Market News and Charts for October 25, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

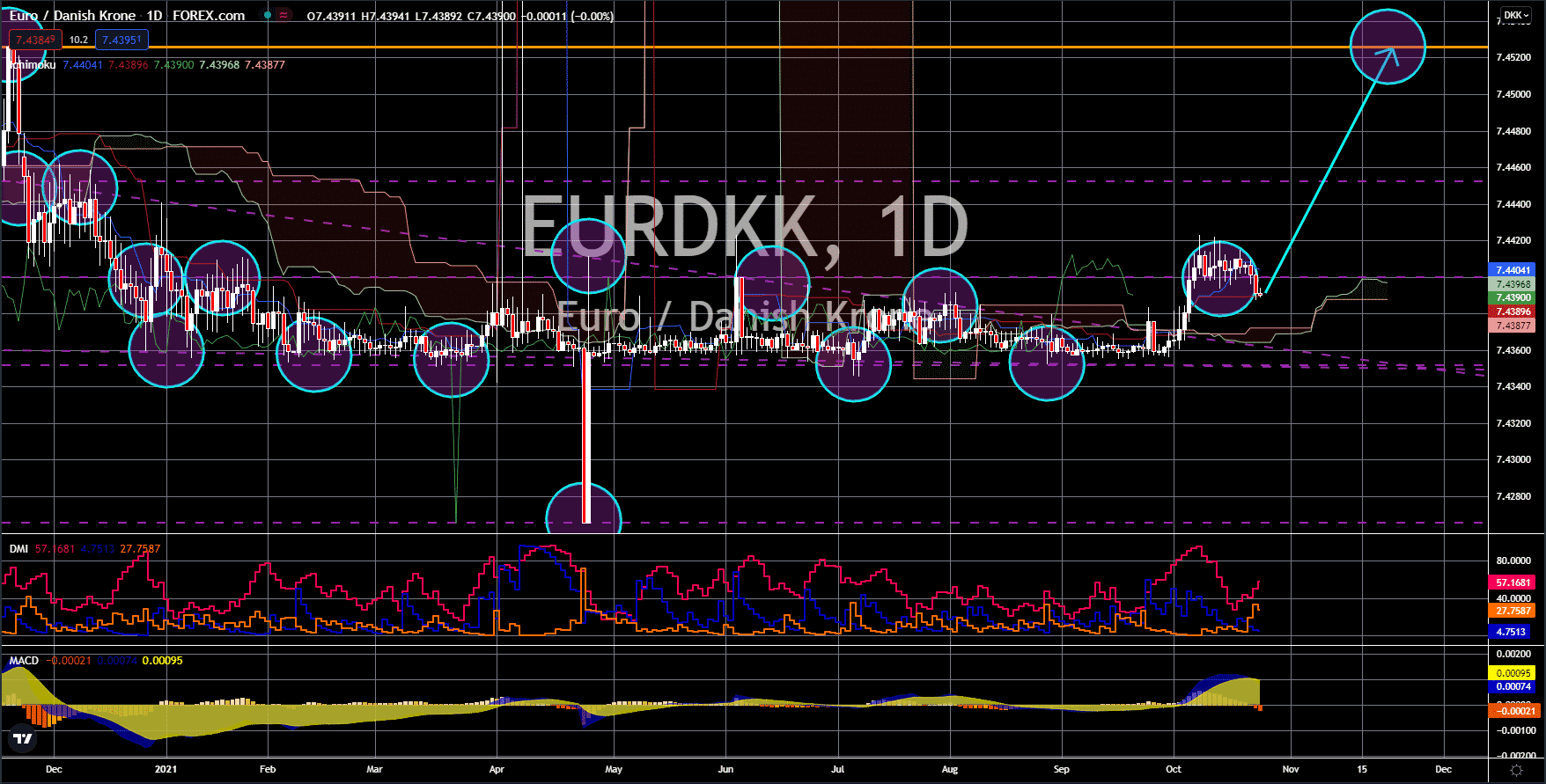

NZD/JPY

Japan’s Coincident Indicator, which measures the overall health of current economic conditions in the country, declined 3.1%. Its October 25 data shown. The result dismayed analysts which were only anticipating a 2.9% drop. The Japanese economy is failing to gain sustained momentum due to macroeconomic instability. The market is shaky ahead of Japanese general elections happening on October 31. The possibility of a new administration’s takeover or the continuity of the current ruling party are both proving to be challenging for Japan. Despite the uptick in Japan’s vaccination rate, the limited testing capacity remains an obstacle in helping the economy recapture the $53 billion worth of government spending which kept the economy running since the start of covid-19 pandemic. A recent deliberation showed that the Japan Leading Index, measuring the direction of the economy, bottomed at 101.3 points in October. This compares to September’s 104.1-point hit.

