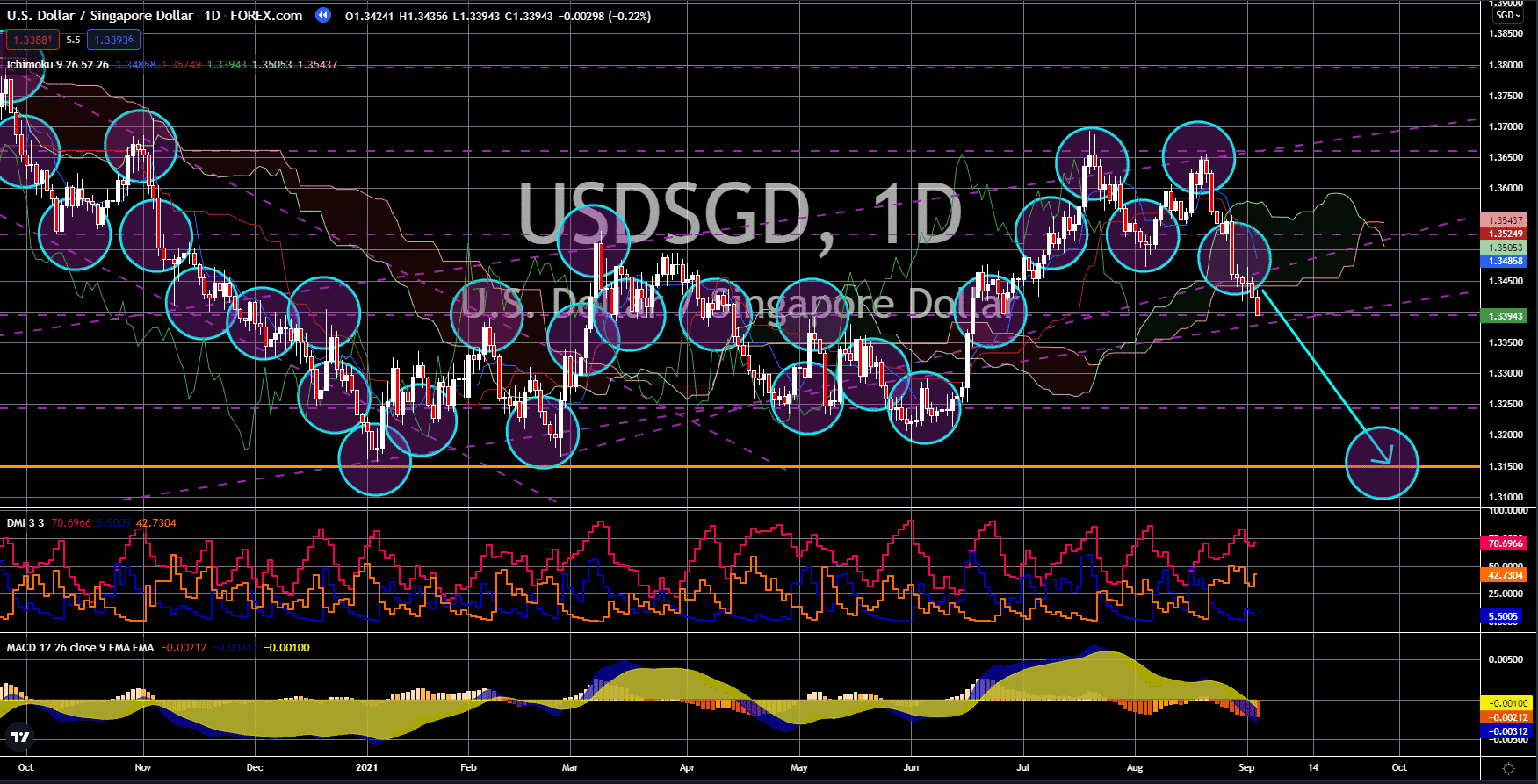

EUR/DKK

Prices will fall towards their previous low at 7.42653 in the short term. The European Union’s Sentix Investor Confidence index for September tumbled to 19.6 points on Monday. The reported figure is lower than the 19.7 points forecasts and 22.2 points result previously. The bearish outlook roots from disappointing August PMI reports. The services sector in the Eurozone showed a worse-than-expected result of 59.0 points. Analysts have an estimate of 59.7 points from 59.8 points prior. The EU’s economic powerhouses, Germany and France, also released disappointing figures of 60.8 points and 56.3 points. Meanwhile, the Composite PMI came at 59.0 points, 60.0 points, and 55.9 points, respectively. On the other hand, the retail sales data shrinks in July. Month-on-month, the report fell -2.3%. Analysts are expecting a 0.1% increase. Meanwhile, the annualized data in July is at 3.1% against the 4.8% estimates and June’s revised record of 5.4% increase.

