Market News and Charts for October 29, 2020

Hey traders! Below are the latest forex chart updates for Thursday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

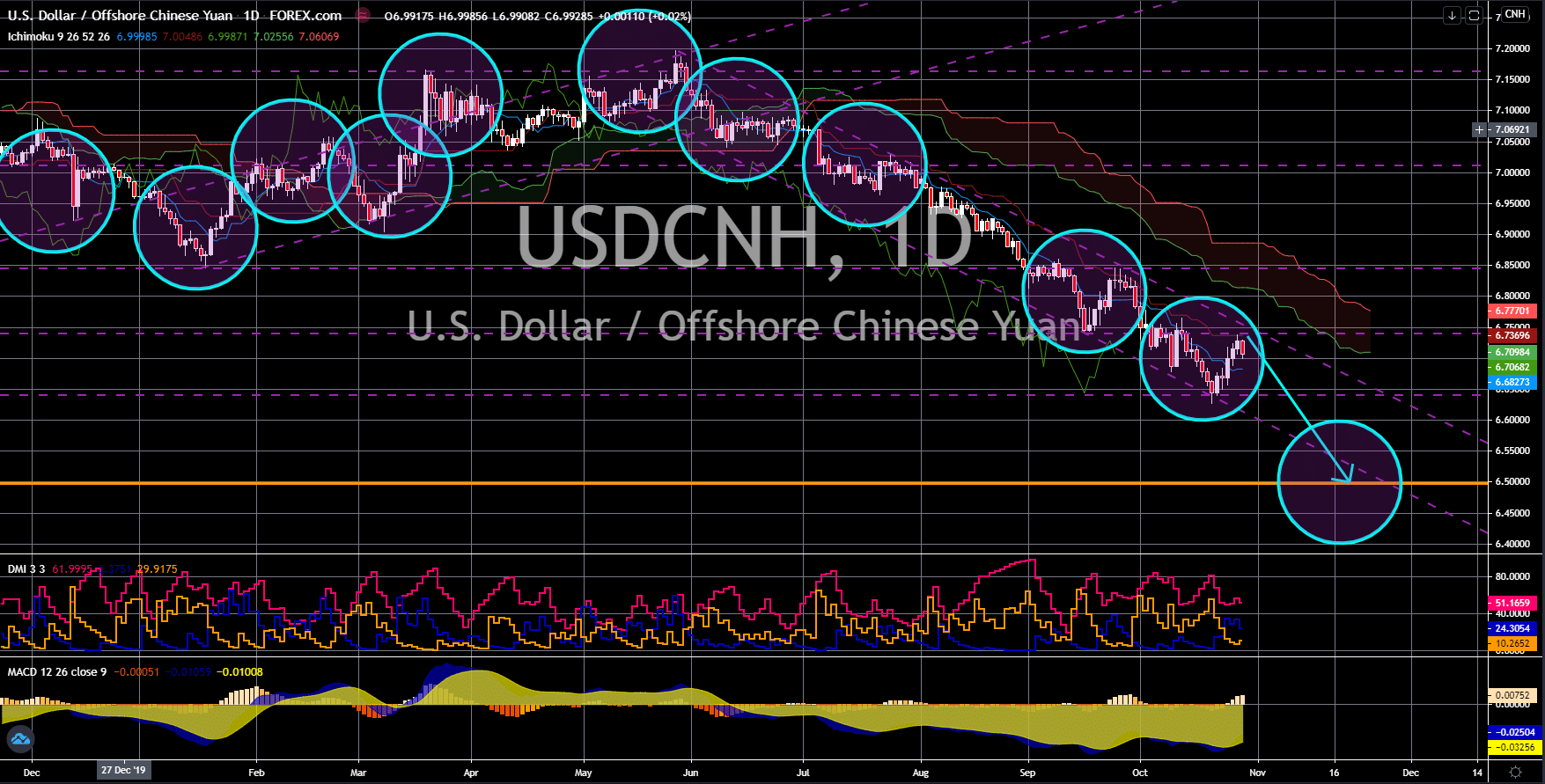

USD/CNH

The pair will continue to move lower in the following days towards its June 2018 low. China is the only major economy who will see a positive growth for fiscal 2020. Analysts are expecting a figure of 2.1% before making a robust recovery of 8.4% next year. Meanwhile, the US Q3 GDP will recover from its recent slump but still below the second quarter’s contraction. The expectations for the report was an expansion of 31.0% compared to -31.4% in Q2 Investors are also looking forward to the initial jobless claims report on Thursday, October 29. Around 775,000 individuals are expected to have filed for their unemployment benefits. This figure was lower by 12,000 than the previous week’s record. If the actual figures will be lower than last week’s 787K, this will be the lowest number of claimants since the third week of March. Despite the positive data from the United States, investors are still expected to dump the greenback against the yuan.

