Market News and Charts for September 03, 2020

Hey traders! Below are the latest forex chart updates for Thursday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

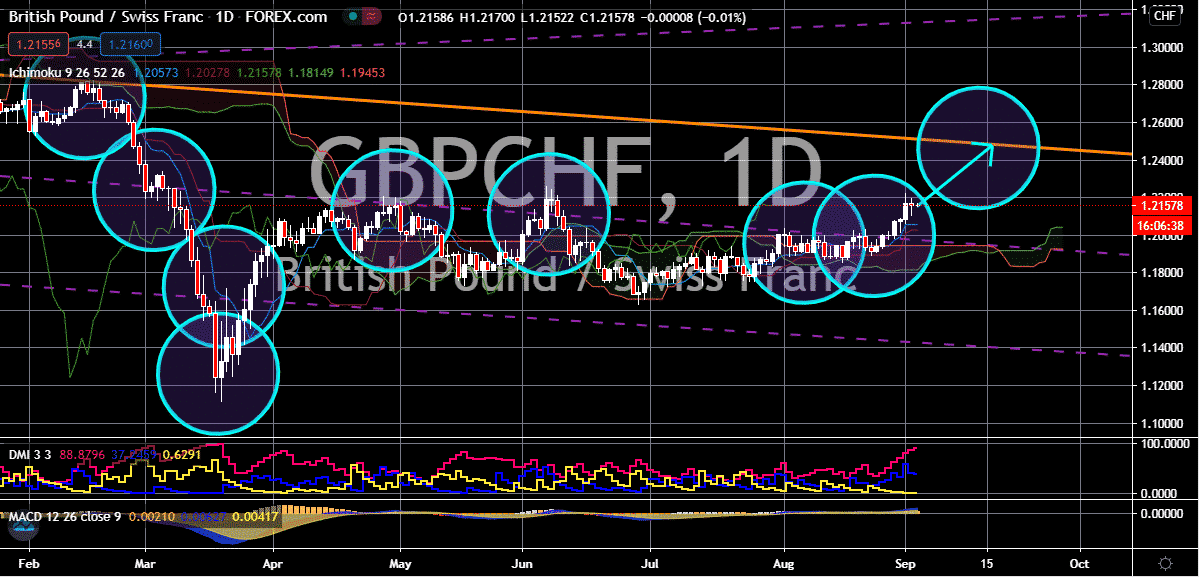

CAD/JPY

The Canadian dollar continues to advance against the Japanese yen. The trading pair is projected to remain bullish and gradually inching its way towards its resistance in the latter half of the month. As of this Thursday, the loonie is seen surfing on the greenback’s selling wave and has been performing well against most of its match up. Some experts argue that the post-pandemic recovery plan, stable crude prices, and Bank of Canada’s monetary policy decisions aren’t the reasons why the Canadian dollar is rallying. In fact, it is believed that the sole fundamental that’s fueling the Canadian dollar is the broader weakness and negative sentiment towards the US dollar. On the other hand, some analysts say that the Japanese yen has a huge potential to fall in the following days in Shinzo Abe’s post-resignation. Now, Japan’s Yoshihide Suga has reportedly won the support of the largest faction of the ruling party to become the next prime minister.

