Market News and Charts for October 24, 2019

Hey traders! Below are the latest forex chart updates for Thursday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

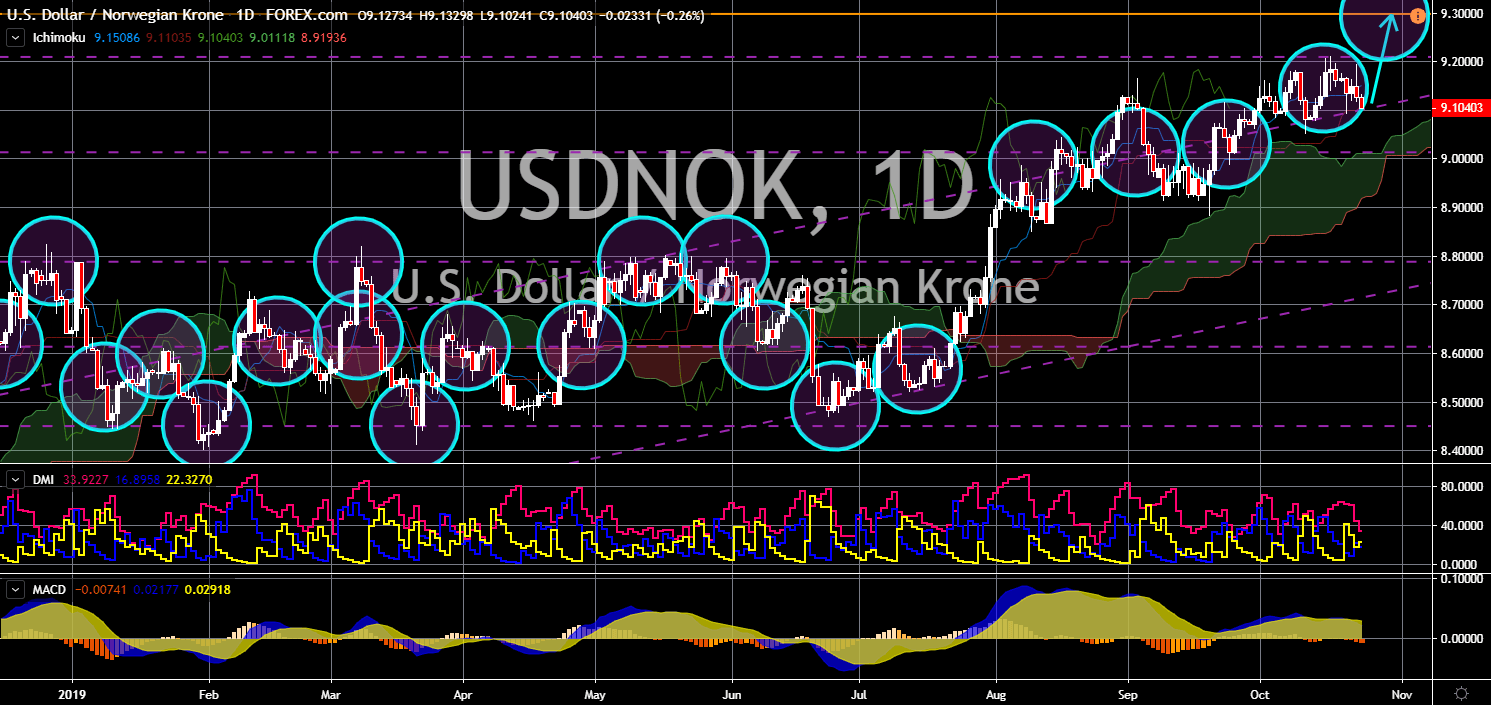

USD/NOK

The pair is expected to bounce back from a major support line, sending the pair higher toward its all-time high. The United States is expected to benefit from the slowdown in the European region and from its strong employment. Norway’s 1 trillion sovereign wealth fund is expected to shift its investment from Europe to the Americas and Asia. This was after Germany, the European Union and Europe region’s largest economy, falls into recession. Aside from this, the Brexit uncertainty could further drag the region into recession. The United States central bank also showed stability after cutting its benchmark interest rate. The Federal Reserve cut its benchmark interest rate twice this year to weigh down economic uncertainty. The European Central Bank (ECB), on the other hand, is losing fiscal and monetary policies that can tame uncertainty towards the bloc. Investors are watching how Christine Lagarde will manage the ECB.

