Market News and Charts for October 28, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

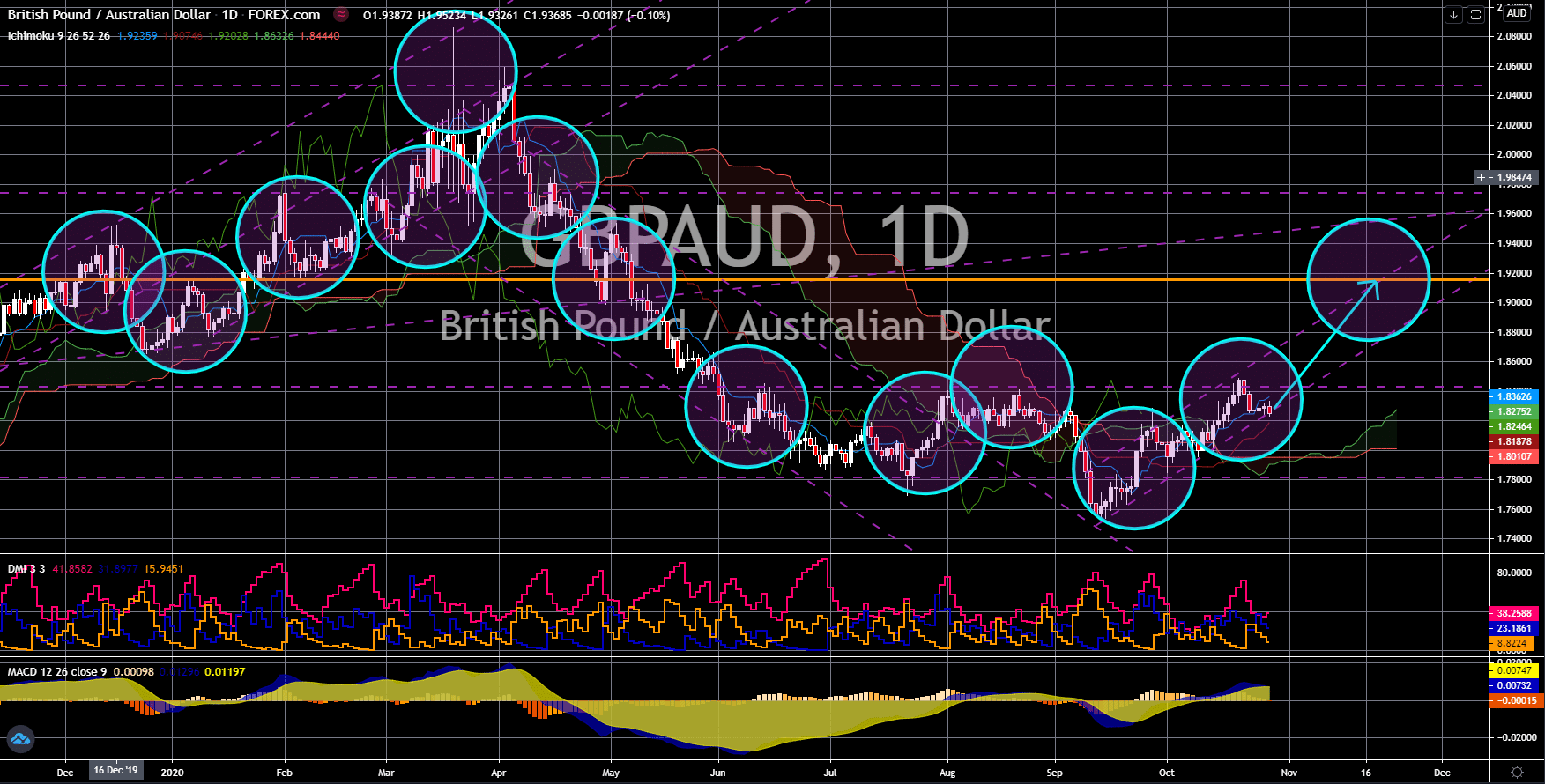

GBP/AUD

The pair will break out from a major resistance line, sending the pair higher towards a key resistance line. Australia posted better-than-expected Q3 Consumer Price Index reports on Tuesday, October 27. Figures came in at 1.6% quarter-over-quarter and 0.7% for YoY report. These numbers were comparatively higher than the results in the second quarter of -1.9% and -0.3%, respectively. However, the prospect of the UK signing trade agreements with other non-EU countries after Brexit is pushing the British pound higher against the Australian dollar. The bulls gained control over the GBPAUD pair in September 14 following the bill passed by the British Parliament which seeks different terms than the current UK-EU deal. Analysts also shrugged off the claims that the UK economy will suffer a $25 billion loss by 2021 if no agreement was reached between the European Union and the sixth largest economy in the world.