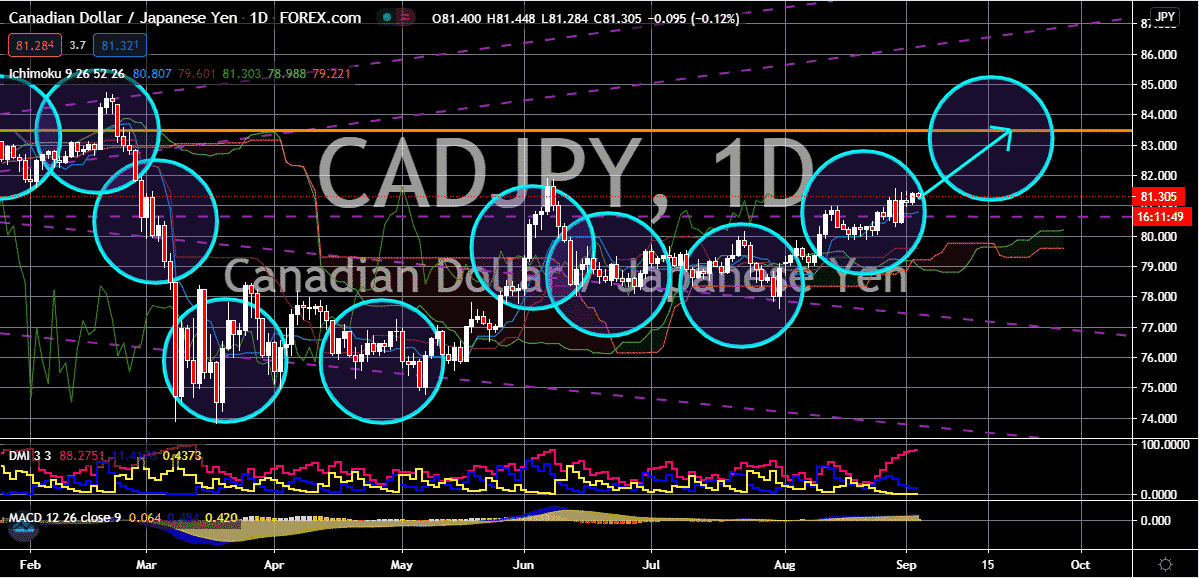

EUR/USD

Bearish investors of the euro to US dollar trading pair are putting up a tough fight in the sessions. Unfortunately, the trading pair is widely expected to remain significantly bullish and continue its ascending trend. Prices should experience volatile runs but hit their resistance by the latter half of the year. Just recently, it was reported that the steeply low inflation in the bloc last month could actually force the European Central Bank to boost its asset purchasing program in a bid to counter deflationary risks. However, as of writing, the US dollar is seen clinging on to its limited gains as more investors trimmed their bets against the safe-haven currency and sold the single currency over the concerns about the ECB. Also, it’s worth noting that the record stimulus and the coronavirus pandemic will still be the main hindrance faced by the US dollar. As long as the number of cases in the United States continues to rise, the buck will remain vulnerable.