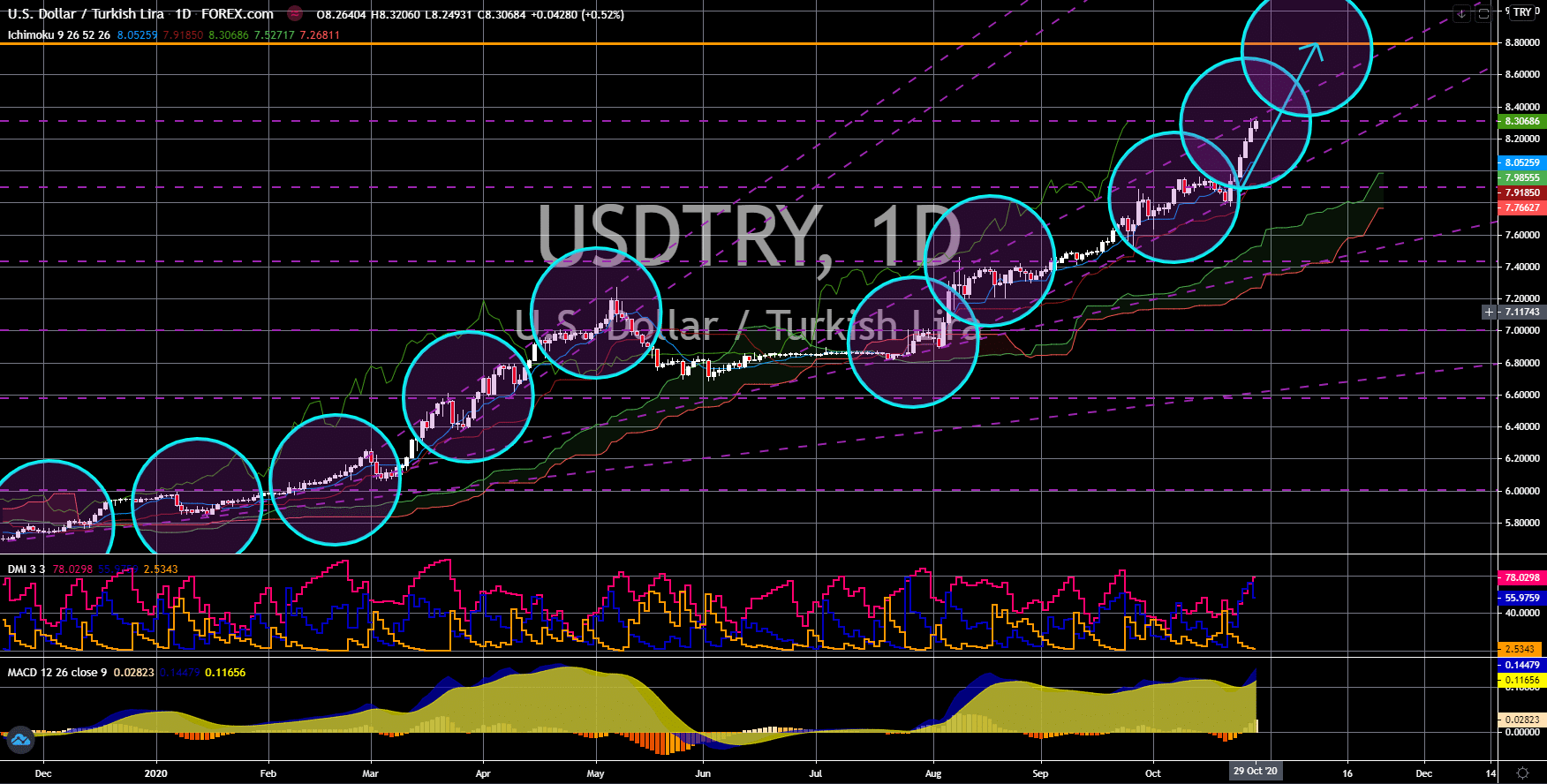

USD/TRY

The Turkish lira continues to decline to its sixth consecutive loss in today’s session, October 29. Analysts are expecting the week to end with another bullish move, ending October as the worst month for the currency. Investors are disappointed by Turkey’s central bank for refusing to raise its rates this week to prevent the lira from further falling. In his defense, Governor Murat Uysal said the Turkish currency was way undervalued and that he is expecting the price to come back to $9.00000 against the single currency and $7.50000 against the greenback. Aside from spiraling debt, the reason for lira’s decline was President Recep Tayyip Erdogan’s call to boycott France’s exports. Other factors that will affect the Turkish lira in medium to long-term was the country’s purchase of Russia’s S-400 defense missile system that draws ire from other NATO. The country has also been applying to become an EU member state since 1999.

