Market News and Charts for September 04, 2020

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

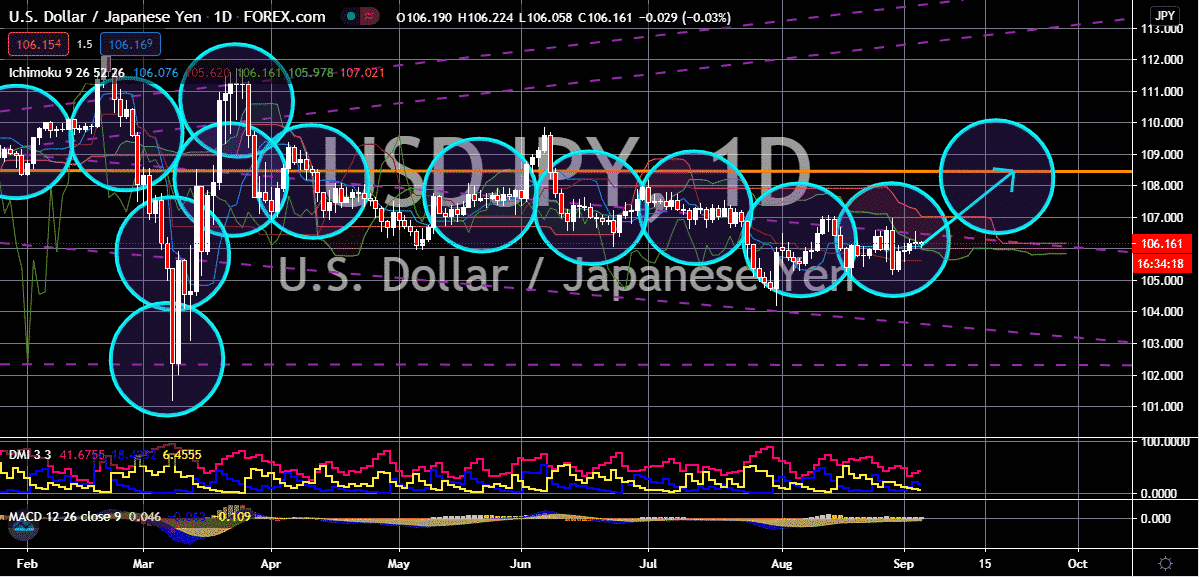

USD/JPY

The US dollar to Japanese yen exchange rate struggles to gain any traction in the trading sessions. The pair’s prices are widely projected to climb up towards its resistance level as the Japanese yen remains vulnerable thanks to the surprise resignation of Shinzo Abe, the country’s longest-running leader. Abe told the public last week that his resignation was due to health reasons and his conditions are getting worse. However, bulls are acting more cautious this Friday as they wait for the results of the August nonfarm payroll. If the NFP shows weaker than expected figures, it would send a wave of volatility in the market, weakening the US dollar and slowing down the pace of the USDJPY pair. But looking at it, the Japanese yen could still be much more vulnerable even by then. According to most experts, Abe’s “Abenomics” fell short, and even despite the leader’s resignation, his successor must pick up the slack to help the country’s struggling economy.