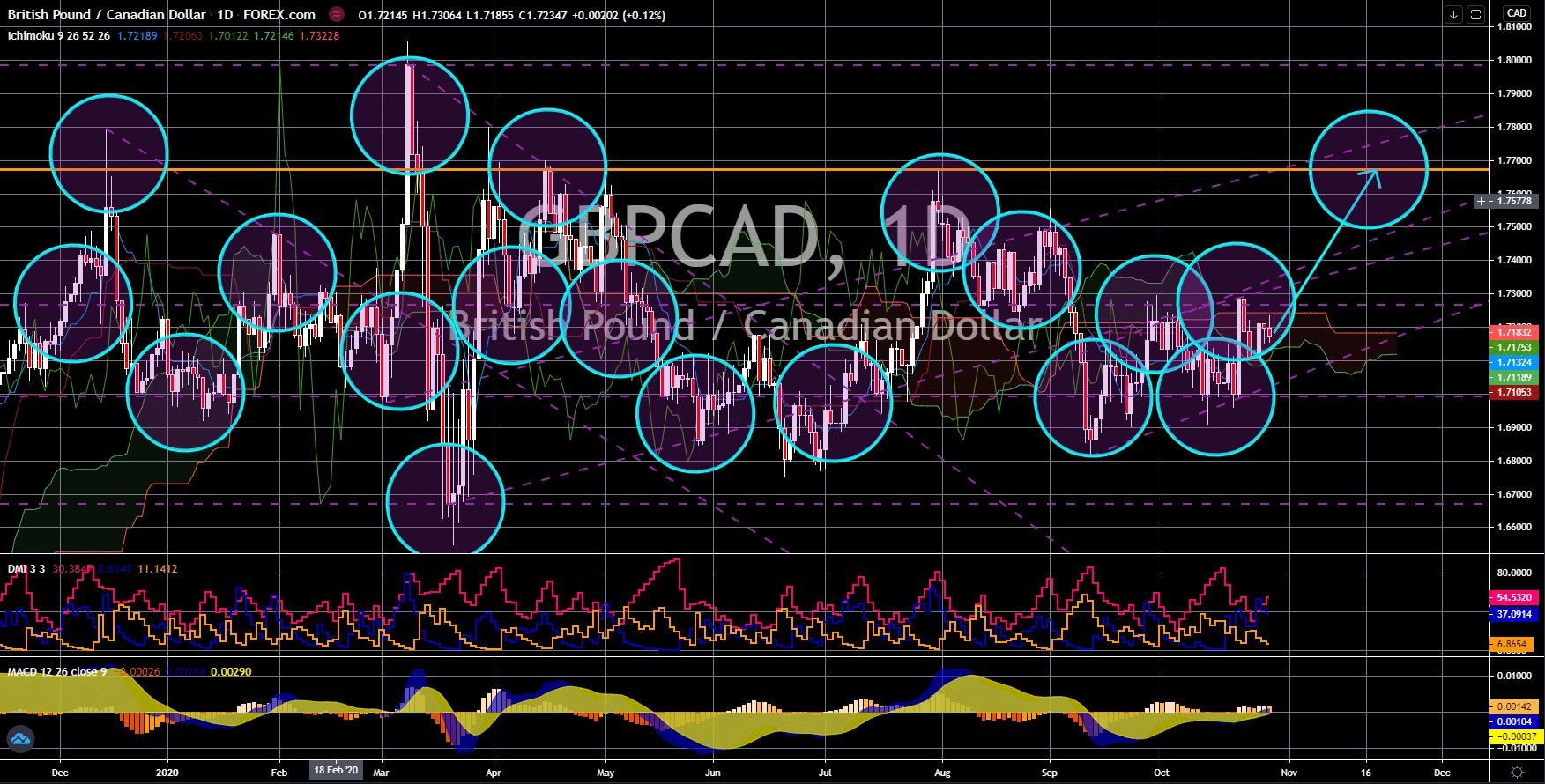

GBP/CAD

The pair will continue to move higher in the following days to complete the “double bottom” chart pattern. Canada is expected to keep its interest rate at a historical low of 0.25% in today’s meeting. According to Governor Tiff Macklem, this will be the central bank’s rate until it achieves an annual inflation rate of 2.0%. However, despite keeping its rate, the BOC said it will increase its bond buying policy to a minimum of $1 billion per week. Currently, the central bank owns a third of the federal government’s debt. Aside from officially announcing its rate until the next BOC meeting, Macklem is also expected to update Canada’s economic outlook for the remaining two (2) months of 2020. Meanwhile, Canadian Prime Minister Justin Trudeau said he will not give a limit as to how much deficit will the government incur when it comes to fiscal stimulus packages. The increasing supply of CAD in the market will make the currency underperform against its peers.