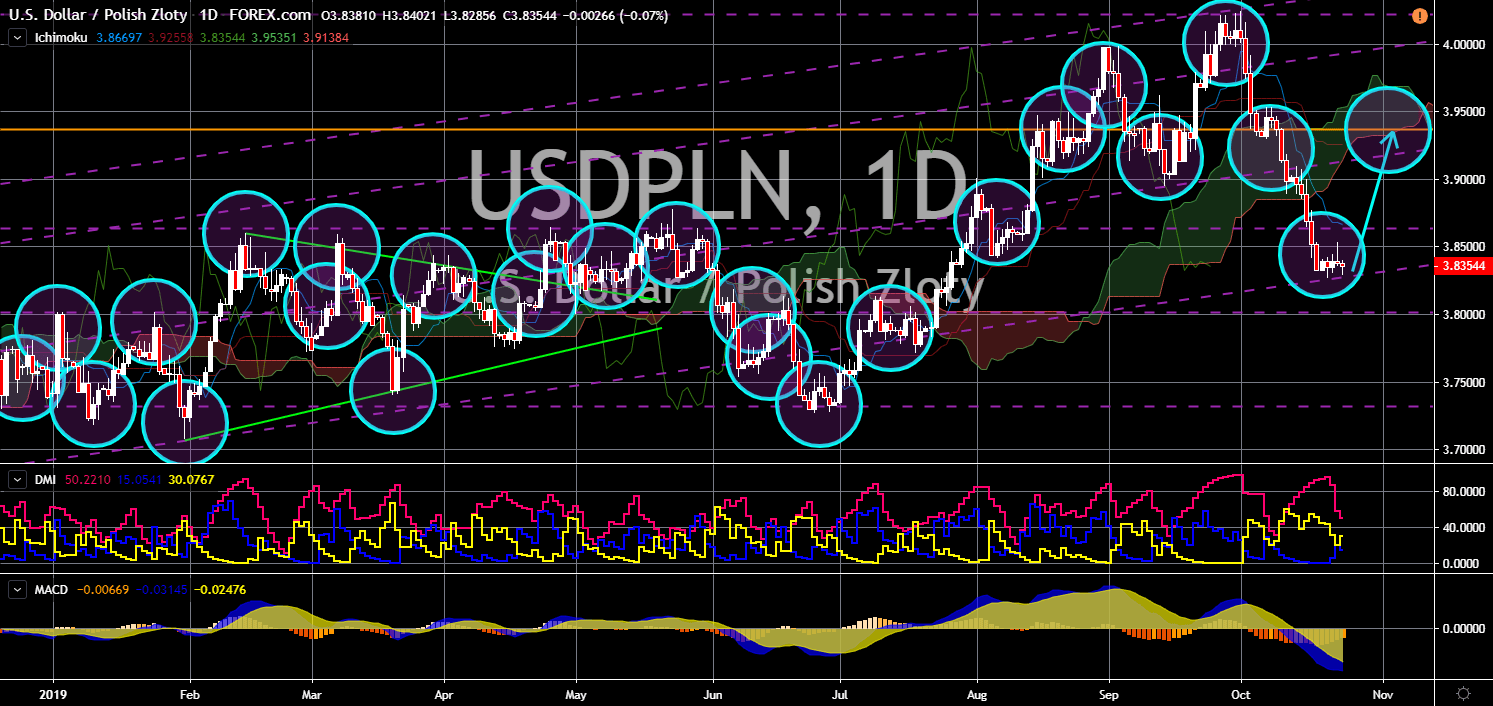

USD/PLN

USD/PLN

The pair will regain its strength after being sold down heavily in the past few days. The United States has formally nominated Poland for entry visa waiver program. This will make it easier for Poles to visit the U.S. This effort was part of the increased cooperation between America and the eastern bloc, particularly the V4 nations. After the long-awaited request of Poland to build U.S. military base in the country, U.S. President Donald Trump had finally answered. U.S. and Polish presidents signed a pact to boost American military presence in Poland. The 1,000 soldiers will be in addition to the 4,500 soldiers already rotating throughout the country. America is militarizing the eastern bloc following the withdrawal of the country, together with Russia, from the 1987 nuclear pact treaty, the INF (Intermediate-range Nuclear Forces). Their withdrawal means that the two (2) nuclear-armed countries can now develop new nuclear weapons.

