Market News and Charts for October 25, 2019

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

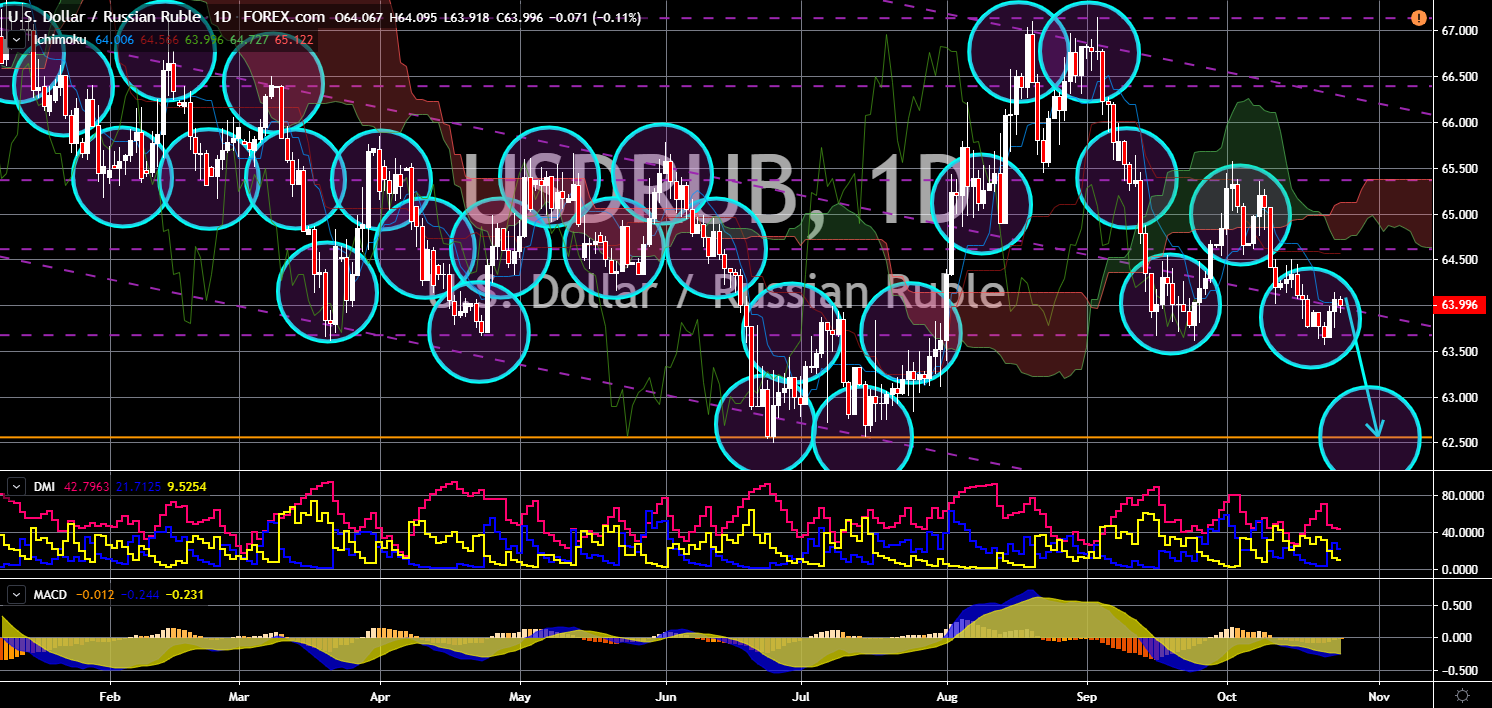

USD/RUB

The pair is expected to breakdown from a major support line, sending the pair lower towards another major support line. Russia is benefiting from the misstep that the United States recently took on Syria. The U.S. and Russia are supporting the opposing sides in the Syrian civil war. The U.S., along with Israel and Saudi Arabia, backs the Kurdish fighters, the opposition in the war. On the other hand, Russia, together with Turkey and Iran, backs the Assad government. Recently, Russia visited the Middle East archrival, the Kingdom of Saudi Arabia and Iran. This flaunts Russia’s rising influence in the region at the expense of the United States. Aside from this, Russia hosted the first Russia-Africa Summit, which was attended by 54 African nations. In other news, the U.S. will be deporting Maria Butina, an alleged Russian spy agent. This was after his 18 months in prison following her arrest in July 2018.