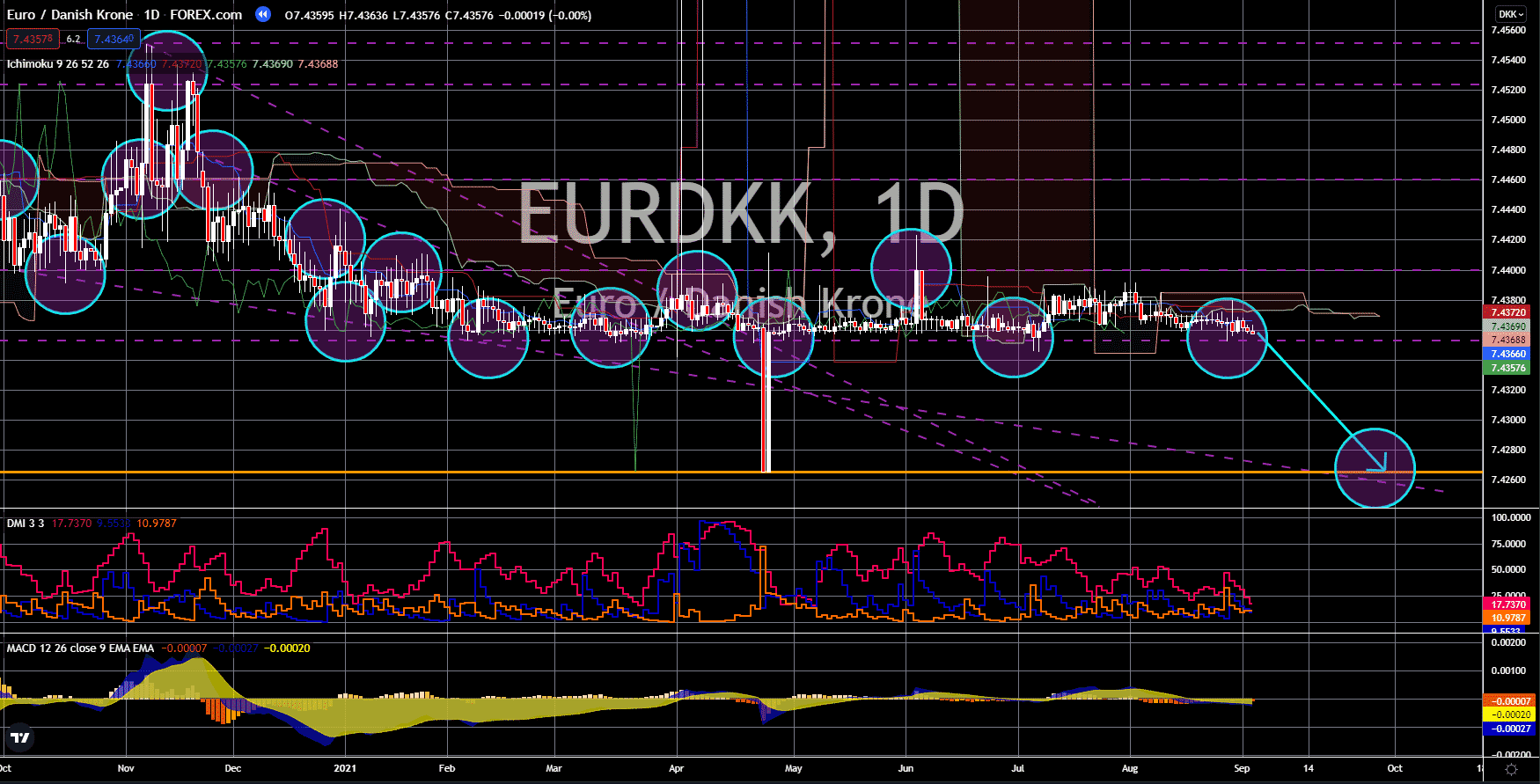

EUR/TRY

The pair will rebound from the support to retest its previous high at around 10.80000. On Friday, Turkey released its Consumer Price Index and Producer Price Index for August. The monthly and YoY data beat the 0.60% and 18.70% expectations, coming in at 1.12% and 19.25%. However, the MoM report grew at a slower pace compared to July’s 1.80%. On the other hand, the PPI results were higher at 2.77% and 45.53% against their previous records. In other news, Turkish exports improved by 52% in August to 18.9 billion year-on-year. The imports also posted an increase of 23.8% to 23.2 billion. As a result, the trade deficit narrowed to 1.13 billion in August. For the past 12 months, the gap towards a zero current account is 29.7 billion. The upbeat data suggest a possible intervention by the central bank. But participants must be cautious amid the dovish stance by President Erdogan. The leader fired the central bank governor this year following a rate hike.

