Market News and Charts for October 31, 2019

Hey traders! Below are the latest forex chart updates for Thursday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

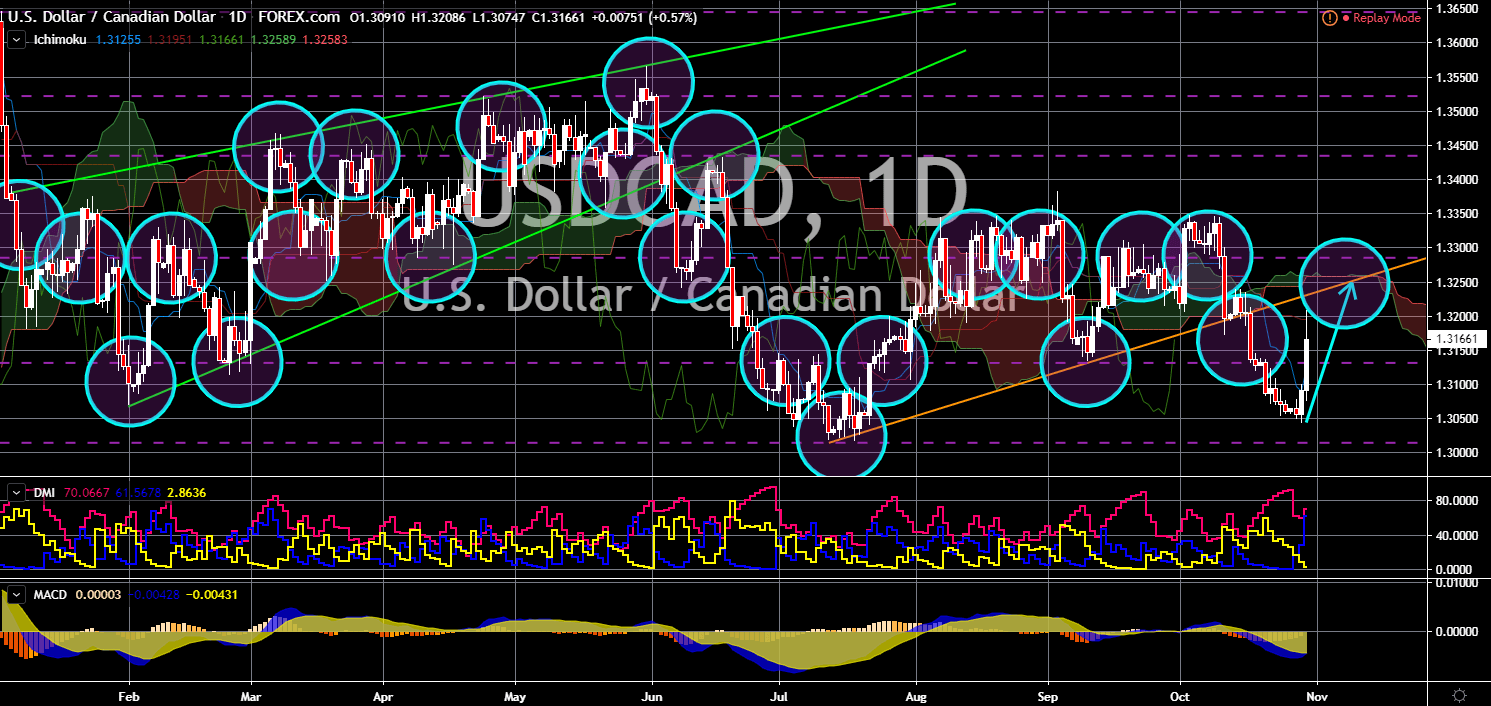

USD/CAD

The pair is expected to continue its rally towards an uptrend resistance line. U.S. House of Representatives Speaker Nancy Pelosi confirmed that the U.S. Congress is near approving the ratified NAFTA (North American Free Trade Agreement). The ratification of the NAFTA is a major political policy by U.S. President Donald Trump and is seen as a major catalyst if Trump decided to run again during the 2020 U.S. Presidential Election. The USMCA (United States-Mexico-Canada) agreement will replace the $1 trillion NAFTA agreement. This is expected to benefit the U.S. farmers who have been suffering from the escalating trade war between the United States and China. The two (2) parties recently expressed their concern whether they will be able to meet this month to finalize the phase one trade deal, which will end the month-long U.S. China trade war.