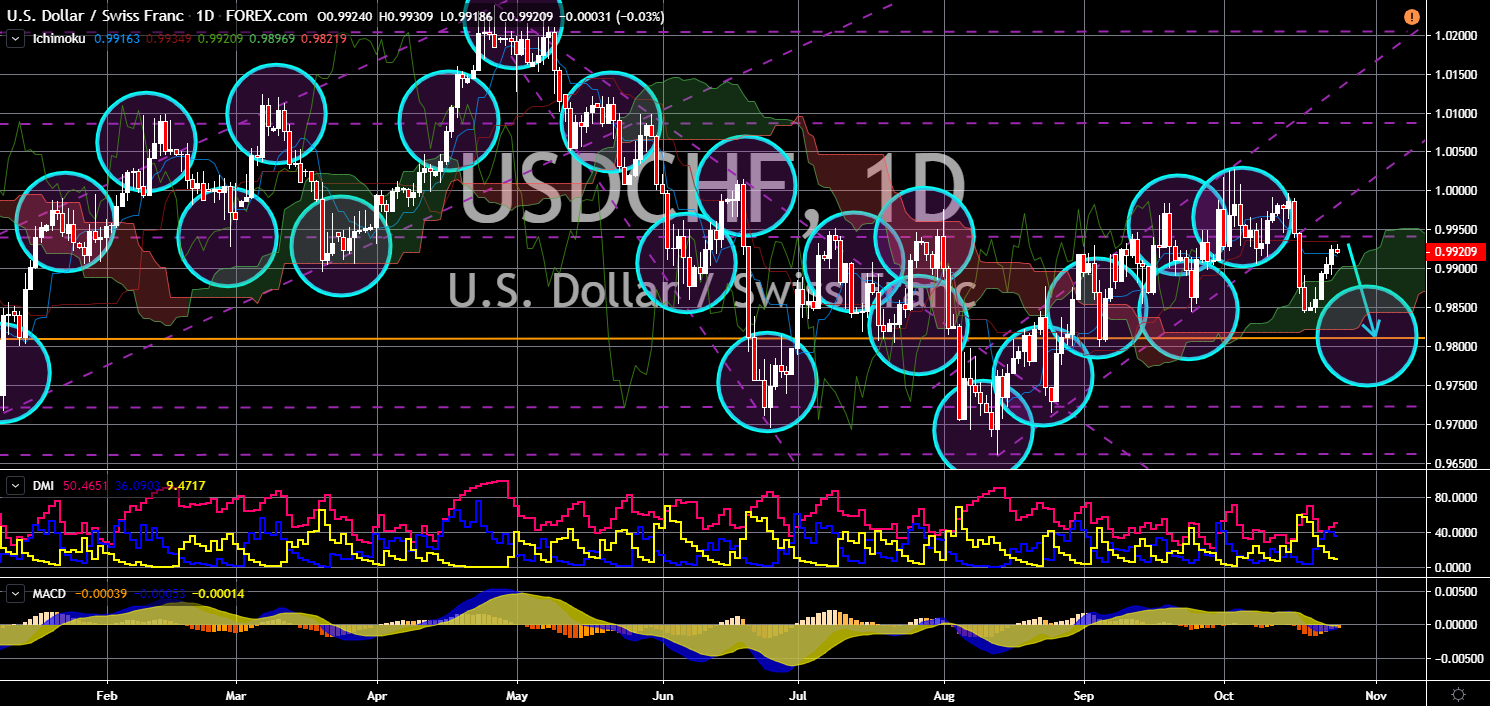

USD/CHF

USD/CHF

The pair will fail to breakout from a major resistance line, sending the pair lower towards the nearest support line. Switzerland is expected to benefit from its removal in the EU’s tax haven list. The list includes countries which the European deemed where being taken advantage of with its lousy tax laws. Switzerland had recently a rift with the bloc following its decision to decline signing the framework deal. The deal was supposed to incorporate the existing bilateral trade agreements between the two (2) economies. This will add to the recent wins of Switzerland. Its win includes the country signing a post-Brexit trade agreement with the United Kingdom. Switzerland was also the first country to sign with China’s Belt and Road Initiative. On the other hand, Switzerland extend its win after it was named the world’s richest. Its citizens’ average wealth is larger compared to the United States.