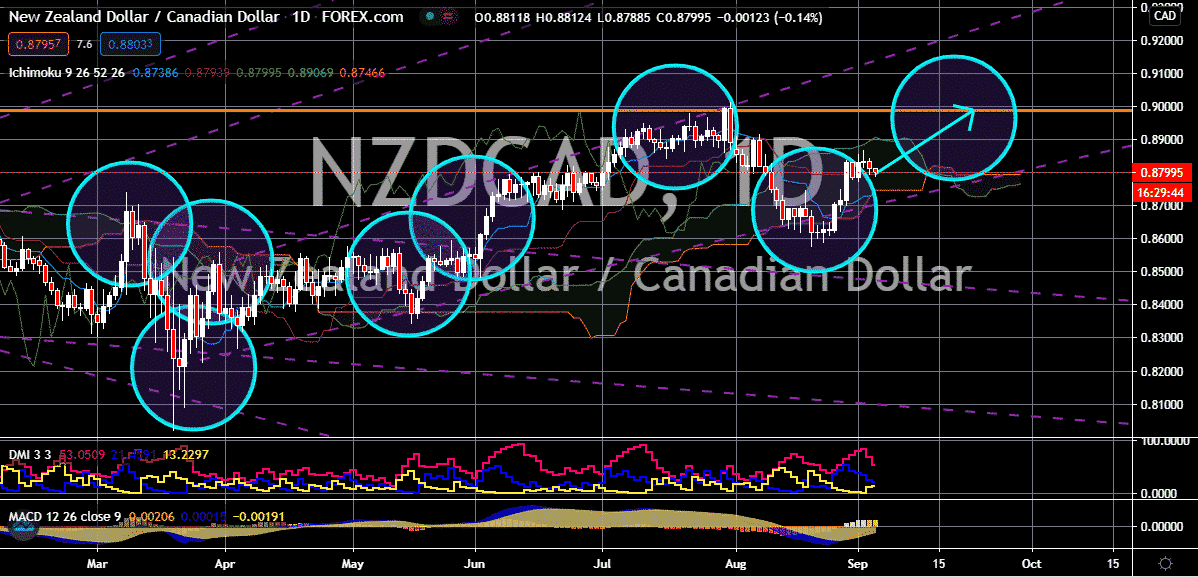

NZD/CAD

As of today, it appears that the prices of the exchange rate are finally slowing down. Unfortunately for the Canadian dollar, the New Zealand dollar is widely projected to remain solid in the coming sessions, forcing the pair’s prices towards their resistance level this September. According to reports, Reserve Bank of New Zealand governor Adrian Orr isn’t expressing any concerns with the kiwi’s strength. Orr has reiterated in the past that the bank is preparing a package of conventional policy measures. Most experts argue that a strong currency might be an alternative to low interest rates which could explain why the reserve bank isn’t interfering right now. As for the Canadian dollar, major fundamentals are holding it back from recovering in the foreign exchange market. the trade deficit, lackluster performance of the stock market, and the drop in crude oil prices have all hindered the chances of the Canadian dollar in the recent sessions.