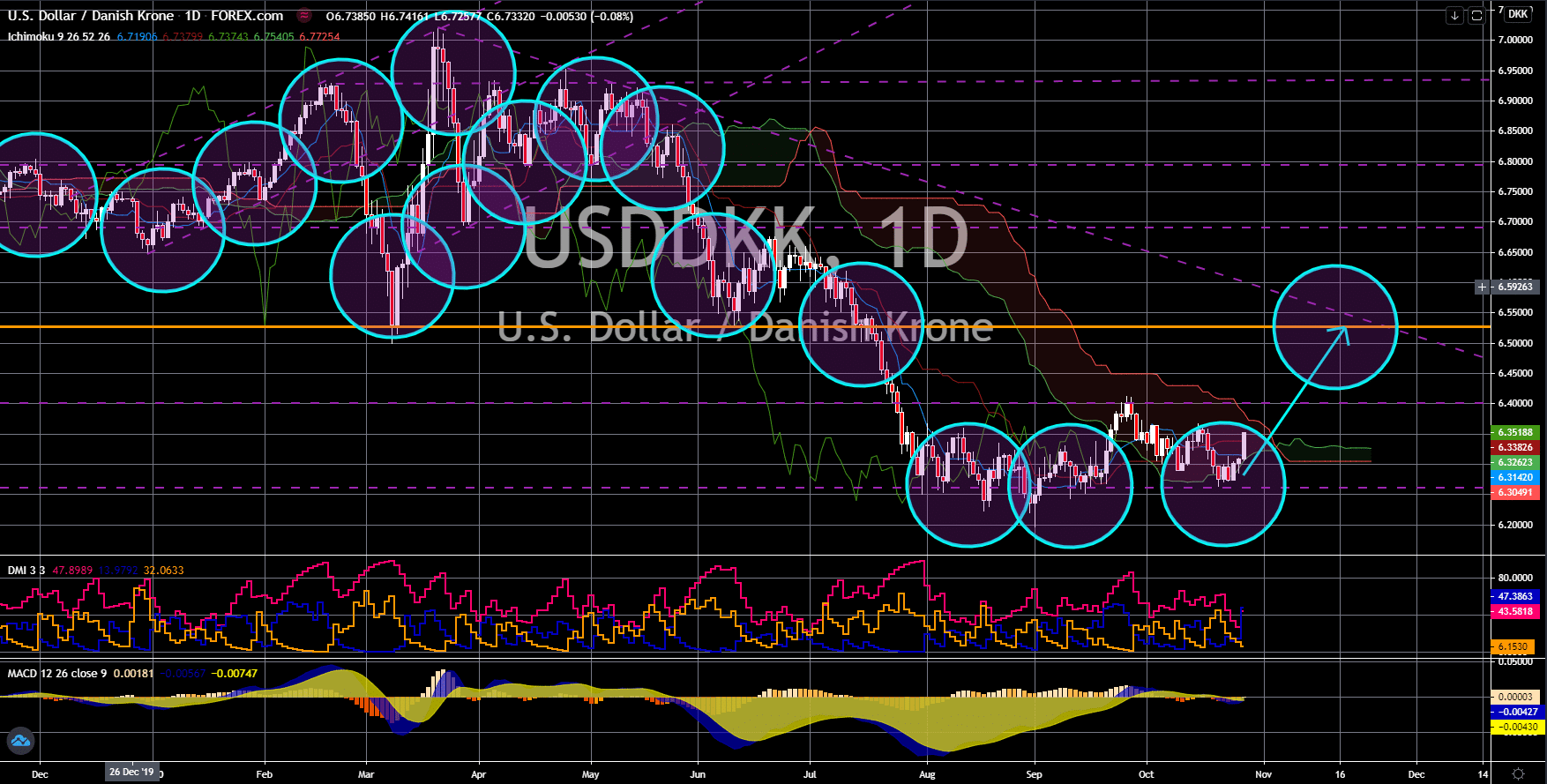

USD/DKK

The pair bounced back from a major support line, sending the pair higher towards a major resistance line. The US New Home Sales MoM report declined by 3.5% on Monday’s report, October 26. This figure represents around 35,000 houses, a relatively small amount when compared to the 959,000 reported result. The catalysts that will drive the price higher in the coming sessions was the expectations for the weekly initial jobless claims and the GDP Q3 QoQ result on Thursday, October 29. The number of claimants for unemployment benefits is expected to add 775K individuals. This figure was lower than the prior week’s result of 787K. Also, the expected result for the report will be the lowest since the third week of March. Meanwhile, the country’s preliminary result for its gross domestic product was an increase of 31.0%. This was an impressive growth following the 31.4% contraction in the second quarter of 2020.