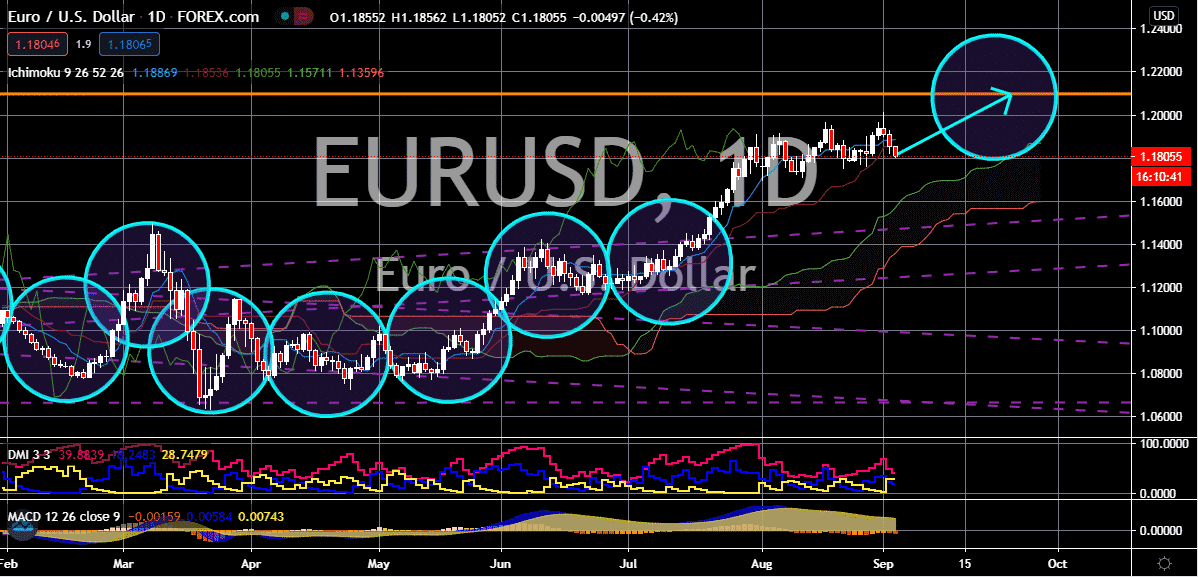

EUR/AUD

Despite the economic concerns in Australia, the Aussie dollar remains solid against the eurozone’s common currency. It is expected that the exchange rate’s prices would eventually fall towards their support level by the latter half of the month. Just recently, the Reserve Bank of Australia announced its official interest rate decision for the month of September. According to reports, the board decided to maintain its rates and the yield on 3-year Australian government bonds of 25 basis points. Aside from that, it was also reported that Australia recorded poor performance in its economic activities, pieces of news that still failed to weaken the sentiment of bearish investors. Looking at it, the euro initially appeared that it would finally recover against the grasps of the antipodean currency. But thanks to the concerns of investors to the comments of the European Central Bank, the tides remain significantly bearish in the trading sessions.

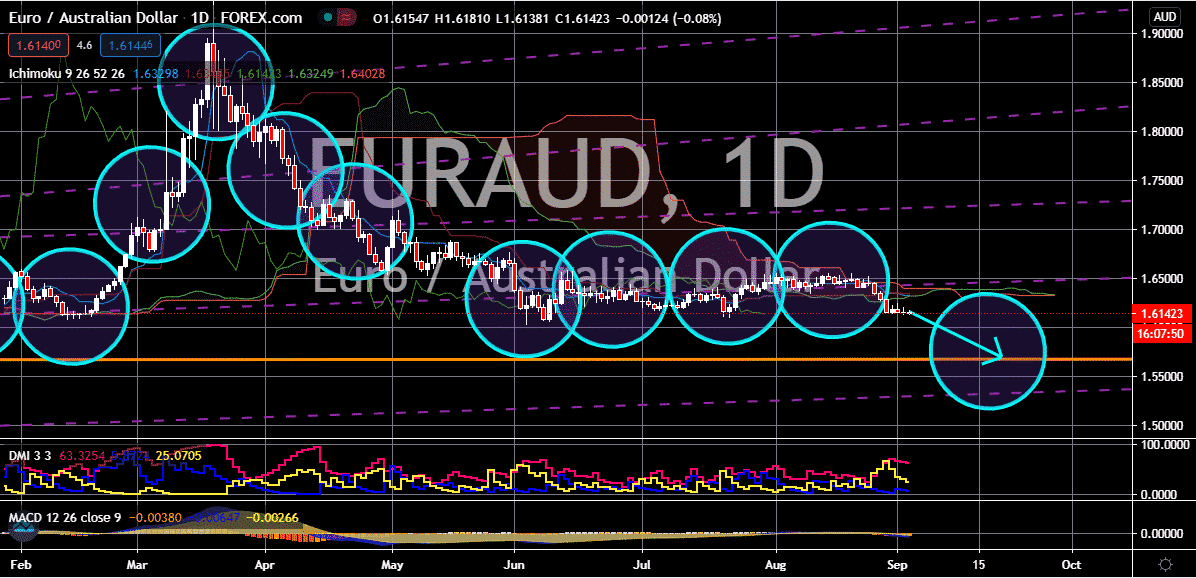

GBP/CHF

The safe-haven appeal of the Swiss franc has no effect on the British pound in the trading sessions. Prices of the pair are now seen trading steady, but it’s expected to turn out bullish in the coming weeks. Despite major concerns over the Brexit deal between the United Kingdom and the European Union, the sterling stands stronger against the franc. Perhaps it could be argued that despite the stronger performance of the Swiss economy, the safe-haven appeal of the franc isn’t helping its cause that much. Just recently, it was reported that the EU chief Brexit negotiator, Michel Barnier, signaled concerns when he said that he is worried and disappointed over Britain’s approach in the negotiation talks. The comment adds up to the negativity that the UK will officially leave the eurozone in January without a trade deal with the EU. Barnier said that he didn’t see any changes in the position of Britain, and this is despite multiple trade talks in the past months.