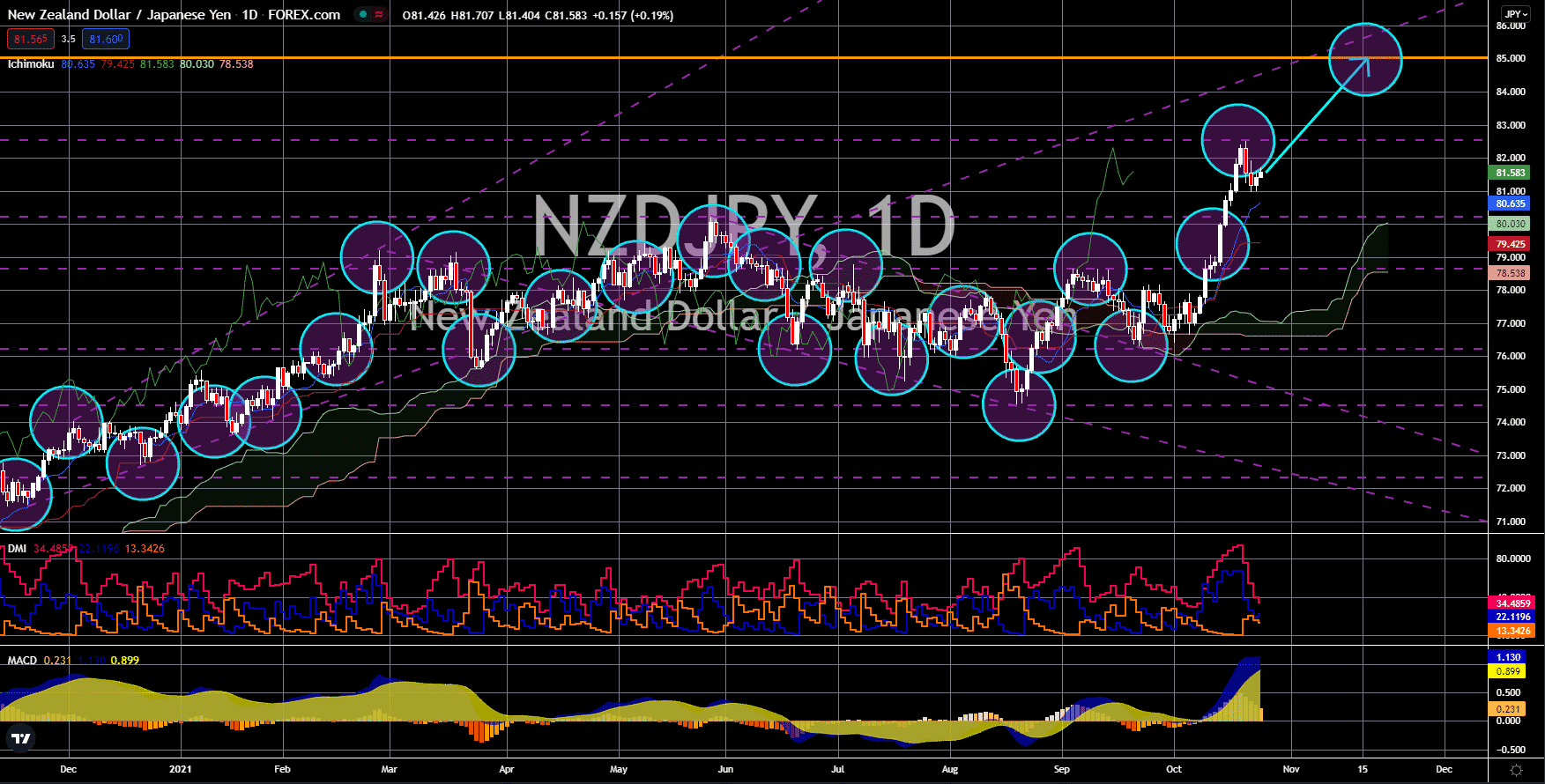

USD/HKD

The United States’ Purchasing Managers’ Indices showed strong results all across the board. The US Services PMI hits 58.2 points which is its strongest settlement since July. Moreover, this jump stepped on experts’ expected 55.1 reading for the period. The October Markit Composite PMI also did not disappoint and came at 57.3 points. This result is higher than September’s 55.0 points. The US Manufacturing PMI did not show as much improvement but remained well-above the growth territory. The economic indicator fell to the line of fives for the first time after clinching 59.2 points which is below the previous 60.7-point record. On the other hand, analysts remain optimistic that this does not signal the start of a sustained fall below 60 points, given that the health of United States’ economic indicators are proving otherwise. In a recent statement, U.S. Treasury Secretary Janet Yellen is expecting inflation to level back to normal levels by the second half of 2022.