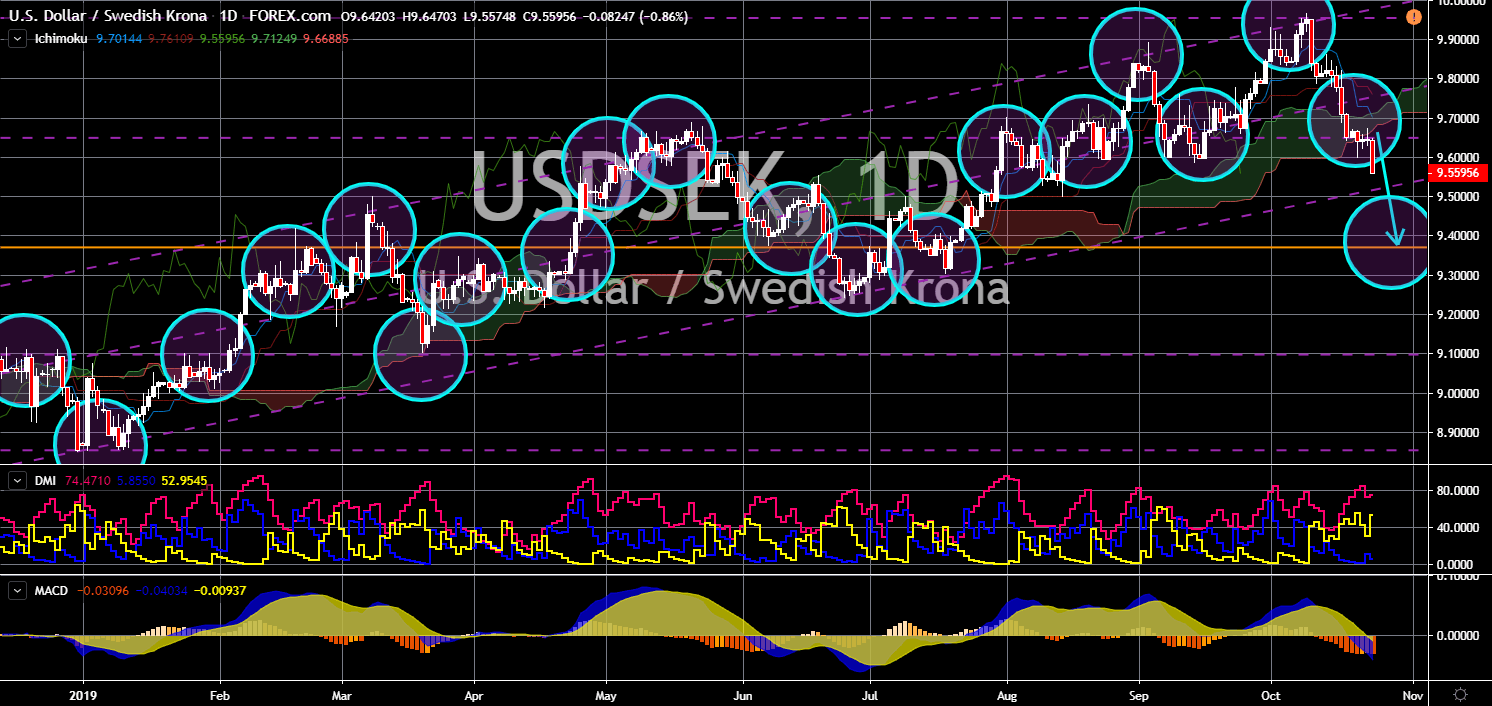

USD/SEK

The pair broke down from a key support line, sending the pair lower towards a major support line. Riksbank, the Swedish central bank, sees holding its current benchmark interest rate of -0.25% through 2020 and beyond. Sweden has the third lowest interest rates in the world below Switzerland and Denmark. Japan completes the list of countries with negative rates. Following the global economic slowdown and threats of recession, central banks around the world are following the negative rates trend. The Federal Reserves, on the other hand, had already cut its interest rate twice this year. This was amid worries that the American economy is heating and that there might no longer room for economic expansion. The U.S. had seen the longest economic expansion in history. The last recession in the country was during the 2008 Global Financial Crisis.