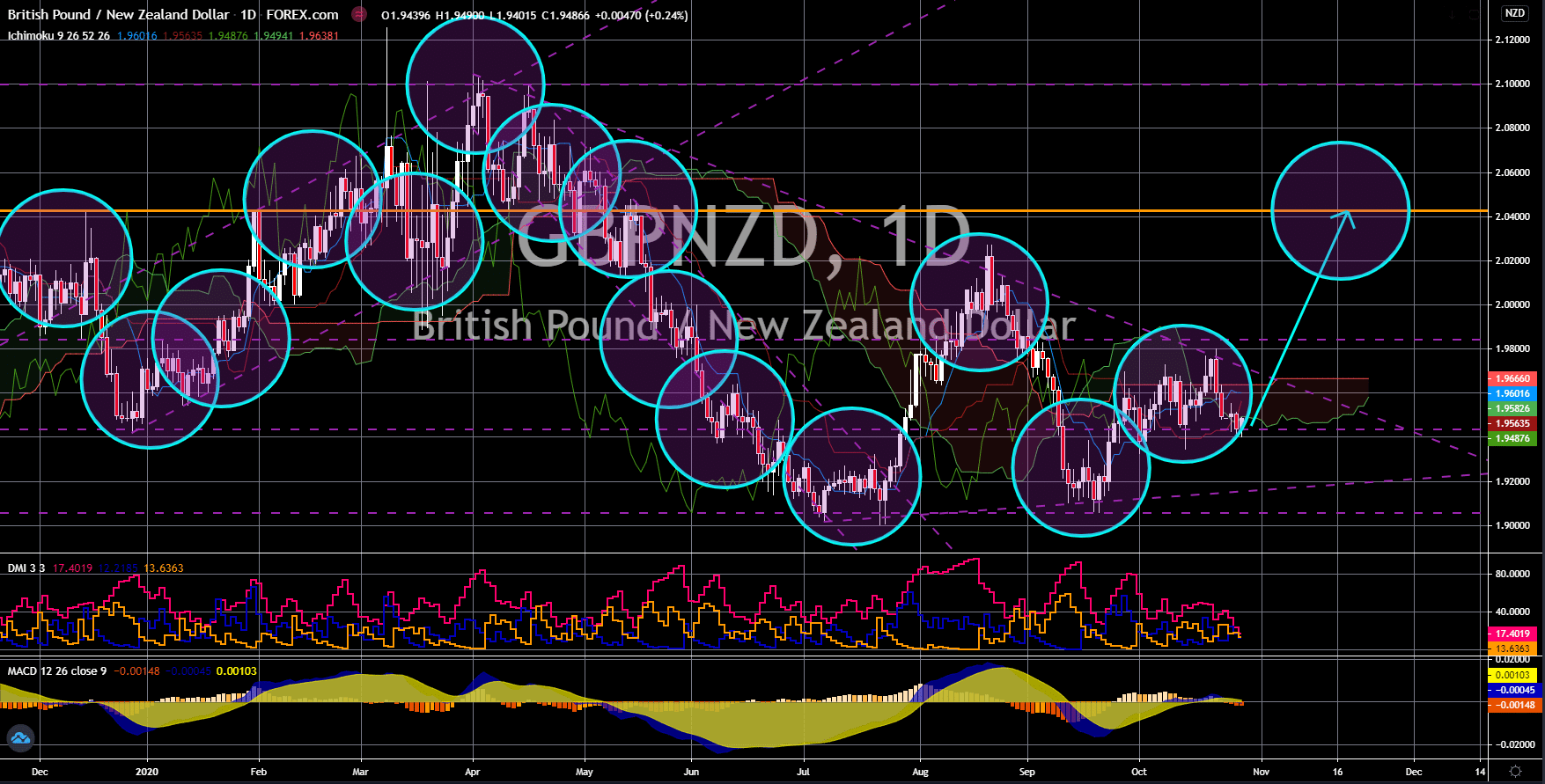

GBP/NZD

The pair bounce back from its current support line to form a “double bottom” pattern. Investors are hopeful for the British pound despite the uncertainty in Europe. Aside from the recent surge in coronavirus cases in the region, the EU and the UK are locked in the negotiating table as the Brexit transition ends in January 01, 2021. The tension further intensifies after the British Parliament passed a bill on September 14. The bill seeks to allow the UK Brexit representatives to change the initial Brexit deal to advance the UK interest during the negotiation. This, in turn, increases the chance of a “no-deal” Brexit. Analysts estimate that the UK economy will lose around $25 billion in 2021 due to its withdrawal from the EU. Investors, on the other hand, pointed out that this was almost the same amount that the UK is contributing to the EU budget. This means that Brexit will hurt the British economy in the short-term but benefit it over the long run.