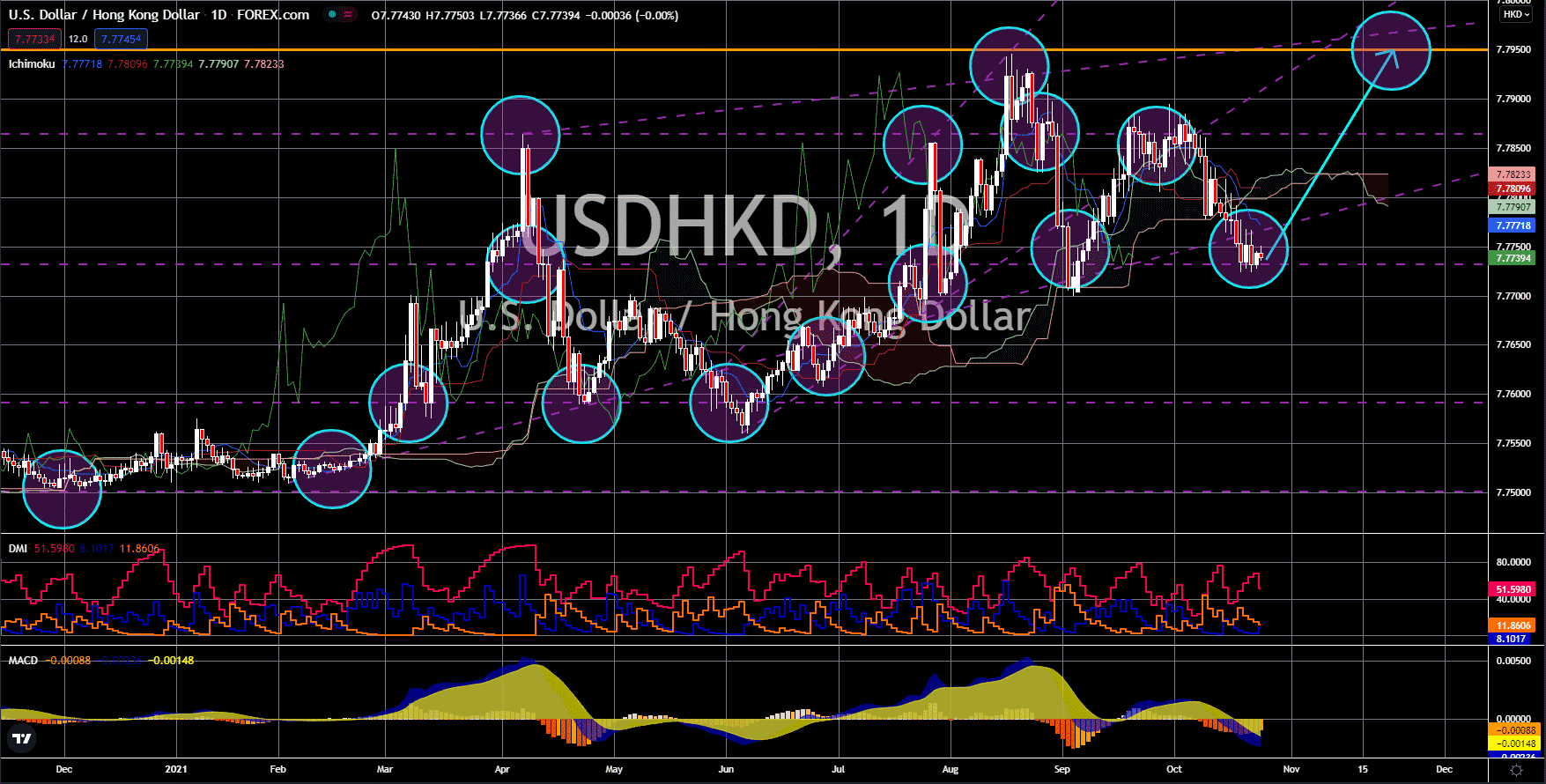

USD/SGD

Singapore’s Consumer Price Index in September grew 2.5% from August’s 2.4%. Such optimism has also been observed in the housing market. Its URA Property Index, gauging the overall mood in the construction industry, hiked to 1.10% quarter-on-quarter in October. This is higher than the September reading’s 0.90% result. The growth in its economic indicators owe their improvement to the government’s rigorous effort to get the entire population fully vaccinated. As of October 25, 82.6% of Singaporeans have already been inoculated, with almost 10 million shots administered. This move helped businesses get back to normal operations faster than other developed nations and nullified fear in the market. Due to its swifter-than-expected recovery, the Monetary Authority of Singapore surprised market participants with a raise on the slope of its currency band last week after resting at 0% for a long. This is after Singapore’s economy grew 6.5% in Q3 year-over-year.

