Market News and Charts for September 01, 2020

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

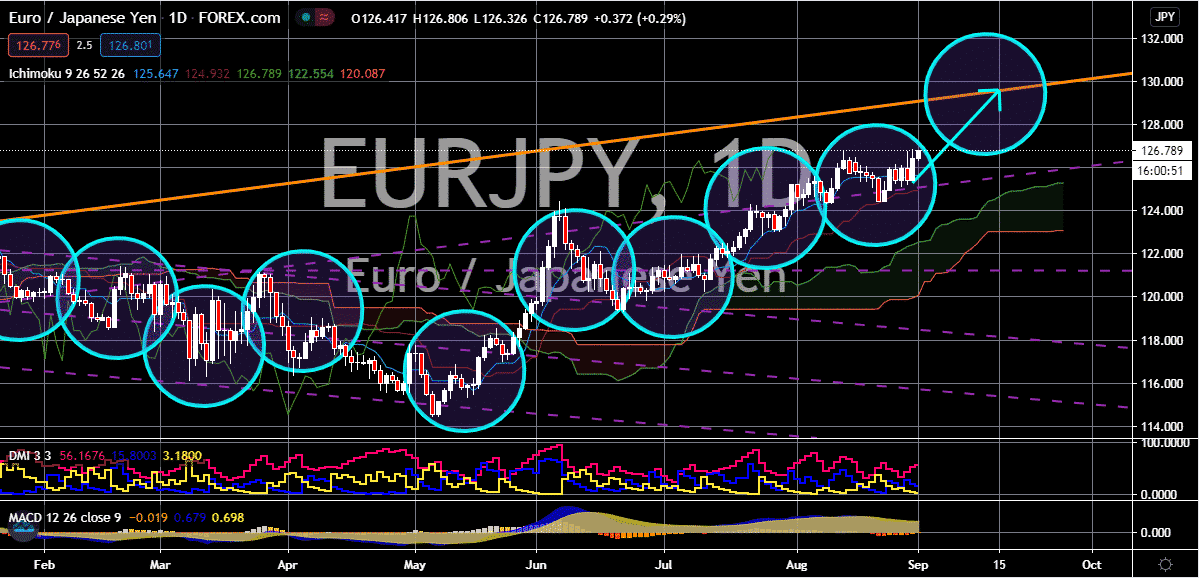

USD/CAD

The US dollar to Canadian dollar exchange rate continues to fall in the trading sessions thanks to Fed-related news. Unfortunately for bullish investors, the trading pair is on track to go down towards its support in the coming sessions, possibly hitting it by the mid-point of the month. Most experts believe that 2020 is the year for bearish investors as the recent shift in the United States Federal Reserve’s policy is combined with several other factors like the number of cases and political uncertainties. Looking at it, the Canadian dollar has been greatly benefitting from the broader weakness of the US dollar. It’s believed that the currency is actually one of the leading players in the foreign exchange market, alongside the bloc’s euro. However, the Canadian dollar is still held back by the travel restrictions in the country. According to the Canada Border Services Agency, travelers that restrictions are still in place at all Canadian international border crossings.