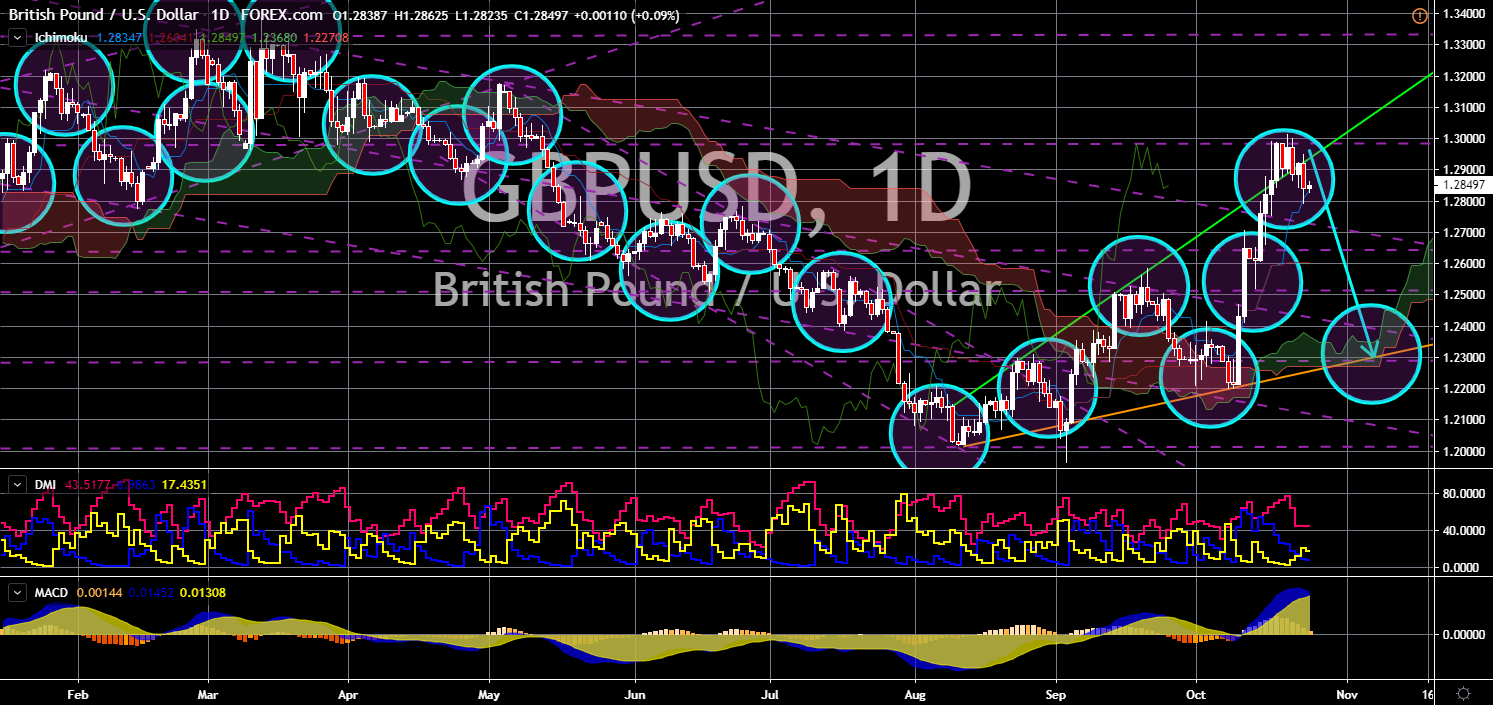

GBP/USD

The pair failed to breakout from the “Rising Widening Wedge” pattern resistance line, sending the pair lower. The future relationship between the United States and the United Kingdom is still uncertain. Last week, UK Prime Minister Boris Johnson and European Commission President Jean-Claude Junker agreed on a draft deal. However, approval of the British and the European Parliament is still needed to finalize the deal. But the UK Parliament had made an unprecedented move forcing PM Johnson to write a letter to the EU letters. On the letter was a request for the Brexit until January 31. The UK is set to leave the bloc on October 31. However, the move by the parliament could make investors to doubt that Britain will crash out from the European Union without a deal. The United Kingdom and the United States agreed to a bilateral trading agreement once the UK officially leaves the EU.