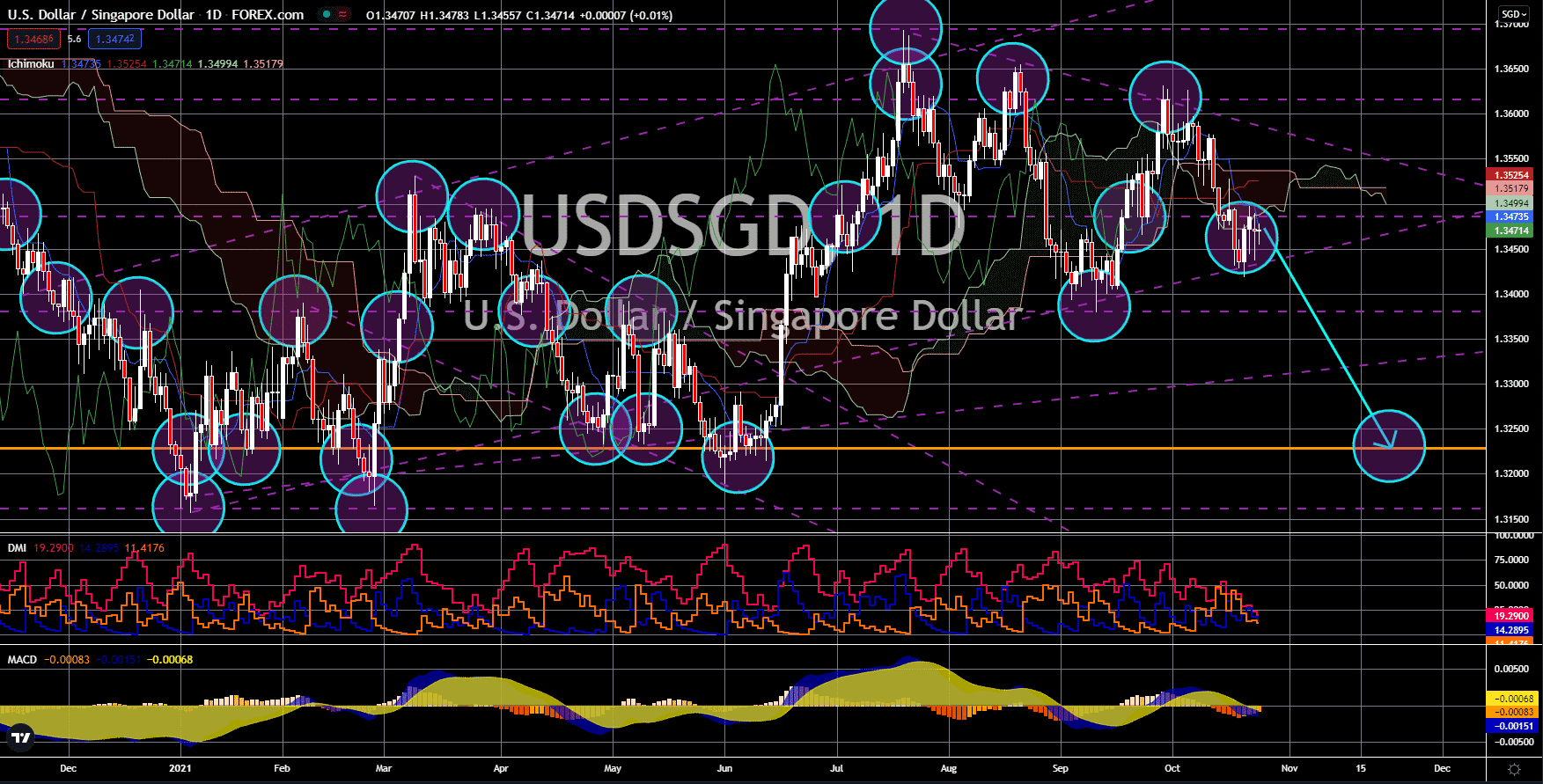

EUR/DKK

Eurozone’s Purchasing Managers’ Index for the manufacturing sector came at 58.5 points during the October 22 release. The actual figure is higher than analysts’ expected 57.0 points. It is also well-situated above the area of expansion which starts at 50.0 points. However, the Services PMI is not showing the same pattern as it failed the forecasted 55.5-point result for the same period after settling at 54.7 points. The bloc’s most powerful economy, Germany, contributed towards the recent decline after the Services PMI plateaued at 52.4 points in October. Nevertheless, its manufacturing is proving otherwise as it hit 58.2 points during the same month which is higher than the average consensus of 56.5 points. This sustained growth came despite the on-going tech crunch which weighed on Germany’s supply chain. European Union leaders bid their farewell to German Chancellor Angela Merkel during her 107th and final European Union summit last week.