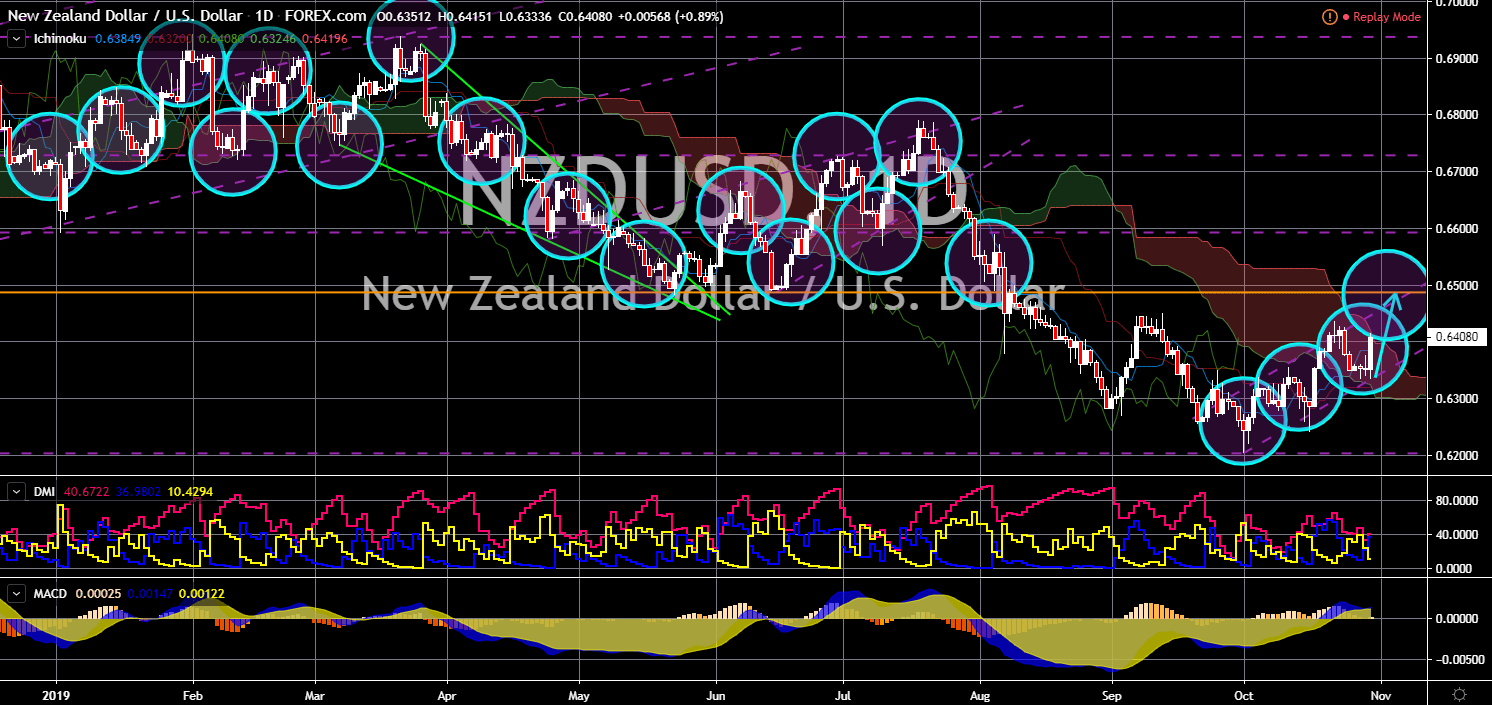

NZD/USD

NZD/USD

The pair will continue moving higher in the following days after it bounced back from a steep uptrend channel support line. New Zealand will once again test its independent foreign policy during the ASEAN (Association of Southeast Asian Nation). New Zealand is pressured to take sides between its largest trading partner, China, on the one hand, and traditional allies, the United States and Australia, on the other. New Zealand has been slowly moving away from its traditional alliance as the world order shifted following the U.S. withdrawal from the rest of the world. In can be remembered that New Zealand was the only country who abstained from taking sides between Venezuela’s Maduro government and self-proclaimed interim president Juan Guiado. New Zealand also voiced its concern following President Trump pressuring the country to ban Chinese telecom giant Huawei.