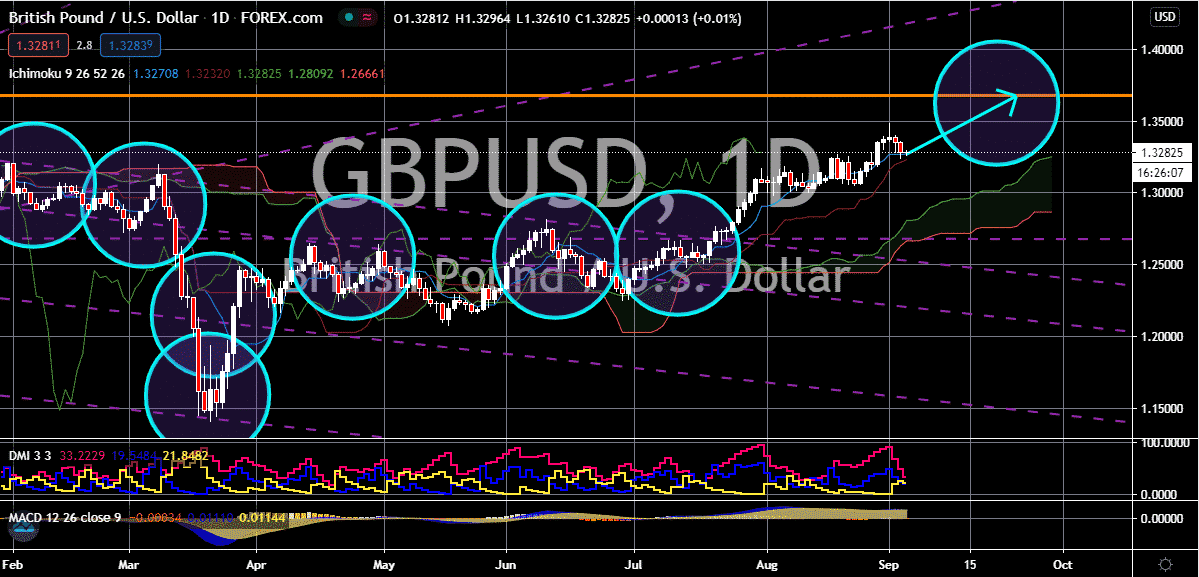

GBP/USD

The GBPUSD exchange rate has faced some turbulence in the past few days, fortunately for bulls, it’s projected that the trading pair would still remain evidently bullish. However, as of today, the British pound to Us dollar is steadying as investors fear that the United Kingdom’s taxes might slow it down. But most analysts believe that the downside of the US dollar isn’t over yet. Meaning that the crucial nonfarm payroll results later could further support the notion that the United States needs more fiscal stimulus. Just recently, it was reported that US Treasury Secretary Steven Mnuchin said that the current administration wants to add more aid to the economy. If the nonfarm payroll produces weaker than expected figures, it could prompt the government to actually do so. Moreover, bulls are also getting more worried about the prospects of a no-deal Brexit scenario by December as both sides refuse to ease their stances in the negotiating table.

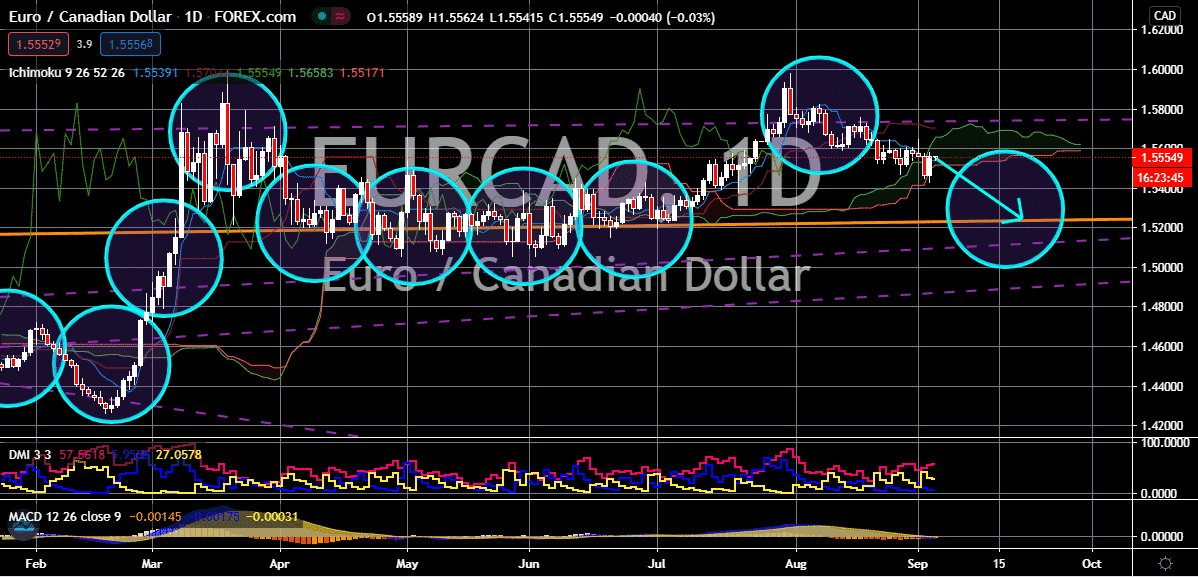

EUR/CAD

The economic woes in the eurozone have slowed down the euro and have opened the door for bearish investors to push the pair’s prices lower in the sessions. It’s believed that the Canadian dollar would be able to take advantage of the euro’s weakness and take it to its support level by the latter half of the month. It was reported that the bloc’s economic recovery from its deepest slump faltered last month, showing signs that more countries in the region are still suffering. Just recently, the French government announced the details of its massive 100-billion-euro stimulus program that would ease the impact of the coronavirus pandemic on the economy. The plan will take over two years to complete, lining up billions upon billions of euros in public investments, tax cuts, and subsidies. Another big factor that’s weighing on the eurozone now and the single currency is the problems with Greece and its economy which was made worse by the pandemic.