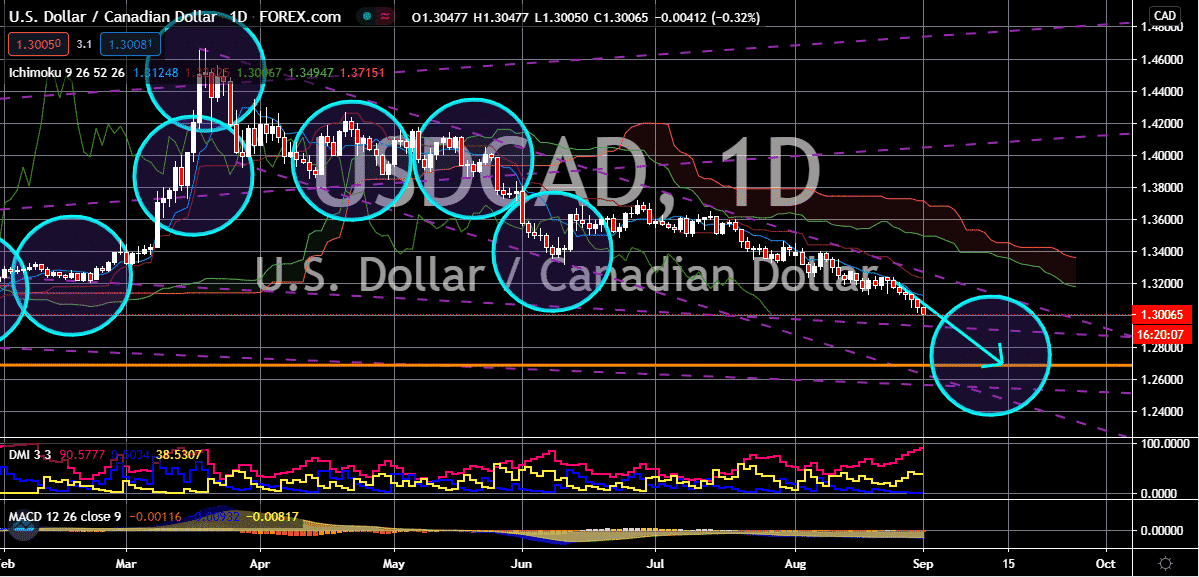

NZD/USD

As the US dollar continues to nurse its losses against most major currencies, the New Zealand dollar sees a wide opening and rallies against the currency. Ever since the Federal Reserve dropped the news last week, the greenback has gotten significantly weaker, allowing bullish traders of the pair to take advantage of the situation. It’s worth noting that the New Zealand dollar isn’t running on any data regarding its economic activities. Instead, it’s affected by the sentiment of the global market. Despite the new cases recorded by the antipodean country, its citizen returned to their daily lives yesterday after the government lifted the lockdown in Auckland, New Zealand. Prime Minister Jacinda Ardern told the public that she is confident that the outbreak there is under control now but still made wearing a mask compulsory on public transportations across the country. The lockdown in New Zealand began on August 12 and it was officially lifted yesterday.