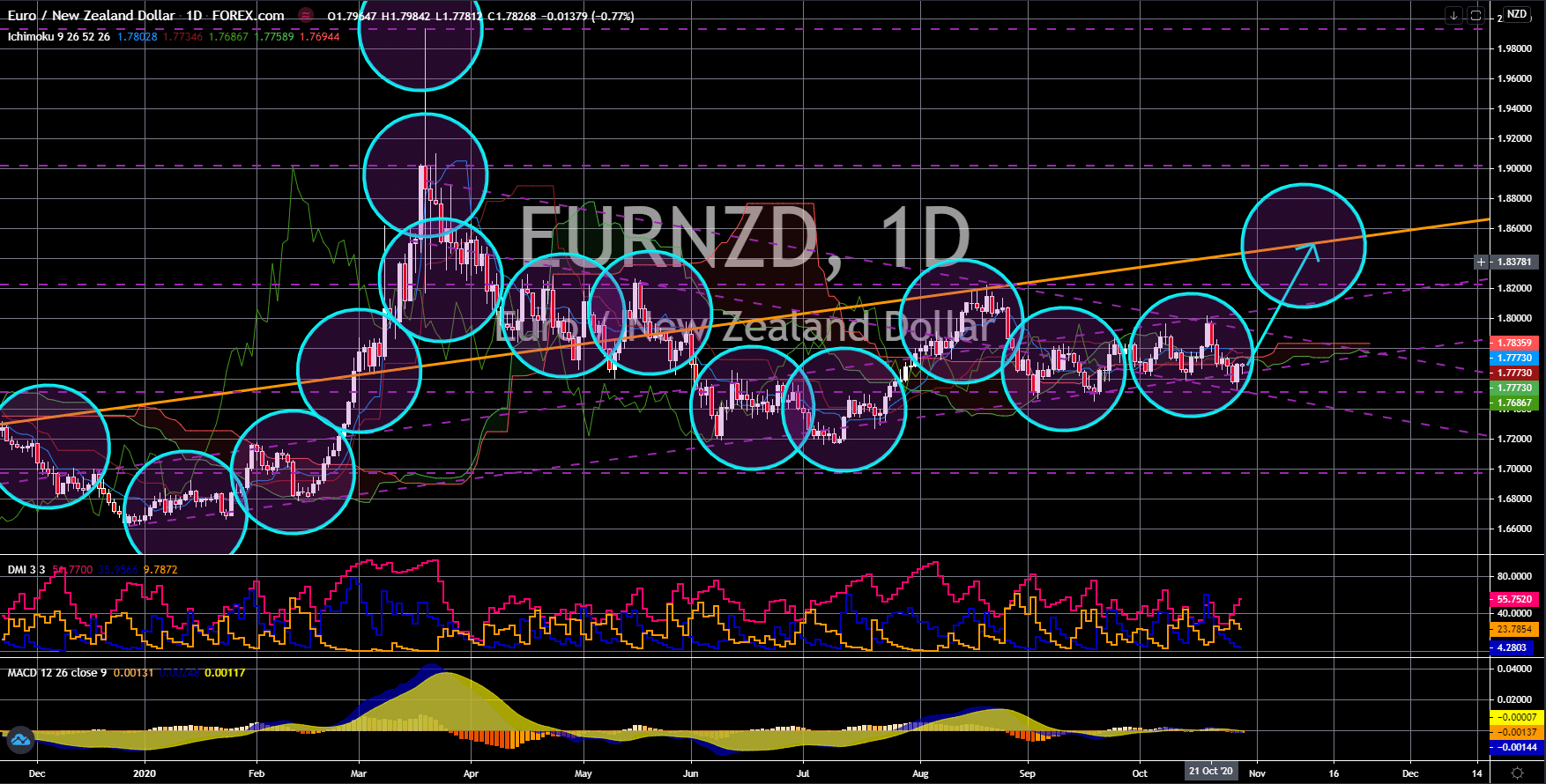

EUR/NZD

The European Central Bank (ECB) kept its rates intact on Thursday’s report, October 29. Deposit facility rate, marginal lending rate, and interest rate figures came in at -0.50%, 0.25%, and 0.00%, respectively. Despite keeping its rates, however, the central bank has urged its member states to increase their stimulus to help the bloc recover from the pandemic. But the struggling economy of New Zealand has made investors of the EURNZD bullish for the pair. Despite winning against the deadly virus, NZ’s economy suffered from imposing one of the world’s strictest lockdowns. A clear sign of an impending disaster was the skyrocketing prices of houses in New Zealand. From January to September 2020 alone, median prices increased by 11.0% of which 2.5% was credited for the month of August to September. Aside from the risk of a bubble, the high prices of property in the country could lead to an affordability crisis especially during the times of the pandemic.

