Market News and Charts for September 02, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

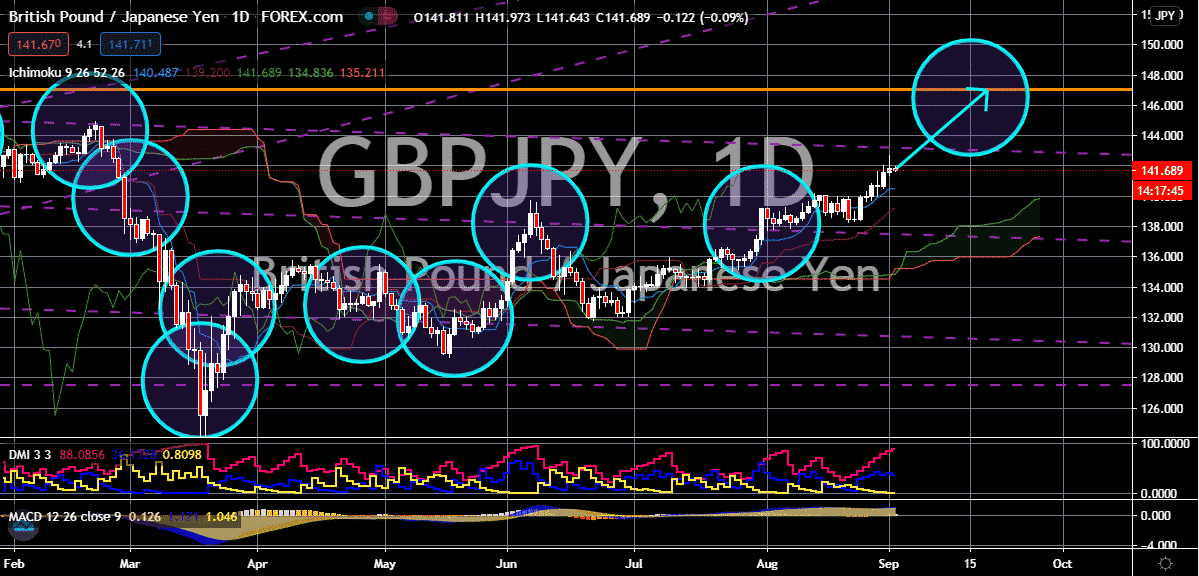

AUD/USD

The Australian dollar remains significantly dominant against the US dollar, and prices are now widely projected to climb higher towards their resistance, hitting ranges last seen in June 2018. The massive economic contraction in Australia may have caused the trading pair to trade neutrally today, it’s still not enough to allow bearish investors to regain their footing in the trading sessions. Meanwhile, the US dollar’s weakness isn’t expected to end anytime soon. Just recently, analysts projected that the beloved safe-haven currency could be in a decade-long decline. The greenback has been weakening as the pandemic continues, and the announcement of Federal Reserve Chairman Jerome Powell last week further reinforced its bearish notion. The new policy will allow the Fed to keep its official interest rates at zero even if inflation finally climbs to its 2% target. The low rates could mean significant weakness for the already struggling currency.