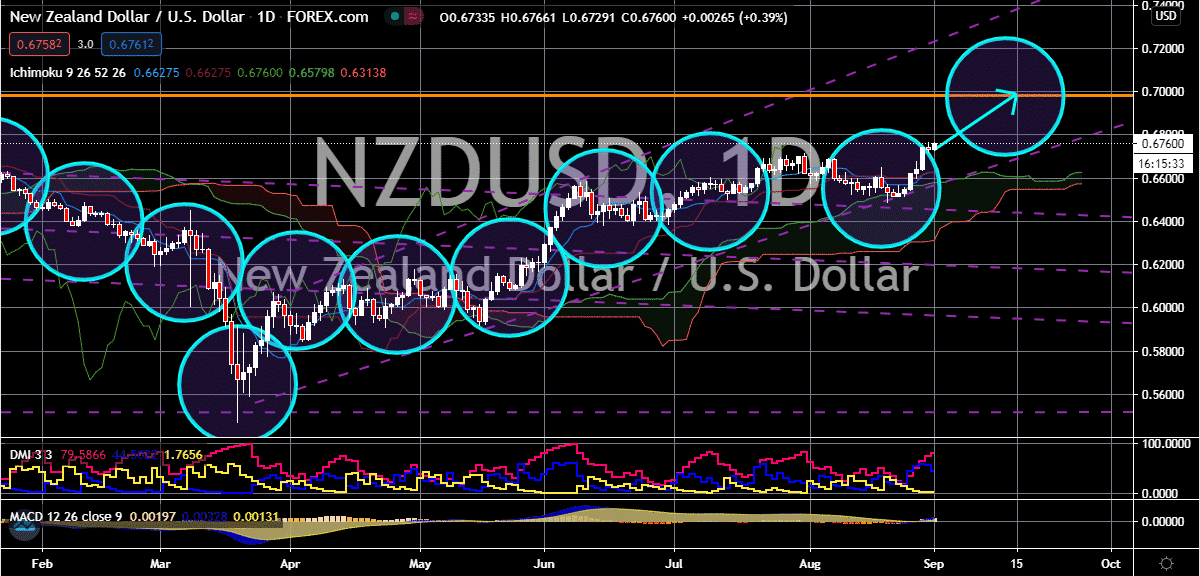

AUD/JPY

The Australian dollar maintains its bullish hold against the Japanese yen and the trading pair is inching its way towards its resistance level. As of today, the trading pair is moving slightly slower after the Reserve Bank of Australia announced that it has decided to leave its official interest rates unmoved at about 0.25% in its most recent board meeting. The decision of the RBA came ahead of tomorrow’s gross domestic product figures, raising a slight cloud of concern among investors. Luckily for the Australian dollar, the Japanese yen lacks the fundamentals to support its cause. Moreover, bears lost their confidence when Shinzo Abe surprised the world with his resignation last week. Abe is the longest-serving Japanese prime minister in the country’s history and according to reports, his resignation was due to health reasons. During a press conference in Tokyo last week, Abe was reportedly suffering from colitis, a non-curable inflammatory bowel disease.

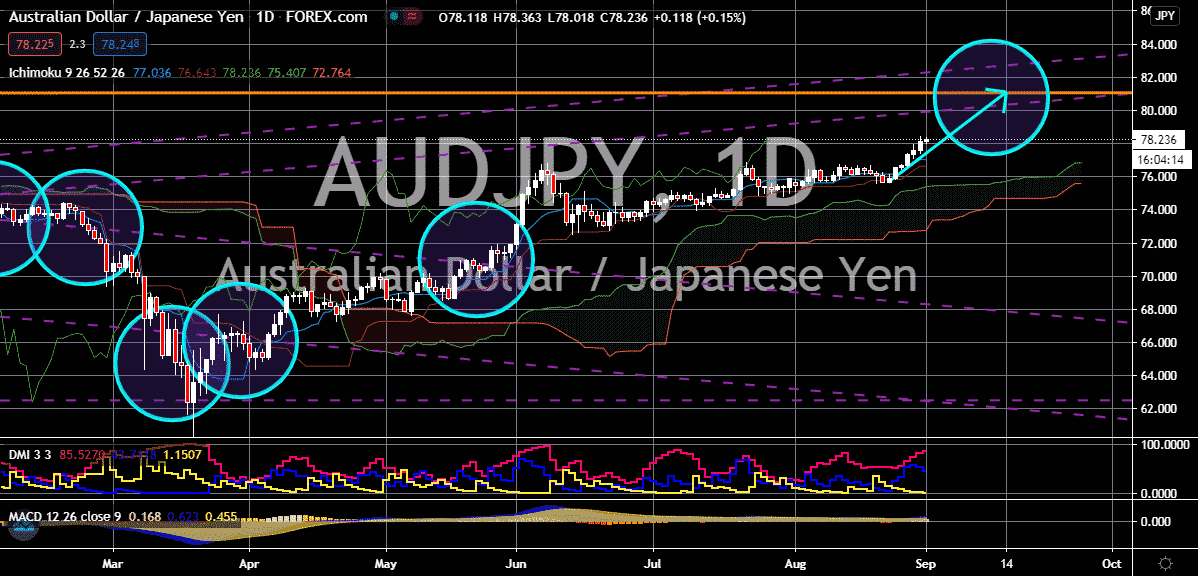

EUR/JPY

The euro power through this Tuesday as the US dollar drops, allowing bullish investors of the trading pair to dominate the Japanese yen. Most experts say that the strength of the euro is very much correlated to the greenback. As the pandemic continues to remain as a big threat, the US dollar’s appeal continues to depreciate, allowing other major currencies, like the single currency, to take control. Other factors that run the euro are now related to the bloc’s economic activities including the scheduled eurozone inflation data. On the other hand, the Japanese yen saw mixed directions against other currencies after the resignation of the country’s longest-running prime minister. The severity of Shinzo Abe’s health has long been known to be serious, but his resignation last week. Abe is seen as a conservative, traditionalist, and nationalist leader, and his departure from the highest post raises questions about the country’s outlook amidst the pandemic.