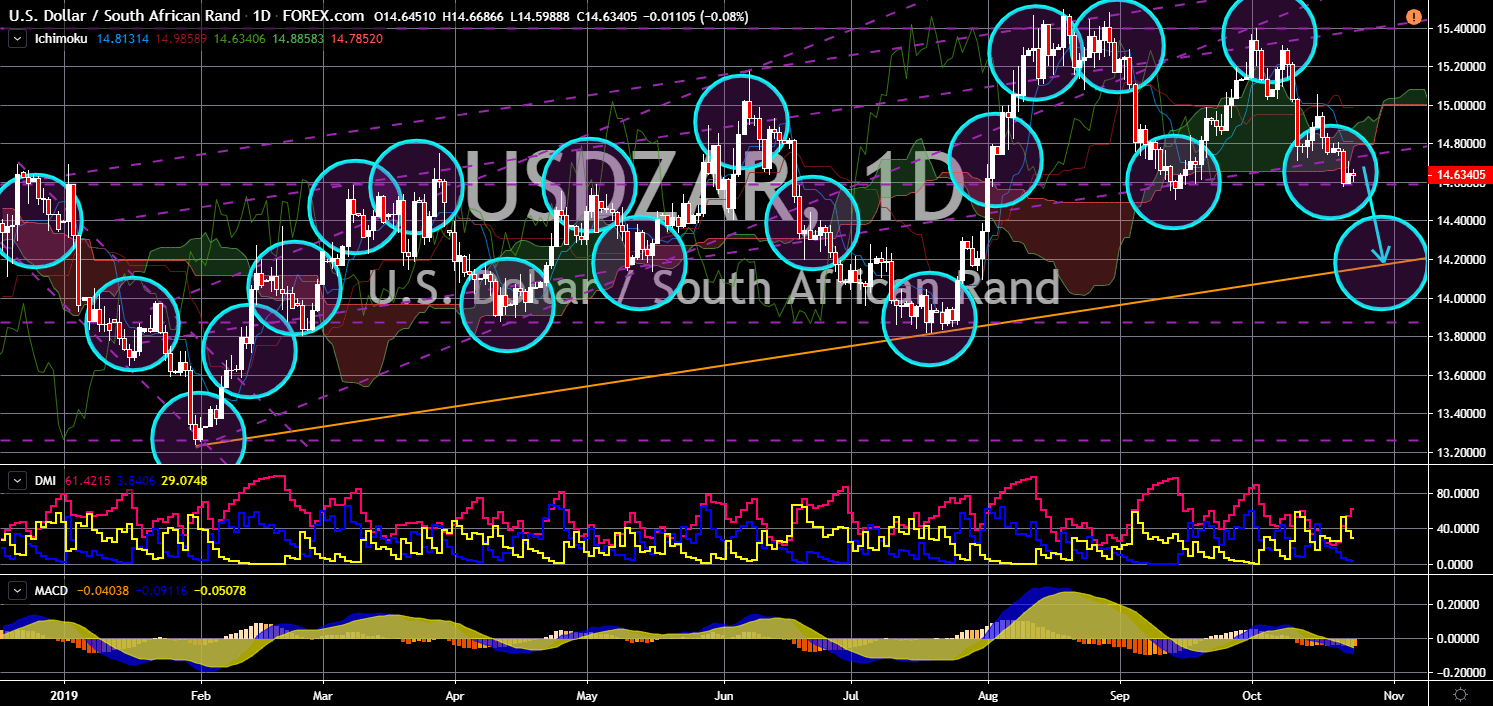

USD/ZAR

The pair is expected to breakdown from a major support line, sending the pair lower towards another major uptrend support line. During the 2016 U.S. Presidential Election, Donald Trump promised to “Make America Great Again.” However, the opposite is happening today. The U.S. is losing its global leadership, while Russia is on the rise. Russian President Vladimir Putin recently visited South Africa to open the first Russia-Africa summit. This is designed to increase the country’s influence throughout the region. More than 50 African states joined the conference, underlining a Russian push to rival the U.S., the European Union, and China as strategic players in the resource-rich region. This was after Putin restored Russia as a key power in the Middle East to raise the country’s profile in the struggle for geopolitical influence. Russia successfully leveraged his Syrian intervention to bolster Russia’s standing at the U.S.’ expense.