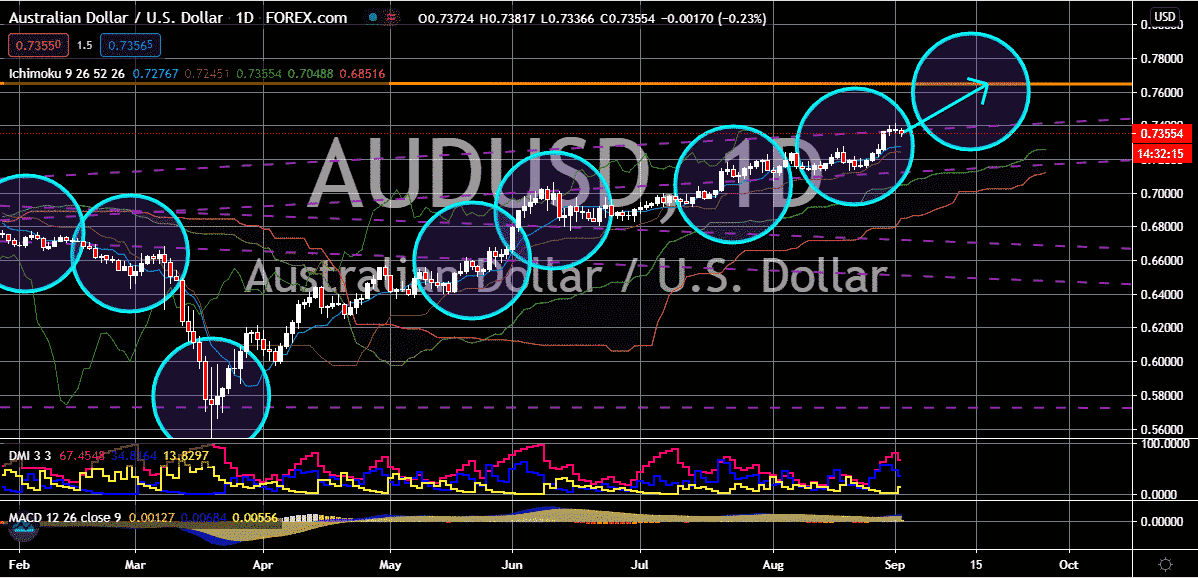

AUD/CAD

The optimism in the worldwide commodity market could finally help the Canadian dollar regain its footing against the evidently strong Australian dollar. Prices of the Australian dollar to Canadian dollar exchange rate are bound to fall in the coming days as oil prices continue to remain bullish. The recently released US crude stockpile data boosted the positivity for the commodity market, buoying prices this Wednesday. Aside from that, another factor that’s adding up to the positivity is the latest forecast of American banking giant, Goldman Sachs for the outlook of crude prices. As for the Australian dollar, it’s seen rallying against most other major currencies today except for the Canadian dollar. Perhaps its appeal isn’t working on the commodity-linked currency. Looking at it, the recently reported poor gross domestic figures produced by the Australian economy is the main factor that’s holding back the antipodean currency this Wednesday.