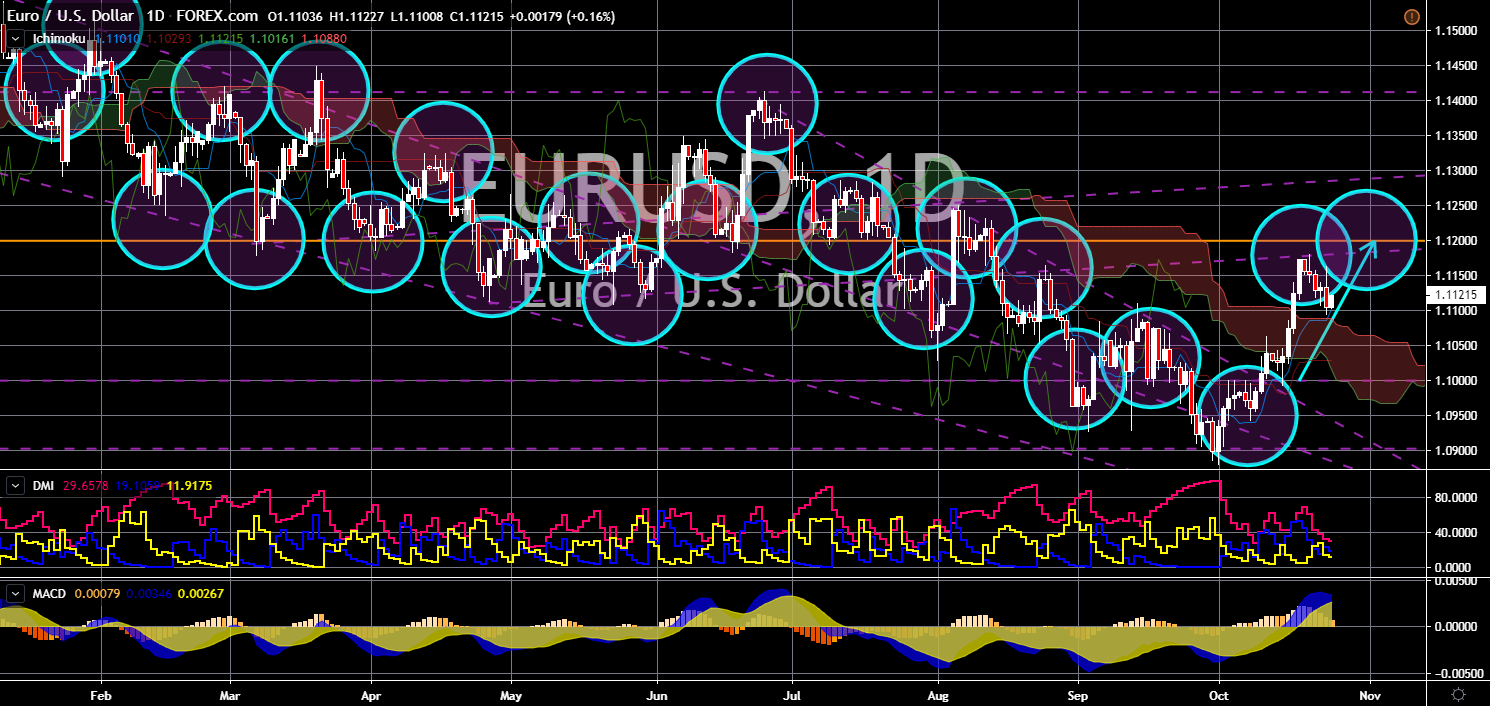

EUR/USD

The pair is expected to continue moving higher in the following days. The European Union is moving away from its traditional ally, the United States, to unconventional partners, Russia and China. The two (2) de facto leaders of the EU had several meetings with Russia and China in the past few months. French President Emmanuel Macron met with Russian President Vladimir Putin to clarify the EU-Russia relationship. On the other hand, German Chancellor Angela Merkel visited China to discuss bilateral trade agreements between the two (2) economies. Since the election of U.S. President Donald Trump, America withdraw from the rest of the global. This leaves the European Union to be the only major economy balancing economic and political power across the world. Another major spat between the two (2) allies was the possibility that the U.S. might sign a bilateral trade agreement with the UK once it officially leaves the bloc.