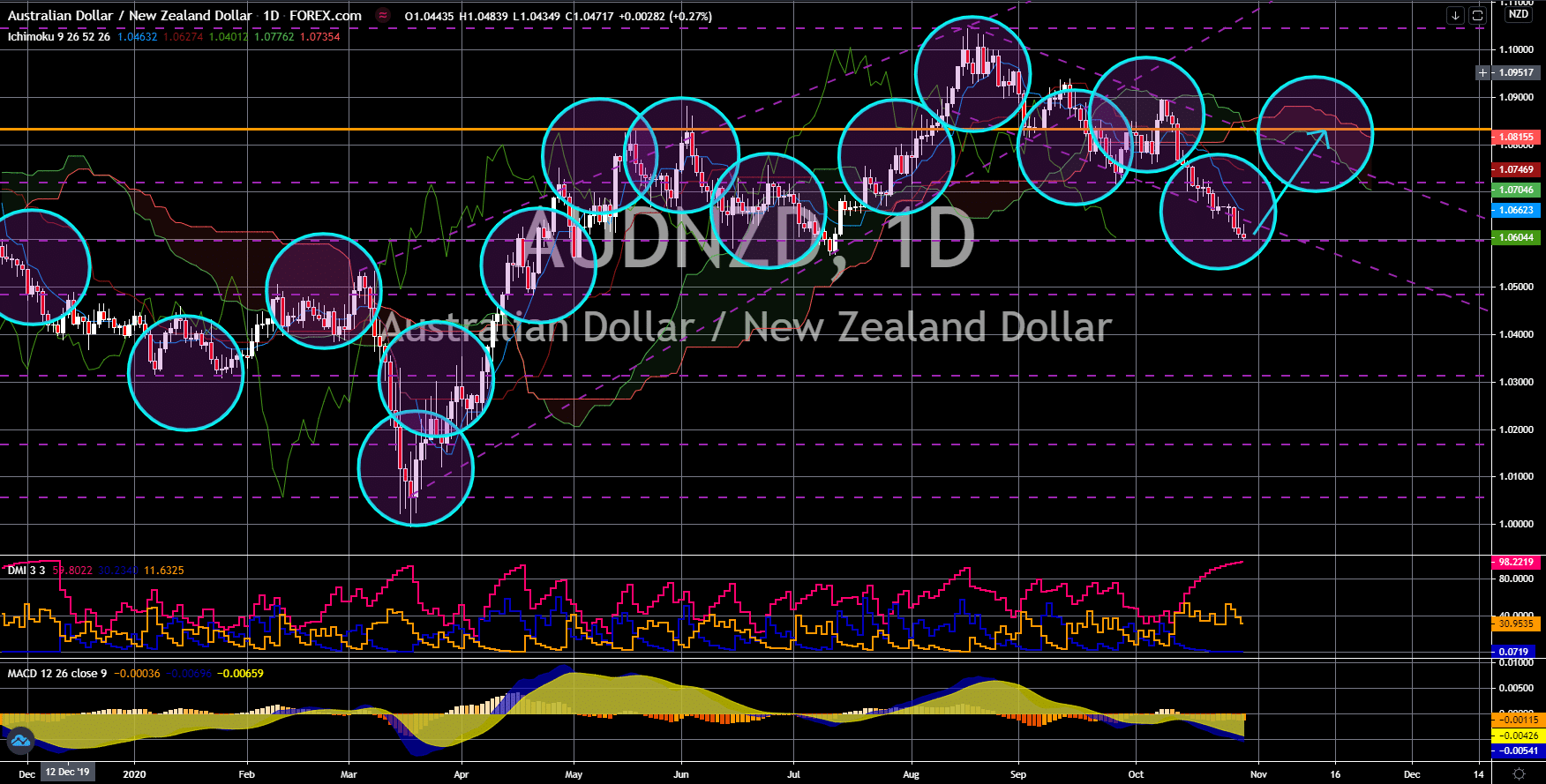

AUD/NZD

The pair will bounce back from a key support line, sending the pair higher towards a major resistance line. The worst may be over for Australia after the Reserve Bank of Australia (RBA) signaled that the country is out of its first recession in almost three (3) decades. The central bank noted that instead of a slight decrease in the third quarter of the fiscal year, they can see growth. In addition to this, RBA Deputy Governor Guy Debelle said Victoria State will stop the country’s recovery. Western Australia is set to open its economy by November 01 after an outbreak of COVID-19 cases was reported in Melbourne. Investors are also looking forward to the next central bank meeting where it will announce its interest rate decision. Some analysts gave a forecast of 0.10% interest rate in the short-term from 0.25%. If the central bank slashed its interest rate by 15-basis points, this will be the country’s lowest rate in history.