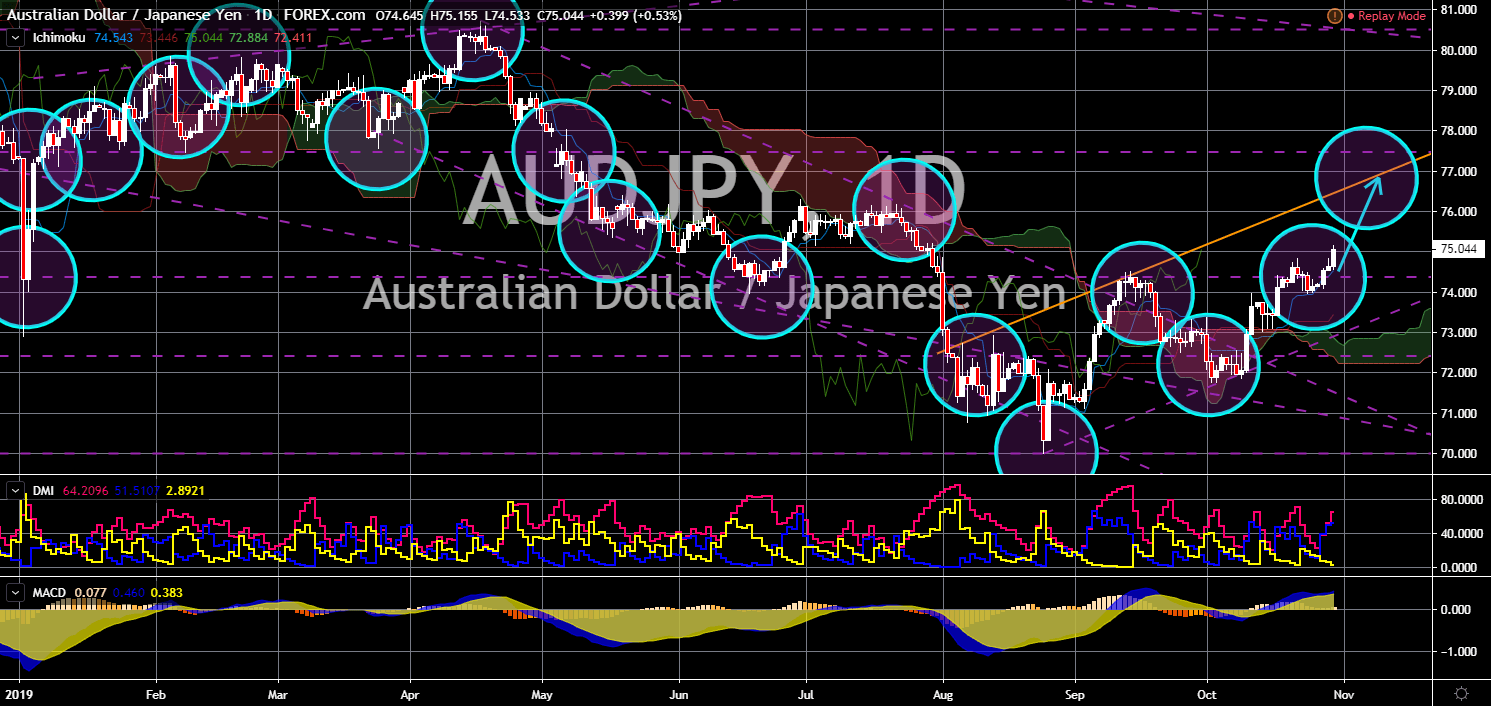

AUD/JPY

The pair is expected to continue moving higher in the following days and to retest the uptrend channel resistance line. Economic tension between regional powers, Australia and Japan, further widened following the recent move by Australia. The Australian consumer regulator filed a lawsuit against the local unit of Mazda Motor for allegedly misleading consumers. The Australian Competition & Consumer Commission (ACCC) also filed charges against the U.S. technology giant Google. Australia and Japan both lead the ratification of the pacific rim trade pact, the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership). Also, the two (2) regional powers were members of the ASEAN Plus 6 and were members of the RCEP (Regional Comprehensive Economic Partnership). On November 04, the Reserve Bank of Australia (RBA) announced that it will be holding onto its current benchmark interest rate of 0.75%.