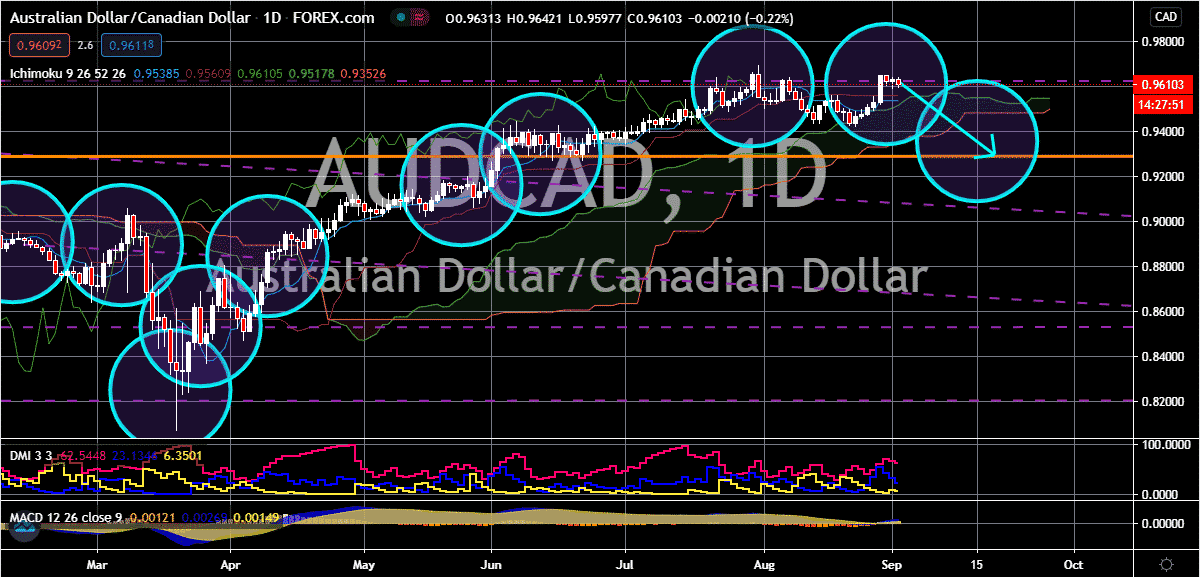

AUD/CHF

The Swiss franc continues to tumble against the Australian dollar and bulls retain their hold on the direction of the trading pair. It’s believed that the trading pair will eventually climb towards its resistance by the mid-point of the month. According to some experts, the Swiss franc is one of the worst-performing currencies matched with the Australian dollar. See, the rallies of gold and silver in the commodity market is one of the main reasons why the Swiss franc is notably slowing down. Looking at it, the decision of the Reserve Bank of Australia to hold its interest rates at 0.25% in its most recent monetary policy meeting didn’t help bearish investors at all. Reports say that the reserve bank even reiterated that the downside in the antipodean country’s economy is not as severe as earlier projected. However, the bank also emphasized that the recovery is both “uneven and bumpy”, suggesting that it’s not going to be an easy road and that the low rates are necessary.

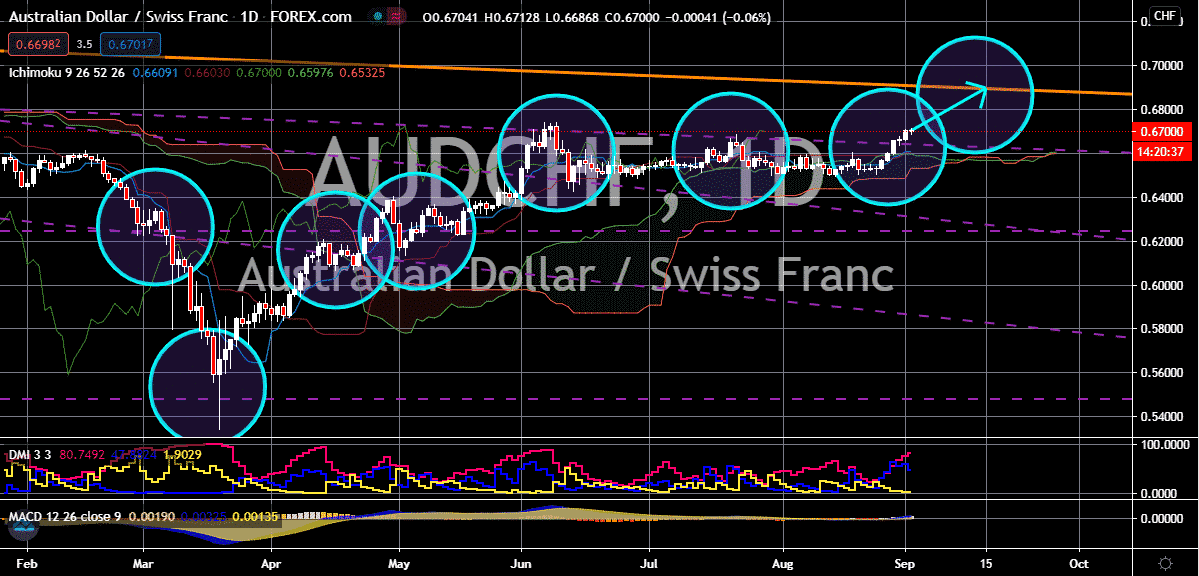

GBP/JPY

Despite the Brexit concerns weighing on the British pound, bullish investors of the GBPJPY exchange remained determined to push the pair to its resistance level. Luckily for the sterling, the Japanese yen is dubbed as one of the worst performers among major currencies. Just recently, it was reported that Downing Street has played down the prospect of reaching a much-need trade deal with the European Union in time for the last month of the year. Britain said that it will be “very difficult” to snatch a deal with the EU. Next week, both of the parties’ chief negotiators are scheduled to meet for the advance round of their trade talks. Japan recently lifted its coronavirus-based re-entry ban for its foreign residents, however, the uncertainties – political and economic – is making it rather difficult to recover. Japanese Chief Cabinet Secretary Yoshihide Suga is expected to confirm speculations that he intends to run for prime minister after Abe’s resignation.