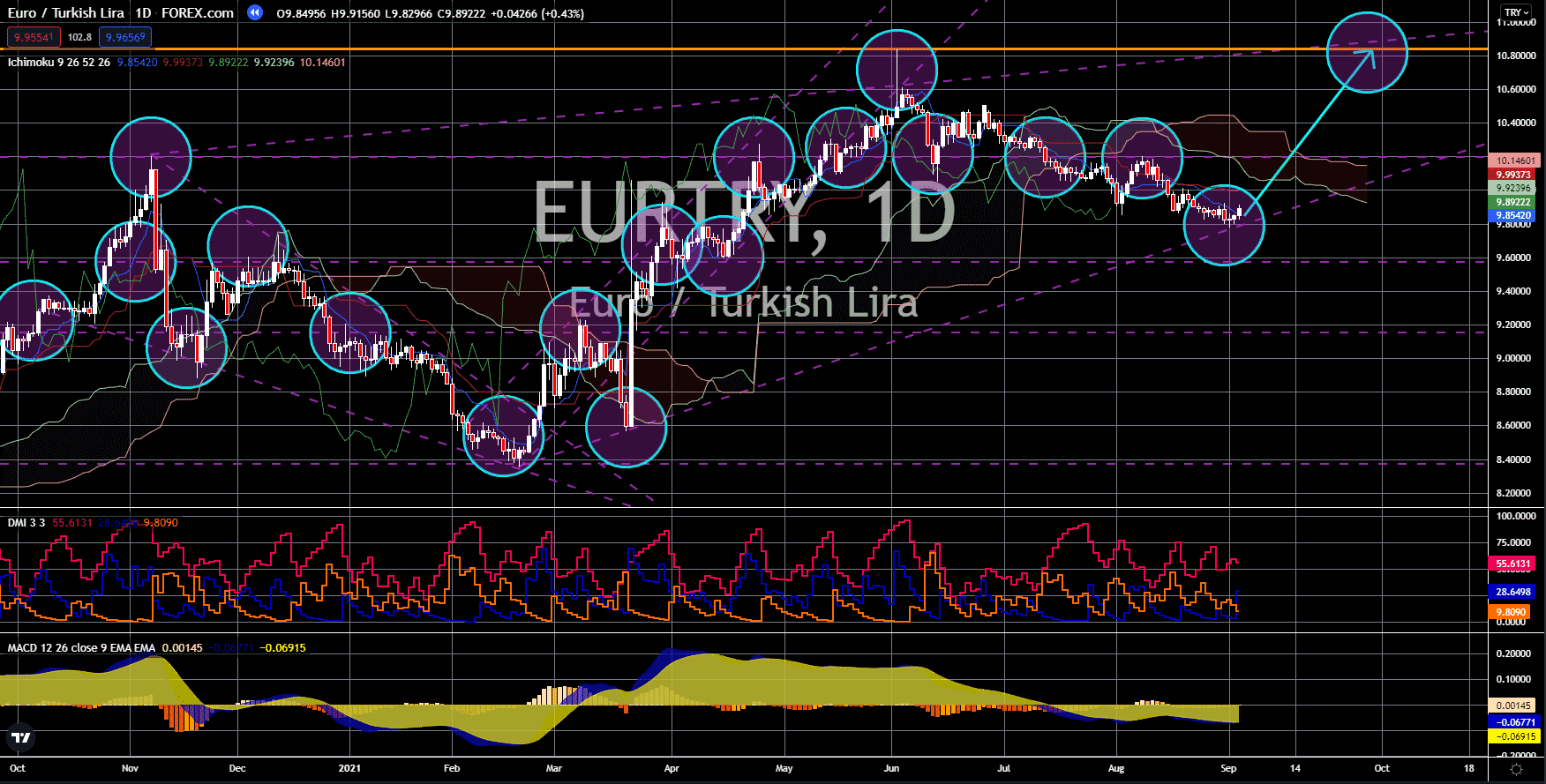

GBP/AUD

The British pound will recoup losses and soar towards 1.95000. Melbourne Institute’s Inflation Gauge was flat zero on September 06’s report. The bleak data is due to the nationwide lockdown, which limits economic activity. Other key economic indicators also fell in August to reflect the current status of the Australian economy. The ANZ Job Advertisements for the month are down by -2.5%, extending the previous month’s fall of -1.3%. The most recent data represents the lowest figure since May 2020. Adding to the disappointments are retail sales at -2.7%, building approvals of -8.6%, and construction index at 38.4 points. As for the Purchasing Managers Index, the 42.9 points result is the lowest in 15 months. Analysts expect weak figures for the upcoming reports as Australia is yet to contain the spread of coronavirus. The country recorded its highest daily cases on September 04 at 1,741. The figures could increase further despite the nationwide lockdown.