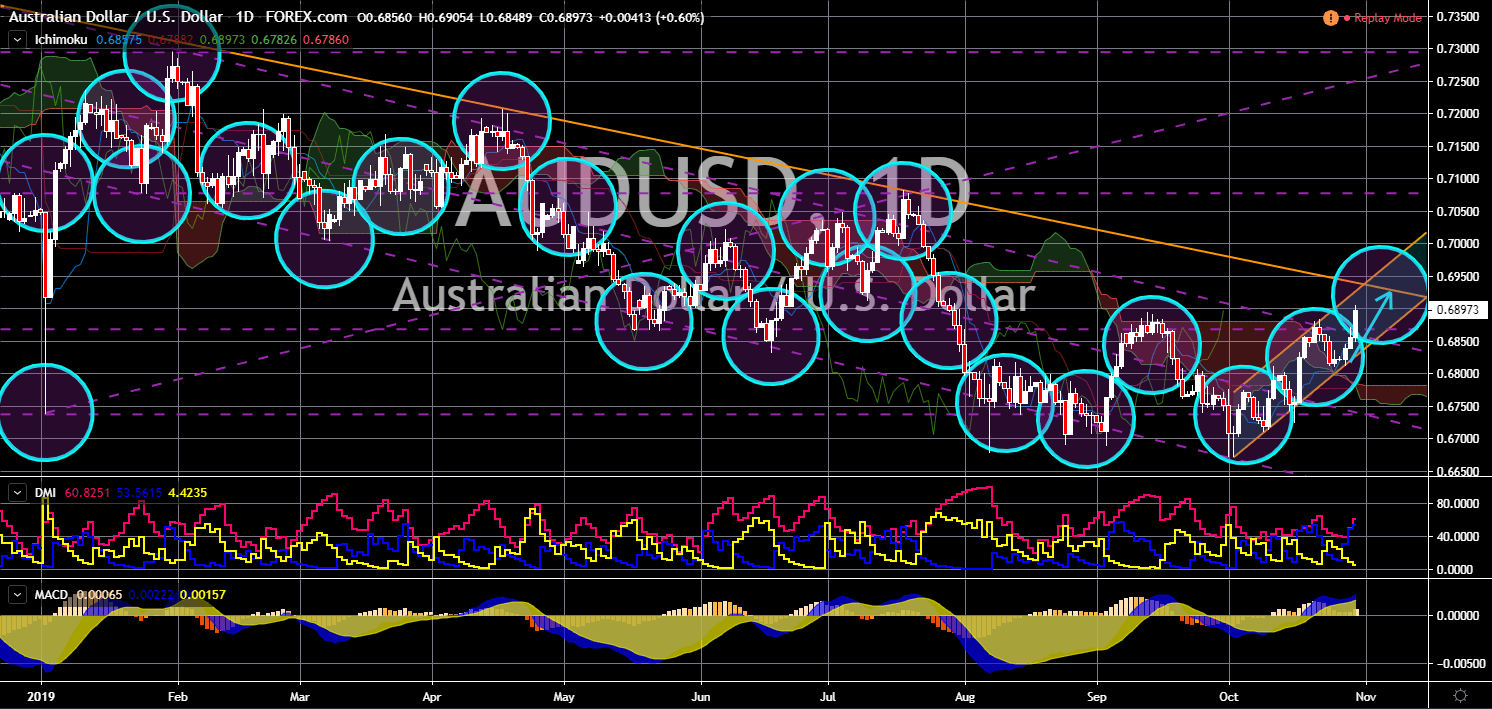

AUD/USD

The pair will continue its rally after bouncing back from a steep uptrend channel support line. On November 04, the Reserve Bank of Australia (RBA) reached a decision to hold its current 0.75% interest rate. This added strength to the Australia Dollar which has been benefiting from the trade negotiations between the United States and China. The two (2) largest economies in the world recently agreed to negotiate on the phase on trade deal, which could possibly end the month-long trade war between the two (2) countries. However, analysts warned that a strong Australian Dollar could potentially hurt the Australian economy. The country exported $253.8 billion in 2018 and a strong dollar will not help Australia to raise this figure. The U.S. Dollar is experiencing some weakness against a basket of major currencies following the Federal Reserve’s decision to further cut its interest rate to 1.75%.